GSP Resources (GSPR.V) has seen its share price come off recent highs as the 12 cent placement that was completed in June came out of the mandatory 4 month hold period. Fortunately the company was able to complete another raise right before and earlier this month, GSP Resources completed a flow-through financing at C$0.215 per unit with each unit consisting of one flow-through share and half a warrant with an exercise price of C$0.30, valid for a period of two years.

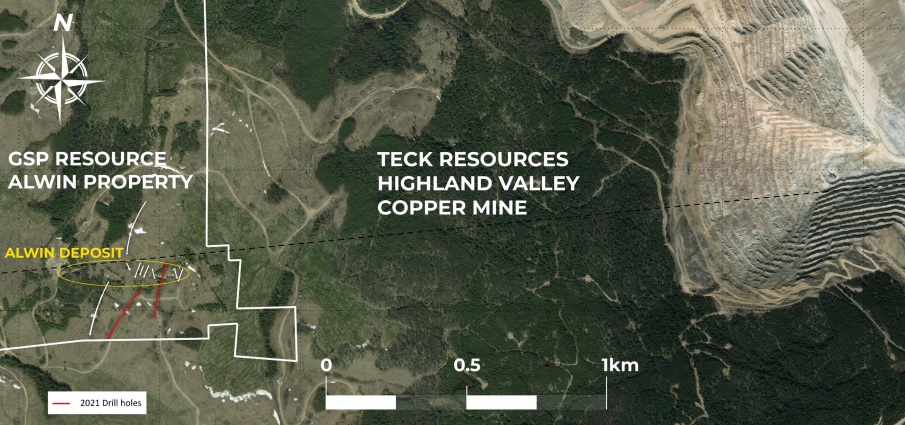

The cash will be spent right away, as the company has already contracted a drill company and the field crews have mobilized to kick off the Fall 2023 exploration program. This program will consist of 5-6 diamond drill holes to test the potential extensions of the known high-grade copper zones at the Alwin property, located right next to the Highland Valley copper mine, owned and operated by Teck Resources (TECK, TECK.A.TO, TECK.B.TO). However, before drilling will start, the company will start with a ground magnetic survey to define host structures which will help to finetune the drill targets.

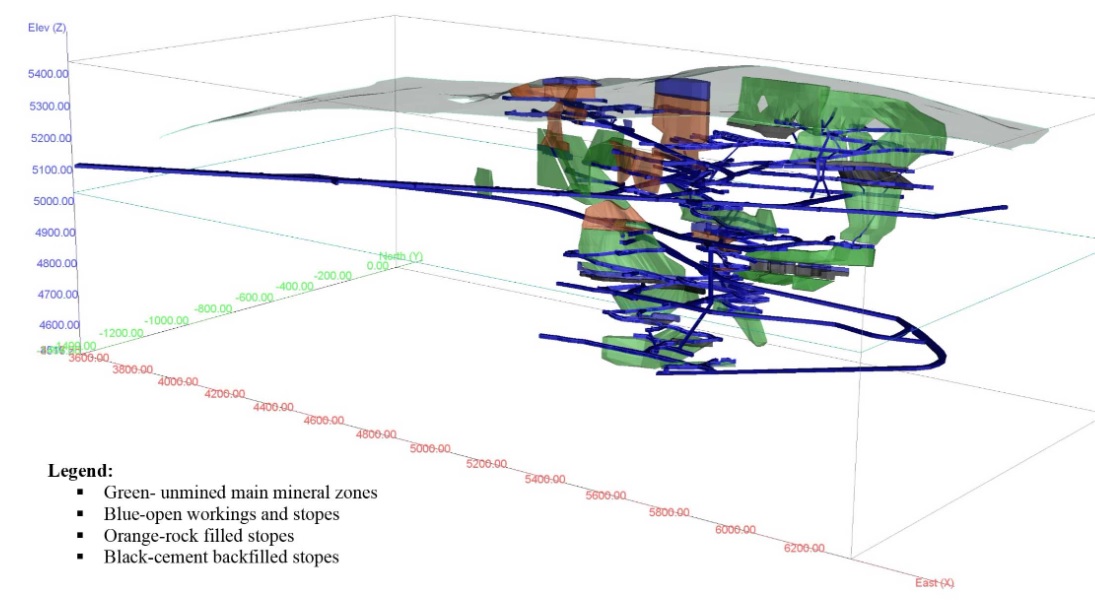

This exploration program comes on the heels of the reinterpretation of in excess of 450 drill holes that were drilled from the Sixties to the Nineties. Those historical data sets, in combination with the data from the 2020-2021 drill program completed by GSPR, have now led to an improved geological model.

Disclosure: The author has a long position in GSP Resources. Please read the disclaimer.