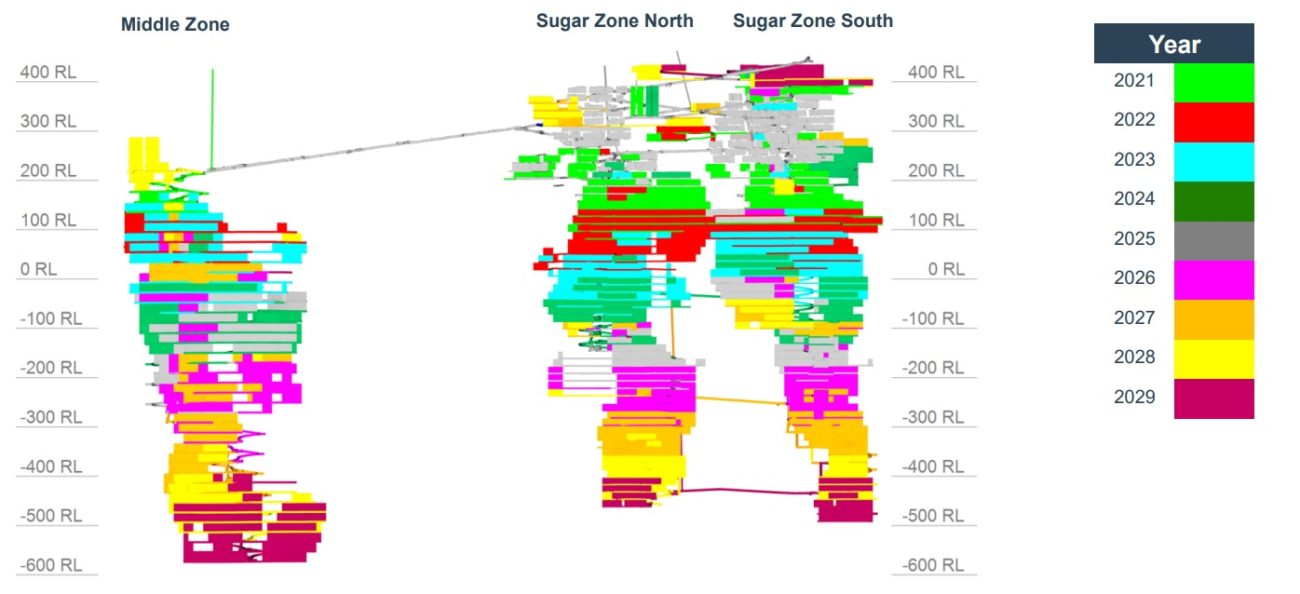

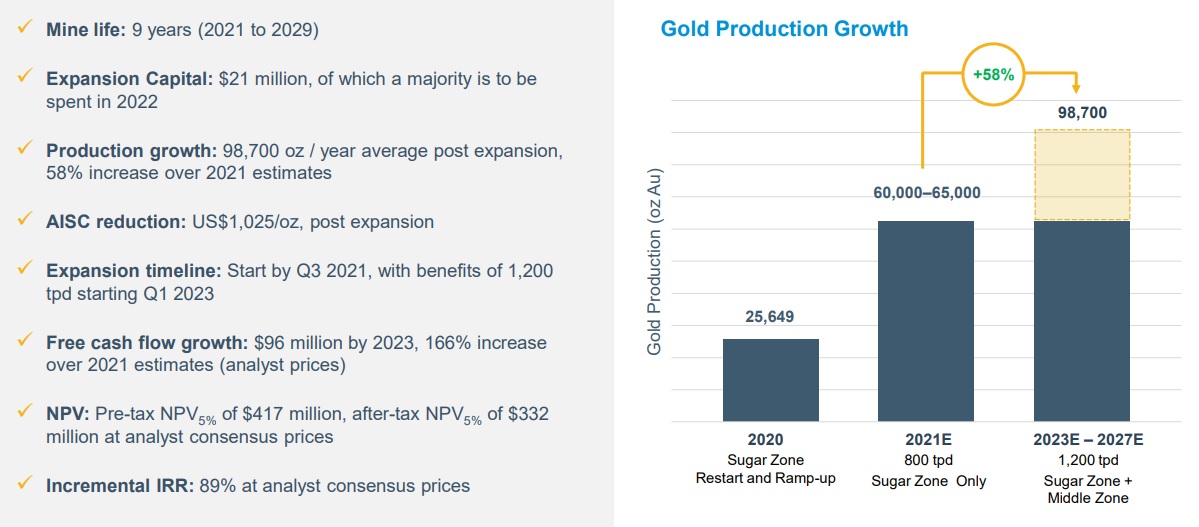

Harte Gold (HRT.TO) has received and published the final results of a feasibility study which looked into the economics of increasing the mill throughput from 800 tpd to 1,200 tpd. According to the study, this could be accomplished with a C$21M capex which would increase the annual gold production by approximately 50%. This would result in Harte Gold exceeding the 100,000 ounce production ate by 2023 before falling back to an output of just under 100,000 ounces per year for the subsequent few years at an AISC of US$1025/oz in the 2023-2027 period. Using a gold price of $1800/oz, the all-in sustaining margin (pre-tax, pre-interest and pre-G&A on the corporate level) would come in at in excess of US$70M per year.

Harte Gold was expecting a US$36M free cash flow result in 2021 based on the current production profile of just over 62,000 ounces of gold, but has used a base case gold price of US$1938 per ounce which is a tad optimistic given the current gold price. Despite this, Harte has a shot at self-funding the expansion to 1,200 tonnes per day as it could use this year’s cash flow to fund the growth capex.

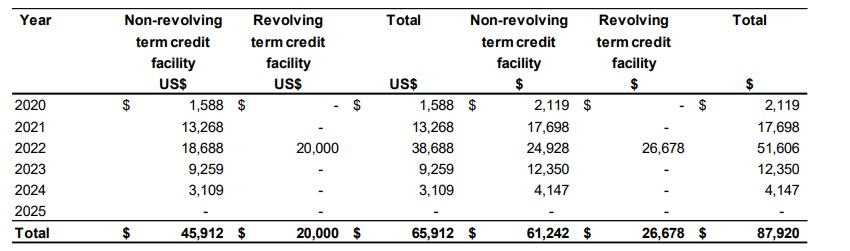

There is however an important caveat. Harte Gold will clearly have to go back to its lenders to discuss an updated debt repayment schedule. According to the financial statements, Harte Gold will have to repay almost C$18M of the BNP debt in 2021 – which is still fine – but is expected to make a payment of almost C$52M in 2022.

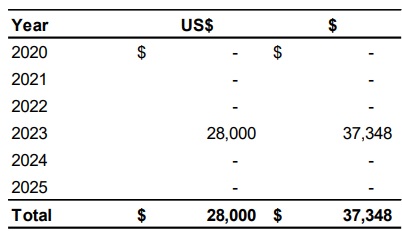

Additionally, Harte Gold is scheduled to repay in excess of C$37M to Appian as port of its debt facility (which has a cost of debt of approximately 14%).

It’s pretty clear Harte Gold won’t be able to make the scheduled debt payments if it decides to go ahead with the expansion plans. Knowing about 1/3rd of the annual gold production has been hedged at US$1390/oz, even at $1830/oz spot the company’s average received gold price will be less than $1700/oz.

So while the Harte Gold expansion plan makes a lot of sense as it the economies of scale would reduce the operating costs by about C$30/t (and that’s meaningful on a total reserve estimate of 3.45 million tonnes as the savings would total in excess of C$100M over the life of mine for an initial investment of just over C$21M), but Harte Gold will have to talk to its lenders. We would be totally fine with doubling the gold hedge by locking in an additional 20,000 ounces per year at the current forward prices if that’s what’s needed to get BNP Paribas across the finish line to renegotiate the debt. If that’s impossible, Harte Gold would perhaps be better off putting itself up for sale.

In its most recent update earlier this month, Harte Gold confirmed it is in discussions with BNP Paribas regarding the amortization of the debt and Harte is now ‘optimistic a mutually agreeable arrangement will be reached’.

Disclosure: The author has no position in Harte Gold for now. Please read our disclaimer.