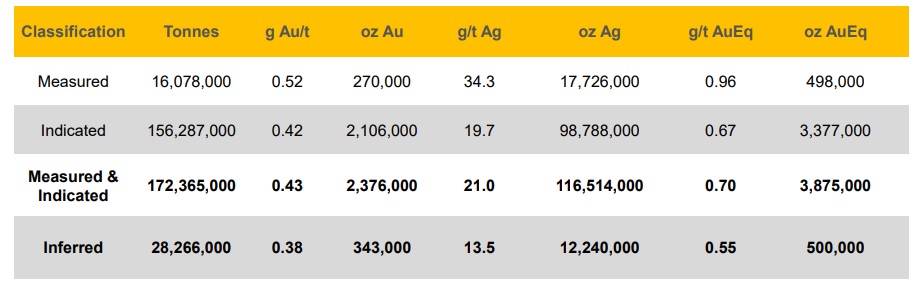

Integra Resources (ITR.V) has released an updated resource estimate on its DeLamar project where it’s currently earning a 100% interest. The total resources increased by just over 20% on a gold-equivalent basis, but what’s more important is that roughly 90% of the ounces are now part of a measured and indicated resource. That’s almost unheard of for a company that hasn’t even completed a PEA yet, and it indicates the upcoming PEA (expected in September) will be very robust as the mine life will be based on the more reliable Measured and Indicated resources rather than using an all-inferred resource.

The average grade of 0.43 g/t gold and 21 g/t silver in the measured and indicated resource is also very decent, as this represents a gross rock value of US$28 per tonne. The net recoverable and payable rock value will depend on the recovery rates (which will be lower for the heap leach operations compared to milling the sulphides).

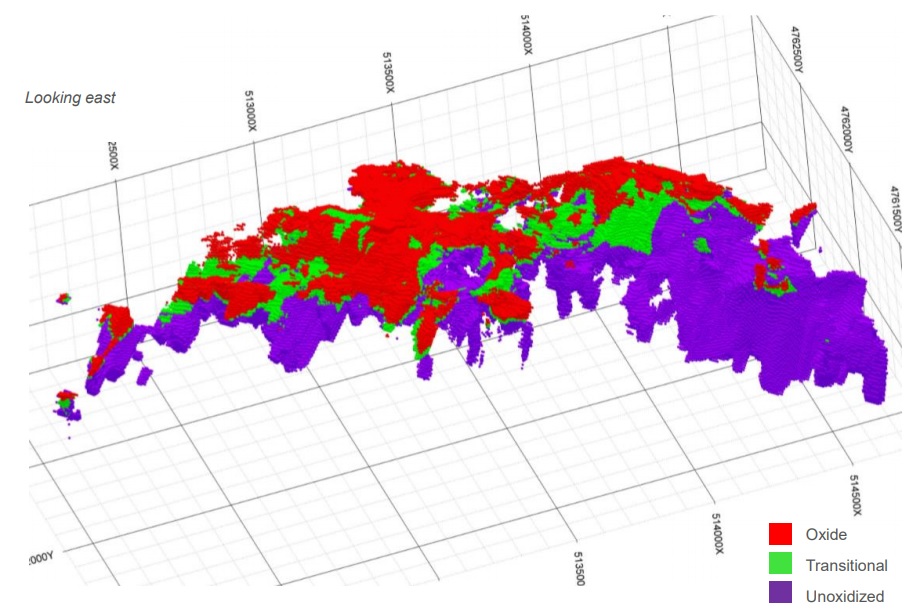

Of the 4.4 million gold-equivalent ounces (based on a silver:gold ratio of 77.7 to 1 ratio. Using the spot prices ($1343 – $14.92) the gold-equivalent resource would be 4.15 million ounces), approximately 1.9 million ounces are classified as oxide and transitional (in the measured, indicated and inferred categories combined), which means they should be amenable to heap leaching. Considering the recovery rate for the silver during the leaching process is substantially lower than for the gold (40% versus 83%), we estimate approximately 60-65% of the 1.9 million gold-equivalent ounces will be recoverable.

This paves the way for an initial heap leach operation that would be larger than we originally anticipated. We had expected Integra to design a mine plan which included a heap leach operation for the first 3-4 years of the DeLamar mine life as A) this would be less capital intensive and B) the revenue from the heap leach operations would help to fund the equity portion of the much more expensive sulphide milling operations. Considering the recovery rate of the silver is quite low in the heap leach phase and good during the milling phase with a recovery rate of 90% for the gold and 95% for the silver at DeLamar and 86% and 63% for the gold and silver at Florida Mountain), it would make sense for Integra to put the rock with higher gold grades and lower silver grades on the leach pad, and to keep the zones with relatively high silver grades for the mill phase.

Interestingly, the Florida Mountan resource contains higher gold values in the oxide & transitional zones while the recovery rates in a milling scenario would be lower than at DeLamar anyway. It’s still very early days, but it looks like Integra could pursue a heap leach operation at Florida Mountain while keeping the DeLamar resource body intact for a milling operation to maximize the silver recovery.

But with 900,000 recoverable ounces gold-equivalent, it now looks like the heap leach phase may last substantially longer than anticipated, and this puts Integra in the luxury position to consider a two-prong approach with heap leaching and milling going on at the same time.

The PEA will be out in September, but we will try to come up with a back-of-the-envelope economic model in the next few weeks.

Go to Integra’s website

The author has a long position in Integra Resources. Integra is a sponsor of the website. Please read the disclaimer