As it has been a while since discussing Integra Resources (ITR.V, ITRG), we caught up with Joshua Serfass. Serfass has been with the company and its predecessor Integra Gold (which was sold to Eldorado Gold (EGO, ELD.TO) for in excess of half a billion Canadian Dollars) and was recently appointed Executive Vice President for Integra Resources.

We decided to have a chat with this fresh face in the management team to hear his thoughts and opinions, not just on the projects but also on how the company deals with ESG requirements and how it plans on being a good corporate citizen.

Sitting down with Josh Serfass

About DeLamar

Let’s start with the Florida Mountain drill program. We already know the DeLamar and Florida Mountain open pits contain a lot of lower grade oxidized mineralization, and in the past year or so, Integra has been focusing on detecting high-grade zones at Florida Mountain and following the gold mineralization there. You got some really nice headline results out of that with for instance 1.25 metes of 16.86 g/t gold and almost 2.5 kilos of silver and 1.5 meters of 12.9 g/t gold and 1,675 g/t silver. How do these higher grade zones change your approach at DeLamar in general?

You’ll have to remember that this district was first operated as a high-grade, underground operation. After gold was discovered in Jordan Creek in the early 1860s, an impressive gold rush that rivaled the famed California gold rush descended on southwest Idaho. At one time, the Silver City area was home to 12 stamp mills, one of the first phone lines in the State and a small army of miners who produced approximately 730,000 oz Au and 57 million oz of Ag. Below Florida Mountain alone, historic mining produced 250,000oz of AuEq averaging an ounce per ton. Fortunately for us, most of this historic mining occurred on one of the six known veins.

Is Plan A still to develop a heap leach operation and subsequently build a CIL plant? Or is that still subject to change depending on how extensive the high-grade zones get, and how the silver price evolves (as using CIL processing will likely triple the silver recoveries)?

The plan is to advance into permitting the scenario that will be presented in the upcoming PFS. This PFS will be relatively similar to the PEA in terms of processing, a heap-leach pad for the oxide and transition material at Florida Mountain and a mill for the sulphide material at Florida Mountain as well some a portion of the sulphide from DeLamar. Recall, the DeLamar sulphide was excluded from the PEA pending more metallurgical work. We now know a portion of that sulphide will be included in the PFS which has the potential to boost the total output and extend the mine life.

What’s new for us (and got us really excited) is the potential high-grade below the existing resource at Florida. As you rightfully point out, there seems to be a lot of potential below Florida Mountain along the shoots and vein structures that were not mined in the early 1900s. To date, Integra has drilled over 90 intersects of +4 g/t AuEq, mostly outside the existing resource envelope. The success of drilling this high-grade mineralization from surface has challenged us to think about how to further drill, explore and potentially wrap a resource around what’s at depth. More to come on this in the future; however, you can imagine what a high-grade resource below Florida Mountain could mean for a project with a mill already constructed in the PFS scenario. In theory, we could displace lower grade open pit mill material with potentially higher grade underground material. To further explore the high-grade potential below Florida, the Company may seek to to evaluate the possibility of transitioning to underground exploration at Florida Mountain if it appears strongly advantageous.

Optionality is the name of the game in our space and the potential high-grade, underground provides another option to the package and could complement an already economically robust project (as presented in the PEA).

In a January update, you also mentioned you were looking at using agitated leach techniques and high pressure grinding rolls to further improve the economics of the project. What does HPGR consist of, and how could this have an impact on the economics of the project?

We recently announced that crush optimization test work has shown a ½ inch crush outperforms the 2 inch crush we used in the PEA. This is still a relatively coarse crush and a size that can be accomplished efficiency with traditional crushing methods and/or HPGR.

The Company did discuss HPGR in January and it is something we are still evaluating. It is a grinding technology that has been used around the World for quite some time but has been slow to make is way into the US mining sector. Essentially, it allows for more efficient fine grinding at a fraction of the energy requirements needed for traditional crushing. In addition, the design allows for continuous feed of material since there is no loading like that used in a traditional cone crusher. The crushing also occurs without any grinding media so it happens rock-on-rock which is very efficient. Furthermore, the rollers in an HPGR unit only need maintenance every 12-18 months versus a crusher which is budgeted for 85% availability per year to allow for maintenance. Coeur Mining (CDE), a mid-tier gold-silver producer who owns 6% of Integra, just announced an expansion at their Rochester Mine in Nevada that will include two new HPGR units with the expectation of a 7% increase in silver recoveries due to these HPGR units.

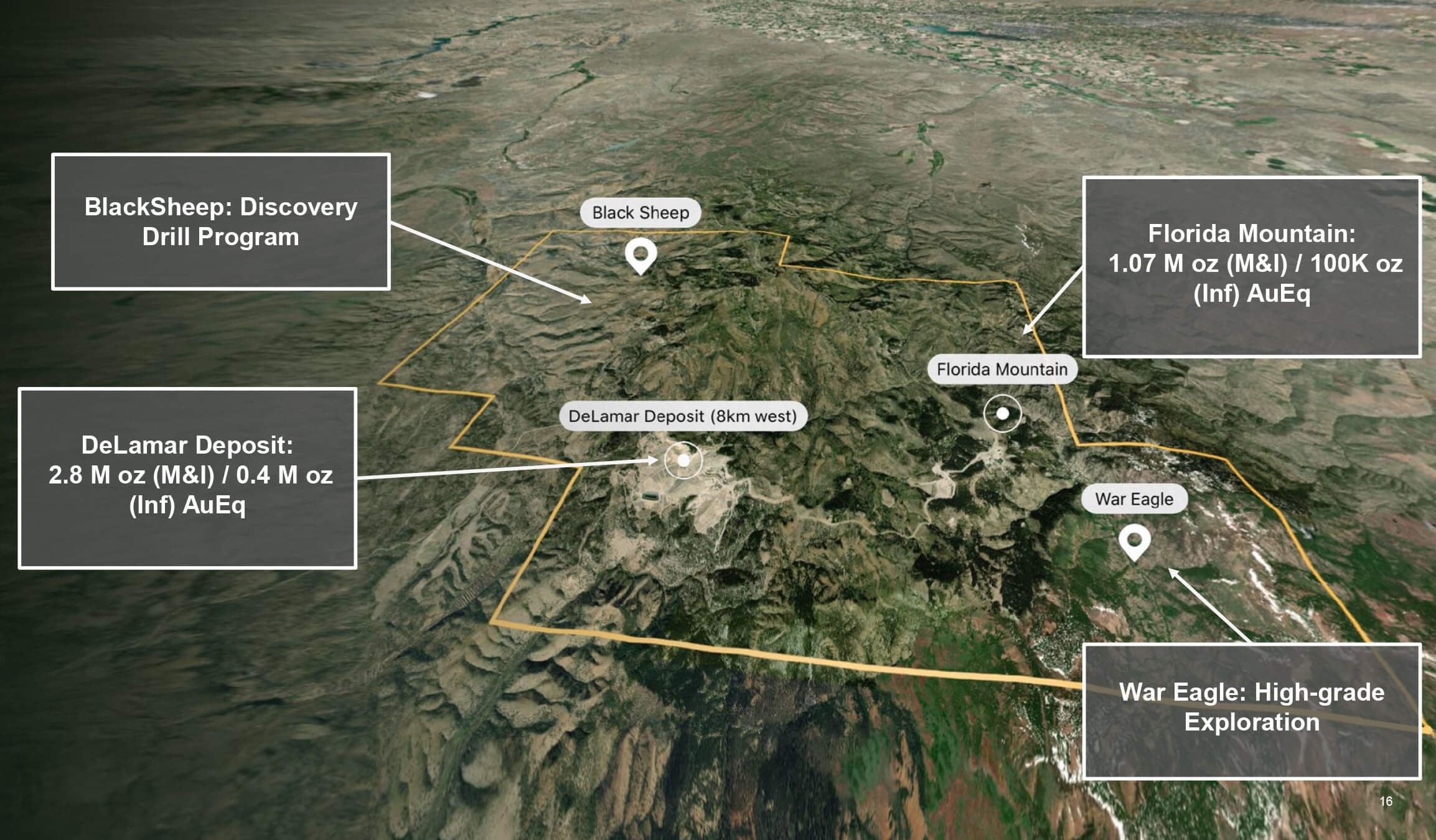

The value and exploration potential of both DeLamar and Florida Mountain has been widely established, but let’s take a minute to talk about two lesser known but prolific exploration targets: War Eagle Mountain and the Black Sheep district. Let’s start with War Eagle. Could you perhaps (very quickly) rehash the 2019 and 2020 drill programs there and what you are targeting with your 2,000 meter drill program this year?

War Eagle is a great target with a fascinating history. History buffs can google ‘War Under the Mountain’ to read about the battle that broke out amongst two mining factions in the 1860s over the valuable gold and silver in War Eagle. Anyway, War Eagle has seen some of the highest grade drilling to date at the project. The plan is to get in there this summer and complete additional fences of drilling to go deeper and test the feeder structures, the same structures that were mined under War Eagle just north of us. With additional successful drilling at War Eagle, we believe there is potential to add another high-grade resource to the project in the coming years.

Another really exciting target for the Company is BlackSheep, a ~35 square kilometer land package northwest of DeLamar along the mineralized milestone corridor. This area was staked in part at the suggestion of Dick Sillitoe and Jeff Hedenquist, arguably the pope and first bishop of epithermal systems. In fact, Waldemar Lindgren, the father of economic geology, wrote about the BlackSheep area in the 1800s, discussing the plethora of silica sinter at surface.

BlackSheep, geologically speaking, is higher in the system and between the first round of drilling, historic workings, multiple soil geochem and IP anomalies, we are confident we are on to something there. It is rare you hit on the first 4 exploration drill holes in an area. Stay tuned…more to come.

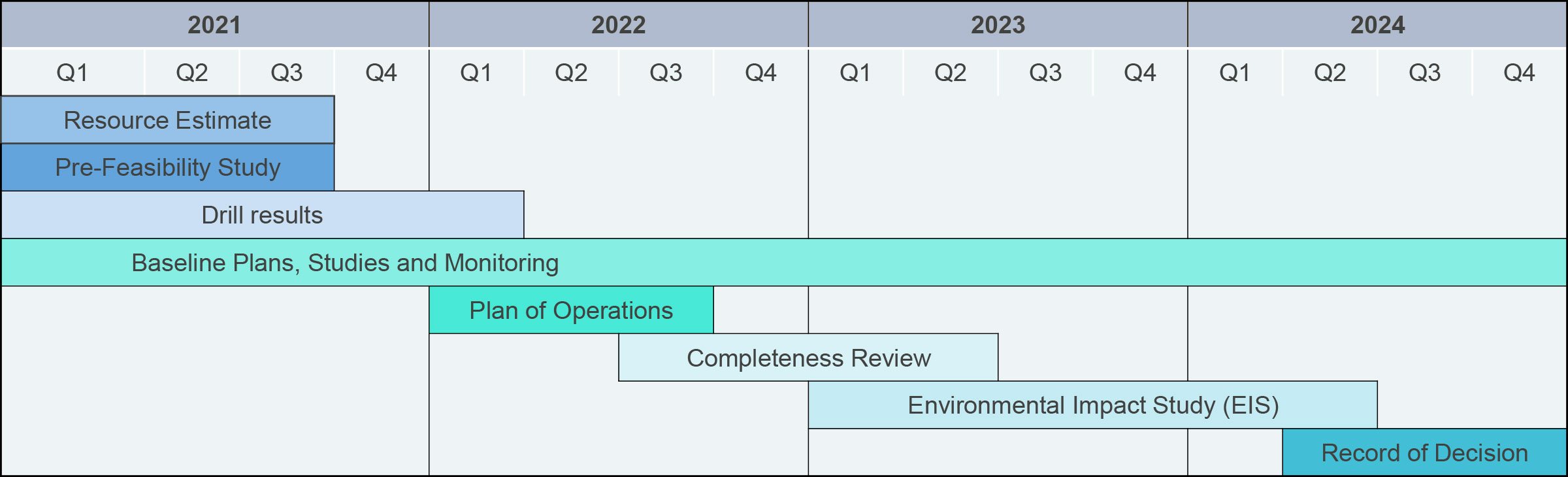

So, Q4 will be extremely important for the company as you will be publishing both an updated resource estimate as well as a pre-feasibility study?

That’s right, Q4 will be a big quarter for the Company. I believe the PFS will be a major re-rating opportunity for the Company. The general processing options will remain the same (heap leach and mill); however, the Company is focusing on increasing the annual production profile from 124k oz AuEq/yr in the PEA to something that looks more like 150k to 190k AuEq/yr in the PFS. The majority of this additional mineralization will come from a portion of the unoxidized material at DeLamar. As you may recall, in the PEA we excluded the unoxidized material from DeLamar because we wanted to do more met work on it to increase our confidence in recoveries and processing. Over the last 2 years, we have made a lot of progress and now know a portion of that unox material can be incorporated into the PFS.

Q4 will be an exciting time for us as a Company because on the back of the PFS we will launch into permitting and advancing the project towards a potential construction decision.

In a recent exploration update from the Florida Mountain area, you seem to be pretty successful in actually chasing and expanding the narrower but higher grade gold and silver veins. In fact, some of the widths you announced in your August 31st update were quite good with for instance your headline result of 9.4 meters containing 12.5 g/t gold and 157 g/t silver for a gold-equivalent grade of almost half an ounce per tonne. Looking at the cross section in your press release, you seem to be getting a much better understanding of those higher grade zones. Is that a correct interpretation and may we expect the efficiency of the Florida Mountain drill program to remain high – of course fully acknowledging this is still exploration and there are a lot of unknown variables?

You absolutely nailed it. With almost 100 hits of 4 g/t AuEq, the geological model and interpretation of these veins and structures keeps getting stronger. Our success rate in hitting these high-grade structures is 70% and growing, meaning that the predictability and success of drilling continues to grow each day. This target is big as well, we have hit high-grade structures over a 1,300 m north-south strike length and up-to 400 vertical.

In last week’s drill update we also noticed your drill bit encountered some good grade to high grade results starting close to surface. Hole 122 and hole 125 for instance with respectively 18 meters at 3.9 g/t AuEq and 31 meters containing 4.47 g/t AuEq at a down hole depth of just 2 meters and 12 meters respectively. Can you comment on how important or ‘expected’ it was to find these high grade intervals this close to surface?

This wasn’t unexpected. The geological team has modeled these high-grade shoots through the volcanics and into the vein systems in the granite. Part of the success we’ve had drilling deep is because of our understanding of these near surface shoots. You can actually see evidence of these high-grade shoots in the Florida Mountain open pit, it is quite incredible actually.

Having pockets of higher-grade material in the “open-pittable” resource should benefit the Company as it potentially brings Florida Mountain online.

You will continue to focus on 3 of the 7 known high grade vein structures, how much more work is required to actually add ounces from these zones to a resource model to ‘boost’ your total resources and to underpin the addition of sulphide resources into your mine plan?

By focusing on 3 main structures, we can better focus our exploration program on potential resource growth at depth. As we’ve mentioned in the last few news releases, the Company is exploring the concept of underground exploration which would allow for more efficient drilling and spacings. Obviously, there is more we need to consider on this front; however, it warranted and advantageous we may purse that option in the future. More to come on that but it goes back to the advantage of optionality on a project, of which DeLamar and Florida Mountain have plenty.

About Integra

As a company, you have always had ESG quite on top of your mind even before the term ESG became mainstream. We remember how well you dealt with the locals in Val D’Or when Integra Gold was working on its Lamaque gold project, and you seem to be applying a similar strategy in Idaho to ensure all stakeholders are on board. Could you elaborate on your ESG initiatives?

You’re absolutely right! Being a good corporate citizen is in our DNA. We certainly like to think we approach exploration/development and the communities in which we work in a different way. Engaging diverse voices, groups, associations, NGOs, etc. is, in our opinion, the best way to advance a project. People may not always agree, but if you don’t provide a platform to hear all views, it will be hard to move forward.

The Company recently hired a community relations manager in Idaho and between her and our ESG program, we’ve been trying to make sure we are visible in the community and always available for questions, information, etc. Some of the recent initiatives we’ve worked on include:

Providing a microloan to the newest (and now only) restaurant in Jordan Valley. We will actually be hosting a community BBQ there in August.

– Created an annual scholarship for graduating high school seniors.

– Had a float and sponsored the annual Big Loop Rodeo.

– At the Murphy Outpost days we had gold panning and lots of information on what we are doing.

In a recent update on your ESG initiatives, you announced you signed an agreement with Trout Unlimited. What does that organization do, and how are they able to help?

The goal of Integra is to be part of the new breed of developers, a group that looks to do things differently and creatively. One of the ways we’re committed to being good stewards of the land is through partnerships with organizations committed to the environment, etc. As you mentioned, we recently signed an MOU with Trout Unlimited. This is a unique relationship and one focused on evaluating and rehabilitating areas like the Jordan Creek watershed which were impacted by historic mining. Warren Colyer, the Western Water & Habitat Program Director with Trout Unlimited, commented, “Collaborative efforts with mining companies like Integra can represent tremendous opportunities to improve fish habitat, particularly in areas like the Jordan Creek watershed where it is difficult to secure funding to reclaim environmental damage from long-ago mining operations. In southeastern Idaho, the results of similar partnerships have really begun to show their merit, such as in the Upper Blackfoot River where landowners, companies, agencies and conservation groups have banded together to improve fish habitat, and trout populations are beginning to show improvement.”

The Company has also engaged Warm Springs Consulting to work alongside the Company on trade-off studies to increase margins while potentially decreasing our environmental footprint. That includes electrification studies to reduce fuel costs, etc. Warm Springs and Integra are looking to push the bounds of what a responsible modern mine plan can look like.

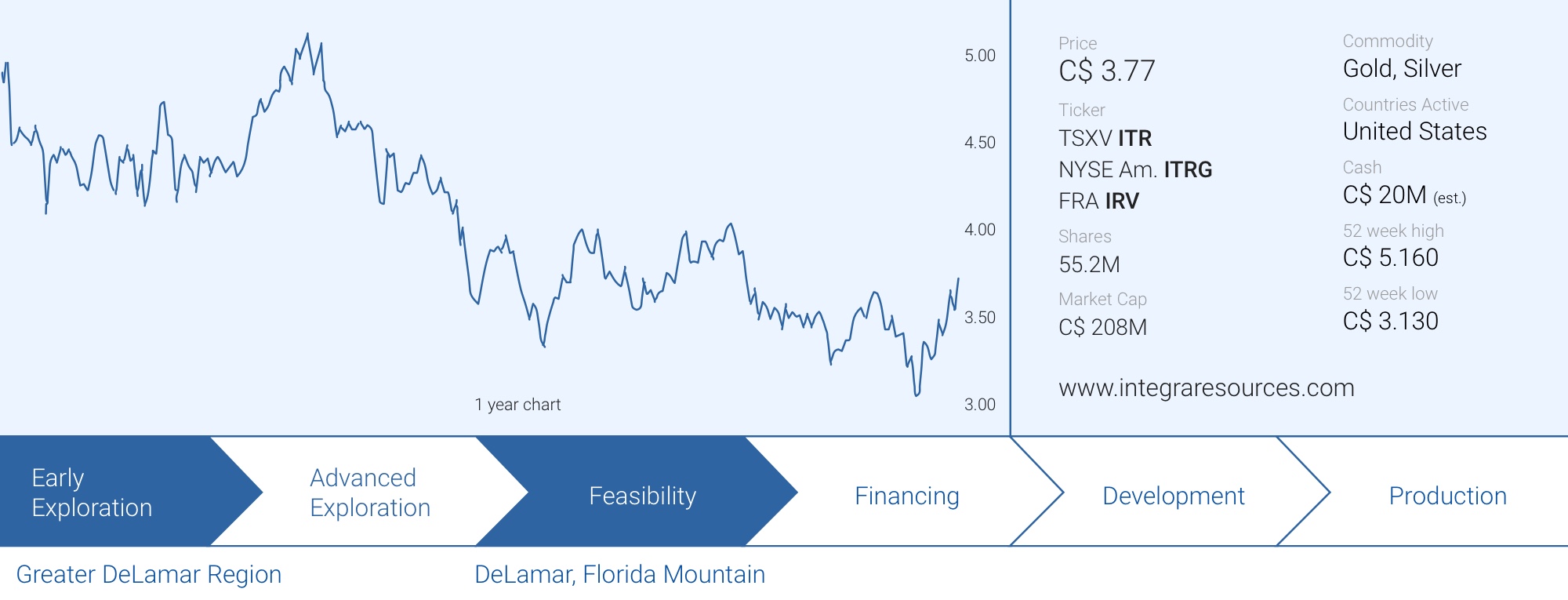

As of the end of June, Integra had a working capital position of about C$12.4M, including C$19.6M in cash. What are your budgets for the remainder of this year and what’s the anticipated budget for next year (i.e., how long will your current cash position last?)

The current treasury will take us into Q4. We’ve been drilling a lot and completing heavy engineering work and baselines studies in order to file our Plan of Operations next year and begin permitting the project. We haven’t started budgeting 2022 quite yet, but a lot of our needs will depend on how much exploration we want to complete. Given the success we’ve had with the drill bit, we definitely want to keep the drills turning.

You still have an active ATM in place, but have barely used it: you issued just 41,000 shares in the first quarter at almost US$4/share. It’s understandable you don’t want to use this tool when the share price is too low. Is it fair to assume you will mainly use the ATM program when your share price is trading relatively high? Or are you planning on using it more often going forward?

The ATM is just another tool we wanted in our toolkit. We’ve used it sparingly and will always view it as a means for opportunistic, quick financing.

How is your shareholder registry evolving? Do you see a switch from Canadian to US investors with your full US listing?

Easy answer, yes, we’ve seen an uptick on US investors. After the NYSE listing, we went on a pretty lengthy virtual US marketing trip from Hartford to Seattle and back. It has paid off and we are seeing about 40% of our volume now occurring in the US.

We’ve seen a lot of interest in the space over the last 2 years due to the gold and silver price. After working through a tough market with Integra Gold, what is your takeaway on this renewed interest? Are you getting more pushback, feedback, etc.?

This is an interesting question. There has been a lot of more money flowing into the space and bunch of new companies and project. This industry isn’t for the weak stomachs. We work hard, travel a lot, and constantly hear how we can do things better. It is always fun catching up with someone who went from the banking side to the issuer side. They always think it would be an easy move until you realize you get very little credit for anything you do. Honestly, the system is broken. There are too many companies chasing too few projects that actually work. The industry has too many followers, management teams, etc. looking to make a quick buck rather than actually investing in mine development.

We are often asked, and in some cases criticized, for performance in comparison to a Company paying for a major promotional campaign. It drives you a bit crazy because we are building something real.We are taking the steps via ESG, PFS, permitting to actually build a mine; however, we, and quite frankly developers as a whole, don’t get a lot of credit for building an asset. It is pretty frustrating, but all you can do is keep your head down and take the right steps to get an asset towards a construction decision.

Conclusion

While most companies consider themselves takeover targets, there’s really just a handful of legit targets out there that could pique the interest of mid-tier and senior producers, and Integra Resources clearly is one of them. By having a multi-million ounce gold (and silver) resource in a safe jurisdiction Integra really puts itself apart from so many other junior exploration companies.

While the share price isn’t always cooperating and there sometimes is a massive valuation discrepancy compared to some companies that aren’t as advanced. New Found Gold would be a good example where the current valuation of $1.4B seems to be a little bit ahead of itself compared to Integra’s DeLamar project with 4.4 million ounces (3.9 million ounces measured and indicated and about 0.5 million ounces in the inferred resource category) and an upcoming pre-feasibility study. But the only thing Integra Resources can do is to continue its methodological approach and tick the boxes towards a development decision. Potential suitors usually like a project to be as de-risked as possible, and that’s exactly what Integra Resources is doing.

And keep in mind, Integra Gold only came into play when it was threatening to go into production by itself. And that will likely be the scenario that will unfold at DeLamar as well. Integra Resources will have to continue to advance the project and its economic studies will ‘have’ to show Integra will be able to build the mine on its own.

The upcoming resource update and the pre-feasibility study will be two very important elements in the chain to create value and we expect to see a substantial improvement compared to the results of the 2019 PEA.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website.