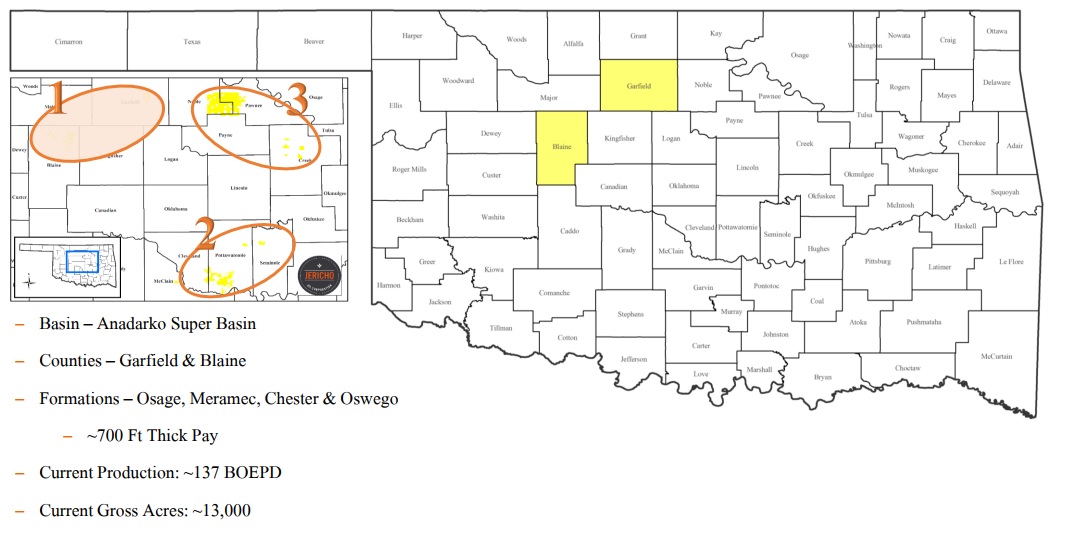

The Jericho Oil (JCO.V) management team has been very busy in the past few months as it completed a series of strategic transactions to A) raise more money and B) strengthen its position in the STACK play.

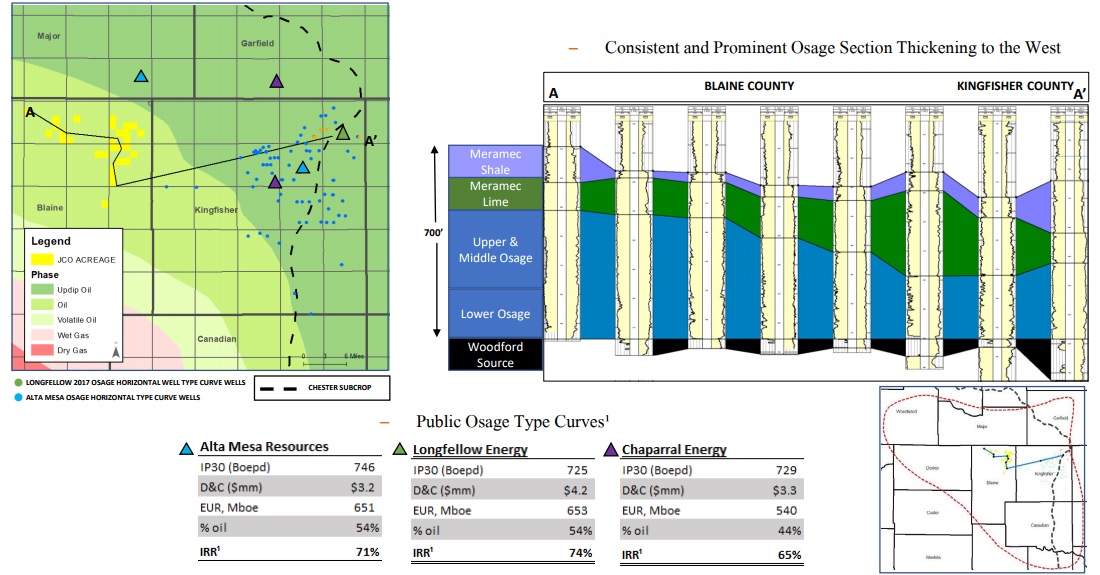

This has resulted in Jericho entering into a farm-in agreement with a private operator to participate in the completion of 2-5 horizontal wells in Major County. Once the first two horizontal wells (with a length of 4,500 feet) will be completed, Jericho’s STACK joint-venture will have established a 50% interest in 6,000 acres. The first well is currently being drilled and upon completion, the STACK JV will earn a 47.5% interest in the well and as Jericho owns 26.5% of the Joint Venture, its indirect stake in the well will be 12.59%.

This initial drill program could be a game changer for Jericho. Not only did it allow the company (through the STACK JV) to gain access to new acreage with a proven operator, it will help the company’s own technical team to gather so much more information about the geological structures and drill protocols. And finally, should the well be successful and reach a flow rate of 500-800 barrels per day, Jericho’s attributable oil production rate will increase sharply.

Although one could argue Jericho Oil isn’t exactly ‘cheap’ with its current market capitalization of C$104M, let’s not forget about the strong cash position, the land position in the very prolific STACK play and the fact Jericho is being backed some strong (and rich) private family offices. As such, Jericho deserves a premium compared to other oil juniors which, for instance, are dealing with heavy oil in Alberta.

The jury’s out, and we’re looking forward to see the initial results of this first well. Finding some oil would be nice.

Go to Jericho’s website

The author has a long position in Jericho Oil. Jericho is a sponsor of the website. Please read the disclaimer