Jericho Oil (JCO.V) received good news from its lender, East West Bancorp, as it confirmed the company’s borrowing base at US$7.5M until the new maturity date of the credit facility in July 2020. The ceiling could obviously redetermined (and will be up for revision in October), but considering the recent exploration success, we don’t anticipate this to be any problem at all.

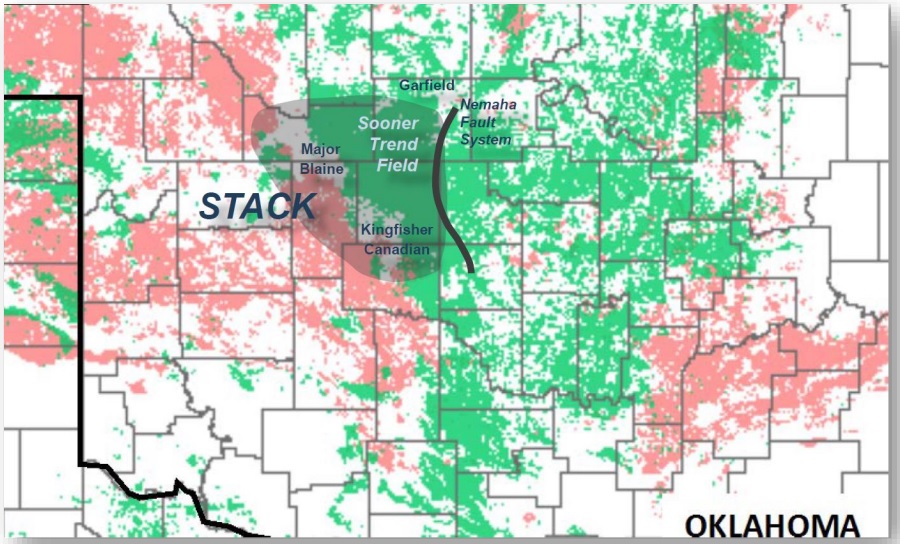

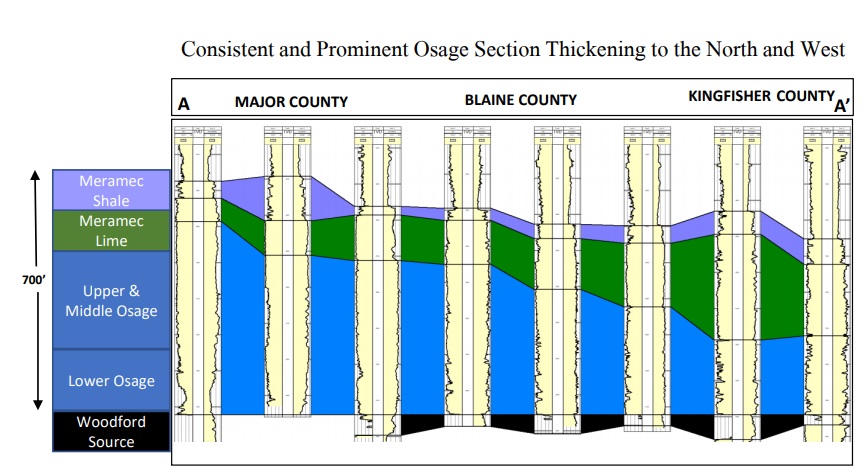

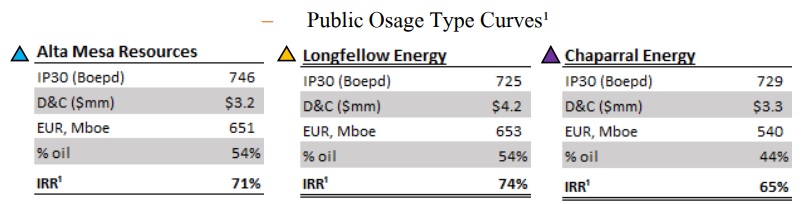

After having participated in two successful wells through the STACK Joint Venture, Jericho Oil elected to participate in developing the Trebuchet well, which will be the third well as part of the joint venture, and the second well targeting the Osage formation. There’s an increased level of activity throughout the northern part of Oklahoma’s part of the STACK play, as for instance Alta Mesa Resources (AMR) has confirmed it will be expanding its mid-stream operations to service these prospective areas of the STACK area.

Considering the estimated cost of US$5M to complete the well and Jericho’s net stake of less than 13%, the US$650,000 needed to fund its part of the well cost could easily be funded from the cash position on the balance sheet.

Jericho has also prepared the paperwork to file a Normal Course Issuer Bid (a share buyback program) starting later this month. Jericho has requested the approval to repurchase 0.5M shares (or 0.4% of Jericho’s share count). This seems to be just a symbolic buyback program but with a net working capital position of C$4.9M as of at the end of June, Jericho is in an excellent (financial) shape.

On top of the very healthy cash position, Jericho Oil has 4.7M warrants with a strike price of C$0.60 expiring in November of this year. Should Jericho’s share price trade above C$0.60 by the time these warrants expire on November 28th, Jericho Oil will be able to add C$2.8M (US$2.1M) to its cash position, which would be sufficient to fund its obligations for the next 3 wells.

Last week, Maurice Jackson of Proven and Probable released an excellent interview with CEO Brian Williamson. You can read the transcript of the interview here.

Go to Jericho’s website

The author has a long position in Jericho OIl. Jericho is a sponsor of the website. Please read the disclaimer