K92 Mining (KNT.V) is keeping its word, and the company has now announced the results of a Preliminary Economic Assessment which was aimed to define how profitable the extraction of ore from the Kora deposit on the Kainantu land package would be.

As the average grade at Kora is exceptionally high (there’s an existing inferred resource estimate containing 1.65 million gold-equivalent ounces at 11.6 g/t) we expected the PEA to be good (it’s not easy to ruin a project with an average grade of in excess of 10 g/t gold-equivalent), but the results exceeded our expectations. The initial capex is estimated at just $14M, which already includes a $3.3M investment program to double the capacity of the mill to 400,000 tonnes per year.

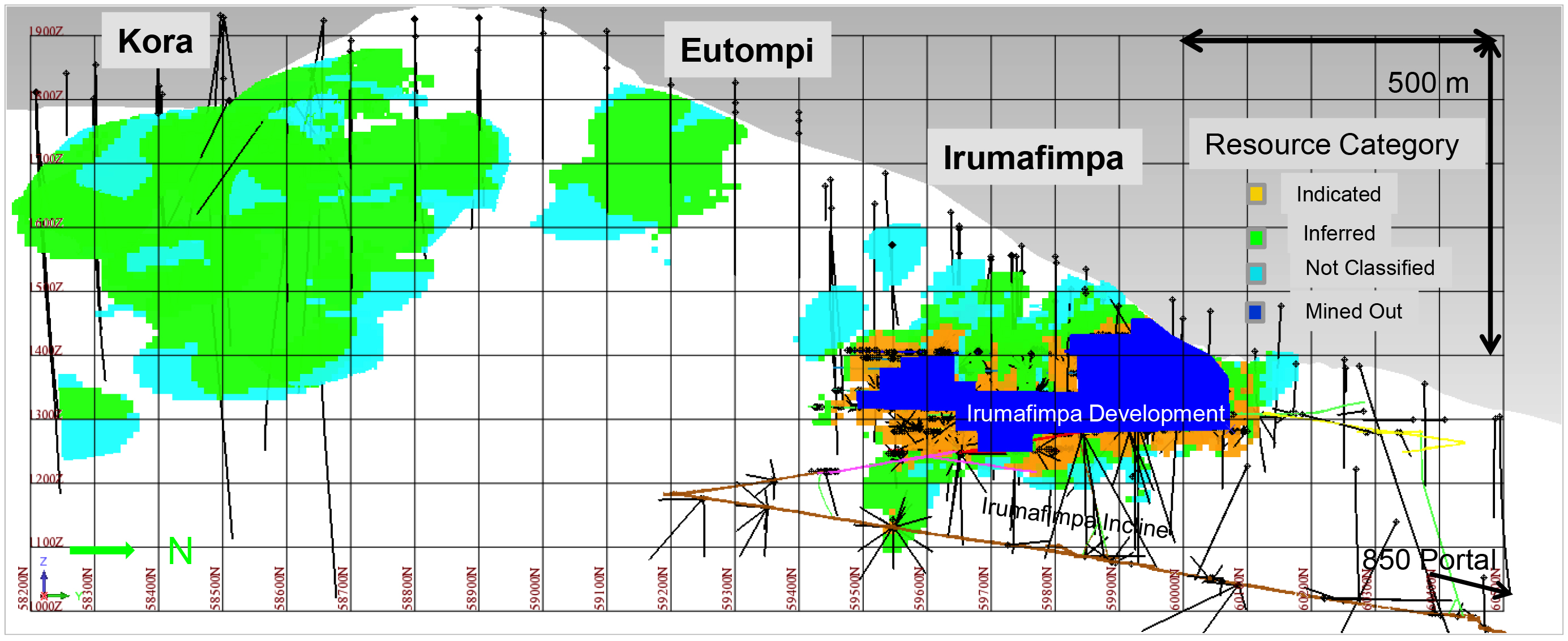

The AISC is expected to be $619 per gold-equivalent ounce (which means the AISC of just the gold using the copper and silver as a by-product credit will be substantially lower) and with an average production rate of 108,000 ounces of gold-equivalent, it shouldn’t be a surprise the pre-tax NPV is coming in at US$415M. That’s approximately C$550M or in excess of C$5/share which could be just the starting point as the Kora zone is open in every direction.

Of course, we are still waiting for the technical report to be filed, and once that has been done, you can expect a more extensive update from us with special attention to how the value of the project changes using different input prices (we are very keen to see the impact of a higher copper price on the economics of the development of Kora as the PEA used a very conservative copper price of $2.18/lbs), and to see how the different mineralized blocks were selected and prioritized in the mine plan.

Go to K92’s website

The author has a long position in K92 Mining. K92 Mining is a sponsor of the website. Please read the disclaimer