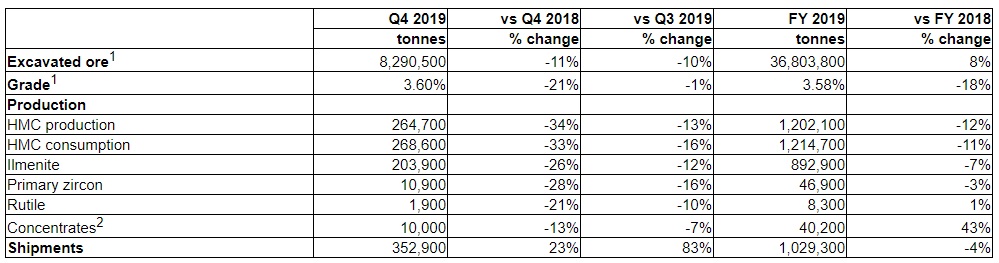

Kenmare Resources (KMR.L) will only publish its financial results in the second half of March, but the company has already prepared the market for relatively weak set of results. Despite having excavated 8% more ore, the lower average grade (which fell by 18% to 3.58%) caused the production of the heavy mineral sands products to decrease as well. The ilmenite production fell by 7% to 893,000 tonnes while the zircon output fell by 3% to almost 47,000 tonnes.

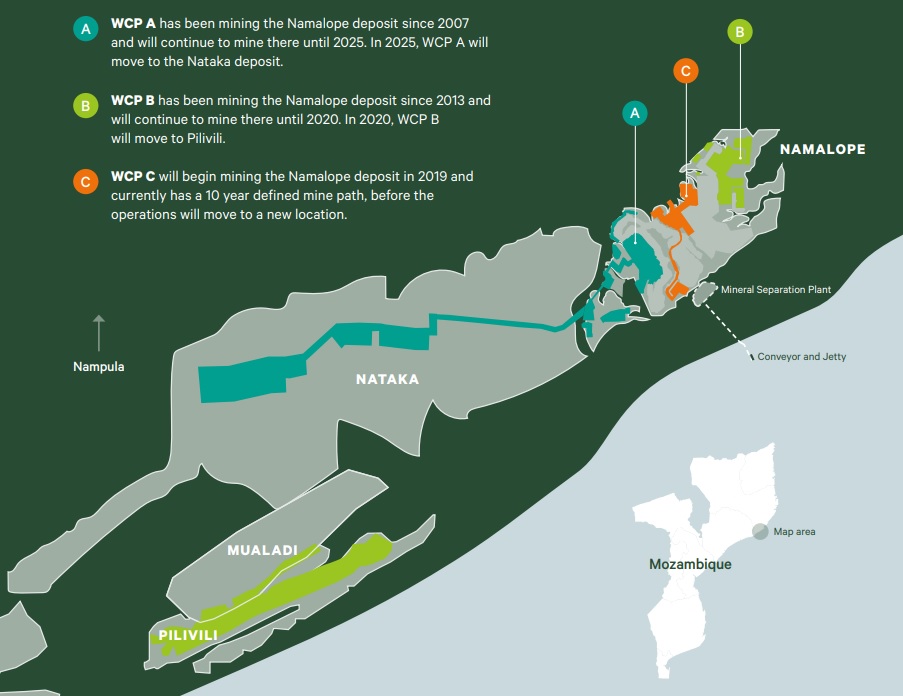

The lower average grade was widely expected as the WCP B zone was mined out and the production was focusing on the A zone which has a lower grade. This also caused the cash operating cost per tonne to increase to $160-165 (from the previous guidance of $150-160/t) but the higher ilmenite price may make up for this as well.

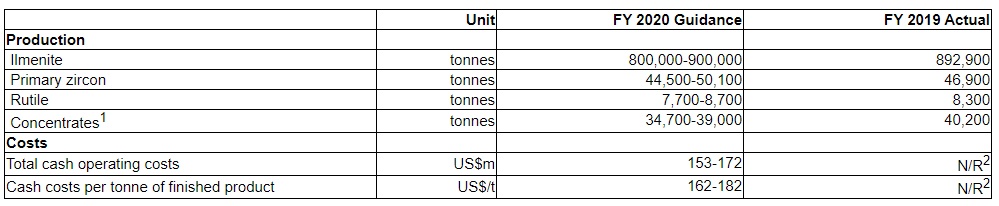

For 2020 we shouldn’t expect any improvement. Kenmare is guiding for an ilmenite output of 800-900,000 tonnes but this also will be the last year of Kenmare producing less than one million tonnes of ilmenite per year. From 2021 on, the company expects to produce 1.2 million tonnes of ilmenite as Kenmare expects to finish its expansion program during this year.

This will pave the way for a higher free cash flow and should also have a positive impact on Kenmare’s dividends as the size of the dividend is directly connected to the net income of the company (the dividend policy calls for a payout ratio of 20% of the net income) which should increase thanks to the 40% production boost.

Disclosure: The author currently has no position in Kenmare Resources.