Lithium Chile (LITH.V) is now in the final stages of raising C$4M in a private placement priced at C$1 per unit which each unit consisting of one share and half a share purchase warrant. Each full warrant authorizes the warrant owner to acquire an additional share of Lithium Chile at C$1.50 within 24 months after the placement closes.

Lithium Chile is also moving ahead with the creation of Kairos Metals Corporation, a spin-off which will own all of Lithium Chile’s current copper-gold assets in Chile. We expect to know more in the next few weeks after Lithium Chile closes its placement, and we believe the spin-off will create more value for the shareholders as Lithium Chile doesn’t get any love from the market for its base metals properties.

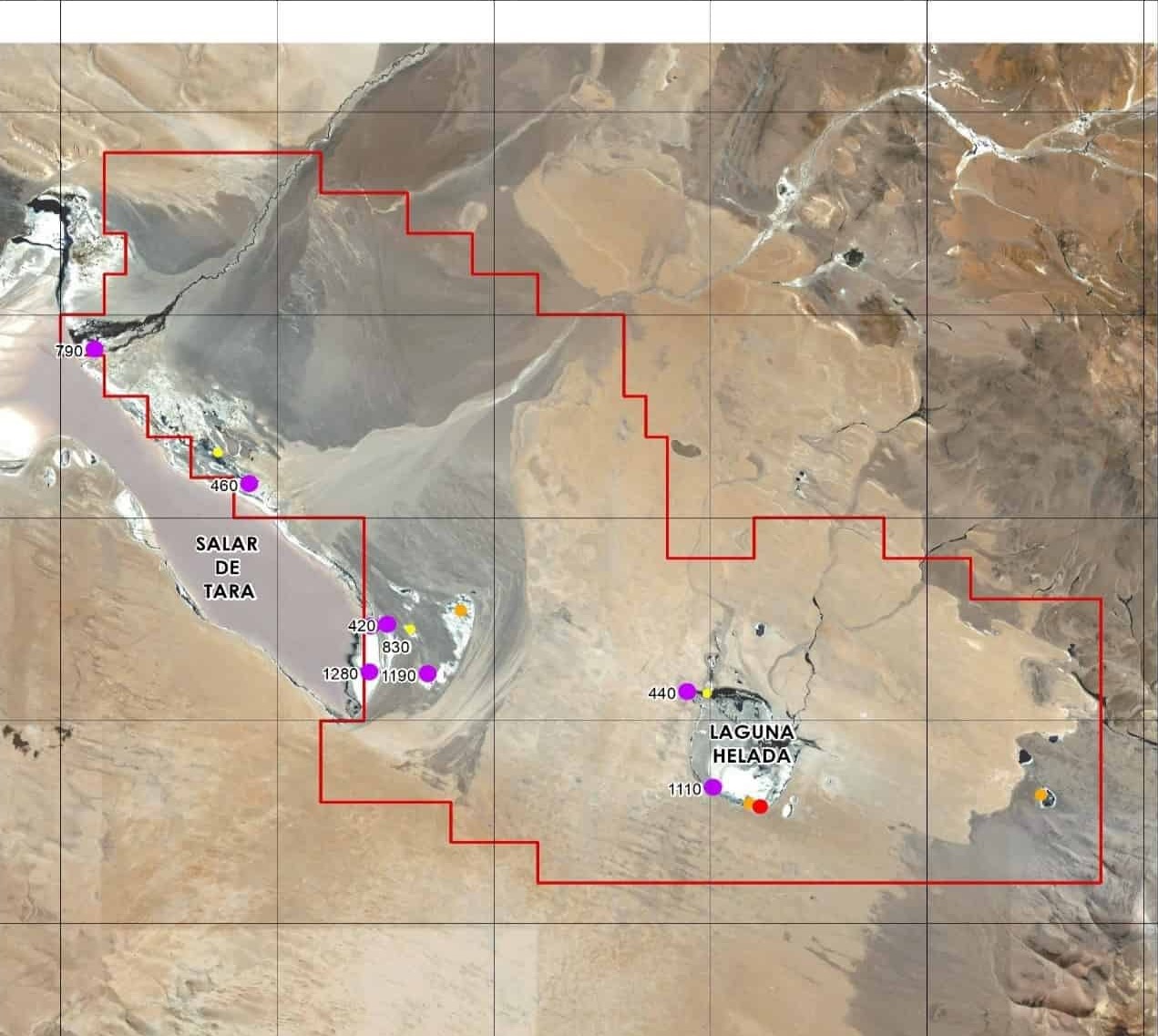

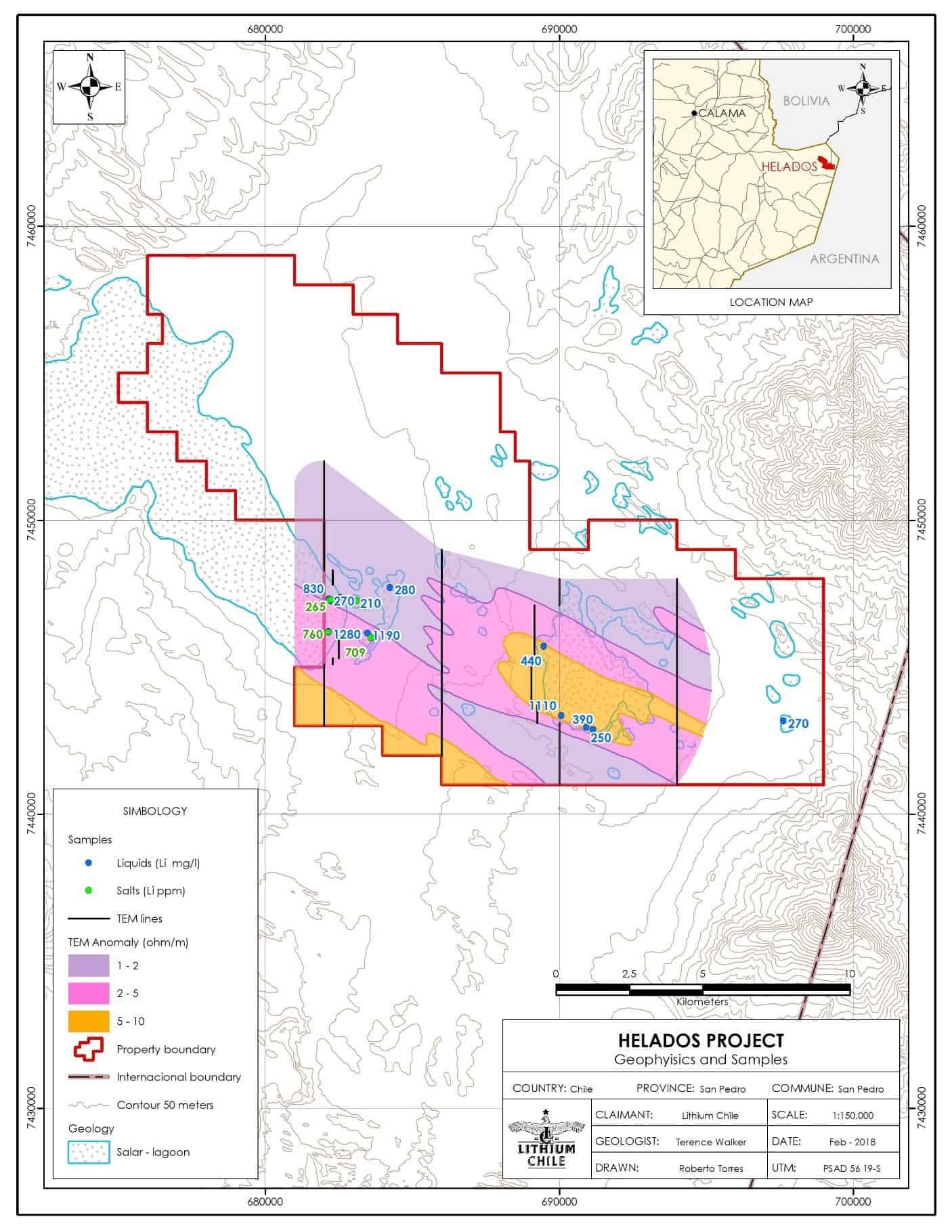

Meanwhile, the company continues to expand its land position in Chile, where it has added an additional 5,900 hectares of land to the Helados brine project, bringing the total land position to 22,700 hectares. The newly acquired block appears to be very prospective as well, as Lithium Chile reports near-surface samples have encountered lithium values of up to 760 mg/l whilst the magnesium/lithium ratio remains exceptionally low (at an average of 2.6 across the Helados property).

On the 22,700 hectare land position at Helados, Lithium Chile’s reconnaissance survey now identified a 6,000 hectare high-priority brine target, and a drill program will be initiated right away. The high-priority zone is located on the southern part of the land package and the survey indicates there’s a horizontal zone with a thickness of 100-300 meters which could be a saline aquifer (based on resistivity data). On top of that the southwestern part of this zone underlies some zones where assays of in excess of 1,000 mg/l have been sampled.

With an additional C$4M in the bank, Lithium Chile will be ready for the 2018 exploration season, and let’s hope the company is able to repeat the exploration success of Millennial Lithium (ML.V).

Go to Lithium Chile’s website

The author has a long position in Lithium Chile. Please read the disclaimer