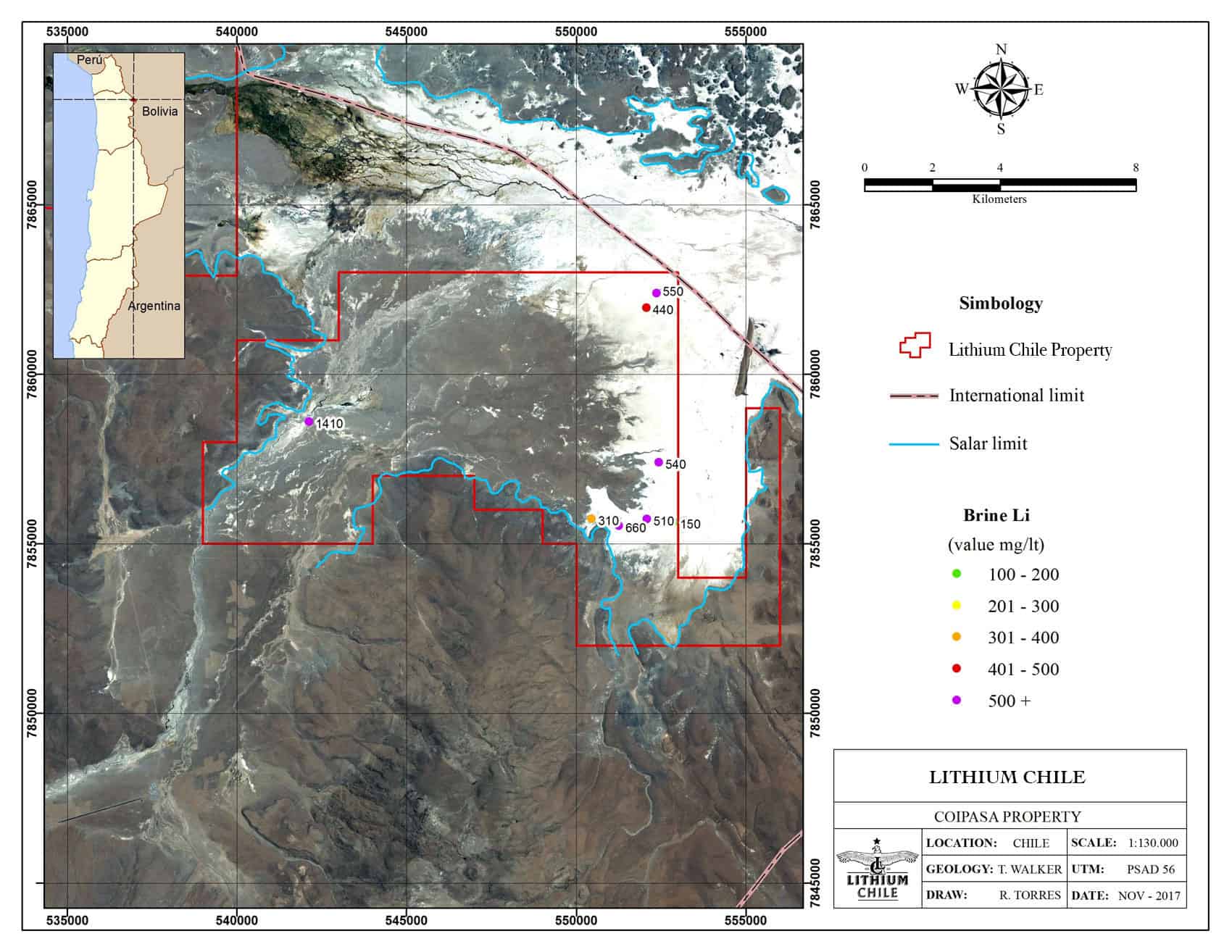

Lithium Chile (LITH.V) has identified a 58 square kilometer lithium brine target area at the Coipasa project. A recent exploration program on the tenements has sampled lithium values from 310 mg/l to 1410 mg/l from brine zones close to surface. Additionally, the (very preliminary) Magnesium:Lithium ratio is just 3.9, substantially lower than the 6.4 in the Atacama salar (the lower the Mg:Li ratio, the better).

The potential brine zones have been found after completing the most recent geophysical survey which showed indications of a 100-300 meter thick brine zone starting at a depth of just 50-100 meters below surface. Based on the geophysical survey and the resistivity levels (less than 3 ohm), Lithium Chile thinks there might be a thick saline aquifer underneath. And considering the high-grade near-surface lithium values, we believe there’s a pretty good chance the brine could be lithium-bearing. The proof will be in the pudding, so we are anxiously awaiting Lithium Chile’s next step to thoroughly explore Coipasa.

In other news, the company also confirmed its shareholders have voted unanimously in favor of the proposed corporate transaction whereby the non-lithium properties of the company would be spun out into a new (listed) entity. All of the copper, gold and silver assets will be re-branded (again) as Kairos Metals, which will come out of the gate with C$1M in cash and a portfolio containing 6 projects and almost 30,000 hectares of land in Chile.

Lithium Chile will remain focused on the lithium projects in Chile, and spinning out the base metal properties might create additional shareholder value. An ‘ex-div’ date for the spinoff will be set after the expected court approval today, and this ex-div date will very likely be sometime later this week.

Go to Lithium Chile’s website

The author has a long position in Lithium Chile. Please read the disclaimer