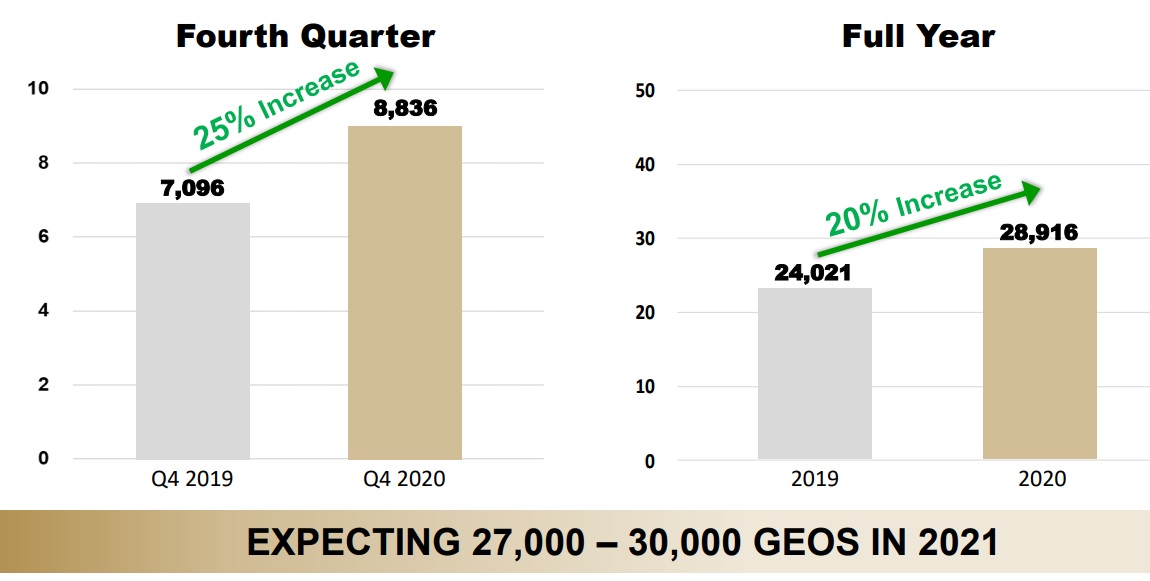

Maverix Metals (MMX.TO, MMX) still has to report its financial results for FY 2020, but the company has already provided a production update. The royalties and streams it owns on the various projects resulted in an attributable production of 8,836 ounces of gold equivalent, which is 25% higher than the amount of attributable ounces in the fourth quarter a year ago.

This brought the full-year attributable gold output to just under 29,000 ounces (on an equivalent basis) which is not only 20% higher than in 2019, but it also exceeds the guidance for 2020. For 2021, Maverix is guiding for an attributable output of 27-30,000 ounces of gold (on a gold-equivalent basis) where it intends to have a 90% cash margin. At the current gold price of $1800/oz, 2021 is shaping up to be another excellent year for Maverix.

Maverix has also boosted its cash balance. While the company received US$50M from Agnico Eagle Mines (AEM, AEM.TO) which repurchased a 1.5% NSR on the Hope Bay gold mine (which we explained HERE), Maverix also sold C$9.8M worth of Northern Vertex (NEE.V) shares which recently completed the merger with Eclipse Gold. Taking all these transactions into consideration, Maverix Metals is now debt free, has about US$50M in cash and short-term investments while retaining its access to a US$120M credit facility. This means the company has access to about US$170M in liquidity to source new deals.

Maverix also announced a quarterly dividend of US$0.01 per share, payable on March 15th.

Disclosure: The author has a long position in Maverix Metals. Maverix is a sponsor of the website. Please read our disclaimer.