Although the initial REE craziness from last summer has subdued a bit, it did have a serious spillover effect as companies in Western nations have given their supply chain a closer look. So although there is nothing new to mention on the REE pricing front, it does look like more and more companies (and government institutions) are looking to secure their REE supplies from ‘safe’ countries. And although this isn’t as ‘sexy’ as a sudden rush on REE stocks, we think this could be an important turning point for the entire sector.

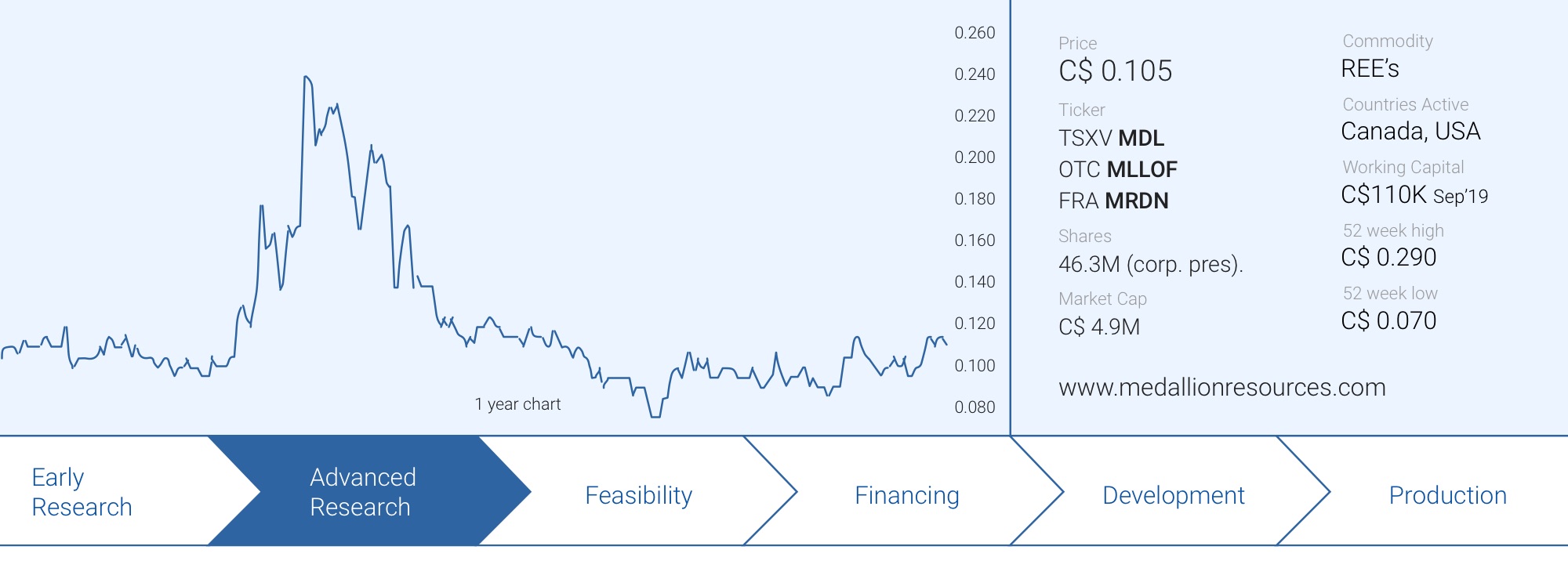

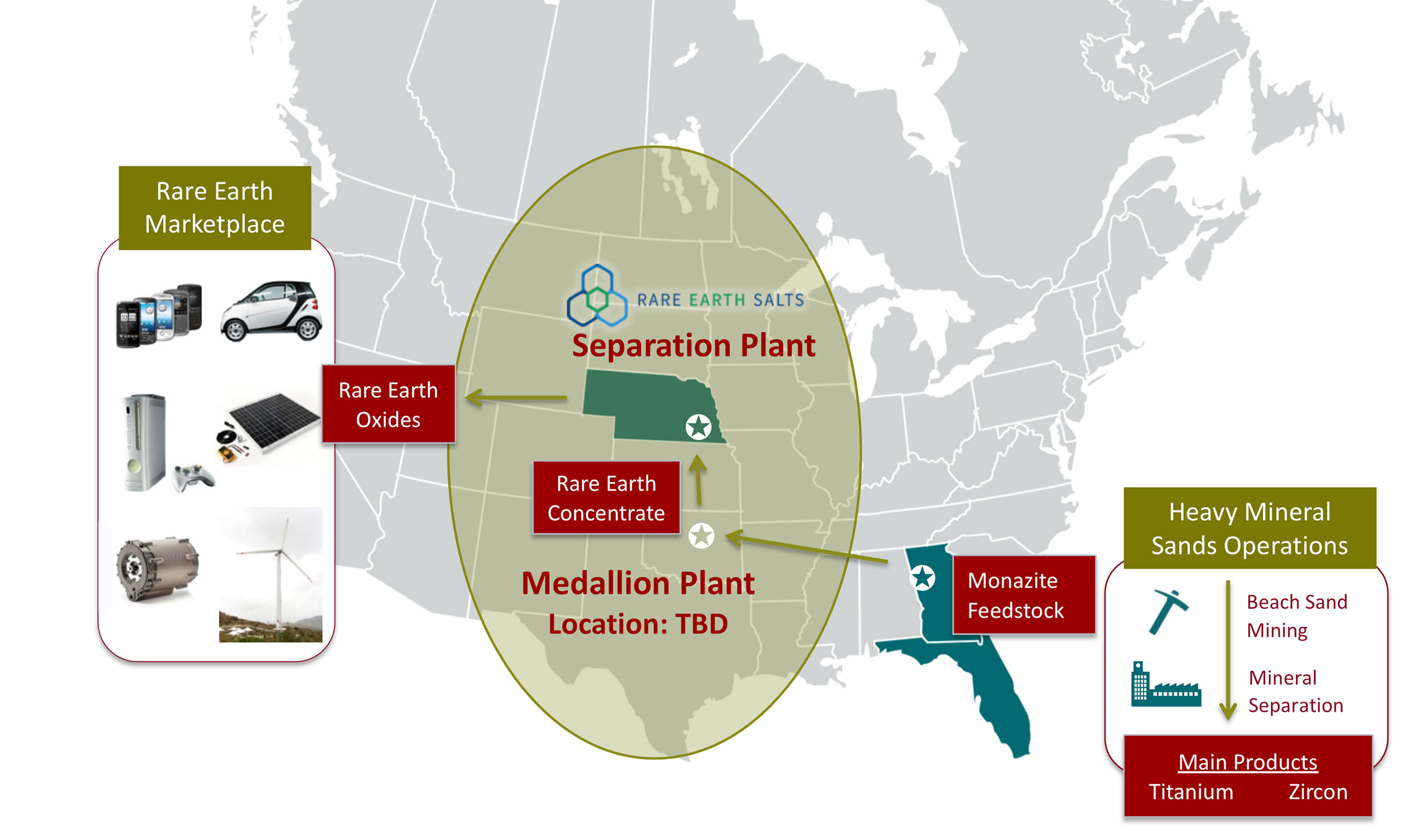

This doesn’t mean there will be an overnight change in the perception of REE companies, but it should help technology-oriented companies like Medallion Resources (MDL.V) to get more attention as the low capital intensity and ‘clean’ output in the form of a REE concentrate produced from the waste product of mineral sands operations should be appealing as the mineral sands could be hauled in from about anywhere on the planet to secure domestic production of an REE concentrate in a Tier-1 country.

Enquiries from the US

There’s an increased interest from first world countries in securing a more reliable supply chain after seeing the impact of the trade war with China. Last week, Medallion disclosed it has received several inbound expressions of interest from REE refineries enquiring about the specs and potential availability of Medallion’s REE concentrate.

The inbound enquiries were triggered by the request from information from the US Department of Defense which is getting serious about substantially reducing its reliance on China-sourced Rare Earth Elements and is putting a scheme together whereby domestic production of the REE end products will be encouraged and subsidized.

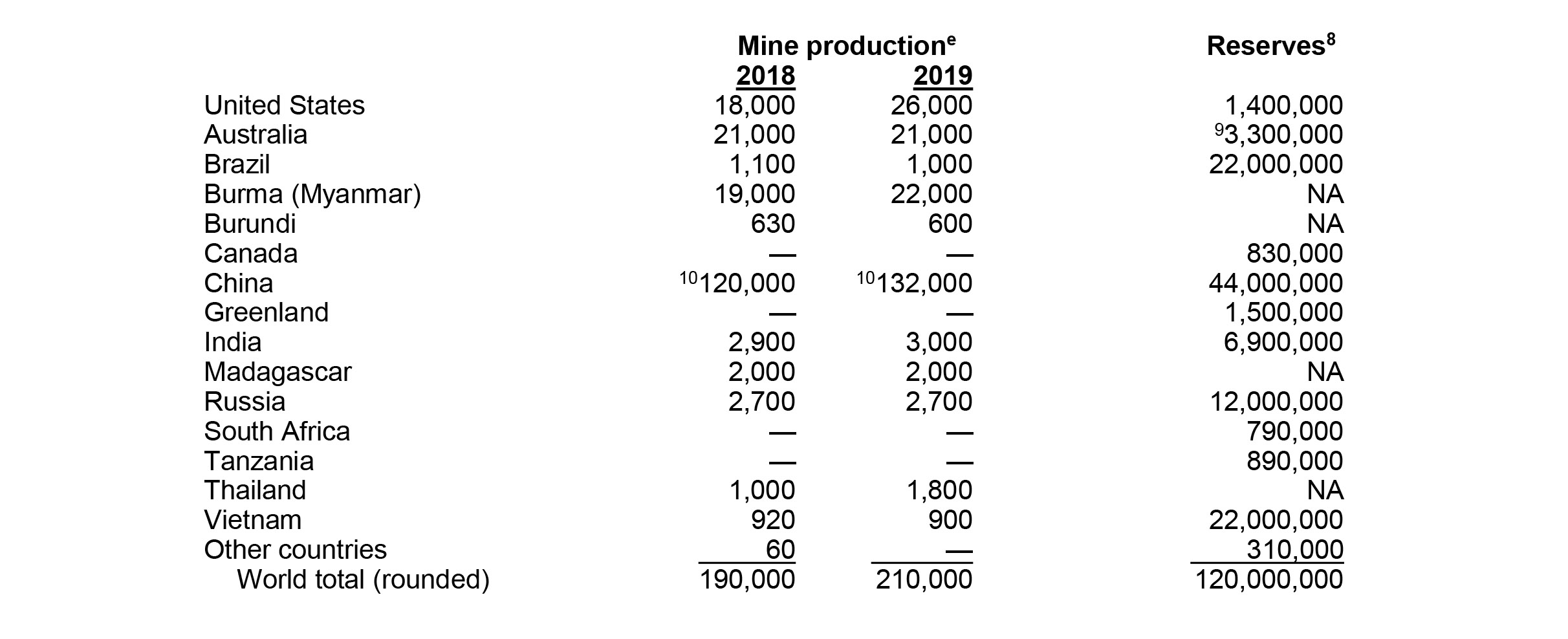

And this could be a perfect way for Medallion Resources to effectively establish its presence in the USA as the company has announced earlier this year it has hired an external consultant to figure out a location in the USA for its first processing plant to convert monazite into a REE concentrate where the neodymium and praseodymium output will be highly sought after. Unfortunately the US Geological Survey – which traditionally does an excellent job in providing background information on the different commodities – does not provide a specific breakdown for the main elements praseodymium and neodymium, but you get the gist by looking at the general breakdown of where the REE metals (as a basket) are coming from.

The world production rate increased by approximately 10%, and roughly 60% of that increase was coming from China while 15% of the production increase was generated in Myanmar and 8% in Thailand. So although the world production increased, pretty much the entire production increase was delivered by Tier-2 and Tier-3 countries (no disrespect to Thailand and Myanmar, but we can hardly count those countries as first world countries with an established high-quality legal framework in place).

Other than the apparent keen interest from end-users without a safe supply chain to strengthen those supply chains, there isn’t anything new to mention on the REE front. Prices have remained stable and we have the impression very little trading has taken place. Now the Chinese New Year is over, we expect to see updated spot prices and are looking forward to see the impact of the Coronavirus on the REE prices and export volumes.

The flowsheet is now ready, and plant sites are being selected

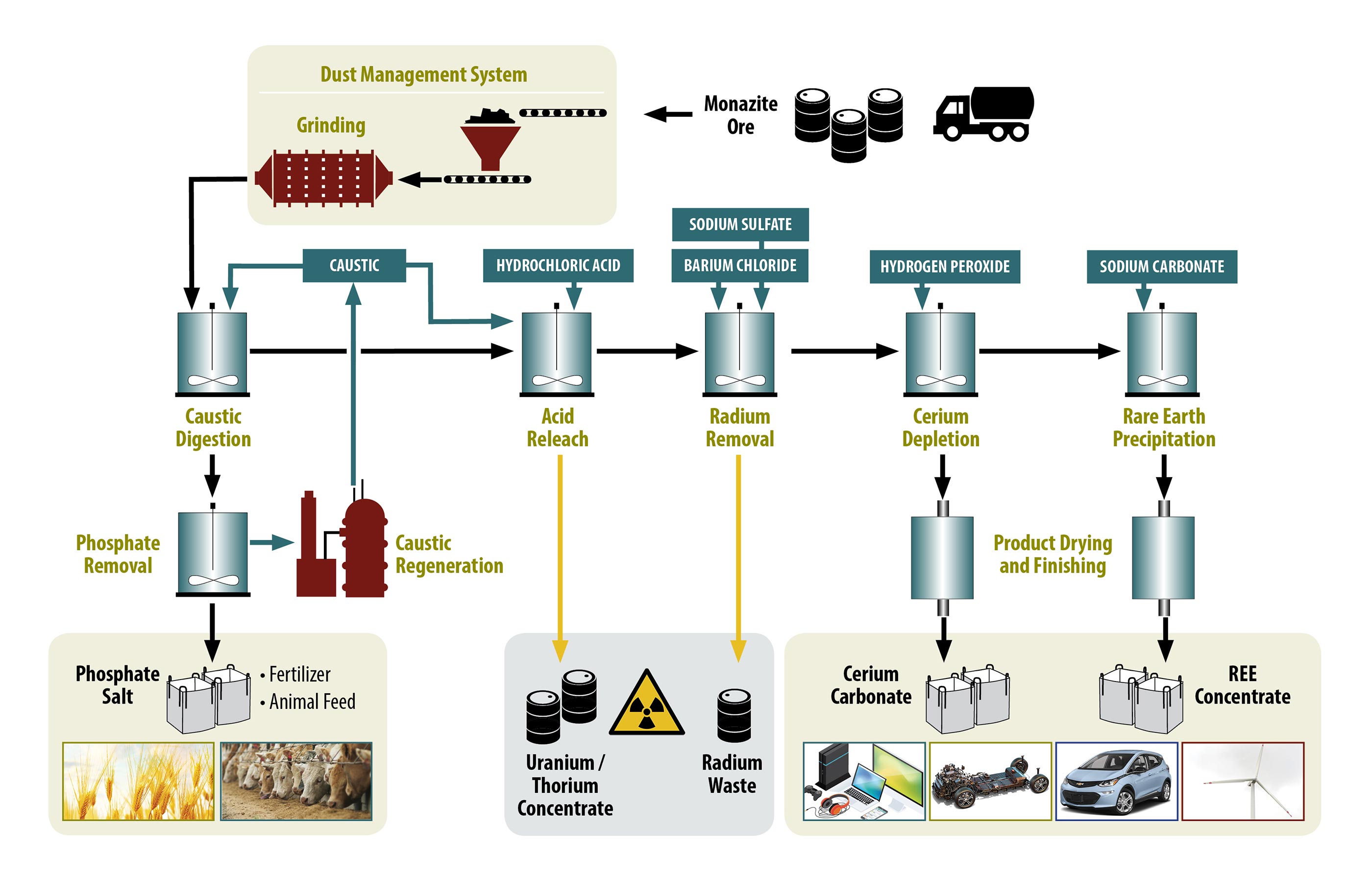

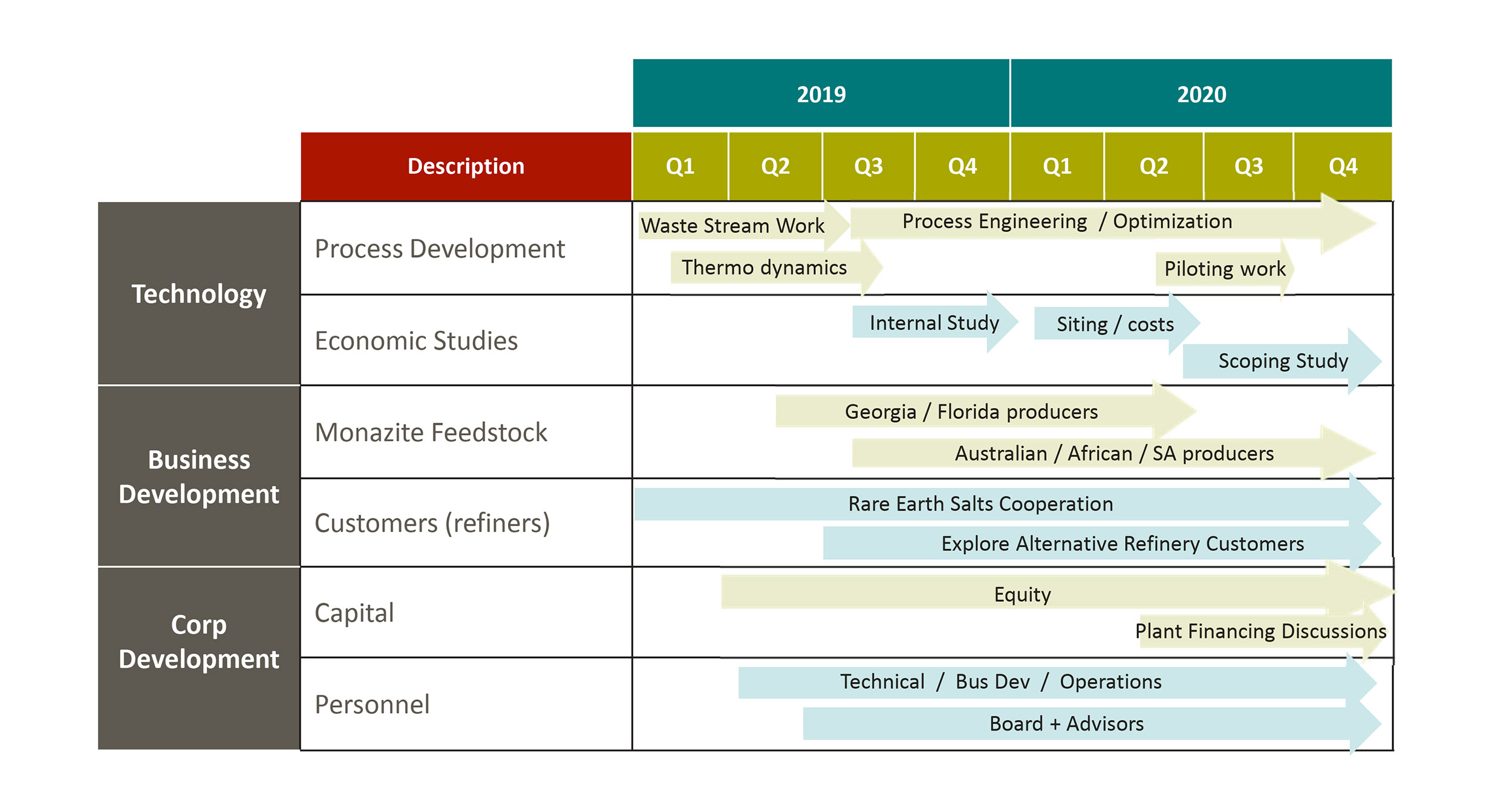

As explained before: after completing a dedicated and detailed metallurgical test program in 2019, Medallion also completed its flow sheet to extract Rare Earth Elements from a monazite sand product, which usually is the discarded product from mineral sands operations as it’s considered to be ‘waste’.

This is an important step for the company as it can now use the flow sheet to further finetune the expected economics of a monazite processing plant as the new flow sheet provides a lot of additional information which were needed to formally initiate price quote discussions (for instance to discharge the waste products and the ability to use ‘common’ equipment that doesn’t have to be custom made). Medallion also focused on increasing the automatization of the plant to reduce the required manpower (and associated labor costs) and (obviously) wanted the entire production process to be as energy-efficient as possible.

Now a (definitive) flowsheet has been established, Medallion Resources will be able to finetune the economics of a monazite processing plant and select a location for said plant. Medallion has now engaged Stantec to evaluate sites in the USA that could serve as home base for Medallion’s plans to build a plant to recover the Rare Earth Elements from monazite, a waste product generated by heavy mineral sands mines.

The company’s decision to focus on the USA perhaps shouldn’t come as a surprise as the country realizes it is depending on other nations to secure a sufficient supply of for instance neodymium and praseodymium, two important elements in magnets. As the US car vehicle industry, as well as the Department of Defense, has been looking to secure a supply of REEs outside of the traditional Chinese circuit, Medallion Resources will undoubtedly be looking to secure monetary incentives that might be available to boost the production of REEs (and then predominantly neodymium and praseodymium) in the States. The inbound inquiries we discussed in the previous section of this report only reinforce the position of the United States as preferred location for the processing plant.

CEO Don Lay also provided more explanation on this update in an interview with Proactive Investors, which you can watch below.

Medallion’s financial situation

In the final quarter of last year, Medallion completed a C$800,000 placement which was priced at C$0.105 per unit (with each unit consisting of one share and ½ warrant with a strike price of C$0.165 and valid for a period of three years). Approximately C$570,000 was raised before September 30th (which is the date of Medallion’s most recent financial statements) while the final tranche of C$231,000 was closed in October.

This also means the working capital position will have received a boost as despite having raised just over half a million in Q3, the working capital position as of the end of September was just C$110,000 as the company had been accruing certain expenses which were subsequently paid off with the proceeds from the first tranche. The financial statements for the quarter ending in December will be filed soon and considering CEO Don Lay’s focus on running the company as lean and mean as possible we would expect the working capital still to be positive. The cash burn in the first six months of the financial year was less than C$600,000 or C$300,000 per quarter while the completion of the flowsheet should result in lower project investigation expenses.

An interesting read

It’s not always easy to find good reads on the REE sector and when we stumble upon a good read we are happy to share it with you. NXT Analytic has recently published a comprehensive analysis of the REE sector in a report titled ‘How to Profit from the Commodity Market’s Blind Spot‘.

The report discusses the background of the REE sector, its main uses and the recent initiatives of the US Department of Defense to look into non-China sourced REE materials. And of course, as the Electric Vehicle industry remains an important purchaser of REE products, NXT also provides more background on the use of REE in EVs and how the expected demand increase for such vehicles will boost the demand for praseodymium and neodymium as main magnet commodities.

Conclusion

Medallion Resources has made good progress last year and completing the final flow sheet to process monazite, the waste product from mineral sands producers, into an REE concentrate was a major step in the right direction.

Unfortunately, the investor interest in the entire REE sector has waned after the spike in the summer of last year, but the level of interest from the concentrate buyers and end-users of REEs has definitely increased. The inbound interest from several US-based REE refineries could be the start of a more sophisticated audience starting to look into non-Chinese supplies of REE products and Medallion’s plans to process monazite into REE concentrate. The monazite could easily be sourced from mineral sands projects that are not controlled by Chinese investors/companies and the processing phase would take place in first world countries. This would allow Medallion to produce a REE concentrate that would be 100% free of any Chinese influence.

Disclosure: The author has a long position in Medallion Resources. Medallion Resources is a sponsor of the website.

Pingback: Caesars Report - Medallion Resources