Metanor Resources (MTO.V) has released its full-year financial results, and just like we did with the financials after the first semester, we will have a closer look at how the company performed, and if it was able to generate a positive free cash flow.

As we explained in our March report (which you can read HERE), we aren’t very interested in accounting profits on the income statements. As mining and oil and gas businesses usually have a high up-front capex and low sustaining capex (relatively when compared with the initial capex), a lot of the mining companies report negative earnings whilst the cash flows are positive. Perhaps a remarkable case is Barrick Gold, which reported a net loss of $2.8B in the financial year 2015, even though its free cash flow was positive to the tune of $400M on an adjusted basis.

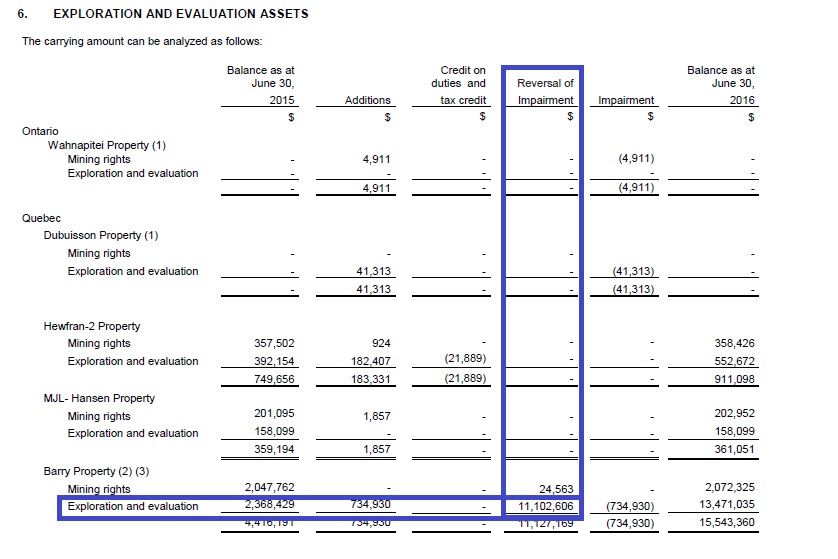

Just for the record, Metanor’s bottom line showed a small net loss of C$2.5M which sounds very reasonable, but you should realize this was predominantly caused by a reversal of an impairment charge of C$10.4M (see above). The entire reversal was based on the Barry deposit as Metanor thinks that project will now be profitable again at the current gold prices. The PEA on the Barry project indeed yielded positive results, but the jury is still out until we have seen the details in the technical report which will be filed any day now.

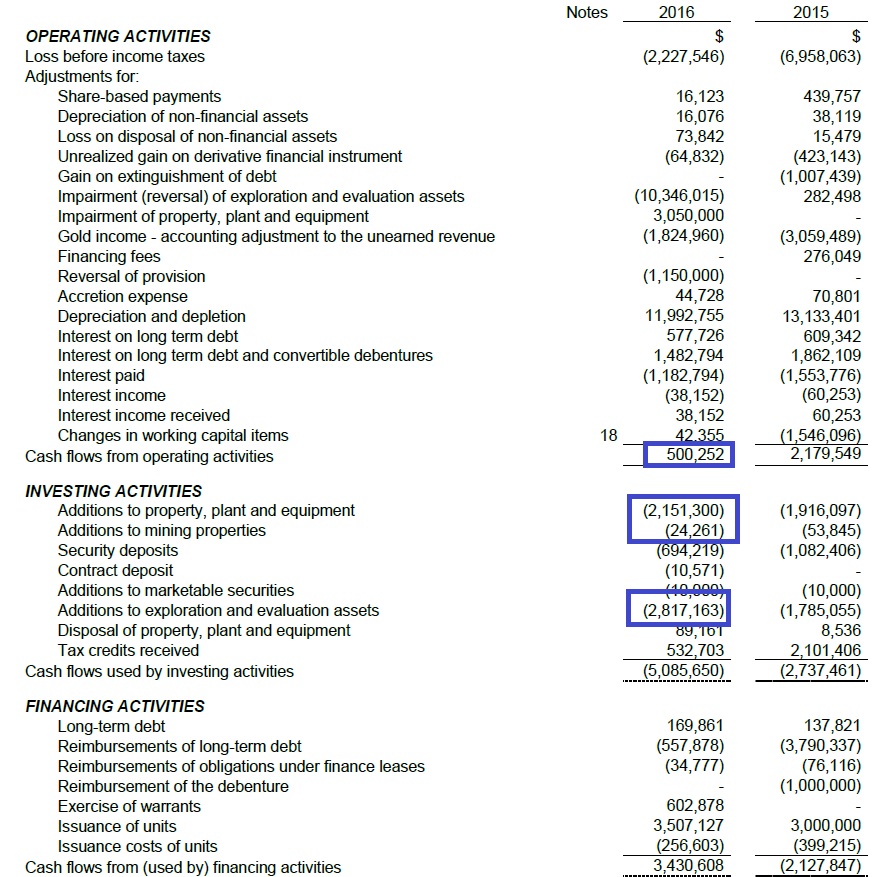

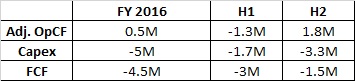

Moving over to the cash flow statements now, Metanor reported an operating cash flow of C$500,000 and whilst that’s already a substantial improvement compared to the first half of its financial year, the second semester wasn’t good enough to cover the entire capex and exploration programs during FY 2016. The next table breaks the performance down to see how Metanor performed in both semesters. We will use the adjusted cash flows, excluding changes in Metanor’s working capital position. We are also including all exploration expenses in the equation. Technically, we would only have to include the sustaining exploration expenses meant to keep the mine life stable, but given the short ‘official’ mine life at the Bachelor Lake mine and the need to bring Barry back online, we will qualify all exploration expenditures as sustaining.

As you can see, Metanor reported a positive operating cash flow in the second half of the year, but the capex also increased, due to an increased exploration spending (C$1.9M in H2, which will hopefully pay off if the Barry project is being brought back into production). It’s also a reason why we prefer companies to be debt-free, as Metanor paid in excess of C$1M on interest expenses.

On an annualized basis, Metanor would be generating C$3.6M in operating cash flow which would be sufficient to cover the sustaining capex on the equipment (C$2.2M), but the company’s exploration programs are increasing the cash outflow. Unfortunately the company has no other option, because it needs to increase its confidence in the Barry project by completing some more infill drilling to validate the PEA expectations.

Go to Metanor’s website

The author has a long position in Metanor Resources. Metanor is a sponsor of the website. Please read the disclaimer