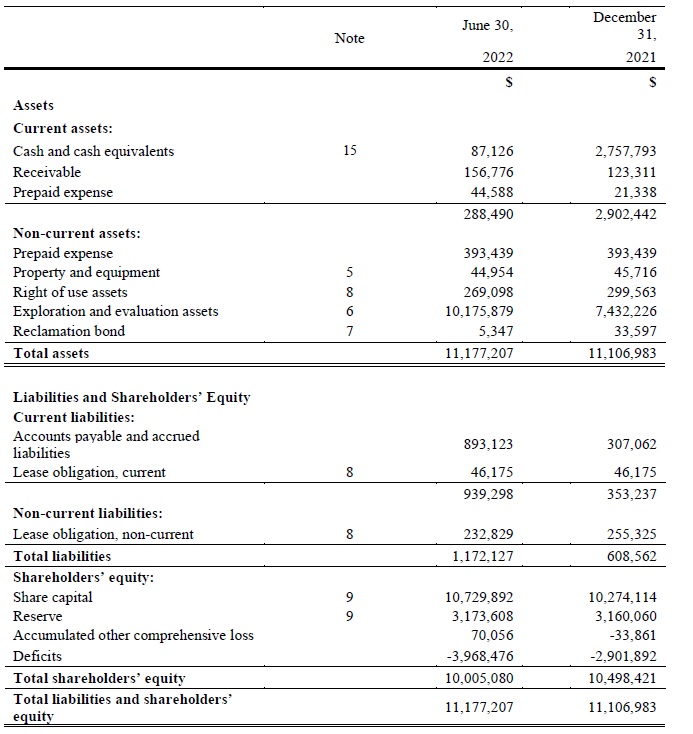

NevGold (NAU.V) recently filed its financial results for the second quarter of this year, and as of the end of June, the company had a working capital deficit of approximately C$650,000. As explained in previous reports and updates the C$0.4M in prepaid expenses currently classified as a non-current assets could and perhaps should be considered as a current asset anyway, in which case the working capital deficit would be a more benign C$0.25M.

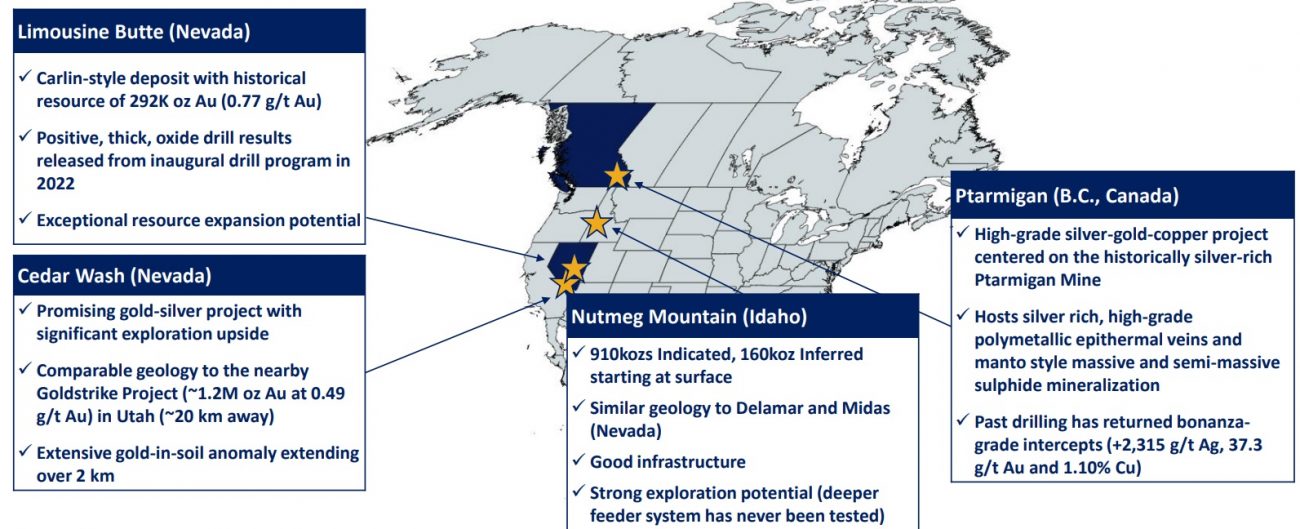

Subsequent to the end of the quarter, NevGold raised C$1M from GoldMining (GOLD.TO) as part of the transaction to acquire the Nutmeg gold project. Additionally, NevGold raised another C$1.12M in a flow-through financing in August, but that cash is obviously earmarked for an exploration program on the Ptarmigan silver project in British Columbia. So while the working capital deficit looks bad, the situation should be remedied by now.

We anticipate to see additional drill results from the flagship Limousine Butte project soon and hopefully that will allow NevGold to raise more money this fall as the company has committed to make a cash payment of C$1.5M in January 2023 and complete C$1.5M in exploration expenditures by June 1 2023 as part of the Nutmeg acquisition agreement. So that’s about C$3M in (non-flow through) cash requirements on top of the plans to continue drilling at Limousine Butte.

Disclosure: The author has a long position in NevGold. NevGold is a sponsor of the website. Please read our disclaimer.