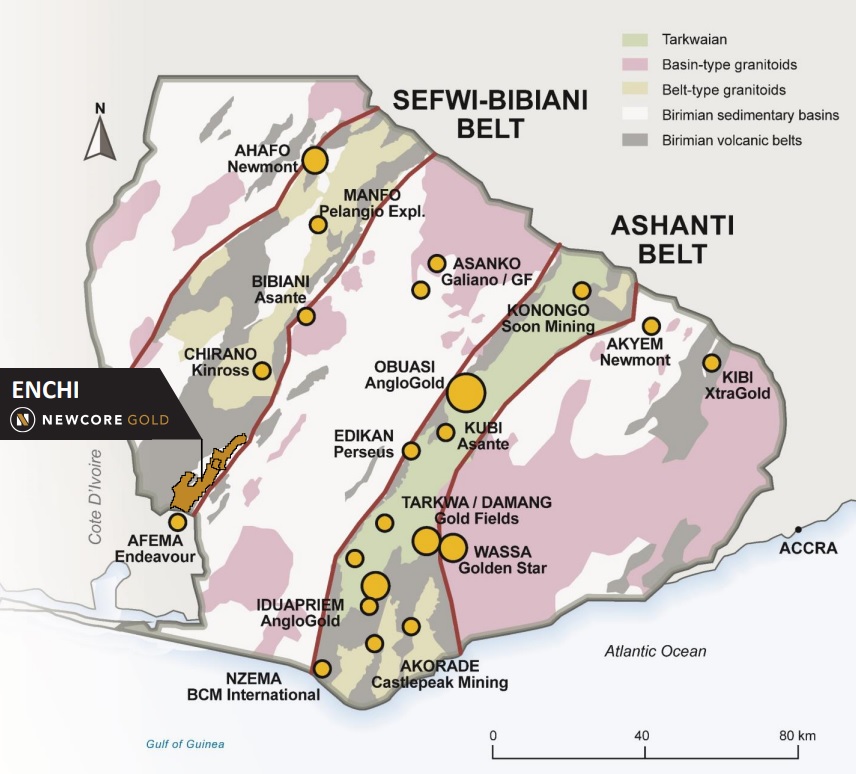

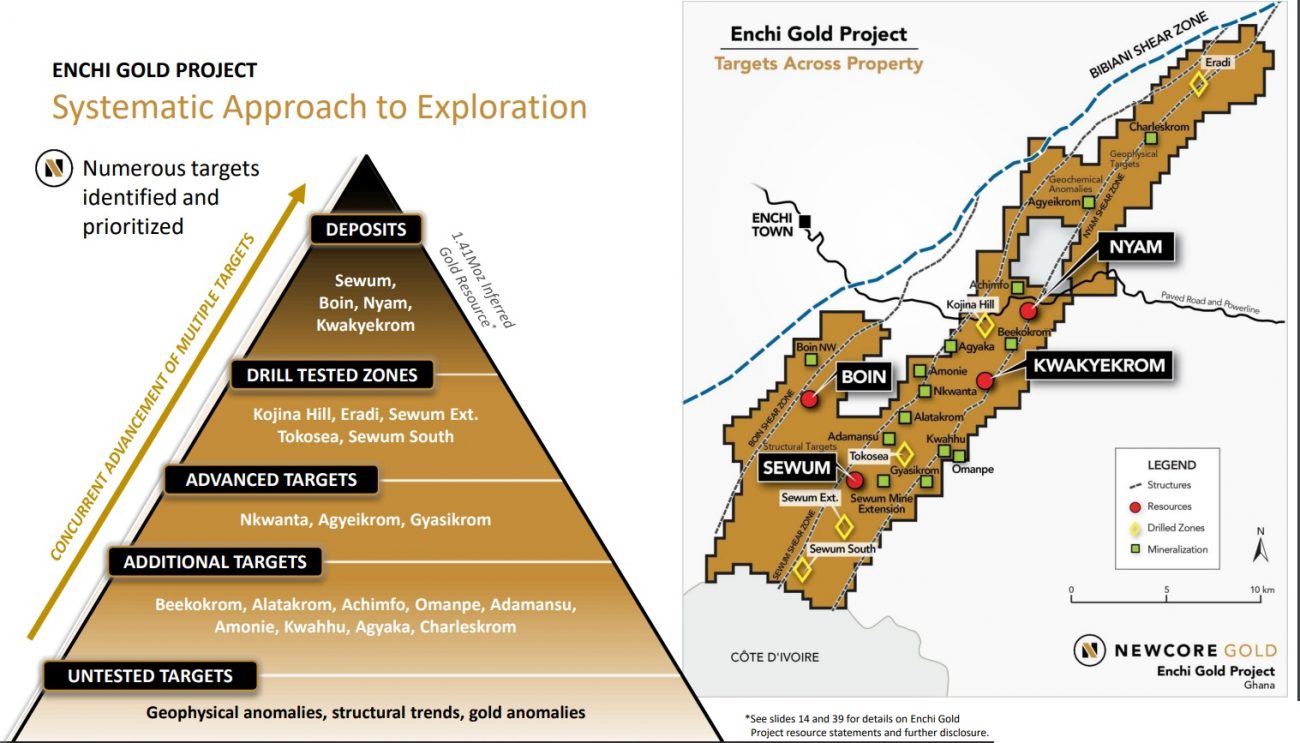

Newcore Gold (NCAU.V) has completed a bought deal for total proceeds of C$5M. This was a straight-share financing (no warrants were issued) priced at C$0.30. 16.7M new shares were issued which brings the total share count to 138.1M shares for a market capitalization of approximately C$40M. The proceeds will be used to continue the exploration activities on the flagship Enchi gold project in Ghana where the current resource estimate of 1.4 million ounces of gold at 0.62 g/t will likely be updated with the data of the ongoing 90,000 meter drill program.

The existing PEA on the project is focusing on a heap leach scenario with an initial capex of US$97M resulting in an after-tax NPV5% of US$168M at $1550 gold. As the PEA has an effective date of June 8 2021, the economics will have to be updated with what will undoubtedly be a higher capex and opex (which was estimated at US$1066/oz on an AISC basis). Of course an extended mine life and increased amount of ounces recoverable (versus the 983,000 ounces in the PEA) may offset these cost increases.

Insiders participated as well with Doug Forster acquiring 166,667 shares, CEO Luke Alexander acquired 96,660 shares while VP Corporate Development and IR Mal Karwowska purchased an additional 70,000 shares in accounts she controls.

Disclosure: The author participated in the financing and has a long position in Newcore Gold. Please read our disclaimer.