Earlier this month, Newcore Gold (NCAU.V) released an updated resource estimate on its flagship Enchi gold project in Ghana. As the company released the update during PDAC it probably was hoping for an uplift in its share price but the market ‘rewarded’ Newcore for its efforts with a 19% decrease.

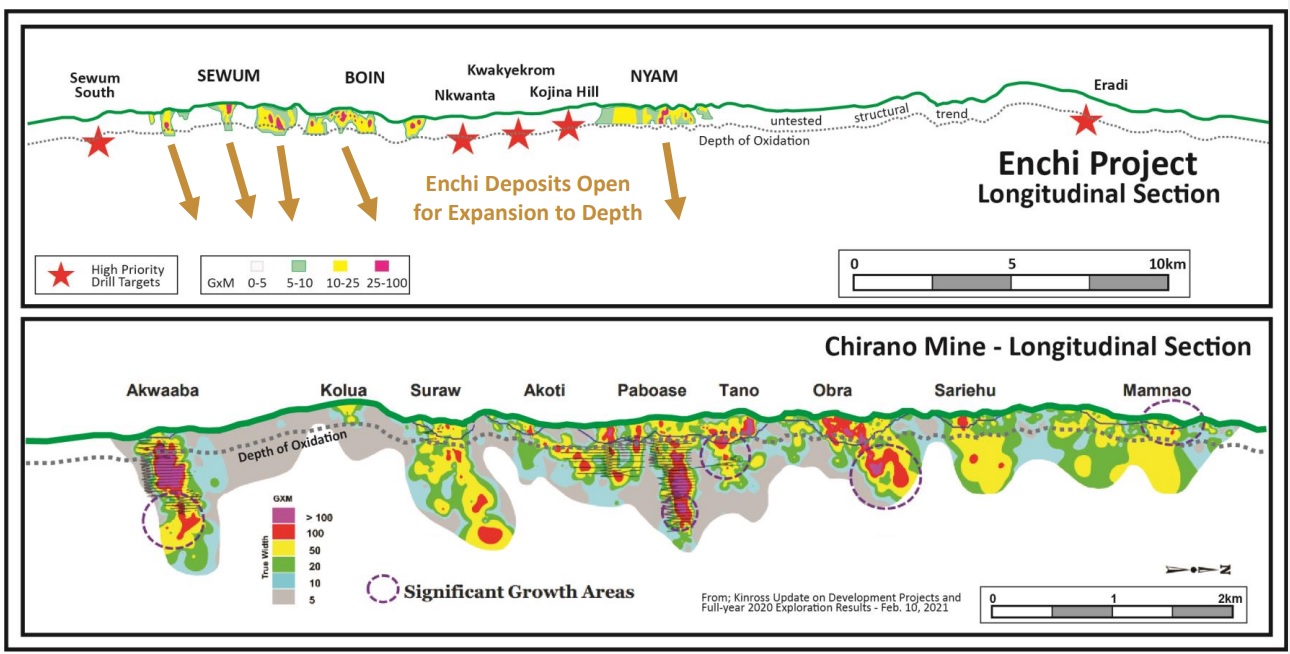

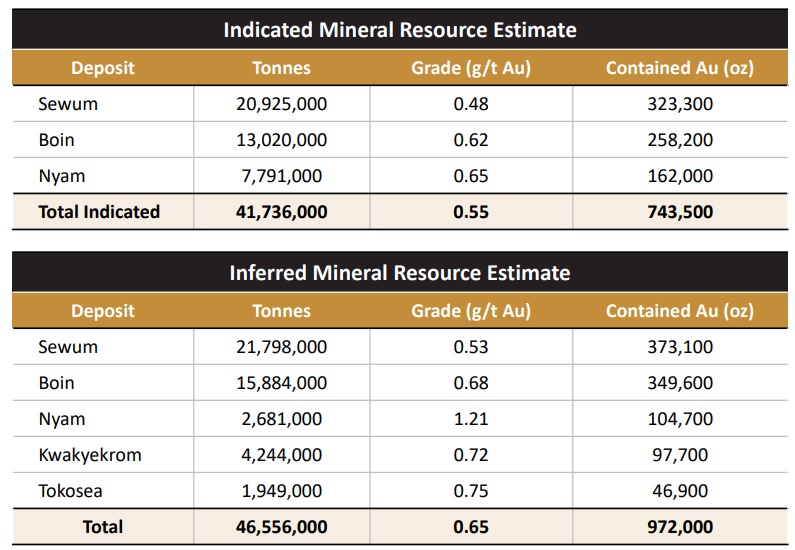

While the resource update wasn’t too bad, the market clearly expected more. The updated resource contains 744,000 ounces of gold at an average grade of 0.55 g/t in the indicated resource category while there is an additional 972,000 ounces of gold in the inferred resource category with an average grade of 0.65 g/t. This compares pretty well with the 1.4 million ounces at 0.62 g/t in the inferred resource calculation from 2021. The grade remained pretty stable while about half of the known inferred resource was converted into the indicated category, adding about 300,000 ounces in the process. While the market was disappointed, the resource really isn’t too bad for just 34,000 additional meters of drilling since the 2021 resource calculation. Approximately 135,000 of the 1.7 million ounces are part of an underground resource with an average grade of approximately 2.5 g/t across three distinct zones (Sewum, Nyam and Kwakyekrom).

On top of the 34,000 meters of additional drilling that is now incorporated in the resource, the company has completed an additional 38,000 meters of drilling that is not included in the current 1.7 million ounce global resource and the path towards 2 million ounces of gold across all categories. The cutoff date for this resource was July 2022 and none of the holes completed since the summer of 2022 have been included in the current calculation.

Disclosure: The author has a long position in Newcore Gold. Please read our disclaimer.