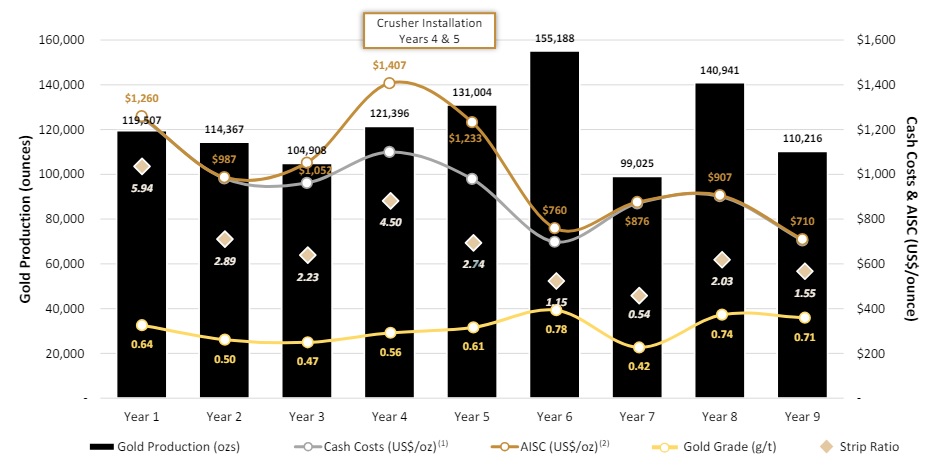

Newcore Gold (NCAU.V) released the outcome of an updated Preliminary Economic Assessment on its flagship Enchi gold project in Ghana. The updated study incorporates the data from approximately 34,000 meters of additional drilling since the previous study was published. In the current version of the mine plan, a total of 1.1 million ounces will be recovered over a nine year mine life with an average gold production of almost 122,000 ounces and a peak production of 155,000 ounces in the sixth year of operations.

The initial capex is estimated at just US$106M and thanks to the very low production cost of just $1018/oz on an AISC basis (this includes the impact of a 7% NSR on the project which is costing approximately $129 per produced ounce of gold at $1850 gold), the payback period is just 1.6 years resulting in an after-tax IRR of 58% at $1850 gold. Meanwhile, the after-tax NPV5% at that gold price is approximately US$371M and this increases to US$632M at $2350 gold which will also make the IRR jump to 92% on an after-tax basis.

With the new study, Newcore Gold succeeded in its efforts to position Enchi as a low-capex and high-return heap leach project and with an initial capex of just $106M, the ‘financeability’ of the project has dramatically improved to the extend that even a mid-tier could easily pull the trigger and actually build the mine. Using a long-term gold price of $2050/oz, the after-tax IRR is a very impressive 65% while the after-tax NPV5% is US$475M. Keep in mind the Ghanaian government is entitled to a 10% free carried interest in the project (which would result in an attributable NPV5% of around US$420M on an after-tax basis). This represents approximately C$3.27 per share based on the current share count of 173M.

Disclosure: The author has a long position in Newcore Gold. Please read the disclaimer.