Once again, the pollsters were wrong this week, as they just don’t seem to understand two things. First of all people vote with their feet, but secondly, and perhaps more important, the anonymity of the polling booth makes everything different. Whereas most people wouldn’t want to be heard or seen on the streets as an openly supporter of Trump, in the polling booth you can do whatever you want. We saw this in Austria where the extreme right presidential candidate almost won the elections and when the British citizens voted to leave the European Union, against all odds.

Two companies will be very pleased with the fact infrastructure spending seems to be high on the new president’s agenda. Zinc shot higher and even traded briefly at $1.18 per pound on Friday, before closing at $1.11. As the world is heading to a zinc supply deficit and only a few new zinc-focused projects are being advanced right now, the focus is on the smaller companies like Vendetta Mining (VTT.V) which is working towards a PEA on its Pegmont Lead-Zinc project in Australia.

Not only is the higher zinc price very welcome (as you can see on the previous image, the zinc price has increased by 56% in the past 12 months), but the lead price is also cooperating well. Whereas lead was trading at 72 cents per pound about a year ago, we closed the day at 95 cents per pound.

What does this mean for Vendetta Mining? The current resource estimate (which will be updated in 2017 and we expect the zinc grade to increase rather substantially based on this year’s drill results) contains 5.2 million tonnes at an average grade of 6.53% lead and 2.78% zinc. This means the sulphide zone had a rock value of $147.5/tonne, but this value has now increased to almost $205/tonne. And keep in mind we expect the zinc grade to increase, which will boost the value even more.

Vendetta will be presenting at the Metals Investor Forum in Vancouver’s Rosewood Hotel Georgia TODAY at 12:10 PM. You can still register for this event HERE, and ask the company all the difficult questions you have in mind.

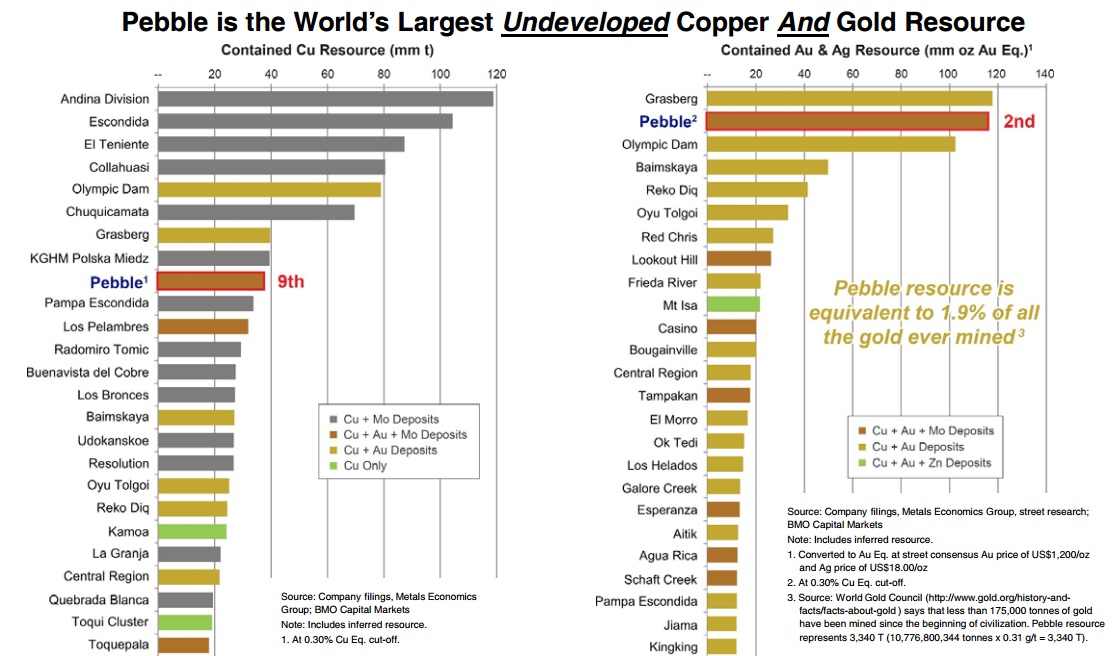

Vendetta isn’t the only company expecting a boost from increased infrastructure spending, and perhaps Northern Dynasty Metals (NDM.TO, NAK) will be the biggest winner. Not only did the copper price increase by almost 20% in one week (before ‘falling’ back to $2.50/lbs), the new pro-business and pro-commodities president might accelerate solving the issue the company currently has with the EPA.

The company has been trying to get the EPA to ‘reconsider’ its pre-emptive veto, a strategy which has only once been used by the EPA in the past 40 years, according to The Washington Post. The big deal here was the fact that Northern Dynasty says the EPA violated the FACA (‘Federal Advisory Committee Act’) which prevents the government to intervene in the EPA decisions.

It has been a long journey, but last month, Northern Dynasty’s Pebble Partnership announced the EPA has agreed to mediation to resolve the current litigation in federal court. That’s a first step, but the simple fact President-Elect Trump will appoint a new head of the EPA might accelerate things. Myron Ebell is named as one of the main candidates for the job and even though we fundamentally disagree with some of his opinions, he might be the right person to get the situation out of the gridlock without anyone losing face, and give Northern Dynasty a fair treatment (which obviously doesn’t mean the permit will automatically be granted).

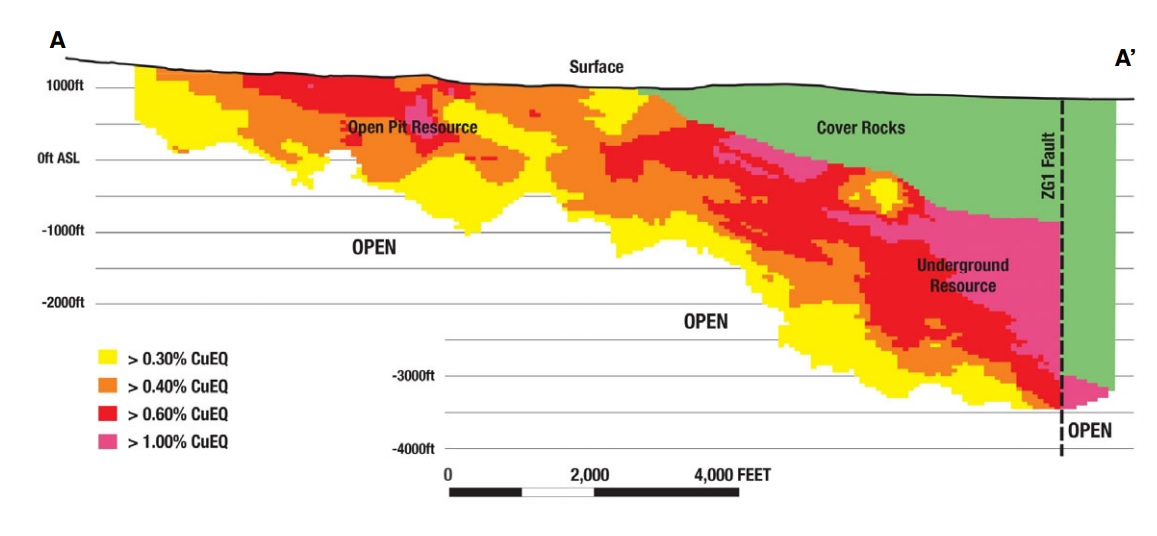

This doesn’t mean anything will change overnight, but 2017 could be the year of a massive breakthrough in the Pebble permitting process which would unlock in excess of 80 billion pounds of copper, 107 million ounces of gold and half a billion ounces of silver.

The author has a long position in Vendetta Mining and Northern Dynasty Minerals. Vendetta Mining is a sponsor of the website. Please read the disclaimer