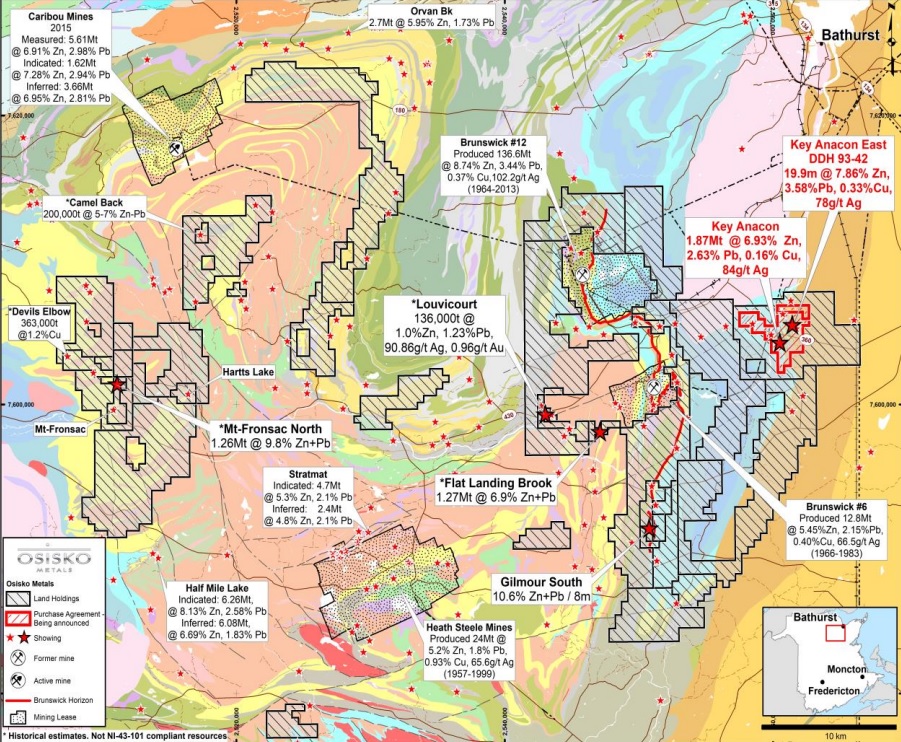

We already reported on Osisko Metals’ (OM.V) proposed acquisition of Pine Point Mining (ZINC.V) in an attempt to boost its zinc portfolio with more advanced stage zinc assets in Canada. Just shortly after announcing the acquisition, Osisko Metals wrote another cheque to purchase the Kay Anacon claims, a 981 hectare land package in the Bathurst Mining camp.

The Key Anacon claims contain two VMS deposits and the ‘Main’ deposit has a historical resource estimate of almost 1.9 million tonnes with an average grade of almost 7% zinc, 2.6% lead and some copper (0.16%) and silver (84 g/t) in a lensed system. These two million tonnes are very likely just the start as Osisko Metals thinks there’s considerable exploration potential at depth (below the 400 meter level) and along strike. Subsequent to this transaction, Osisko also purchased the Camel Back deposit and the claims owned by Canadian Continental Exploration Corporation which are both in the Bathurst mining camp as well.

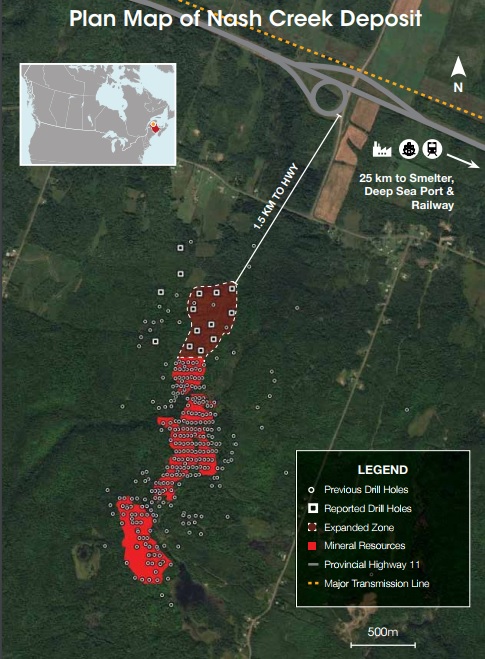

As Osisko Metals is now finally putting its cards on the table with the ‘growth through acquisition strategy’ now officially launched, we can’t help wondering if Callinex Mines (CNX.V) could be next? The company appears to be ticking all boxes as it owns advanced stage zinc projects in the Bathurst Mining district with Nash Creek as perhaps the most advanced Bathurst-based property owned by a junior mining company (we don’t consider Trevali Mining (TV.TO) to be a junior company anymore.

After having focused on its Manitoba exploration portfolio in the past few years, Callinex Mines drilled approximately 20,000 meters on its zinc projects in 2017, and we’re looking forward to see a resource update on the Nash Creek project as Callinex has successfully expanded the mineralization towards the north of the known resource.

Once the resource update will have been completed (which we expect to be the case in February), Callinex will very likely immediately work on a Preliminary Economic Assessment report which should take just a few months. According to Callinex’ recent shareholder letter, the PEA will be looking at a 15-20 million tonnes open pit in a standalone scenario and we would expect companies like Osisko to be very interested in advanced stage deposits as the Net Present Value provides a first ‘tangible’ valuation of the project.

Although Callinex continues to work in the Flin Flon district as well (drilling 2.5% zinc and 0.42 g/t gold over almost 8 meters which was recently announced. We will discuss this in a separate blog post), we firmly believe Nash Creek will be the main value creator in 2018.

Go to Callinex’ website

The author has a long position in Callinex Mines and Osisko Metals. Callinex is a sponsor of the website. Please read the disclaimer