Pacific Ridge Exploration (PEX.V) has completed a non-brokered private placement for total proceeds of C$3.06M (C$3M in net proceeds after taking a C$55,000 finders fee into consideration) after closing a second tranche of the financing. Of the C$3.06M, only C$0.7M consisted of flow-through units (priced at C$0.17) and the vast majority of the financing were hard dollars (priced at C$0.14 per unit).

Each unit (both hard dollar and flow-through) includes a full warrant which allows the warrant holder to acquire an additional share for C$0.20 during a three year period. As in excess of 20M warrants were issued as part of the financing, these warrants represent a potential additional cash inflow of in excess of C$4M if they get in-the-money and are exercised.

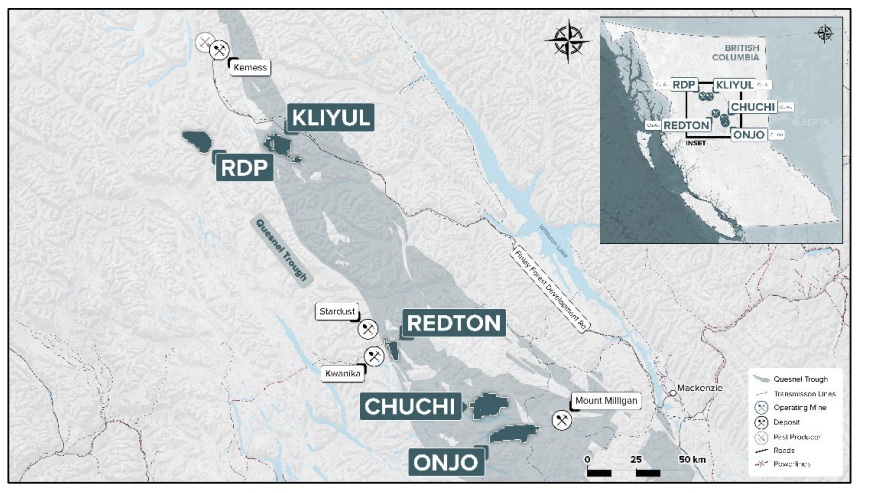

The company also announced it is partnering with the Fiore Group which will provide the company with financial advisory and administrative services. Two Fiore-related people were appointed as strategic advisors to Pacific Ridge to help the company advance its British Columbia based exploration properties as efficiently as possible.

Disclosure: The author has a long position in Pacific Ridge. Pacific Ridge was a sponsor of the website in the past 12 months, but currently isn’t. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.