Pacific Ridge Exploration (PEX.V) has closed the best efforts brokered financing, raising a total of C$7.43 in a combination of hard dollars and flow through money. The company issued 19.15 million charity flow-through units at C$0.328 per flow-through unit and an additional 5 million hard dollar units at C$0.23 per unit.

The units consisted of one share and half a warrant per unit with each full warrant allowing the warrant holder to acquire an additional share of Pacific Ridge at C$0.35 for a period of two years after the closing date of the placement (so until April 2024). The brokers exercised their over-allotment option in full and were compensated with almost C$300,000 in cash and 1.3 million warrants. The net proceeds to Pacific Ridge were approximately C$7.1M which puts the company in a better position (cash-wise) than it has been ever before.

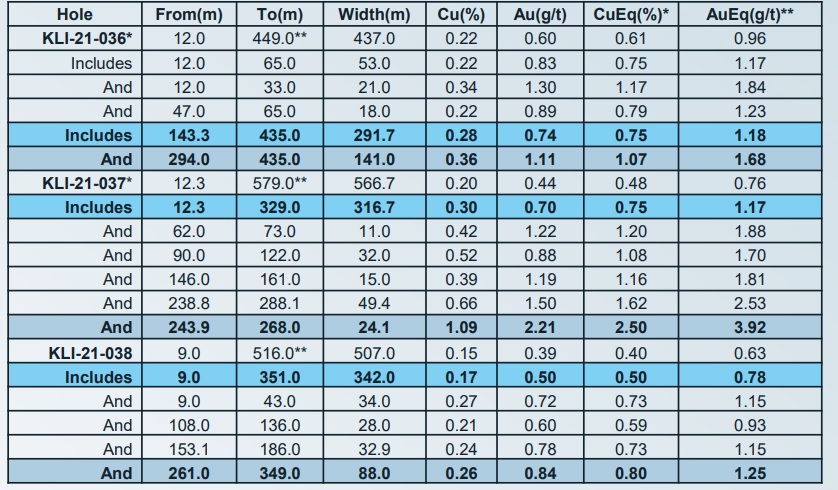

The additional financing allowed Pacific Ridge to further expand its drill program at Kliyul. The company had originally budgeted for a 5,000 meter drill program but has now increased the planned exploration program at Kliyul to 6,000 meters of diamond drilling. This means the 2022 exploration program will be 4X larger than the 1,544 meters drilled in 2021 when Pacific Ridge was only able to complete three holes. Drilling should start by the end of the second quarter.

Disclosure: The author has a long position in Pacific Ridge after participating in the recent capital raise. Pacific Ridge is a sponsor of the website. Please read our disclaimer.