The share price of Prairie Mining (ASX:PDZ, PDZ.L) has been on fire since our latest update in August, as the company has now expanded its project portfolio in Poland with the acquisition of the Debiensko hard coking coal project.

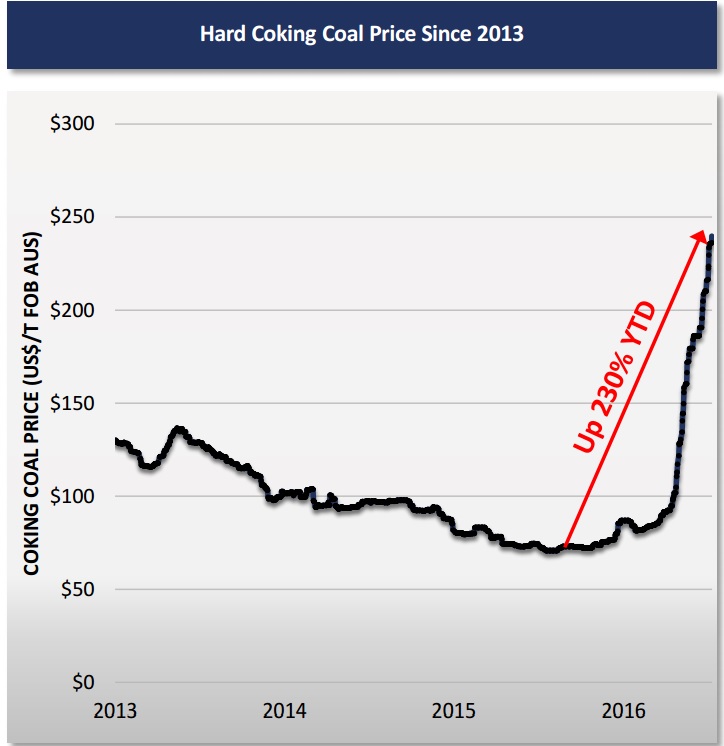

This is a really interesting acquisition considering Debiensko is fully permitted and has a 50 year mining concession in good standing, making it one of the most enticing near-term producing coking coal projects in Europe. As the price for coking coal has been increasing again (with a reported Q4 settlement price of approximately $200/t, compared to a sales price of less than $100/t in the past few quarters), this project definitely has its merits and will most definitely be adding shareholder value considering the total purchase price was just 2M EUR (of which 1.5M EUR is a deferred payment). Even though the company had to deal with a forced seller, this does sound ridiculously cheap, so we hope Prairie can avoid any negative surprises.

We have always considered Prairie Mining to be a prime takeover target by Bogdanka, a Polish coal mining company, but with the addition of the Debiensko project to the project pipeline, Prairie now has several options (including the outright sale of the Jan Karski project, to fund the construction of the Debiensko project).

Go to Prairie’s website

The author has a long position in Prairie Mining. Please read the disclaimer