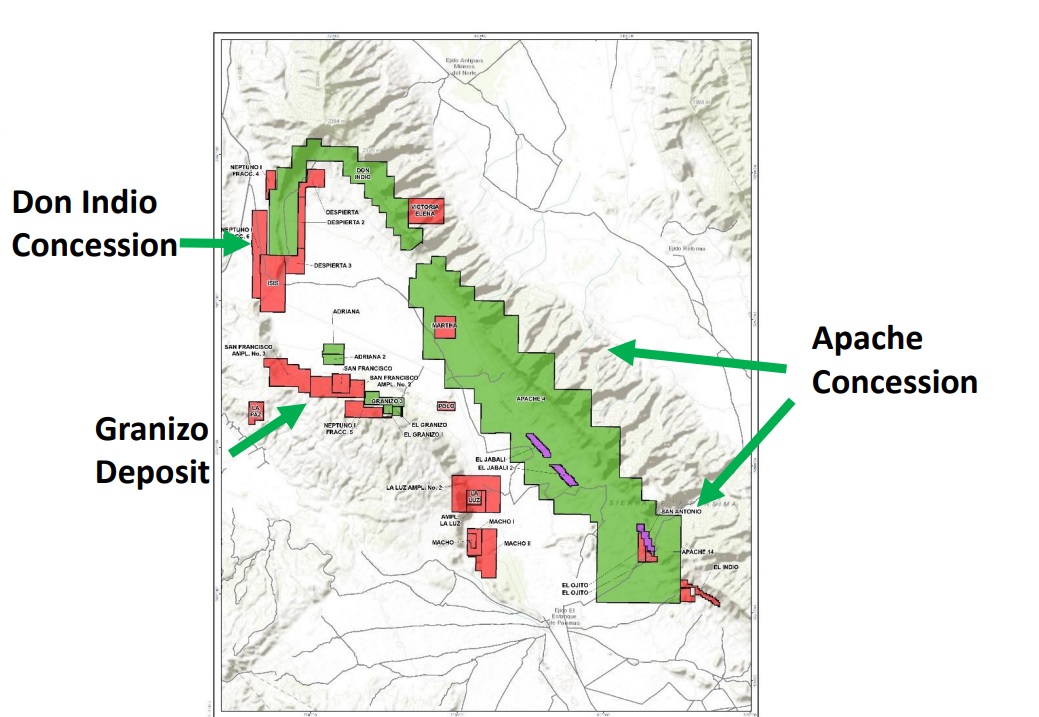

Prize Mining (PRZ.V) continues to work on its Manto Negro copper-silver project in Mexico’s Coahuila state and after a drill campaign that could best be described as ‘hit and miss’, Prize Mining continued to refine the exploration targets at Manto Negro to identify the targets that need to be drilled when it kicks off the next drill program.

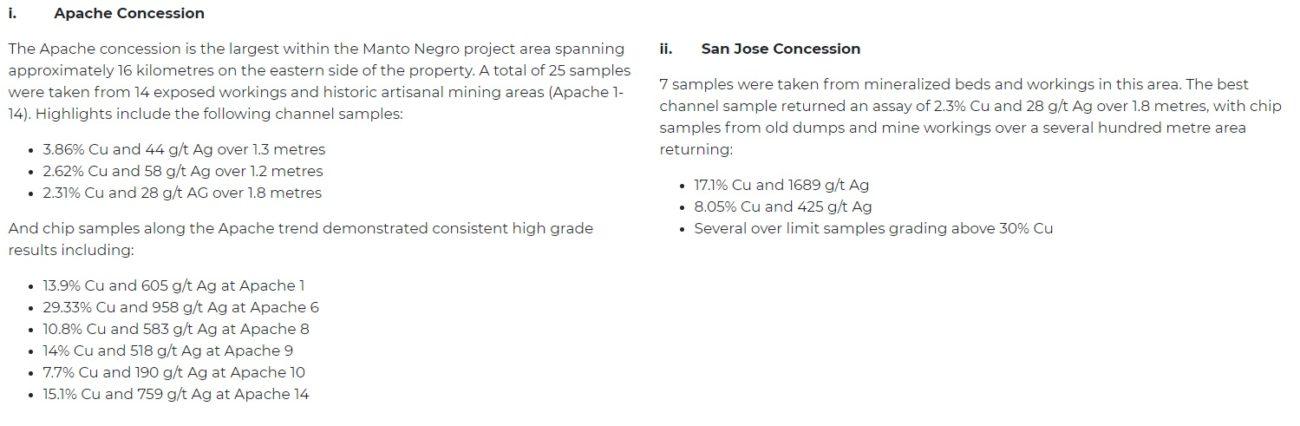

Prize’s sampling program was successful in identifying several high-grade copper-silver zones on the Apache, San Jose and Las Curvas concessions, which also have excellent copper values at surface, in the San Marcos sandstone zone. You can see a summary of the encountered grades at both Apache and San Jose here below.

The Manto Negro project remains interesting but Prize Mining will have to raise more cash soon as its working capital position was just around C$400,000 as of the end of May, and the second tranche of its C$0.025 financing, which closed in June, added less than C$200,000 to the treasury. Considering Prize’s normalized G&A cash burn remains relatively high (at approximately C$350,000 in the quarter ending on May 31st), the company will very likely have to hit the equity markets again (if it doesn’t want the payables to spiral out of control) after completing its 5:1 rollback and name change to Boundary Gold and Copper Mining.

Disclosure: The author has a long position in Prize Mining. Prize isn’t a sponsor of the website but has been a sponsor in de preceding 12 months.