Radisson Mining Resources (RDS.V) has announced earlier this month it has closed its C$25M financing. This warrant-free financing was priced at C$0.60 which means just under 41.7M shares were issued. This was a bought deal financing and Cormark Securities received C$1.5M in cash commission, resulting in net proceeds of C$23.5M.

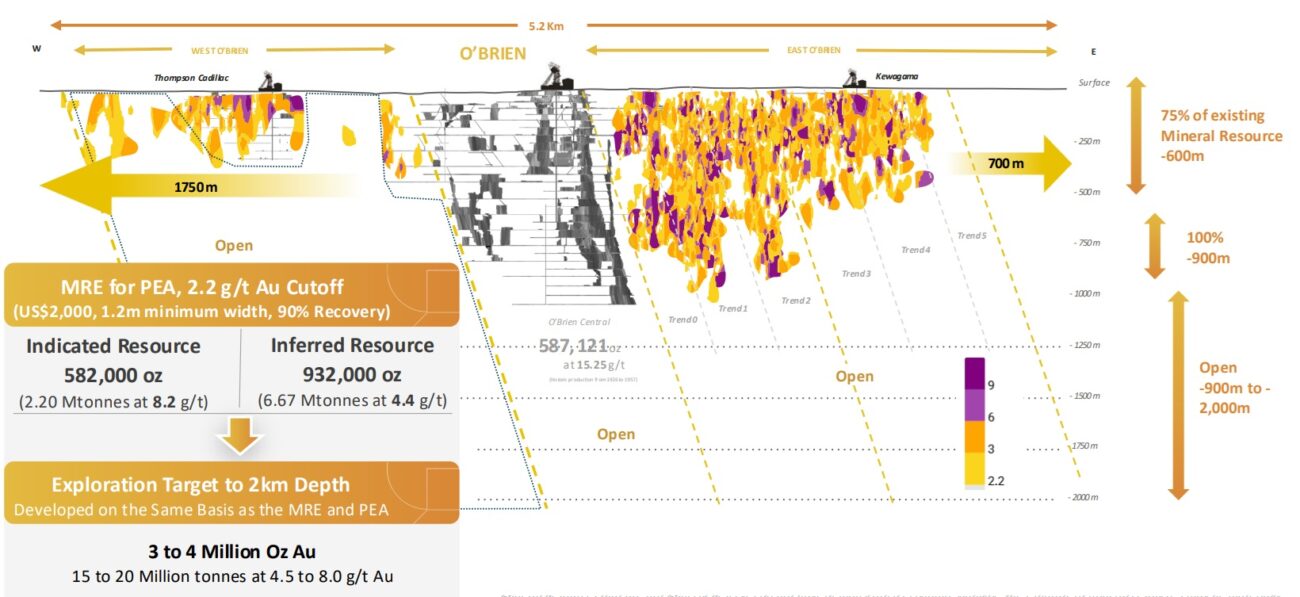

The company will use the proceeds of the offering to continue its exploration activities on its fully owned flagship O’Brien gold project which already contains 0.58 million ounces of gold in the indicated resource category and an additional 0.93 million ounces in the inferred resource category for a combined resource of approximately 1.5 million ounces, across all categories. The drill program was recently expanded to 140,000 meters.

Disclosure: The author has a long position in Radisson Mining Resources. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.