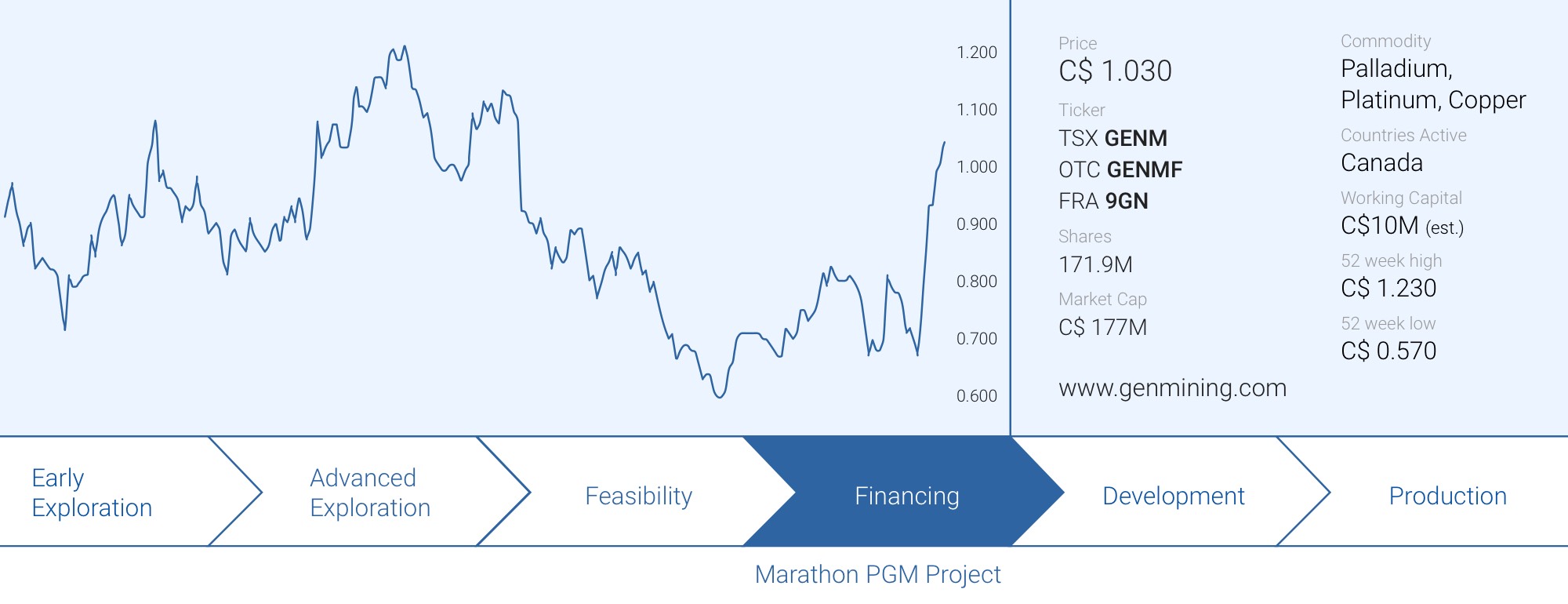

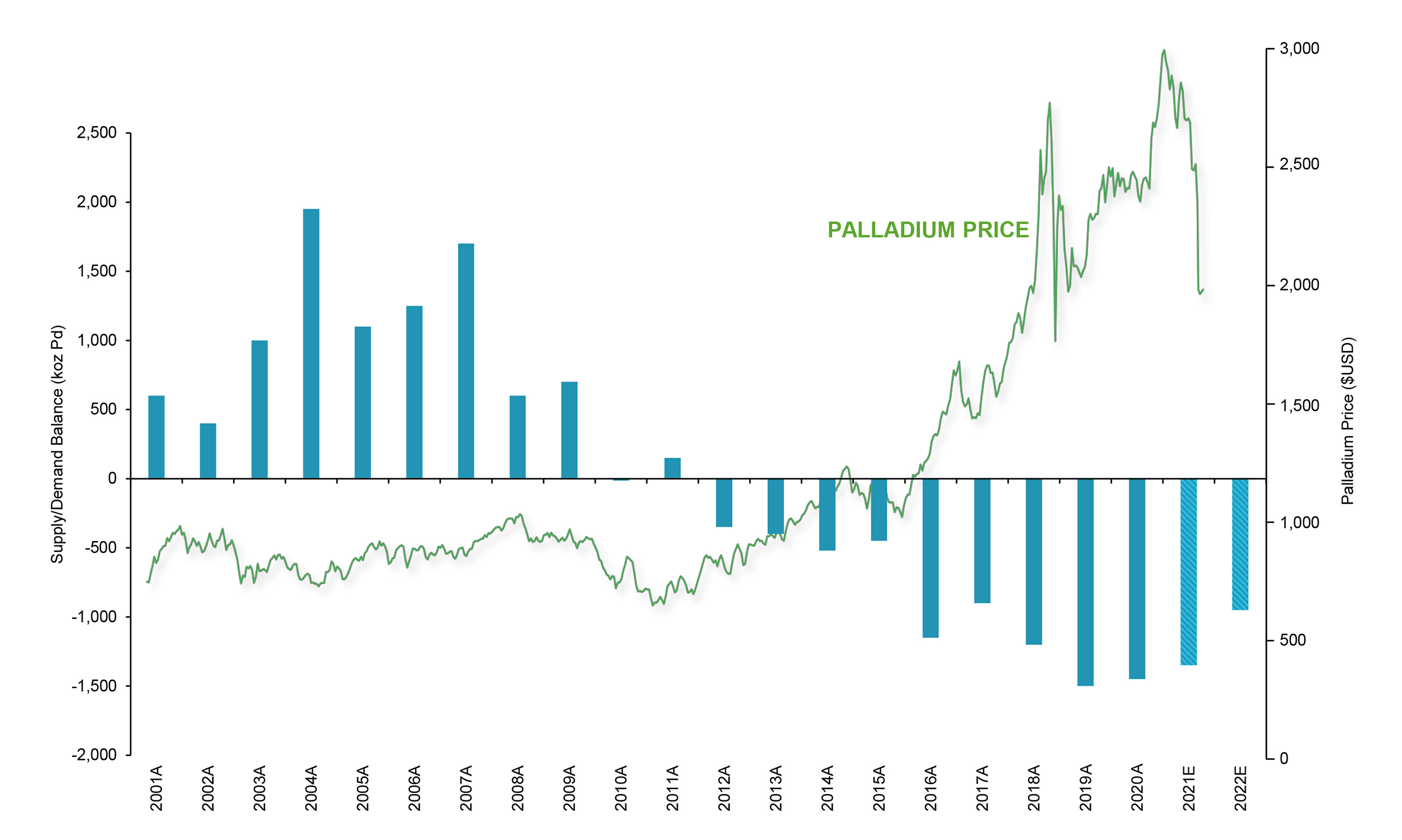

Ever since acquiring the Marathon PGM project from Sibanye-Stillwater (SBSW), Generation Mining (GENM.TO) has done everything right but has barely been rewarded by the market. Sure, the palladium price has dropped back below $2,000/oz but Generation has made immense steps forward in reducing the risks associated with the project.

Not only does Generation Mining now fully own the project after entering into an agreement with Sibanye-Stillwater, it has also entered into an excellent streaming agreement with Wheaton Precious Metals to raise C$240M towards building the mine.

Sibanye-Stillwater is now out of the picture

As you may remember, Generation Mining originally entered into an agreement with Sibanye-Stillwater wherein it could earn an 80% interest in the project whereafter SBSW had the option to re-acquire the majority stake. Sibanye opted not to do so and as it also didn’t contribute its 20% share of the expenses in the joint venture, Sibanye’s stake in the project gradually decreased to just 16.5% as of the end of November. This seemed to indicate Sibanye had no real interest anymore in maintaining a stake in the Marathon PGM project.

We had hoped for Generation Mining to indeed come to an agreement with Sibanye as the market would likely also prefer clarity. Additionally, it’s easier to market and finance the construction of a project when you’re a 100% owner rather than an 83.5% owner with the 16.5% partner not showing too much interest in actually moving the project forward.

Generation Mining must have been working on a deal for several months behind the scenes when it announced in December it had reached an agreement with Sibanye whereby it was acquiring the remaining 16.5% interest Sibanye had in the project by issuing just under 21.8 million shares at a deemed price of C$0.69 per share (for a pro forma value of approximately C$15M). This bumped Sibanye’s share position to 32.8 million shares for a 19.1% stake in Generation Mining. The newly issued shares will be subject to lock-up agreements for a period of up to 18 months with gradual releases so those 21.8 million shares won’t hit the market right away. But of course, Sibanye-Stillwater had about 11 million shares before the deal and those shares are not subject to any hold period anymore.

While Sibanye may continue to hold the position for strategic reasons, keep in mind the company has – other than the 18 month hold period on the new shares – no obligation towards Generation Mining. Should Sibanye want to sell shares, we hope it will be able to do so in an orderly fashion by organizing block trades rather than selling on the open market. But so far, so good, as Sibanye hadn’t sold a single share of the stock issued by Generation Mining as part of the 2019 acquisition agreement.

An excellent streaming deal with Wheaton Precious Metals will reduce the equity needs to actually build Marathon

Obtaining full ownership of the project is important as it will make Generation Mining’s life easier if it wants to secure construction funding for the project. And something must have been cooking for quite a while as just two weeks after announcing Generation was moving towards full ownership of the Marathon PGM project, GENM announced an excellent deal with Wheaton Precious Metals as the latter is acquiring a gold and platinum stream on the project.

It wasn’t a secret Generation Mining had been working on a streaming deal as the company’s executives have alluded to this funding option during several conference calls and presentations to the investment community. We are not surprised by Generation Mining signing a streaming agreement, but we are pleasantly surprised to see how good the agreement is.

Let’s discuss the different elements of the streaming agreement.

The cash payments by Wheaton Precious Metals

This is the straightforward part. Wheaton Precious Metals will wire a total of C$240M to Generation Mining. An initial C$40M will be made available immediately and will have to be used for the development of the project. This will come in handy to make the deposits for the long-lead items and get through the permitting process.

Discussions with Generation’s management indicate the company expects to spend about C$50M by the time the official construction of the project starts. Of this C$50M (including working capital requirements), about C$10M has been earmarked for the permitting process with an additional approximately C$25M for additional detailed engineering and just over C$10M for long-lead items.

The C$40M from Wheaton Precious Metals will be welcome and this tranche, in combination with the existing C$10M cash position should be sufficient to cover this budget. Additionally, there are about 8.5 million warrants with an exercise price of C$0.75 and an additional 675,000 warrants with an exercise price of C$0.52 expiring in the first half of February. As Generation Mining’s share price is now strongly trading above the exercise price we can assume all warrants will be exercised. Upon exercise, the total cash proceeds to Generation Mining will be C$6.7M. In conclusion, Generation Mining won’t have to raise additional cash until it effectively starts to build the mine.

The remaining C$200M will be made available during the construction process upon Generation Mining meeting certain milestones. It’s important to know that proceeds from a streaming deal are generally accepted as equity contribution in a financing mix, and later in this update, we will explain what this specifically means for the Marathon project

What does Wheaton get in return?

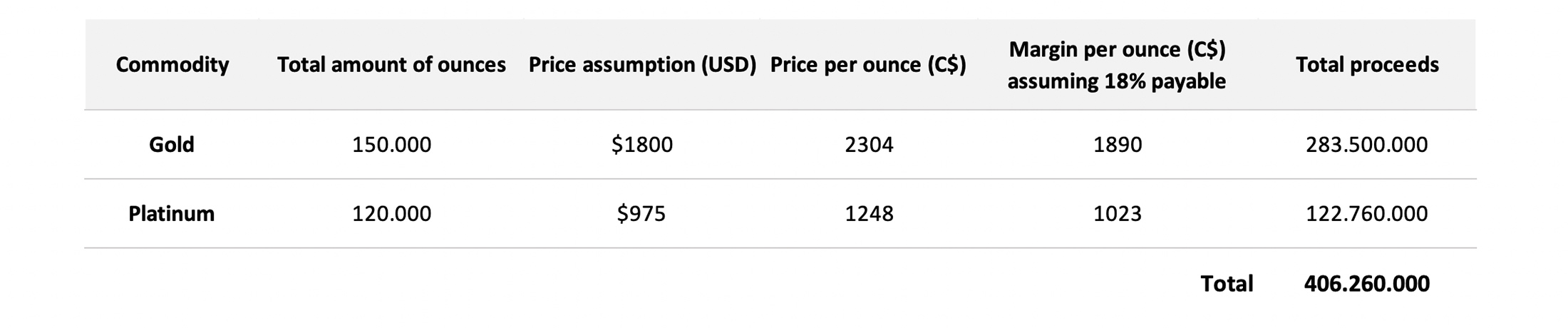

Wheaton Precious Metals will receive 100% of the payable gold production until 150,000 ounces will have been delivered whereafter it will receive 67% of the subsequent gold production. Wheaton will receive 22% of the payable platinum production until 120,000 ounces of platinum have been delivered. Once that threshold has been reached, Wheaton will be entitled to 15% of the platinum production.

What’s interesting is that Wheaton’s ‘extra’ deliveries on top of the minimum of 150,000 ounces of gold and 120,000 ounces of platinum will only start if and only if the mine life of Marathon PGM gets extended. According to the feasibility study, the project will produce 151,000 ounces of gold and 537,000 ounces of platinum. This means that the delivery thresholds were based on the actual expected life of mine production and that Wheaton only gets the ‘bonus’ if Generation Mining is able to keep the mine running for longer and producing more metals than anticipated in the feasibility study.

Wheaton Precious Metals will pay 18% of the spot prices until the delivery thresholds for both metals have been reached, whereafter the consideration will increase to 22% of the spot price.

Let’s talk numbers

Wheaton is paying a lot of money, so it should be getting a lot in return, right?

It actually looks like this deal was very well negotiated by Generation Mining. Let’s have a look at what Generation Mining would be giving up in return for an immediate lump sum payment.

We ran the numbers based on the delivery requirements for the gold and platinum using today’s prices of US$1800 gold and US$975 platinum. On a pre-tax and undiscounted basis, Wheaton Precious Metals will receive just over C$400M. Note: we also rounded the numbers as the feasibility study ends up with 147,000 ounces of payable gold and 524,000 ounces of payable platinum.

Giving up C$400M in future revenue for C$240M up-front is excellent. Keep in mind the deliveries to Wheaton will likely only start in 2025. This means Wheaton will generate the C$400M over a 17-18 year period.

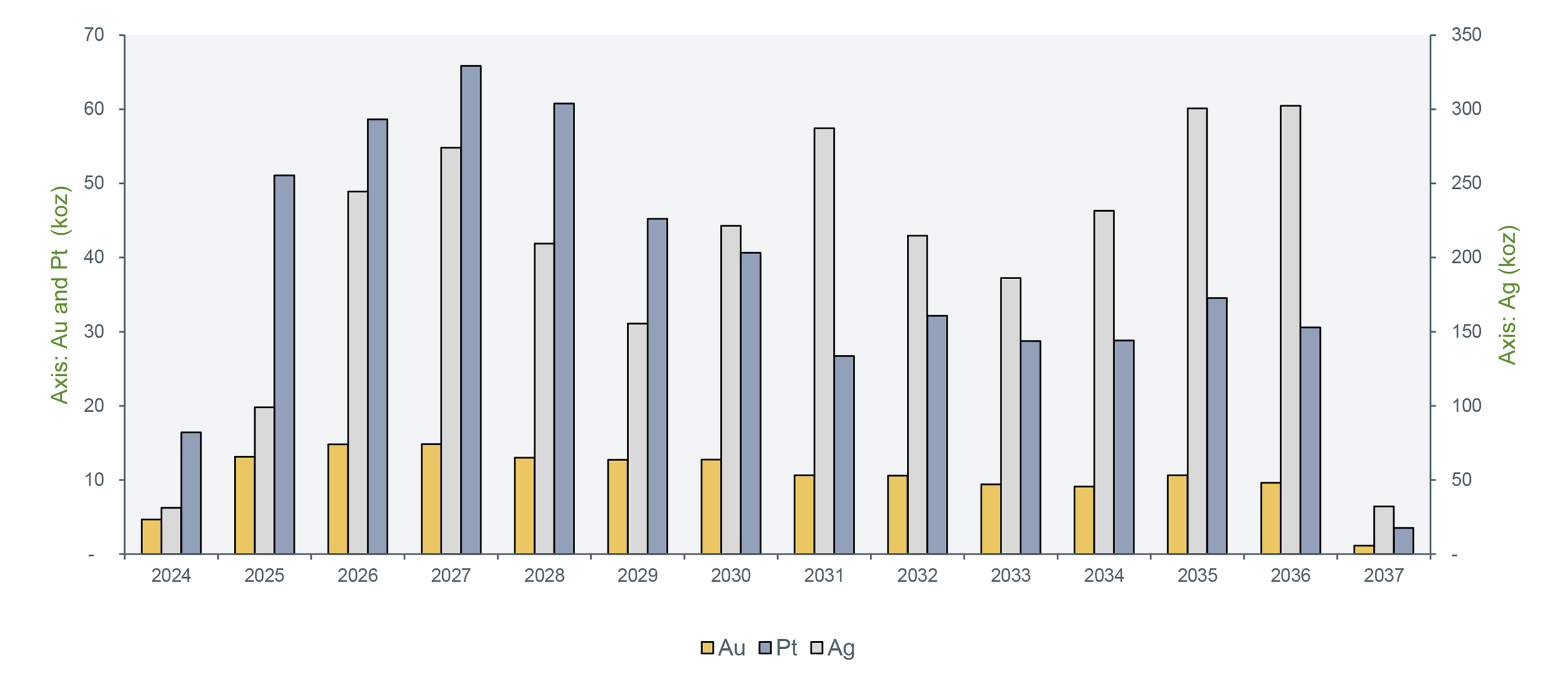

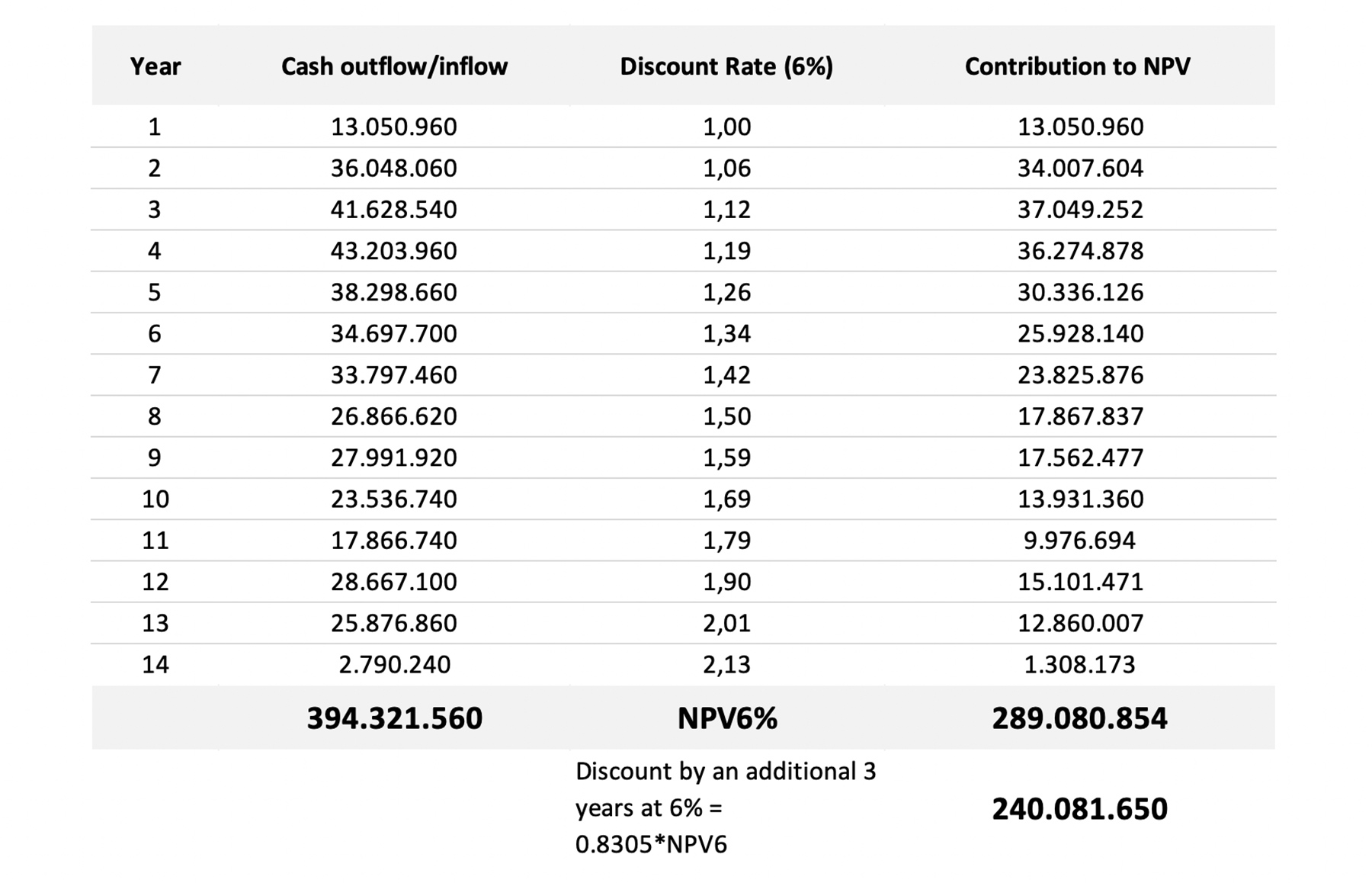

To explain how good this streaming deal is, we also ran the numbers on a pre-tax NPV6% of the stream using the actual anticipated production numbers from the feasibility study using the actual amount of payable metals which you can find on page 540 of the technical report. This results in the following operating cash flow per year for Wheaton Precious Metals (again pre-tax and undiscounted) per metal.

If we would subsequently discount the annual cash flows by 6% (again, the same discount rate used in the feasibility study), the pre-tax NPV6% of the cash flows attributable to Wheaton Precious Metals at the start of the mine life and using $1800 gold and $975 platinum.

According to our numbers, based on the feasibility study, the pre-tax NPV6% of the streams at the start of the mine life is C$289M. If we would discount this back by an additional 3 years at 6% (as we are at least three years away from commercial production), the pre-tax NPV6% comes in at C$240.1M. Almost exactly the C$240M Wheaton Precious Metals is paying for the stream.

This means the streaming deal is pretty much NPV neutral for Wheaton Precious Metals which predominantly appears to be betting on 1) higher gold and platinum prices and 2) a longer mine life than anticipated in the feasibility study.

The bottom line is that the pricing risk for about 150,000 ounces of gold and 120,000 ounces of platinum has now been fully transferred to Wheaton Precious Metals.

Why exactly is this a good deal for Generation Mining?

A streaming agreement actually helps to move the price risk for certain metals from Generation Mining to the streamer. That obviously works both ways and if the gold and platinum prices increase, Wheaton Precious Metals will be very happy.

But what’s more important for Generation Mining is the fact it’s basically exchanging future revenue over the next two decades to a lump sum upfront payment. That’s extremely important for a non-revenue company as this streaming agreement seems to provide a substantial portion of the required equity investment to build the mine at an exceptionally low cost of equity.

Assuming the entire C$40M of the initial payment will indeed be used during the permitting process, for engineering, and to make a deposit for certain long-lead items, let’s just assume Generation Mining will only have C$200M to spend on the construction activities as we would like to err on the conservative side of things.

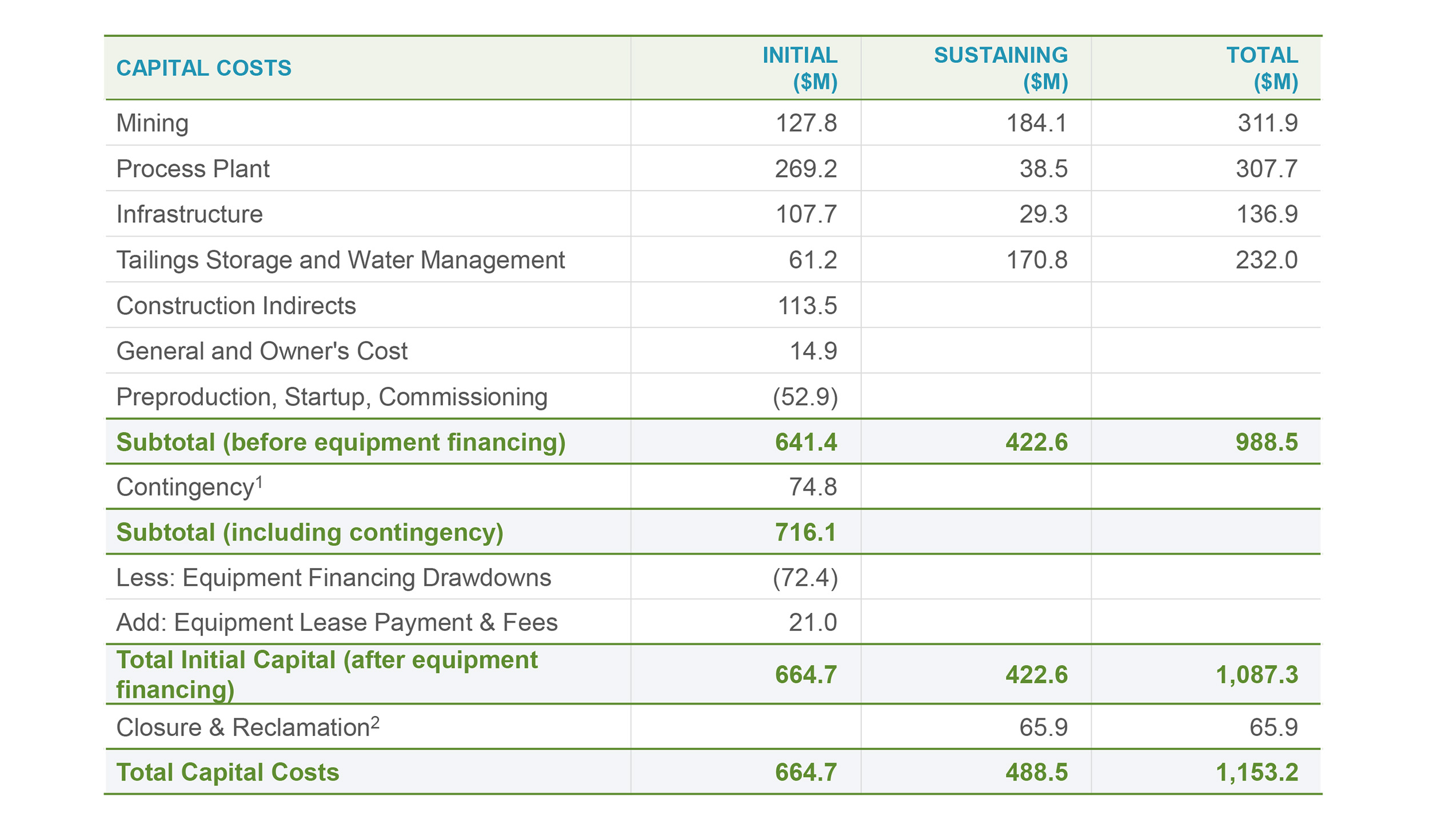

The original capex was estimated at approximately C$665M, but due to the weaker Canadian Dollar and increasing inflation, the 2023-2024 capex will likely come in closer to C$750M, so let’s be conservative and use C$750M for simplicity sake. We would obviously be happy if the capex number would actually come in in line with the feasibility study estimate.

According to the feasibility study, the total capex pre-equipment financing was estimated at C$716M and after including the estimated C$51M in net equipment financing drawdowns, the final capex was estimated at C$665M, including C$75M in contingency allowance.

We most definitely expect the cost of the process plant to increase compared to the 2021 feasibility study numbers, but the C$75M contingency is obviously the very first cushion that will be used to absorb the higher capital expenditures.

By using C$750M in total initial capital expenditures, we are increasing the total ‘cushion’ to C$160M as the capex including equipment financing and excluding the contingency is estimated at approximately C$590M. We’d be happy to see the total capex spend come in below that level but for now, let’s use C$750M to err on the cautious side. And we would like to emphasize this is our own assumption and in no way a company-provided guidance.

Assuming a traditional 60/40 Debt/Equity financing structure, this means the 40% equity portion of the capex would be approximately C$300M. Of which two thirds would already be covered by the Wheaton payments. This means that even in our high-capex scenario of C$750M Generation Mining would only have to raise an additional C$100M in equity.

That could happen through a straight equity placement, but keep in mind the company may have a few other aces up its sleeve. First of all, it has only committed to sell a minor portion of the expected platinum production to Wheaton as part of the streaming deal. It should be pretty easy to monetize a larger position of the expected platinum output, either with Wheaton or another streaming company. There’s also silver although the anticipated payable production of 2.8 million ounces won’t be extremely valuable, and the Rhodium remains the wildcard. There is some Rhodium at Marathon PGM and the company is using 0% recovery and 0% payability for the Rhodium right now.

Secondly, the anticipated copper and palladium production hasn’t been touched yet. According to the technical report, Marathon PGM will produce a copper-PGM concentrate and Generation Mining could easily market this concentrate. There are some hungry buyers out there that would likely be interested in securing the copper concentrate. Not only could this result in advantageous terms for the construction debt (especially Japanese and German concentrate buyers could provide debt on very cheap terms), those concentrate traders or users could perhaps pre-pay some of the earlier concentrate purchases which would further reduce the need to issue shares as part of the funding package.

CEO Levy and his team are likely keeping quite a few balls in the air but the C$240M streaming deal with Wheaton PM will make their lives much easier as the payments will cover the majority of the equity component, even if one would use a more conservative C$750M total capex bill to build Marathon PGM.

Conclusion

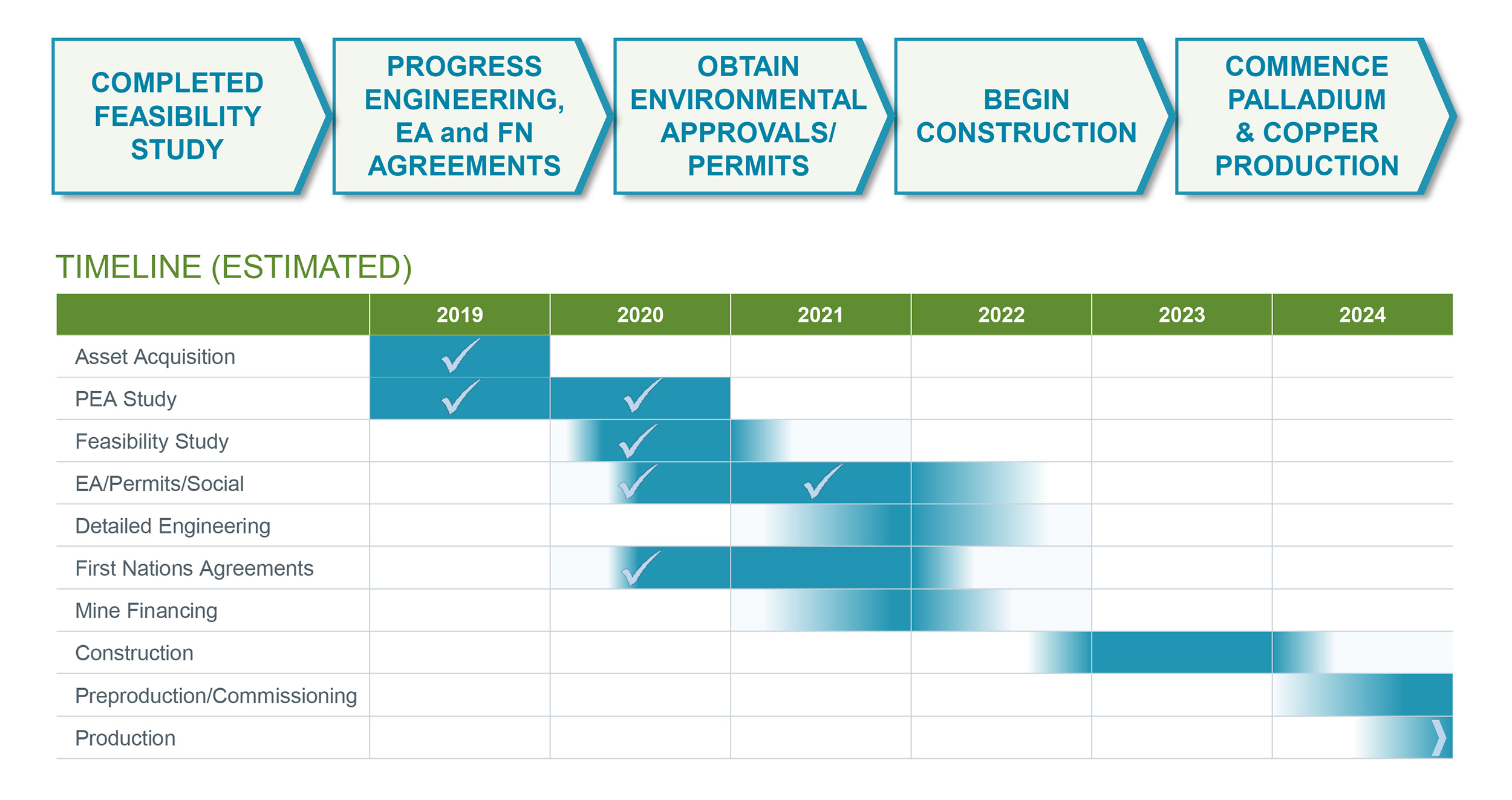

Generation Mining has reduced the risk profile of developing the Marathon PGM mine, but of course getting the mine permitted is now the major task at hand. Fortunately, the company can now fully focus on getting through the permitting process as the initial tranche of C$40M from the Wheaton Precious Metals package will be available right away and this should be sufficient to get through the permitting process without having to raise too much additional cash.

Streaming companies have the continuous pressure to find new deals that are large enough to be meaningful either as growth investment or just to replenish the depleted reserves and resources. We think Generation Mining has done an excellent deal in negotiating this agreement as using the current gold and platinum prices, it was able to sell the gold and platinum stream at almost exactly the pre-tax NPV6% of the sum of the cash flows. An absolutely excellent deal as it has transferred a portion of its cash flow risk to Wheaton Precious Metals by receiving the C$240M upfront payment as a lump sum.

The streaming deal with Wheaton Precious Metals is an excellent deal as it ticks an important box and clears the management’s plate to fully focus on the permitting process.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. Please read the disclaimer.

This is really a well prepared report by Caesars. But, Generation Mining Team has also significantly checked other boxes. Somehow, Generation Mining has assembled a really great and cohesive team to move the project forward checking one box. More importantly, they’ve prepared an excellent Environmental Impact Statement with a public hearing starting on March 14th checking another box. Lastly, they are deeply committed to working with the First Nations checking a third box. All said, Generation Mining has exceeded my wildest expectations, and I feel privileged to own a few chares of their stock.