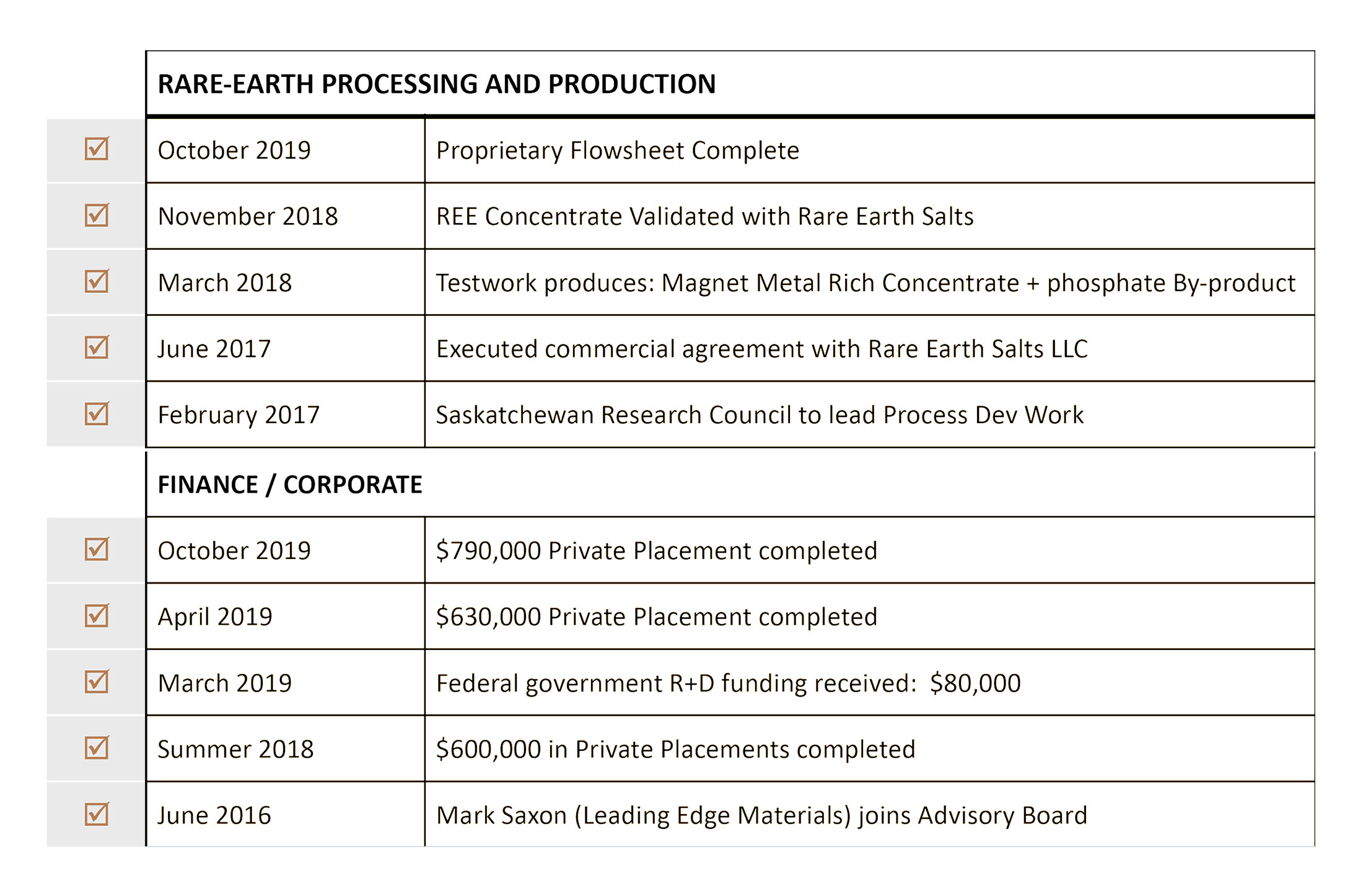

Over the past two years, Medallion Resources (MDL.V) continued to work on finetuning its flow sheet to maximize the recovery of saleable metals from the monazite it is planning to process. After several years of blood, sweat, and tears, the extensive metallurgical test work has resulted in a definitive flowsheet which will now be tested in a pilot plant environment in 2020.

We sat down with CEO Don Lay to discuss Medallion’s recent news, views on the REE space and the path forward to start commercial operations.

Completing the flow sheet & raising money

After a dedicated and detailed metallurgical test program, Medallion Resources (MDL.V) has now completed its flow sheet to extract Rare Earth Elements from a monazite sand product, which usually is the discarded product from mineral sands operations as it’s considered to be ‘waste’.

This is an important step for the company as it can now use the flow sheet to further finetune the expected economics of a monazite processing plant as the new flow sheet provides a lot of additional information which were needed to formally initiate price quote discussions (for instance to discharge the waste products and the ability to use ‘common’ equipment that doesn’t have to be custom made). Medallion also focused on increasing the automatization of the plant to reduce the required manpower (and associated labor costs) and (obviously) wanted the entire production process to be as energy-efficient as possible.

Now a (definitive) flowsheet has been established, Medallion Resources will be able to finetune the economics of a monazite processing plant.

Meanwhile, Medallion has now also closed the second tranche of its financing which was announced in August. The second tranche consisted of almost 2.2 million units for a total of C$231,000 as each unit consisted of one common share as well as half a warrant with an exercise price of C$0.165, expiring in February 2022 (after a 2.5 year term).

This brings the total proceeds of this financing to almost C$800,000 and will be used to further advance the engineering studies on the monazite processing plant. Medallion’s share price has now dropped to 8 cents which is almost 25% below the level the financing was conducted at, so MDL was smart to take the money.

A Q&A with CEO Don Lay

The process

You recently completed the final flow sheet for the process to process monazite into saleable REE concentrate. This was a long process that took well over a year. Could you elaborate on how the flowsheet was put together and fine-tuned, and how important this step is for Medallion’s business model?

Well, the credit for our flowsheet, which we’re very proud of, must go to Kurt Forrester, our metallurgist. He is a “measure twice, cut once” type of person and recognized that the processing techniques they use for monazite India and China, just won’t cut it in North America or other developed markets. He re-envisioned a modern process that was highly automated, efficient and 1st tier in its approach to the environment and safety. This, of course, lengthened the development time but we ended up with an excellent proprietary design that adds long-term value for the shareholders.

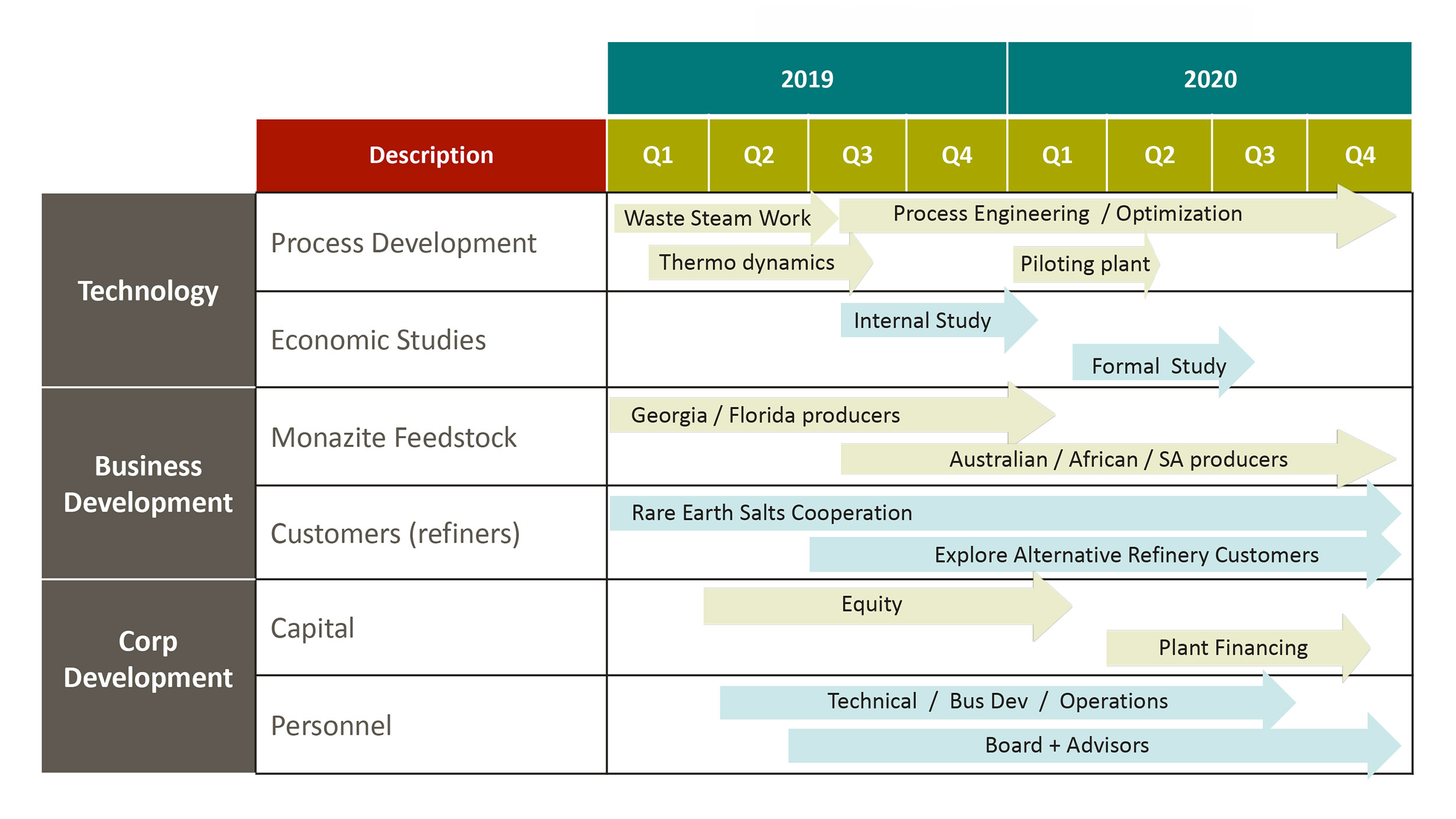

With this work done we are now moving forward on process engineering work and will then directly move to plant design to get better estimates of plant capex and opex costs. This part is obviously critical to investors, suppliers, and customers.

What are the next few steps to further advance your business plan? When will you start working on a pilot plant to further increase the confidence in your current flow sheet?

We’ve got some decisions to make on a pilot plant or formal studies. We’ll be able to do that once the current process work and trade-off studies are complete. We expect to announce an update on our plans sooner rather than later.

Back in August, you announced in a press release Medallion had answered to a ‘request for information’ from the US Department of Defense (which obviously wants to figure out how it easily can gain access to non-Chinese sources of REEs). Could you provide more insight in how this process works? Does the DoD have to reply to your submission?

Yes, we responded to the US Dept of Defense along with other North American companies. This was to inform them about the market and the ability of different players in the marketplace. Based on this they will be issuing five different Request for Proposal’s (RFP). The first one is out and is related to Heavy Rare Earths’ separation. I expect we’re in line to respond to at least one of the four remaining documents.

It will all take a number of months before deals get done – but I can tell you the Department of Defense is taking these projects very seriously and have set aside significant budgets.

The REE market

Let’s take a moment to discuss the overall REE market. We saw some initial excitement during the summer when it looked like the REE sector was being dragged into the US-China trade war as a threat by the Chinese government to reduce the export of REE products to the US. The entire sector was set on fire, but this seemed to have died down, what’s your take on the current REE market?

There were actually two news topics going on – rare earths were dragged into the China-US trade dispute in a very public way and secondly – pricing had picked up smartly. Were the two related? Hard to say. Since then pricing has returned to back to its previous longer-term levels and although rare-earth are mentioned from time on the trade topic they are not headline news at the moment.

As you’re obviously more tuned into the REE space (where the prices are relatively opaque and investors have to rely on third party websites to figure out the current prices), are you seeing any changes in the demand/pricing for the more important metals like neodymium and praseodymium? What is your mid-term and longer-term outlook?

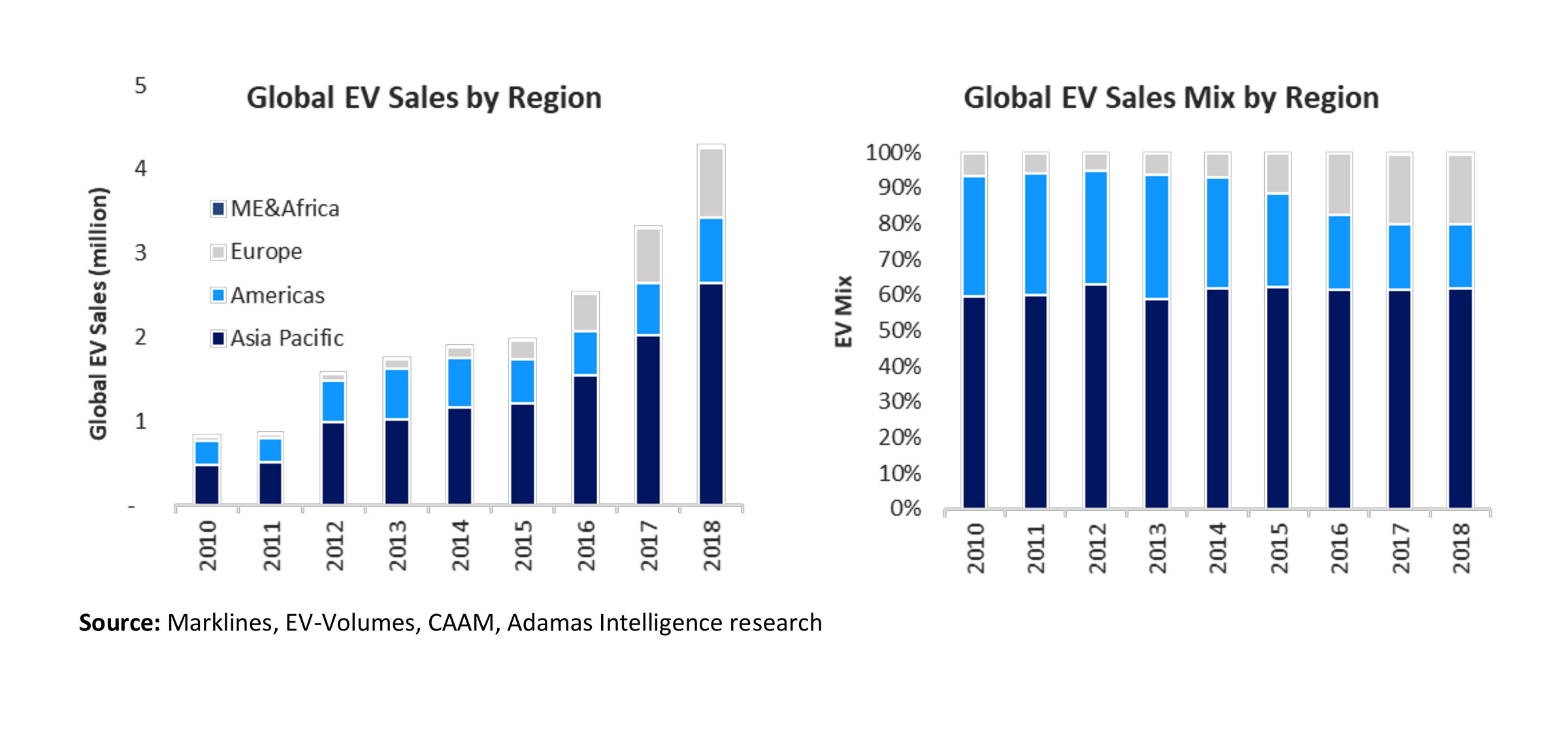

The consensus in the industry is that the EV automakers can handle anything up to $100/kg for NdPr. The prices are about $50/kg now. That pricing would be in a much larger marketplace of course according to analyst forecasts. And over the last year we have certainly noticed more interest from overseas in getting access to REE feedstock that we will to provide.

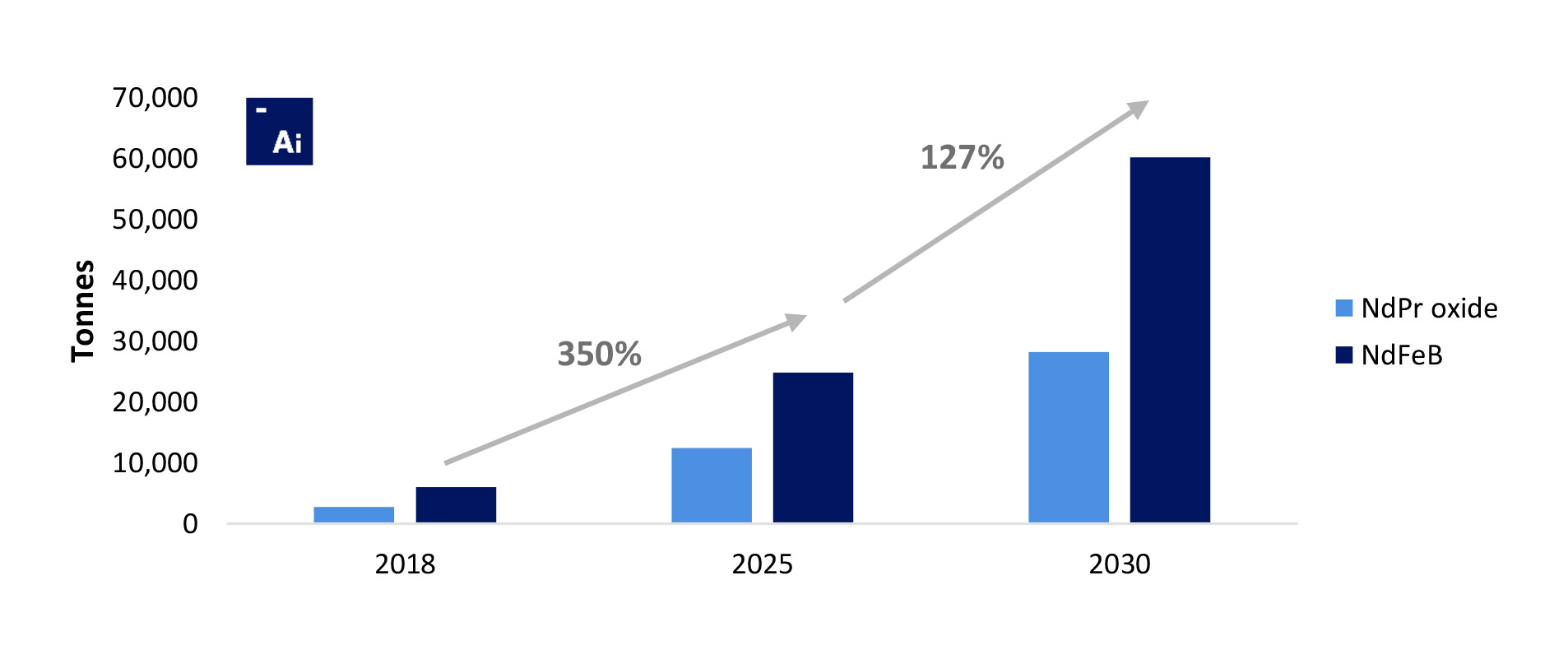

Rare earth demand for EV traction motors to increase by 350% between 2018 and 2025 (Source: Adamas Intelligence, H2 2019 Report)

We came across some recent research from Adamas Intelligence looking at the shortfall of REE supply in the context of the demand for Electrical Vehicles. Adamas claims the production of Nd and Pr will increase at a slower rate than the global demand which will result in ‘the draw-down of producer inventories and, ultimately, shortages of these materials’.

Yes, electrification trends including EV and hybrid vehicles as well as wind turbines are going to drive secular growth for NdPr. So we’re very excited about that. This area does rally look to drive the rare marketplace for the next 10+ years. And certainly for company’s like ourselves that have a good percentage of NdPr.

Corporate

You recently took advantage of renewed interest in the REE space to close a placement, raising almost C$800,000. The first tranche was raised pretty quick and closed in August. The second tranche took almost two additional months to complete. Was this an indication it again became tougher to get investors interested in the REE sector?

Capital for rare-earths is still difficult in North America. In Australia it’s a much different situation as there are 4 or 5 REE developers with markets over $100M. This does not exist in North America at the moment although Australians are starting to invest in North American rare-earth plays right now.

If there’s one thing Medallion has been really good at, it’s running a tight ship by maximizing the return on investment. The burn rate of the company has been exceptionally low as you’re obviously running a tight ship. Could you elaborate on the use of proceeds of the recent C$800,000 financing?

Sure thing. We’ve got process design work ongoing at the moment which is going to directly lead to engineering design so we can determine capital and operating profits. Also we’ve tendered for trade-off studies for potential sites and local costs for re-agents, etc. This will take as well into next year when we’ll be looking to get going on the PEA work.

The time line in your presentation mentions an internal study starting this quarter followed by a formal study in H1 2020 and a pilot plant. What would be your anticipated cash needs for the next 13 months (until the end of 2020)?

We’ve got some flexibility on how we plan this out. It’s really too early to say at this point. If we get attractive investment at the right price we’ll take and move forward quickly. In the meantime we will continue to use the capital judiciously.

At what point will you have to start negotiations to effectively enter into binding agreements to secure your monazite supply?

We could enter into binding contracts today except we can provide a date so it’s a bit moot. We are working closely with the producers to be sure we can align on amounts, specifications and timing. There is no shortage of monazite available and we look to be the first outside of the the Indian government or Chinese to process it.

Conclusion

Completing the flowsheet was a major step forward for Medallion Resources and this proprietary flow sheet will now be used to work on the pilot plant. We hope to see some test batches being processed in said pilot plant in 2020 as that will be another major milestone for the company.

Medallion seems to be making good progress and hopefully, the market will realize the importance of having an independent producer of REE concentrate from recycled monazite.

Disclosure: The author has a long position in Medallion Resources. Medallion Resources is a sponsor of the website.