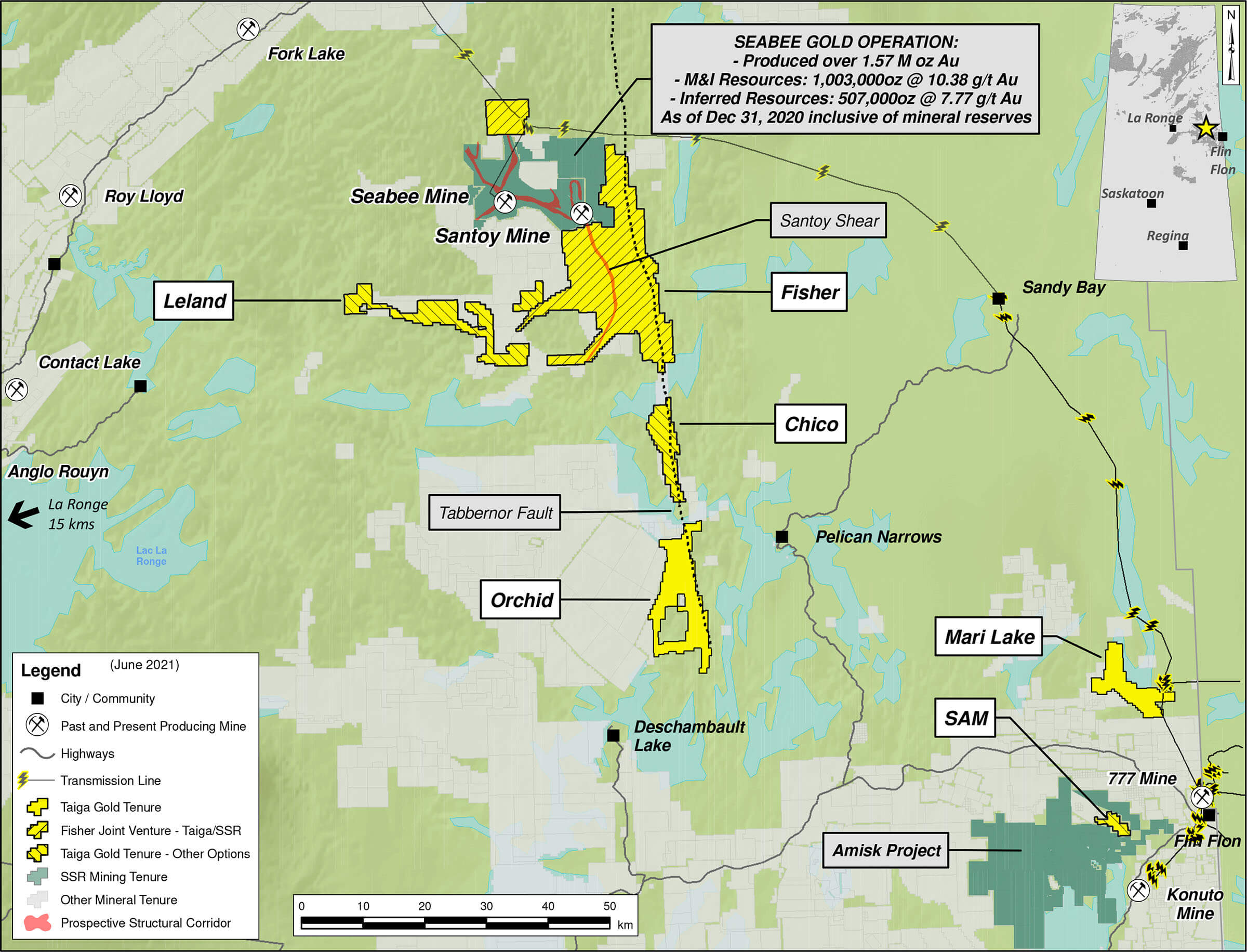

Taiga Gold (TGC.C), which was originally spun off from Eagle Plains Resources (EPL.V) for its Fisher gold project in Saskatchewan, will be busy on several exploration fronts this year. Despite the main focus of the market likely remaining with the Fisher gold project where Taiga Gold owns a 20% stake in a joint venture structure with senior producer SSR Mining (SSRM, SSRM.TO) owning 80% of the project, Taiga has announced exploration activities on other projects. And it has the funds to do so after a well-timed capital raise earlier this year.

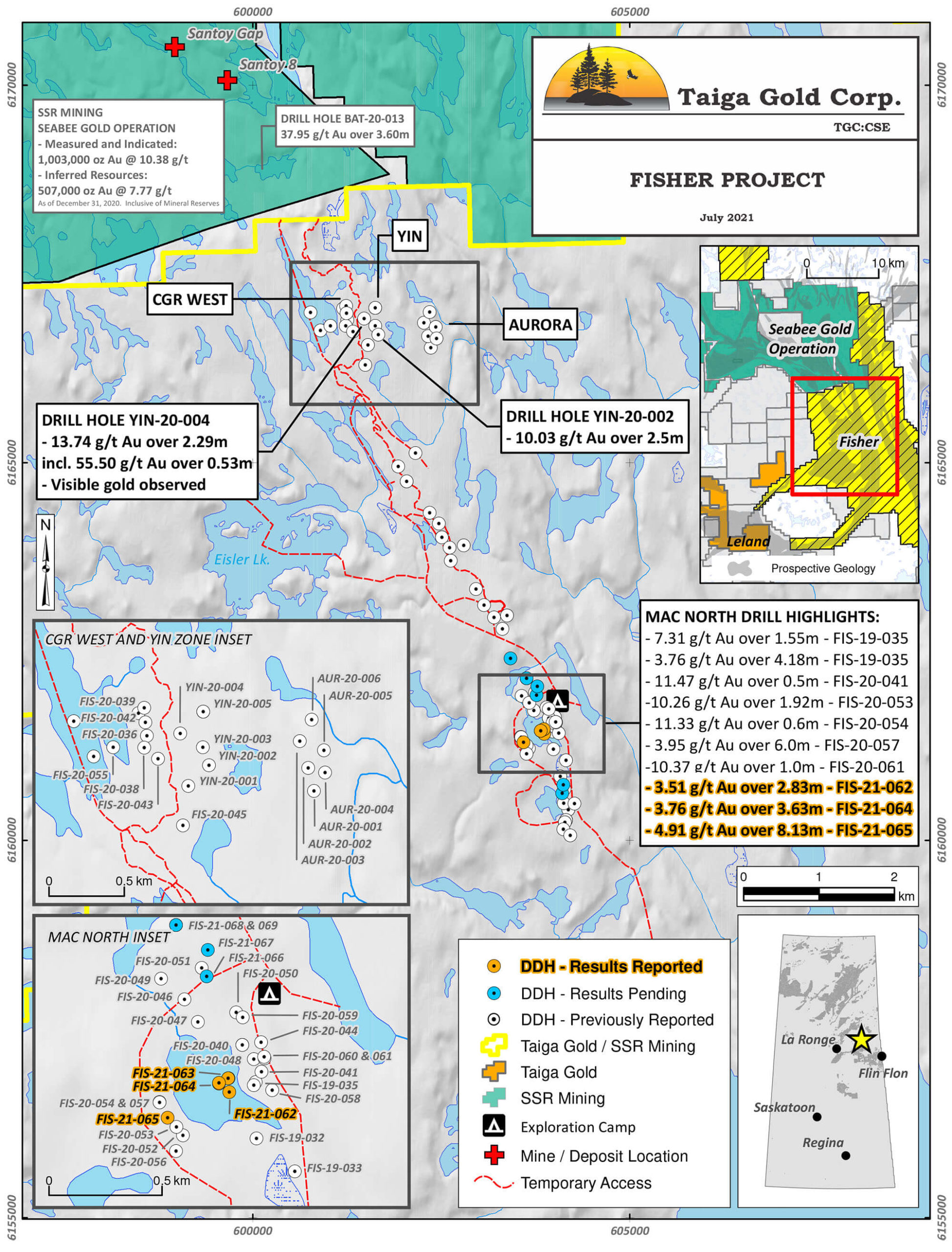

Last week, Taiga Gold released assay results from four holes drilled by joint venture partner SSR Mining on the Mac North zone of the Fisher project. Mac North is located just about 8 kilometers south of the property border and less than 12 kilometers from the Santoy 8 and Santoy Gap zones, currently being mined by SSR Mining.

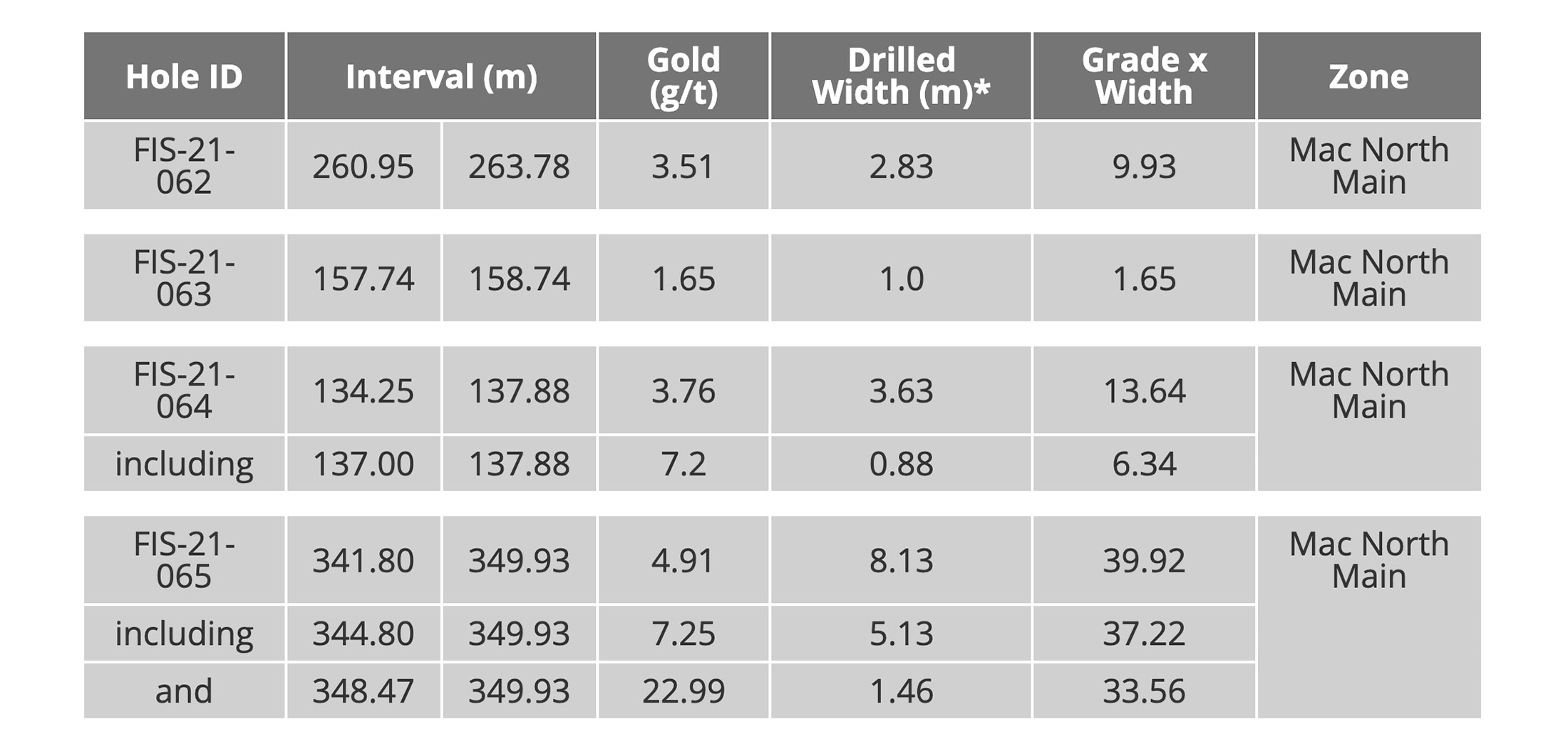

Taiga released the assay results from four holes last week

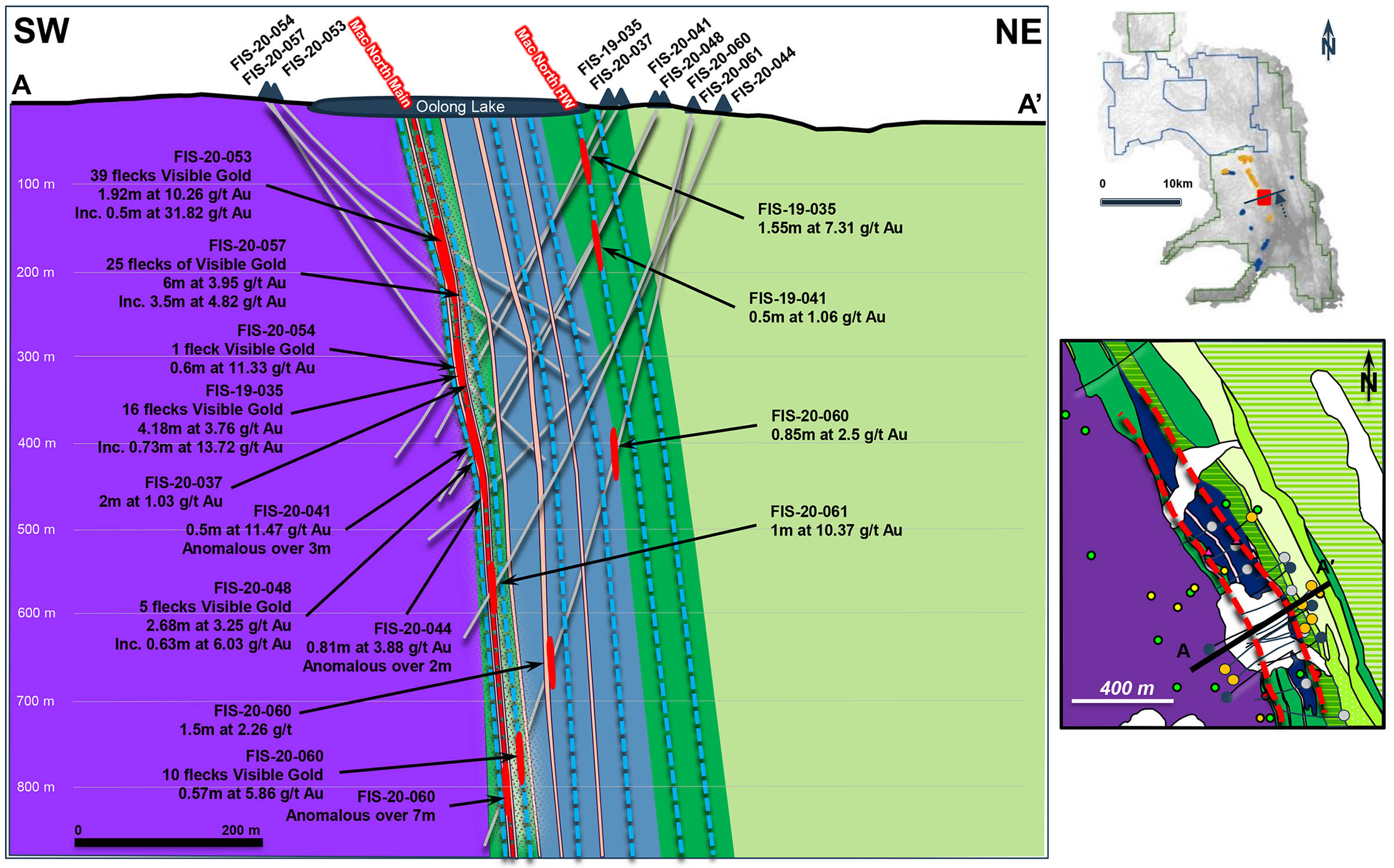

In a previous update, we discussed how the SSR Mining/Taiga Gold tandem was continuously getting a better understanding of the mineralized structures on the Fisher project.

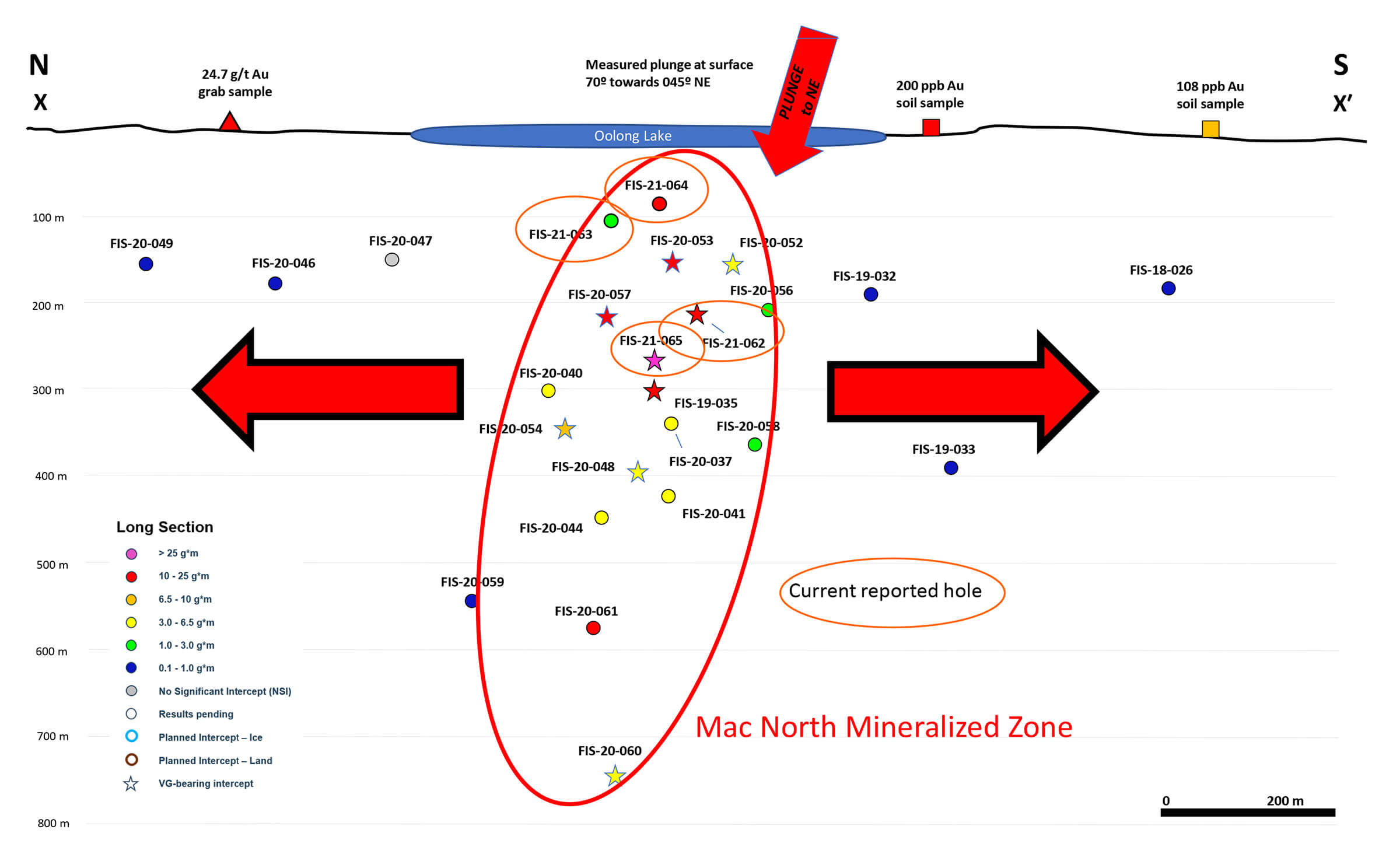

As a brief reminder, the most important takeaway in Taiga’s February exploration update was the confirmation of mineralized areas within the Santoy structure and the proof of concept. The gold-bearing mineralized structures in the Seabee-Fisher region are determined by what could best be described as ‘flattened cylindrical shoots’. And in the past 24 months, SSR Mining was figuring out how those cylinders were twisted (it’s not because you find gold you immediately know what the 3D version of the system looks like), and the technical team was able to confirm its theoretical concepts with the 2020/2021 winter drill program. This was the image we used to explain the theoretical concept.

A cylinder-shaped zone of mineralization, quite similar to the gold mineralization currently being mined at the Santoy Deposit ~12 km to the north, has now been determined and this gets the joint venture partners to a more exciting phase of the exploration program at Mac North: resource definition drilling.

SSR Mining has now released the assay results of the final four holes of the winter program, and all four holes encountered mineralization with hole 65 yielding the best results at the Fisher to date with 8.13 meters of 4.91 g/t gold thanks to a higher grade interval of 1.46 meters containing almost 23 g/t gold. If we would look at the 5.13 meter interval of 7.25 g/t gold and isolate the very high grade 1.46 meter interval, the average grade of the interval is well within the economic parameters currently being mined at Santoy.

All four holes encountered mineralization at Mac North, and this further validates this area as the main area of interest, and the most advanced exploration target so far. That’s promising for the resource definition drill program as we expect SSR Mining to accelerate the efforts at Mac North in order to define a resource that could subsequently be used to develop a plan to fit Mac North into the mine development plan of SSR Mining. It’s easy enough to consider Mac North as a potential satellite deposit that could provide mill feed to the existing Seabee mill, but keep in mind the anticipated lead time from calculating a resource to actually developing the asset would easily be 5-7 years. So SSR Mining will have to start thinking about its plans for 2028-2030 from next year on and this could pave the way for an accelerated drill program at Mac North to ensure SSRM could kick off economic studies ahead of depleting the existing mines at Seabee.

The next few steps at Fisher

The four holes reported last week were drilled in March. Since then, SSR Mining has completed an additional seven holes at Fisher and those holes have now been sent to the lab. The seven-hole drill program consisted of two holes at Mac, two holes at Mac North Hangingwall, and three holes at the Jasmine zone, a new drill-ready target. Should mineralization be discovered at Jasmine, that would mark the fifth gold discovery on the Fisher property and this would validate the plans for an upcoming regional exploration program. We anticipate seeing assay results in 6-8 weeks from now.

While the joint venture partners still need to formally approve future exploration programs, it looks like there will be a three-pronged approach. First of all, drilling at Mac North will likely continue keeping the long lead time from discovery to a potential mining scenario in the back of the head. Secondly, there’s a bunch of other previous discoveries that the technical teams likely would like to improve their understanding of the structural controls of the mineralization.

But thirdly, and this could perhaps be even more exciting, it sounds like there will be some more regional exploration as well. There may be some wildcat drilling but we would also expect some field teams to be sent out to generate new drill targets. Or as CEO Tim Termuende suitably mentioned in a recent call ‘Part of the value of Taiga Gold is in the unknown’.

And while the main focus of this update report is on the Fisher (and Mac North) drill results, keep in mind Taiga Gold is working along a significant portion of the Tabbernor fault and has staked claims along dozens of kilometers of the fault. In some cases, joint venture partners are spending their money to earn ownership in a property (like SKRR Exploration (SKRR.V) which has already spent C$1M exploring the Leland gold project, which is bordering both Taiga’s Fisher project as well as SSR Mining’s Seabee project), but in other cases, Taiga Gold is trying to crack the code by itself.

Drilling activities on Taiga’s 100% owned Orchid project have now been completed and assay results should be out in a few weeks. This is the very first time most zones of the Orchid project will have seen any drilling activities and with some surface showings with double-digit grades, it won’t take much to see some positive surprises once the assay results will be released. Of course, it’s very difficult to predict where Mother Nature has deposited the gold, but Taiga Gold is clearly drilling in the right postal code along structures related to the Tabbernor Fault. And although SSR Mining currently has a joint-venture interest specifically with the Fisher project, we are pretty sure they are keeping an eye on every project owned by any third party within trucking distance from the Seabee milling facilities.

Taiga Gold is now fully cashed up after a smart raise

Taiga closed a non-brokered placement in April which consisted of just under 12.5M flow-through units priced at C$0.20 per unit. Each FT unit consisted of one share as well as a full warrant allowing the warrant holder to acquire an additional share of Taiga Gold at C$0.30 for a period of 2.5 years (ending mid-October 2023). Should those warrants end up being ‘in the money’, Taiga would be able to raise an additional C$3.75M (but we obviously aren’t there yet).

This raise puts Taiga Gold in an excellent position as it will have about C$5M in cash after receiving the C$3M option payment from SSR Mining (SSRM, SSRM.TO) and this puts the company in an excellent position to continue to contribute its 20% share whenever there’s a cash call for exploration activities on the Fisher project rather than being pushed into a corner. Additionally, the recently raised cash will also be used to fund the exploration activities on the Orchid and Mari Lake exploration projects. A solid move by the Taiga Gold management team as the share price has held its ground since the financing was completed. The C$0.20 flow-through shares will come out of the typical 4 month and 1 day hold period on August 17th.

The raise also means Taiga Gold will likely be able to answer all cash calls coming from SSR Mining. If SSR mining proposes a C$5M exploration budget (just an example), Taiga Gold will have to (be able to) put C$1M on the table to fund its share. Considering we are still in the early stages of the exploration story at Fisher, we expect Taiga to continue to fund its pro-rata stake in the joint venture.

And there are some risks involved. SSR Mining is operating several profitable mines and has a positive working capital position of about US$1.2B (close to C$1.5B) so it can decide to spend C$10M or even C$20M on Fisher without as much as blinking an eye. We have seen how SSR Mining took advantage of poor decision making at Golden Arrow Resources (GRG.V) which had to relinquish its 25% stake in the Chinchillas project after it was pushed into a corner by SSR Mining and likely would not have been able to meet the cash call requirements.

That’s why it will be very important for Taiga Gold to maintain a healthy treasury at any given moment to make sure it can continue to fund its 20% share of the Fisher exploration programs. To be clear, Taiga is well-financed at this point as it received C$3M in cash from SSR Mining when the latter exercised the option agreement earlier this year and recently raised an additional C$2.5M in flow-through funds.

We estimate the company currently has a working capital position of around C$4.5M, which would put it in a very enviable position.

Also keep in mind that Taiga holds a 2.5% net smelter royalty on most of the claims comprising the Fisher property (some of the claims at Fisher have underlying royalty interests that would dilute this 2.5%). This royalty is not included in the Fisher JV, so maybe an important asset to Taiga going forward. In addition, this royalty comes with an annual advance royalty payment of $100,000 to Taiga. SSR Mining has an option to repurchase 1% of this NSR for C$1M in cash.

Conclusion

After the previous winter drill program was completed, the field team thought it had figured out how the mineralization at Fisher was structured. This boded well for the winter/spring drill program, and the assay results of the first four holes seem to confirm a successful extrapolation of the exploration theory.

Although the spring drill program was quite short with just 7 holes drilled for a total of just over 2,800 meters, the additional data and information will be valuable to further unlock value at Fisher. We know SSR Mining is drilling on its Seabee land package right up to the property border with Taiga Gold, and the four discovery areas of the Yin, Abel Lake, Mac, and Mac North zones are located on the same fault, just a bit further south.

The next two months will be interesting as Taiga should be able to release the assay results from the Orchid drill program while the seven holes drilled on the Fisher project should be ready for publication sometime in September.

Taiga is now fully cashed up allowing it to hit the ground running and answer any cash call that may come its way.

Disclosure: The author has a long position in Taiga Gold. Taiga Gold is a sponsor of the website. Please read our disclaimer.