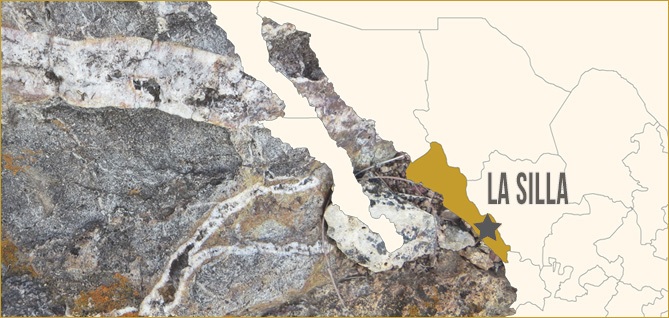

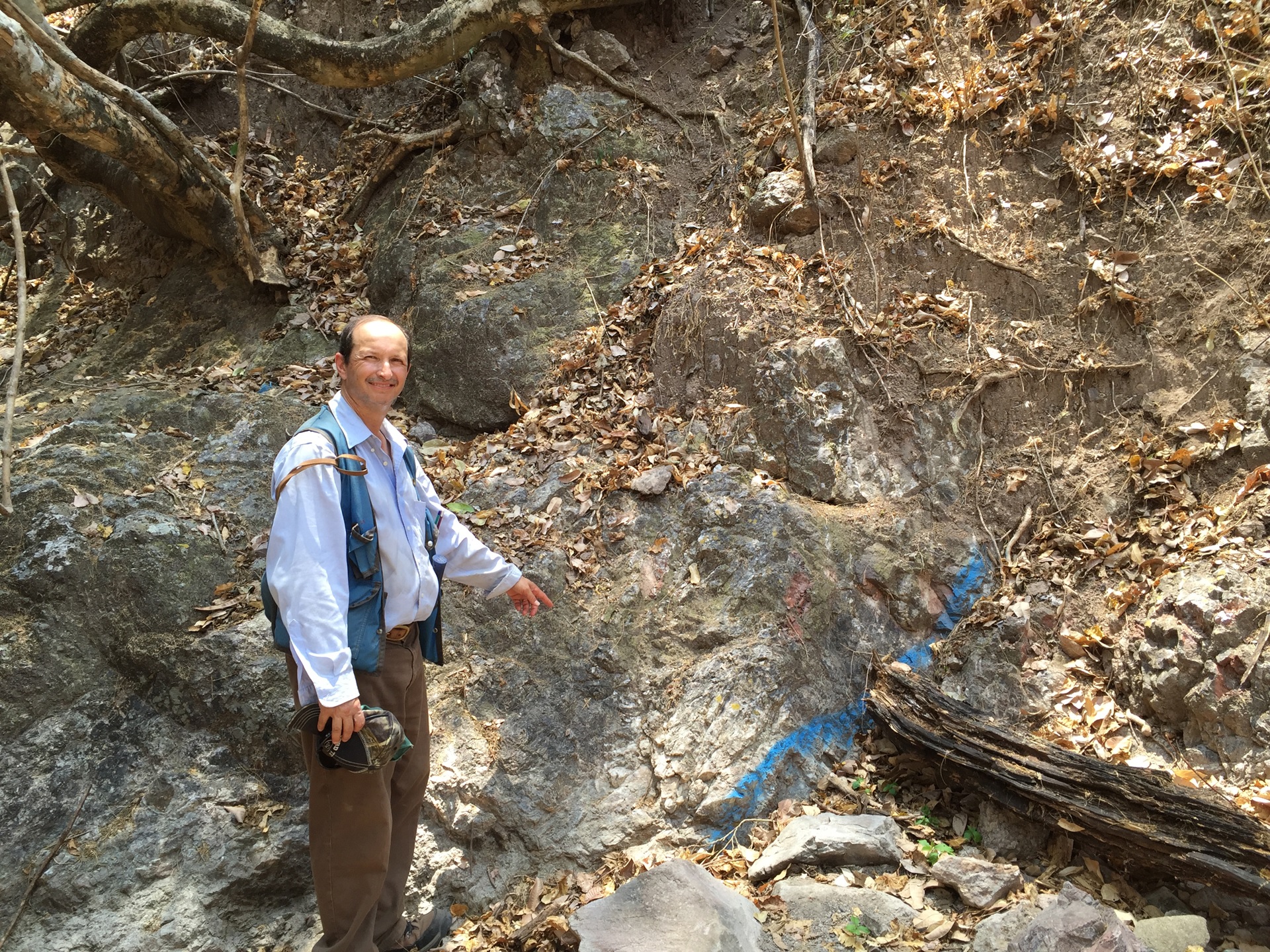

Riverside Resources (RRI.V) appears to have found a good partner for the La Silla project in Mexico’s Sinaloa province. As this project is located on the same regional trend as the San Dimas Mine (currently owned by First Majestic Silver (AG, FR.TO) after it acquired Primero Mining (PPP, P.TO) to avoid a bankruptcy of the latter), we can imagine there were several interested parties.

As per Riverside’s usual approach to these types of joint venture agreements, it will get stock, cash and a firm exploration commitment from Sinaloa Resources, which will issue C$1M worth of stock, pay C$60,000 in cash and spend at least C$3M on exploration expenses within 36 months to earn an initial stake of 70%. Should Sinaloa be happy with the exploration results, it will be able to acquire the final 30% stake as well by issuing an additional C$0.5M worth of stock and incur an additional C$1M in exploration expenditures (within an unidentified time frame). And if that wouldn’t be enough, Riverside will retain a 2.5% NSR on the La Silla project.

So, long story short, yes, La Silla could end up in the hands of Sinaloa Resources, but with C$1.5M in stock and C$60,000 cash, Riverside Resources is getting a decent deal, as especially the 2.5% NSR could be valuable should Sinaloa Resources be able to identify an economic deposit. This appears to be a good deal for Riverside as it will walk away with a bunch of stock (which will do well should Sinaloa Resources be successful), and the firm commitment from Sinaloa to spend C$4M on exploration to acquire full ownership of the project will give Riverside a lot of bang for its buck.

Go to Riverside’s website

The author has a long position in Riverside Resources. Riverside is a sponsor of the website. Please read the disclaimer