Golden Arrow Resources’ (GRG.V) share price got slammed last week as a sell recommendation from a newsletter sent the shares approximately 30% lower before the share price recovered some of the lost ground. This seems to ruin the company’s plans to raise C$2.625M which was meant to top up the treasury, as the financing is priced at C$0.35 per unit with each unit consisting of one common share as well as a full warrant allowing the warrant owner to purchase an additional share for C$0.55 within two years.

This financing isn’t strictly necessary as Golden Arrow still had a cash position of approximately C$7M as of the end of June and although there definitely is a cash burn associated with the investment in the 25% owned Puna Operations subsidiary, Golden Arrow played it smart and got joint venture partner SSR Mining (SSRM, SSR.TO) to commit to a C$10M credit facility. This loan will only mature either on December 31st 2020, or 24 months from the first delivery of ore from Chinchillas to the Pirquitas mill (whichever comes first). The loan isn’t particularly cheap (US Base Rate + 10%), but it definitely is a cheaper funding option than raising C$10M on the open market.

Golden Arrow could just cancel the private placement, but an easier solution would be to reprice it to perhaps C$0.30. That would give Golden Arrow a post-financing share count of 111 million shares for a market capitalization of less than C$35M while it remains on track to meet its funding requirements for the construction phase of Chinchillas.

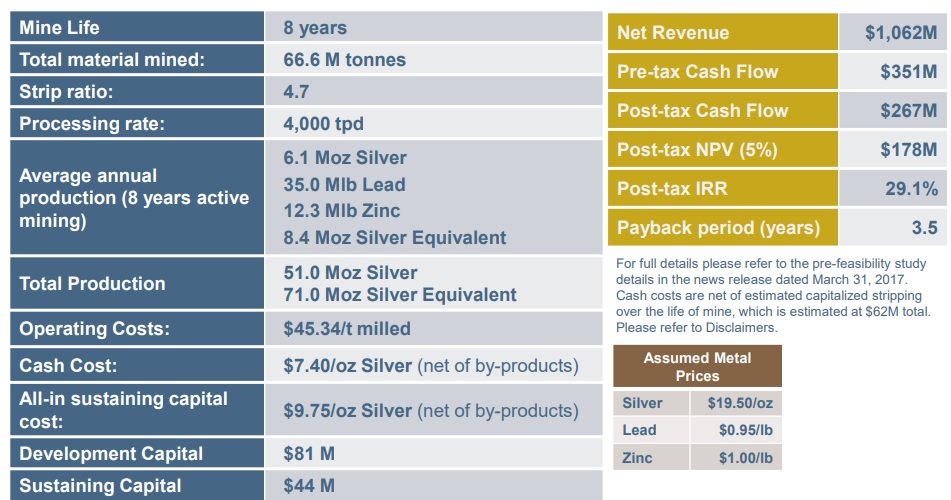

The low silver and zinc prices obviously aren’t helping Golden Arrow’s share price either. The base case NPV5% of Chinchillas showed an after-tax value of US$178M (US$44.5M Attributable to Golden Arrow) using a silver price of $19.50/oz and a zinc price of $1/lb, but with the silver price currently trading below $15/oz, the intrinsic value of Chinchillas is pretty close to zero. The other (early stage) exploration properties also have some value, but buying Golden Arrow Resources is predominantly buying a cheap call option on the silver price.

Although Chinchillas is almost worthless at $14.50 silver, the after-tax NPV8% at $19.50 silver would very likely be around US$150M, and excluding the upfront capex, the sum of the net cash flows is expected to be approximately US$230M. Taking the financing structure into account (a large part of GRG’s contribution will be funded by equity) we estimate Golden Arrow’s 25% to have a value of C$75M. Divided by 115M shares (est.) results in a fair value of C$0.65 per share using a silver price of $19.50/oz. This is purely based on the current mine plan and ignores the potential to extend the mine life, and it also attributes zero value to the other exploration properties. On top of that, applying the current zinc price of $1.20 per pound (compared to the base case scenario which used a zinc price of $1/pound) would increase the after-tax net cash flow attributable to Golden Arrow by an additional 3-4 cents per share.

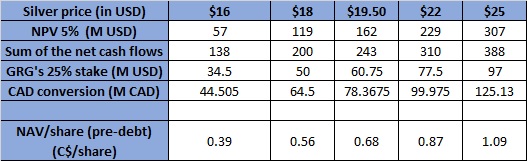

In the next table we are providing a very basic back of the envelope calculation of the value of Golden Arrow’s 25% stake using different silver prices (provided by the sensitivity analysis in the published pre-feasibility study), a stable lead price of $0.95/pound, a share count of 115M shares and an USD/CAD exchange rate of 1.29. Keep in mind Golden Arrow will have some debt on the balance sheet, so that will also have to be taken into consideration.

Keep in mind these calculations were based on a discount rate of 5%, and a higher discount rate will have a negative impact on the NAV/share. But even after applying an 8% discount rate, the upside potential at a higher silver price remains enormous. And that is exactly how investors should look at Golden Arrow Resources: a call option on the silver price through its 25% stake in Puna Operations, with experienced mining company SSR Mining as the operator of the mine and mill. In the most recent quarterly update, SSR confirmed it produced 0.7Moz silver and 3.2 million pounds of zinc at Chinchillas, and 25% of this production result is directly attributable to Golden Arrow.

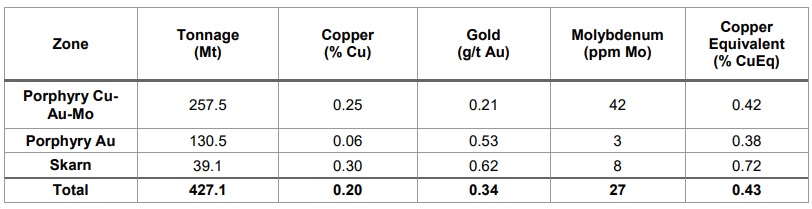

And Golden Arrow continues to add promising properties to the company. Earlier this week, GRG announced it has signed definitive agreements to acquire the Atlantida Copper-Gold project in Chile. The project was previously owned by Inmet and currently has a historic resource estimate of a combined 427 million tonnes at an average grade of 0.20% copper and 0.34 g/t gold. The porphyry zones appear to be relatively low grade (the average CuEq grade is just 0.4% which won’t be economic at the current copper and gold prices), but Golden Arrow seems to have a completely different exploration plan.

Keep in mind this historic resource estimate was completed in 2012 when the copper price was trading at $3.50 per pound and the gold price was $1600/oz. Needless to say the resource was based on those metal prices, and some zones that would not be economic at today’s commodity prices were viable back then. We think Golden Arrow has a good shot to outline a smaller but higher grade resource estimate on the Atlantida project, and we are looking forward to the company initial exploration plans. The Atlantida project will be part of New Golden Explorations, a division of Golden Arrow that will very likely shortly be spun out to the GRG shareholders.

Go to Golden Arrow’s website

The author has a long position in Golden Arrow Resources. Please read the disclaimer