Lithium has been an out-of-favour commodity for a few years now but interestingly, the lithium price has now reached a level that makes mining operations uneconomical, even if you’re a low-cost producer of lithium from brines as even companies like an Orocobre (ORL.TO) aren’t profitable.

This doesn’t mean the companies in the battery supply chain aren’t active. The very same Orocobre signed another agreement with Toyota and Panasonic whereby the latter will step up their purchases of lithium hydroxide in the next few years while on its over-hyped Battery Day, Tesla Motors (TSLA) boss Musk mentioned it was looking at producing its own lithium from Nevada clay deposits where it has staked 10,000 acres in an unnamed location. Musk appears to have been tipping its hand with this statement: not only would Tesla have to attract a lot of technical know-how to make clay-hosted lithium deposits work (it will take time and effort to design a flow sheet), it also directly and implicitly validates clay-hosted deposits as a valid source for Tesla’s own battery plans.

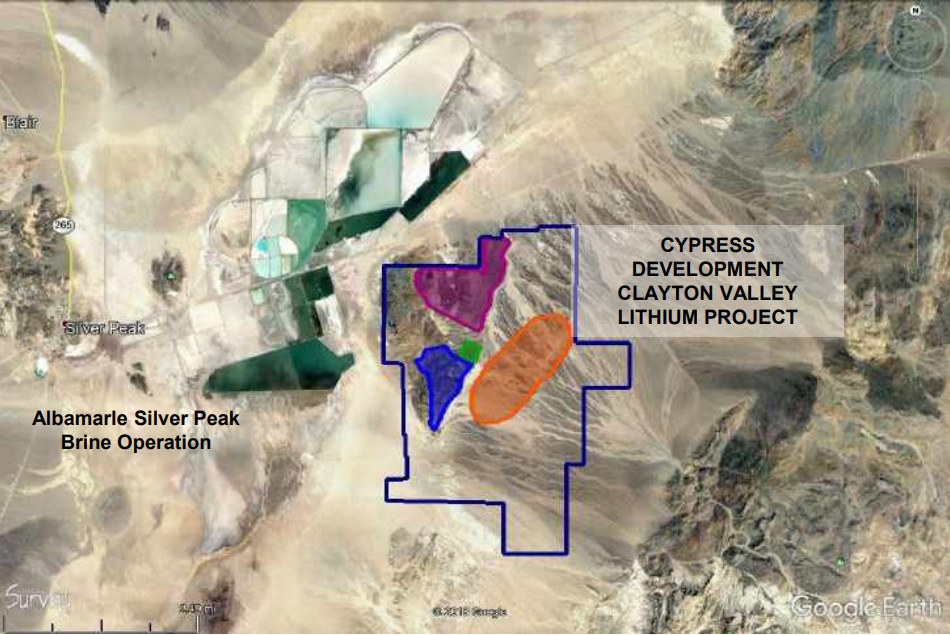

We caught up with Bill Willoughby, the CEO of Cypress Development (CYP.V) which recently announced an updated resource estimate and a positive pre-feasibility study on… its Nevada-based clay-hosted lithium project bordering Nevada’s only producing lithium mine.

You recently announced a 55% increase in the Clayton Valley resource estimate which now contains in excess of 900 million tonnes at 1062 ppm Li in the measured and indicated resource and an additional 100 million tonnes at a grade slightly below 1000 ppm. What was the main reason for CYP to increase the resource estimate? Extending the mine life to show potential partners or buyers you own a multi-decade mine life project?

We obtained drill results which showed the presence of additional resources to the south. It was necessary to re-model this portion of the property with the additional resources to determine if there was any impact on the overall plan. Regardless of the impact, we want the resource statement to include the entire property and all the available drill data.

The pre-feasibility study was based on a total mineable resource of just over 400 million tonnes. Now the updated resource came in at over 900 million tonnes, may we anticipate an increase of the mineable resource/reserve in upcoming economic studies? Or was this increase in M&I resources important to ensure the mineable reserve in a feasibility study would come in close to the resources used in the PFS?

No, you can’t assume any increase in reserves based on changes in resource. Reserves are the product of the production schedule and we don’t see a need to update it at this time. The resources in the PFS were ample to support the production schedule. It would be premature to comment on the reserves that would form the basis of a feasibility study without the additional metallurgy and engineering that will be developed in the pilot plant program.

What are the next few steps for the project, and could you provide a time line and expected costs?

The next major step as described in the PFS (see Section 26) is the pilot plant program. The expected timing from start is 6 months at a cost of US$6.75 million. Since the PFS was completed, additional metallurgical tests and other work has been done in preparation for the program. So far, all the work is positive in moving the project forward. We need several steps to occur, including securing additional financing, before we can say with certainty when that timeline will begin.

At what point in time do you think it will be opportune to repurchase 2/3rd of the NSR? Once a construction decision has been made?

This is not a priority at this time. Most likely it would be done prior to production.

You recently announced the adoption of a shareholders rights program. An intriguing thing to do now the lithium price seems to have bottomed. Has the PFS created significant inbound interest from potential partners that would like to secure a US-based supply?

We cannot comment on interest level or discussions. We are continually working to advance the project while staying within budget and increase our shareholders’ value. The timing of announcing the rights plan was to include it in the materials for the upcoming AGM. The rights plan doesn’t prevent a hostile takeover but does give the shareholders some insurance if such an event were to occur.

As of the end of June, the working capital position was just around C$700,000. However, a lot has changed since then as your share price is now more than twice as high, after reaching a triple back in August. May we assume you have seen additional cash come in from warrant exercises? There were 6.15M C$0.22 warrants and almost 9.4M C$0.33 warrants outstanding, which are now in the money.

There have been options exercised as well. We’ve come off the high in share price of C$0.51, possibly in part due to the additional shares, so the exercises have slowed. We have about C$1.5 million on hand.

What’s your view on the current situation in the lithium markets? How long can the current low price for LCE last? And what’s your take on the hydroxide side of the market? How can Cypress cater to an increased demand for lithium-hydroxide products?

We read the analysts predictions and see the overall demand growth for lithium in EV markets. Our focus is to make our project attractive under present economic conditions. Part of that path, seeing the demand for lithium hydroxide in North America, has been to base the PFS on producing lithium hydroxide as the end product.

Disclosure: The author has a long position in Cypress Development but has recently exercised some warrants and sold some shares to cover the warrant exercise cost. The author also has a long position in Orocobre. Cypress is a sponsor of the website.