Wesdome Gold Mines (WDO.TO) released its production results for the first quarter earlier in April and despite a 36% decrease in the total amount of tonnes milled, the gold production increased by 6% to 19,000 ounces of gold thanks to a 54% grade boost (to 18.5 g/t) at Eagle River and 22% (to 2.2 g/t) at Mishi. The substantially higher grade at the Eagle River mine was caused by reaching the high grade 303 lens ahead of schedule which provided a nice boost.

We’ll have to wait for Wesdome to publish its financial results until May, but despite the lower throughput, it should be a good quarter on both the income statement as well as on the cash flow statement (depending on how much Wesdome spent on underground development which isn’t cheap, but necessary to keep the operations going.

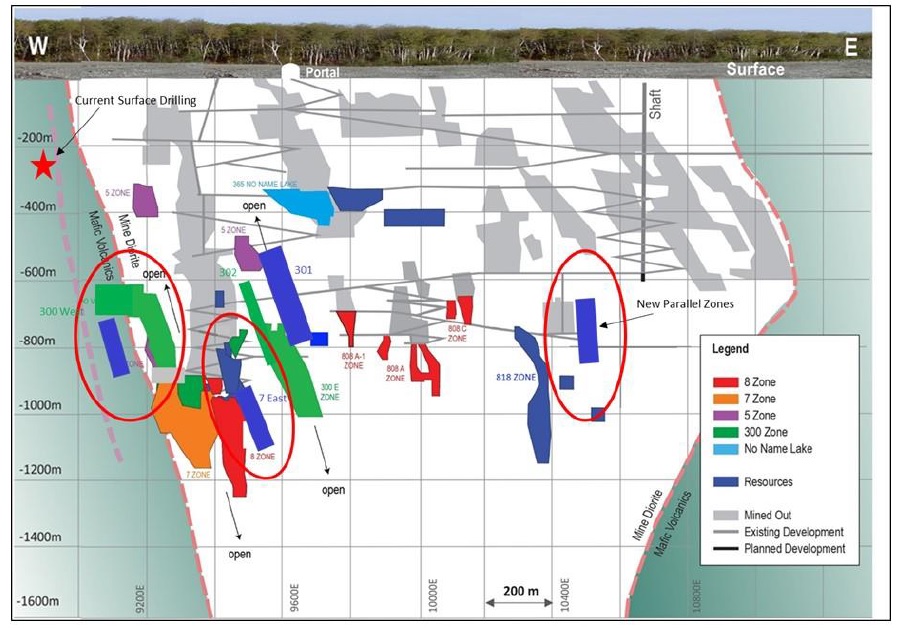

And Wesdome is spending its cash wisely. It’s currently wrapping up a 7,000 meter drill program that was designed to follow up on the last drill program in 2018 which discovered two structures that could very well be the extensions of the already known 300 and 7 structures, about 200 meters further east. These two new structures have now been called the Falcon Zone and Falcon 300 (the extension of the 300-structure) has now been traced over a strike length of 100 meters and an additional 150 meters down dip while Falcon 7 has a strike length of 130 meters and 180 meters down dip. Early assay results look promising with 3.3 meters of 11.5 g/t and 1.1 meters of 1.1 ounces of gold per tonne of rock (assays were capped at 60 g/t).

Wesdome’s current market cap of C$581M isn’t particularly low but as the company has no debt (just some lease-related liabilities) and C$27.4M in cash in the bank, its enterprise value – based on the year-end 2018 financial statements is approximately C$554M.

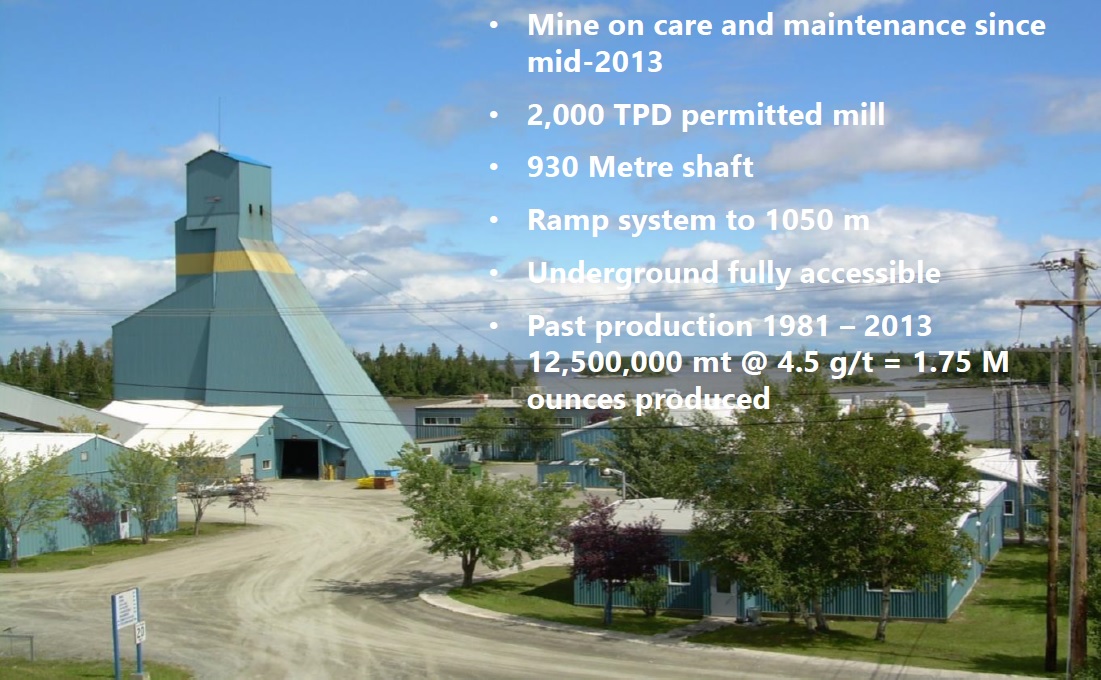

Wesdome produced almost 72,000 ounces of gold from the Eagle River complex in 2018 ad a cash cost of just US$699 per ounce while the all-in sustaining cost was estimated to be less than US$1000/oz. Respectable results, and although this may not justify the market capitalization of in excess of half a billion Canadian Dollar, the market only started to realize last year Wesdome still has the Kiena asset in Québec which is currently aggressively being explored.

In the past year or so, Wesdome’s share price increased from less than C$2 to in excess of C$5 as the market seems to have re-discovered the ‘optionality’ in Wesdome. The operating team has now proven at the Eagle River complex it knows what it’s doing, and Wesdome’s management is spending every incoming dollar of free cash flow on further advancing the Kiena project. 105,000 meters of drilling has been completed there in the past three years, and Wesdome is planning to complete an additional 59,000 meters of drilling with 5 underground drill rigs. In fact, Wesdome is also planning to spend more money on its Eagle River complex where approximately 114,000 meters will be drilled this year (compared to just 60,000 meters last year).

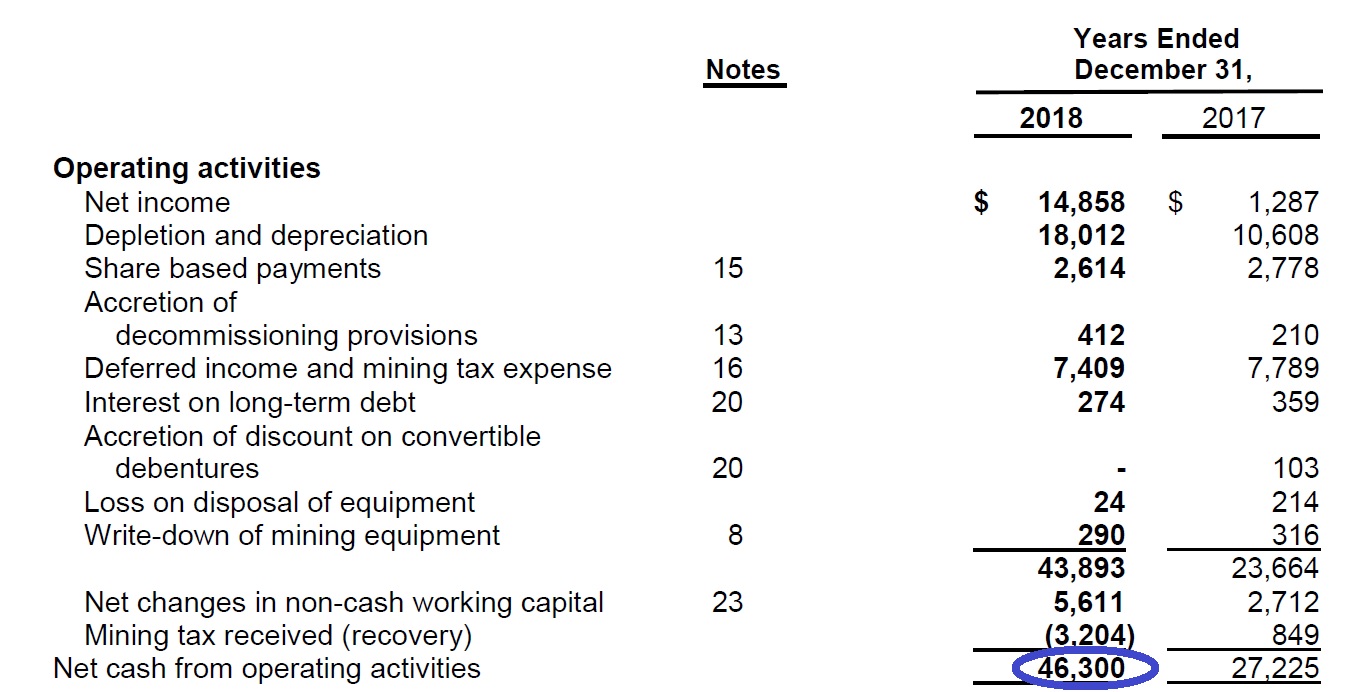

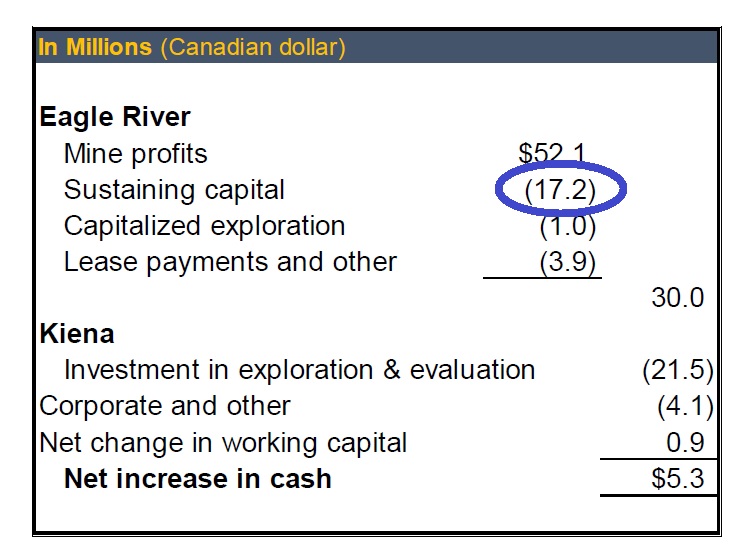

In 2018, the sale of the produced gold generated an operating cash flow of C$46M (after deducting the C$274,000 in interest expenses from the operating cash flow rather than looking at it as an investing cash flow, but before adjusting this result for a C$7.4M deferred tax payment), but it spent approximately C$40M in capital expenditures. Fortunately Wesdome’s MD&A report provides an excellent overview of where the money went:

As you can see, only C$17M of the C$40M that was registered as capex and/or capitalized exploration expenses was deemed to be a sustaining capex. This means the Eagle River complex generated C$46M – C$17M = C$27M in free cash flow which supported all other activities. Note, the C$27M already includes the C$1.7M annual expense to keep Kiena on care and maintenance. This was obviously expensed and not capitalized.

So. Is Wesdome expensive at its current market capitalization? Based on the Eagle River operations, yes. But Wesdome is also working hard to unlock the value of the 1.6 million ounce Kiena gold project where it could restart the existing mill once it figures out a new mine plan. Additionally, the Kiena mill could still serve as a toll mill for smaller projects in the vicinity. The Kiena complex used to be the ‘hidden value’ on the balance sheet but the market has caught up on this and now expects Wesdome’s further growth to come from Québec.

Go to Wesdome’s website

The author has no position in Wesdome. Please read the disclaimer