Earlier this month we flew to Sweden to visit the Tomtebo project where District Metals (DMX.V) has just started a 5,000 meter phase II drill program. We were able to talk to the project geologists and see representatives of EMX Royalties (EMX.V) (EMX), which vended the project to District Metals for cash, shares and a royalty.

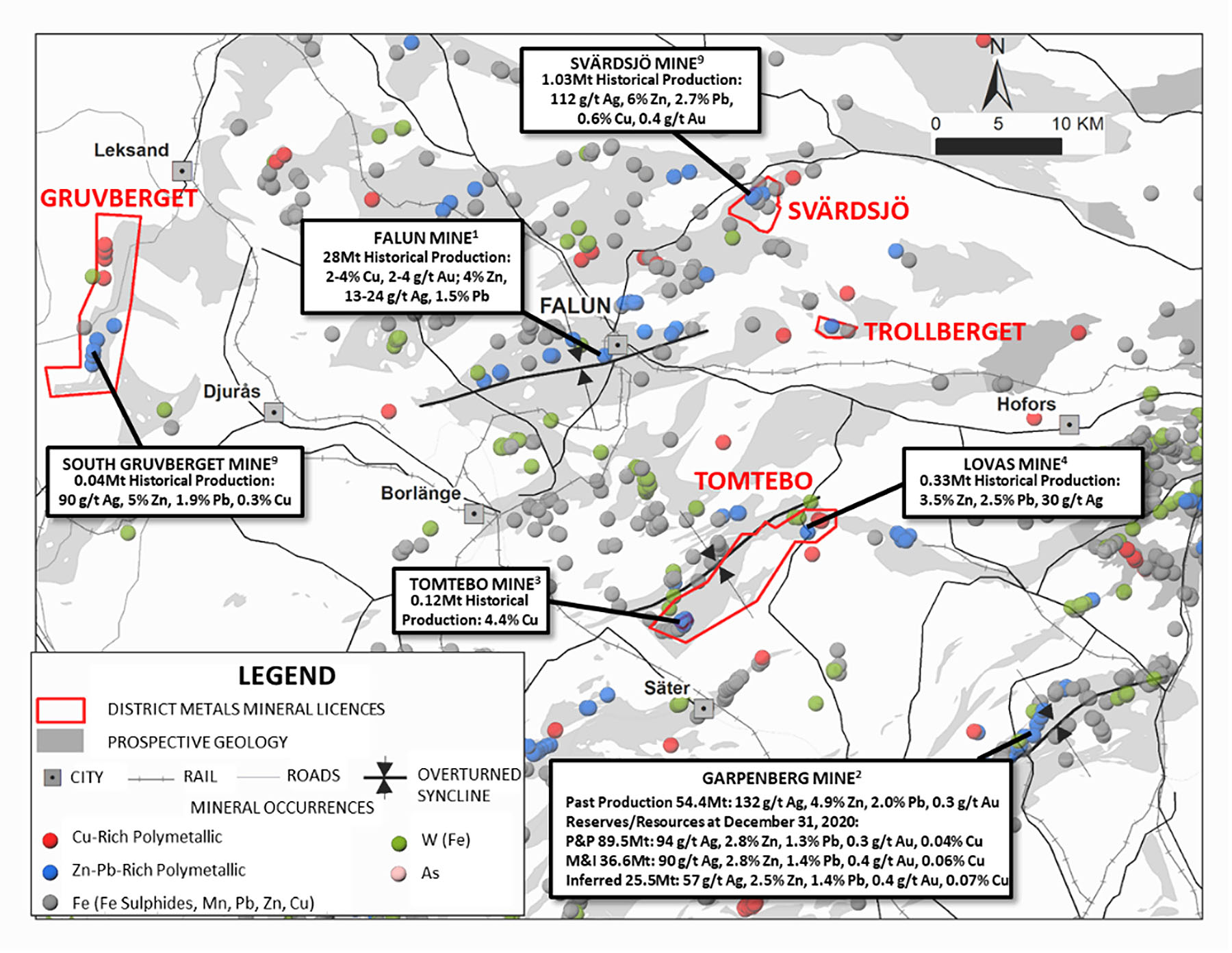

District recently beefed up its presence in the region as it acquired two new projects in Sweden’s Bergslagen district and after seeing the rich history and the potential of the region, we fully understand why District aims at becoming a top-tier exploration company in the area.

We spent an entire day on and around the Tomtebo flagship project with CEO Garrett Ainsworth and country manager Hein Raat. Although Raat is Dutch, he speaks fluent Swedish and that’s a tremendous help to keep the local communities involved in the company’s plans.

A brief re-introduction to the Tomtebo flagship project

The 5,144 hectare Tomtebo project is located about 200 kilometers northwest of Sweden’s capital, Stockholm. The project contains three separate licenses that are contiguous to each other and where exploration activities can be traced back to the middle ages with first production at Tomtebo in 1648 while the Lovas Mine was in production in 1561. Of course, the historical production wasn’t meaningful in today’s terms given the poor technology available and limited options.

The best location to try to find a new mine is in the shadow of an existing mine. Not only did District Metals secure a land package containing two past-producing mines, but the Tomtebo land package is also located in the Bergslagen district of Sweden, known for its numerous iron and precious metals rich polymetallic occurrences. The Tomtebo project is within hiking distance from the Garpenberg mine, currently owned and operated by Boliden, a well-respected Swedish commodity group (and the fifth largest zinc producer and sixth largest zinc smelter in the world).

It makes sense to zoom into Garpenberg for a minute as that is perhaps the best example to show how prolific the Scandinavian VMS-related deposits can be. This mine has produced about 55 million tonnes of ore and still contains 75 million tonnes of ore in the reserve categories with an additional 68 million tonnes in the measured, indicated and inferred resource categories. If anything, this shows how big those Swedish VMS-related deposits can be. Having a 200 million tonne deposit just down the road indicates you’re hunting in elephant country.

As Garpenberg is pretty close to Tomtebo, we briefly visited the Garpenberg mine site which clearly shows you the little surface disturbance this mine creates. The only testament to having an underground mine is the mill and the tailings facilities.

During the site visit at Tomtebo, the abundance of existing infrastructure became very clear. While a lot of companies brag about having access to infrastructure when they really mean ‘there’s some sort of power line about a 100 kilometers away, the infrastructure actually couldn’t be any better at and around the Tomtebo project.

The drive from Stockholm to Säter, the nearby town is likely one of the easiest drives we have experienced in a while as you get out of the airport and drive straight to the project on highways and very well-maintained secondary roads that would make many Western European countries jealous. It likely also is one of the very few projects where a train station with a direct connection to the international airport of Stockholm is less than 15 minutes away.

So it’s very easy to move around and get to the project (the drill rig we saw was literally 100 meters away from the road in an easily accessible field) and that’s a good first step as access is important. But that’s not the only positive quality of the Tomtebo project. Sweden has an abundance of water (another box that needs to be ticked) and the access to cheap (wind and hydro-generated) power shouldn’t be too difficult as there’s a high voltage powerline literally running through the property. While all these elements were obviously known from reading the technical report on Tomtebo, it’s always nice to see with your own eyes how blessed the Tomtebo project is in terms of infrastructure and accessibility.

A 5,000 meter phase II drill program has started

The assay results from the first phase drill program in 2021 have all been received with the publication of the results obtained from holes 17 to 21, in September. You can also re-read our earlier report on the Phase I drill results here as we explain in more detail how valuable the rock in some of the drill holes actually is.

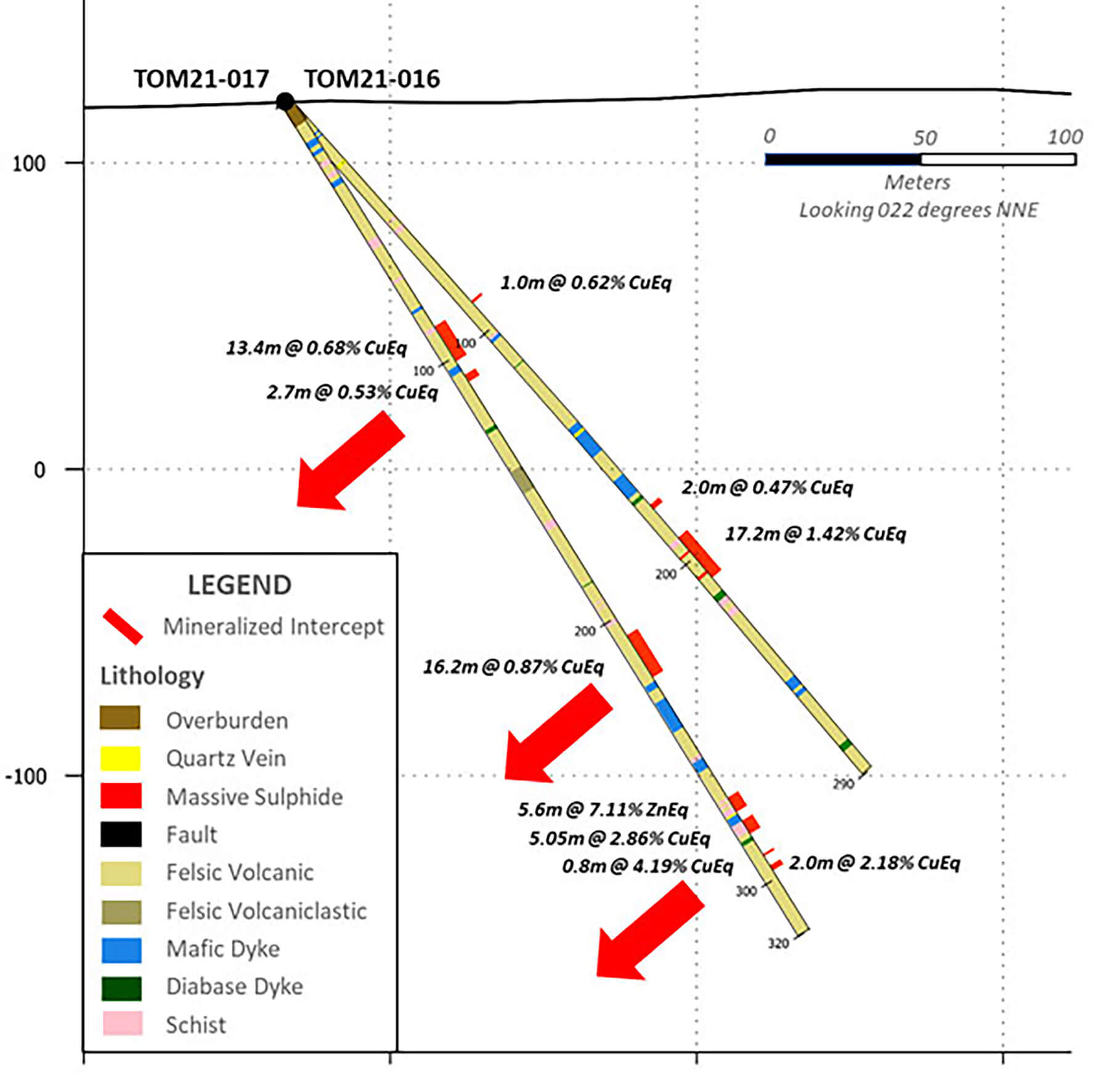

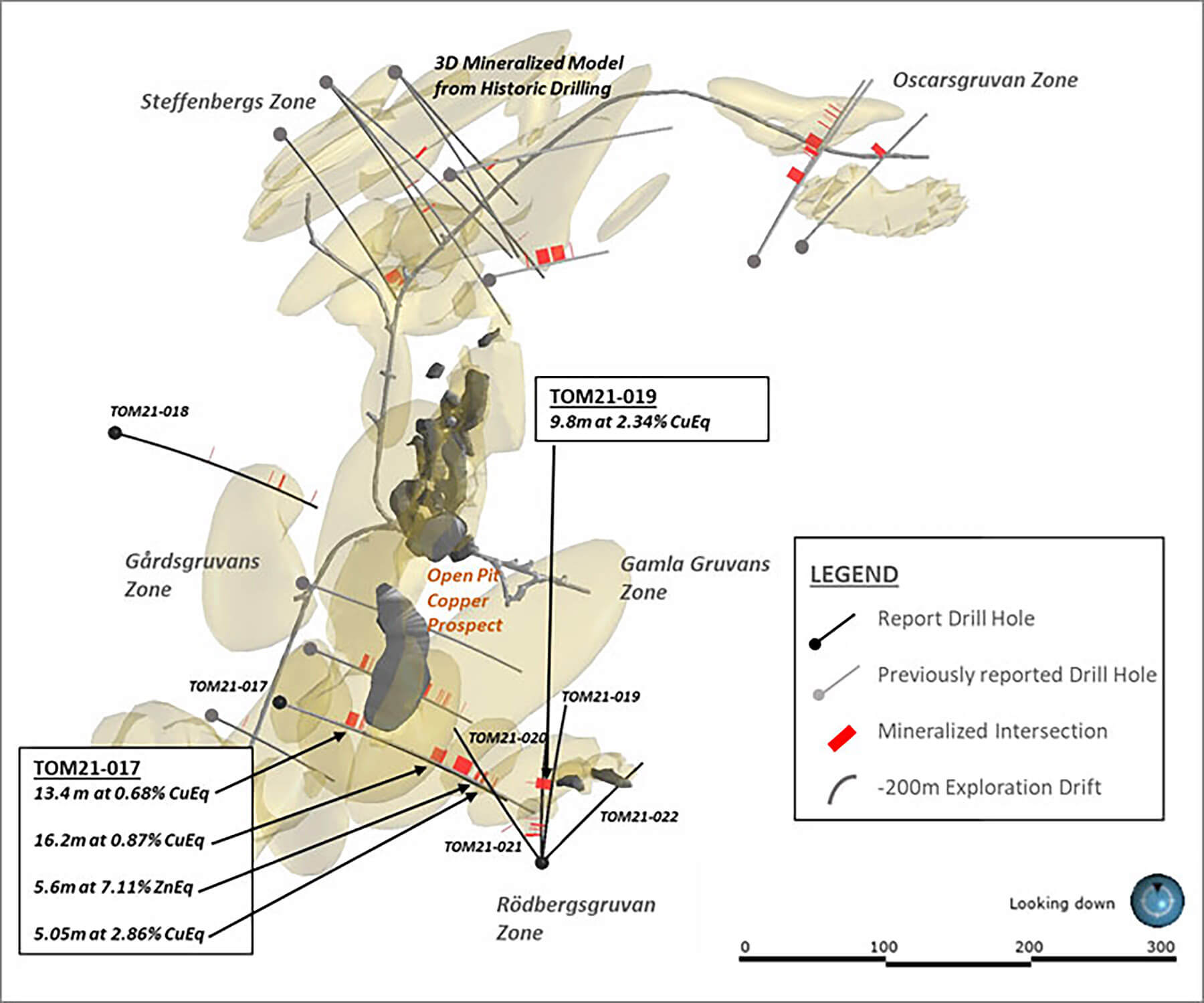

But back to the September update now. Holes 17 and 18 were drilled on the Gardsgruvan zone and hole 17 is interesting as it intersected multiple lenses of mineralization, some narrower than the others, but with for instance 5.6 meters containing 2.81% copper-equivalent (or, as it’s a zinc-rich hole, 7.11% zinc-equivalent) and 5.05 meters containing 2.86% copper-equivalent including almost 2 metes of 4.95% CuEq, there’s clearly something interesting going on in that hole. Hole 17 was drilled as a step-out at depth from hole 16, which encountered 17.2 meters of 0.94% copper and 0.28 g/t gold.

Hole 18 was following up on an old drill hole from the 60s which drilled horizontally to the west from the underground exploration drift. While mineralization was encountered, hole 18’s assay results were perhaps a bit less inspiring but with 3.70 meters of 0.78% copper-equivalent there still is a lot of smoke in that part of the project and District Metals will for sure be back out there, drilling.

But that will likely happen after the recently started phase II 5,000 meter drill program as the current drill program is focusing on stepping out from the mineralization encountered in the Phase I drill program and to further refine the interpretation of the mineralized structures.

District actually provided a rather detailed overview of what it intends to do in its Phase II drill program and rather than just rehashing the press release, this is what District plans to do:

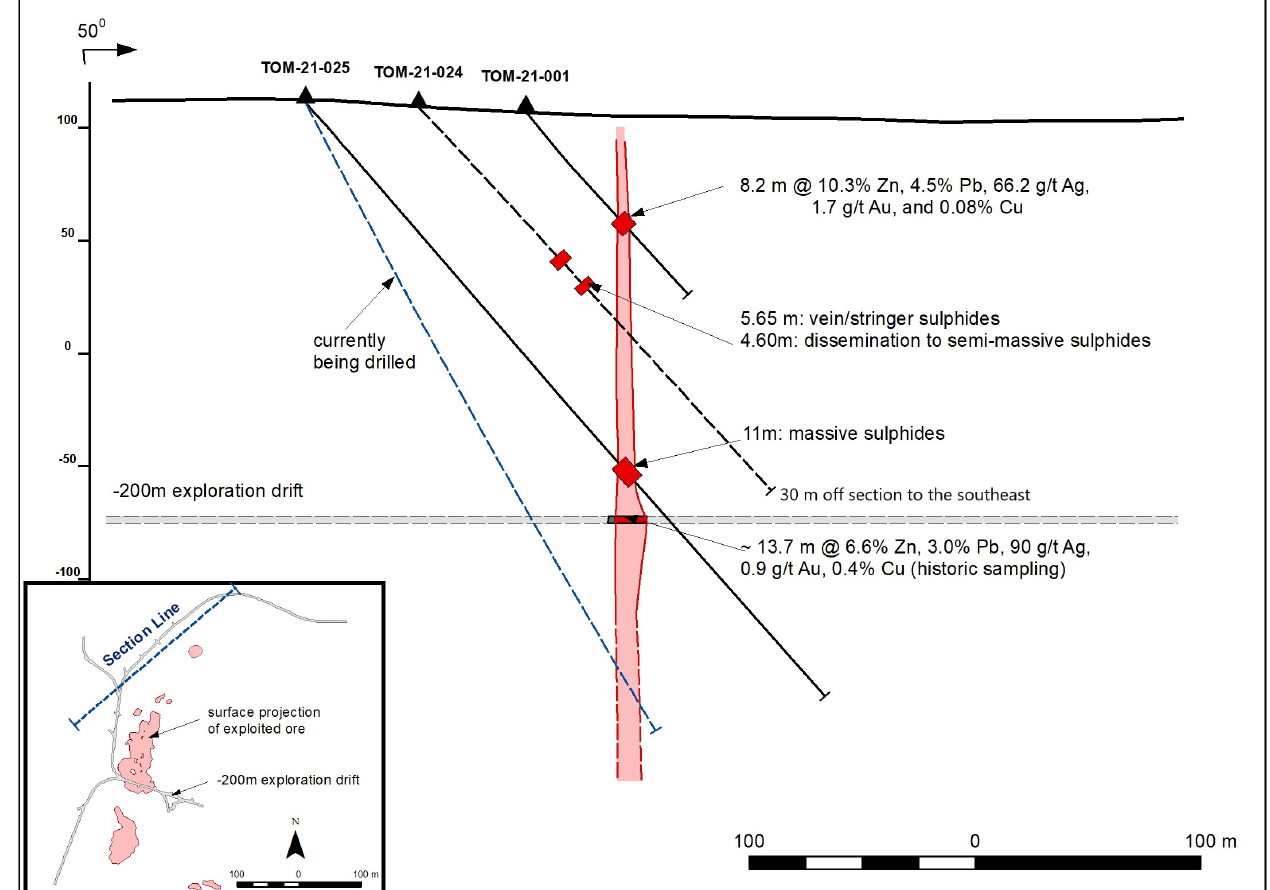

- Steffenburgs zone: step outs below hole TOM21-001, which intersected 8.2 m at 20.94% ZnEq1 (65.3 to 73.5 m) and is supported by the largest and strongest BHEM conductive plate from the Phase I drill program.

- Oscarsgruvan zone: step outs below and east-northeast from hole TOM21-002, which intersected 12.55 m at 331.9 g/t AgEq2 (90.8 to 103.35 m), and 4.8 m at 505.6 g/t AgEq2 (125.0 to 129.80 m) supported by numerous geophysical anomalies and the whole rock geochemical interpretation.

- Gårdsgruvans zone: step outs below and southwest from hole TOM21-017, which intersected 13.4 m at 0.68% CuEq3 (88.1 to 101.5 m), 16.2 m at 0.87% CuEq3 (206.8 to 223.0 m), 5.6 m at 7.11% ZnEq1 (269.2 to 274.8 m), 5.05 m at 2.86% CuEq3 (278.1 to 283.15 m), and 2.0 m at 2.18% CuEq3 (295.3 to 297.3 m) supported by numerous geophysical anomalies and the whole rock geochemical interpretation.

- Northeast Gravity Target: testing a very significant blind gravity high anomaly with coincident magnetic and conductive anomalies located 1 km northeast along trend from the historic Tomtebo Mine. This gravity high anomaly remains open to the northeast and at depth where an exploration target of 34.0 Mt at a density of 3.45 g/cm3 has been modeled at shallow depths (40 to 320 m). Note: in a recent update the hole drill-testing the anomaly did not encounter anything significant and the assay results will determine the future of the anomaly.

- Southwest Gravity Target: testing a significant gravity high anomaly with coincident magnetic and conductive anomalies located 600 m southwest along trend from the historic Tomtebo Mine. This gravity high anomaly is associated with historic iron sulphide occurrences, which are known to sometimes coalesce with polymetallic sulphide mineralization in the Bergslagen District. An exploration target of 28.7 Mt at a density of 3.50 g/cm3 has been modeled at shallow depths (near surface to 420 m) at this target.

- Tomtebo Mine Proximal Gravity Targets: testing gravity high anomalies to the south and east of the historic Tomtebo Mine, which are supported by coincident magnetic and conductive anomalies.

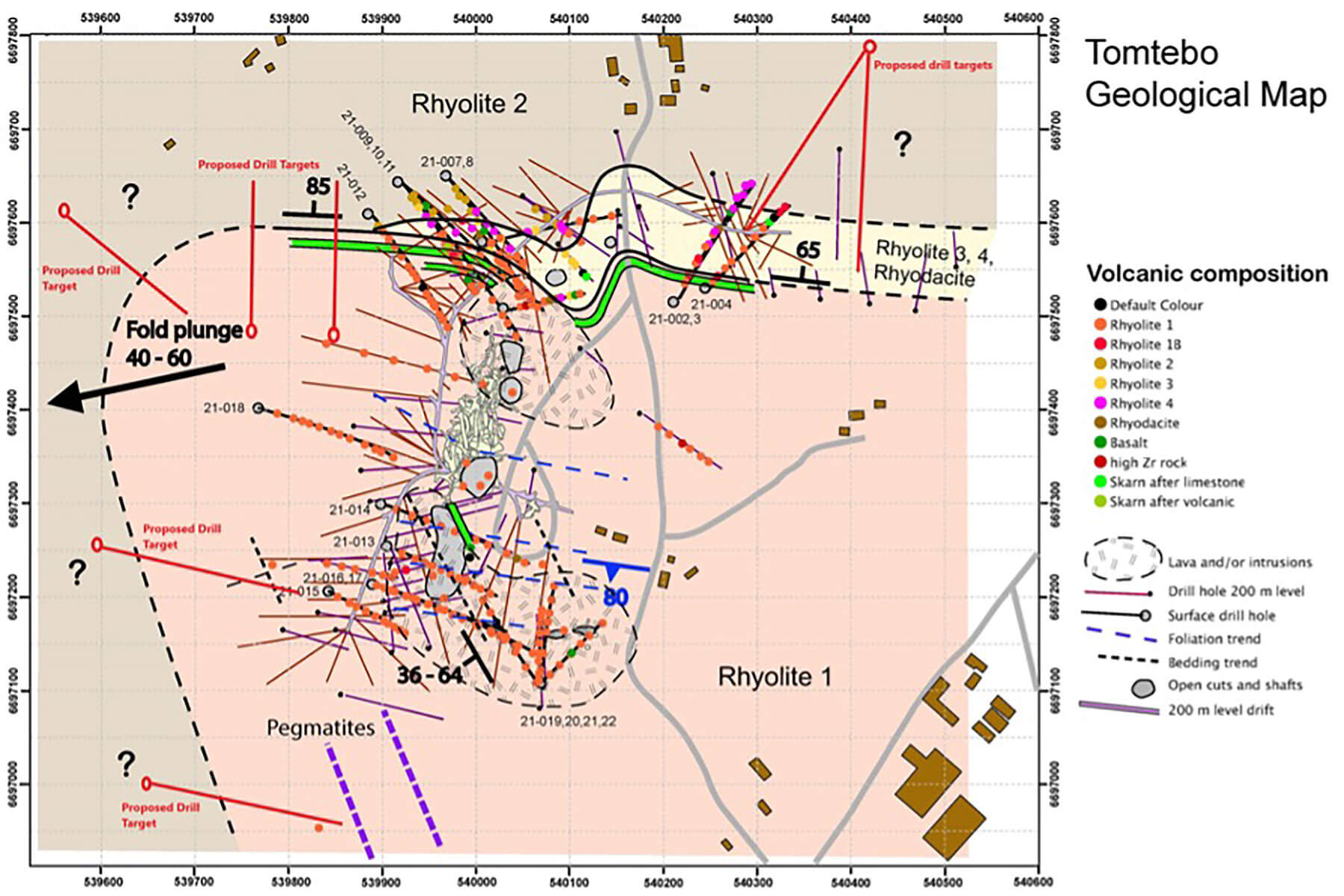

- West of Tomtebo Mine: systematic analysis of whole rock geochemistry in drill core from the Phase I program combined with structural mapping data has resulted in an interpretive breakthrough where the massive sulphide fertile horizon (between the Rhyolite 1 and 2) has been identified. This fertile horizon remains wide open and untested for at least 800 m west of hole TOM21-012 and the historical Tomtebo Mine.

The drill rig has been mobilized and was on-site doing the final checks when we visited Tomtebo. The first hole was drilled in the Northeast Gravity target. A target District wanted to drill before but as it would have to access a field, it waited until after the harvest season to ensure it maintains an excellent relationship with the locals. Unfortunately the hole didn’t yield the desired results. After losing the first attempt at a depth of 40 meters, a second hole was drilled but it failed to intercept any sulphide mineralization and the anomaly was likely caused by a slightly magnetic dyke swarm.

District already completed two other holes (in excess of 1,000 meters of drilling has already been completed so far), and hole 24 and 25 were both drilled at the Steffenburgs Zone and the company seems to be pretty excited about hole 25 as that hole encountered 11 meters of massive sulphide mineralization. That’s very important as this hole was drilled more than 100 meters down plunge from hole 001 which encountered 8.25 meters containing 20.94% zinc-equivalent. Encountering massive sulphides so much deeper could indicate the continuity of the system is pretty strong.

As you can see below, District Metals continues to drill that mineralized area as it started hole 27 from the same drill pad as hole 25 and that hole will target the Steffenburgs mineralization yet another 100 meters below hole 25, and even below the exploration drift. And we shouldn’t be too worried about hole 24 not exactly hitting the structure as it was later determined the hole may have been drilled a bit too far to the south/southeast from the plunging massive sulphides. And as you can see on the image below, hole 24 did encounter some semi-massive sulphides so it is possible that hole skimmed the juicy part of the system.

The samples from the first three holes will be rushed to the lab, and this means District is now anticipating to have the assay result in the first few days of December.

Assay results will be prepared in Sweden and will then be flown to Ireland for assaying. The turnaround time (excluding rush submissions) will be pretty long as the Irish lab is quite busy due to the exploration activities in Europe heating up again, and the lab guided for a 6 week turnaround time. This means it’s unlikely we will see results from the other holes before January.

The Bergslagen district is very prolific, and District Metals scooped up a few more projects along the way

Earlier this year, CEO Garrett Ainsworth already mentioned he liked the district and that there were a few projects on his list. During the summer months, District Metals entered into agreements to acquire two additional polymetallic properties in Sweden’s Bergslagen district. The terms are very reasonable, and the geologists seemed keen to start working on those projects.

Svärdsjö

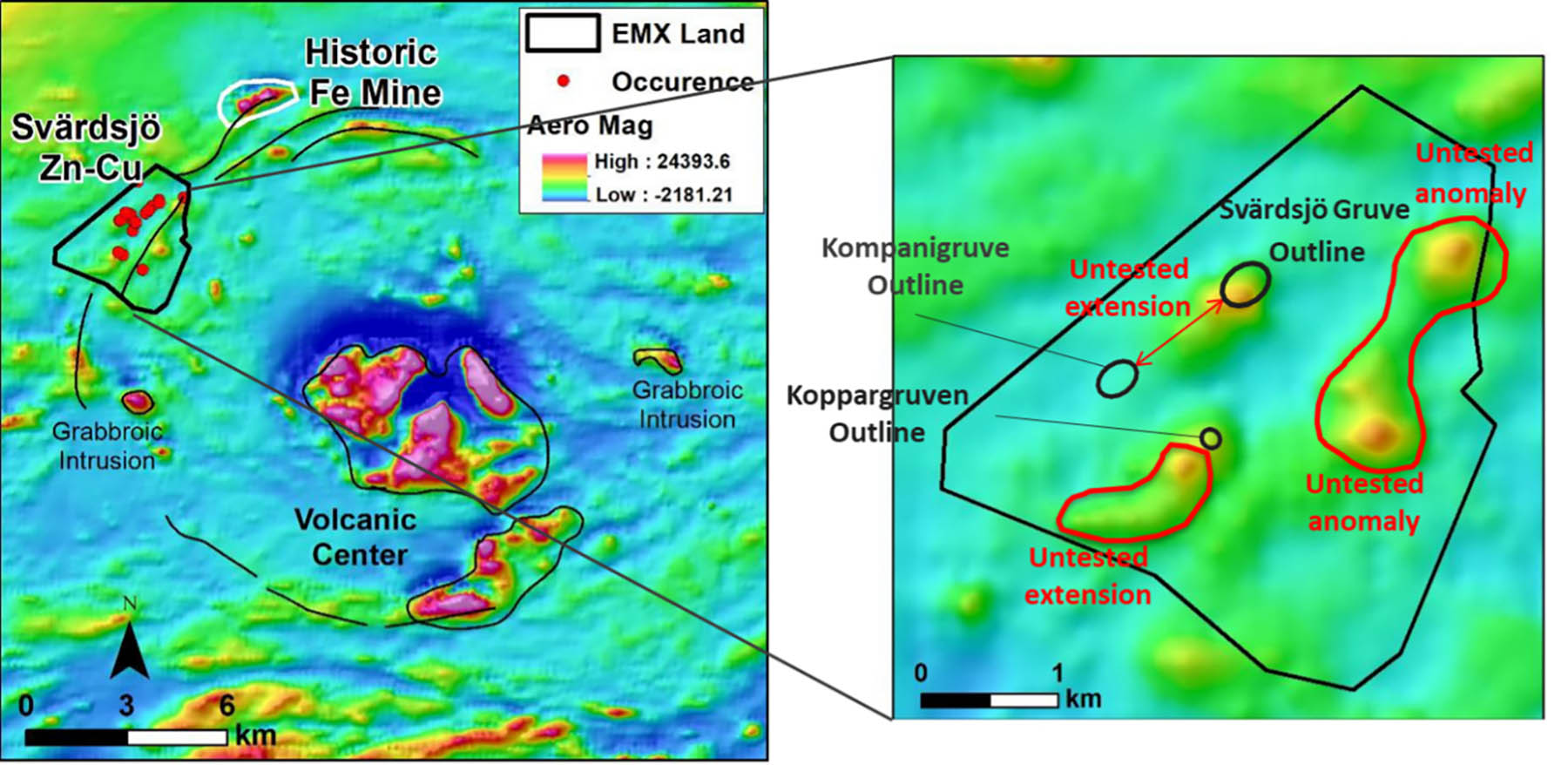

The Svärdsjö project is just about 25 kilometers from the Tomtebo project and this confirms the potential of the entire region as the host rocks, structure and alteration at Svärdsjö are the same as at Garpenberg, Tomtebo and the historic Falun mine, which is just 15 kilometers away.

Mineralization at Svärdsjö was discovered about a millennium ago and mining activities started in the 14th century. Svärdsjö is actually one of the larger past-producing mines as records indicate in excess of 1 million tonnes were mined up to a depth of 390 meters and with an average grade of 112 g/t silver, 6% zinc, 2.7% lead, 0.4 g/t gold and 0.6% copper, the grades are excellent. At the realistic metal prices ($23 silver, $1.25 zinc, $0.90 lead $1750 gold and $4 copper), this represents a gross rock value per tonne of US$376. Just to be clear, the net recoverable and payable value per tonne will be about 30-35% lower once we take recovery rates and smelter terms into consideration but it goes without saying that even after making these adjustments, that type of rock is very valuable.

Interestingly, the mine wasn’t exhausted when it reached the 390-meter mining level. According to the company, the mineralization remains open at depth and along strike. Hardly a surprise as both Zinkgruvan and Garpenberg are currently mining the deposits at a vertical depth of respectively 1,300 meters and 1,400 meters. These types of polymetallic deposits have a tendency to go deep and there’s no reason to expect the Svärdsjö project (and Tomtebo, for that matter) to be any different. The previous owner of the project was Boliden but they lost the license after a 10-year tenure in 2019 where after EMX Royalties picked up the claims.

EMX is now selling the Svärdsjö project to District Metals for an initial payment of C$35,000 in cash and 1.66 million shares which brings the EMX stake in District to just under 10%.

Subsequent to the initial payments, District Metals must spend at least C$150,000 per year in the next few years while committing to reach a total spend of at least C$1M within the first five years of closing the deal, including a minimum of 3,500 meters of diamond drilling. EMX is also entitled to receive C$275,000 in cash or stock upon the publication of each resource update or PEA and has been issued a 2.5% NSR of which 0.5% could be repurchased for C$2M at any time within the first six years of closing the deal. District will be required to make annual advance royalty payments starting at C$25,000 per year starting on the three-year anniversary after closing and increasing by C$10,000 per year to a maximum of C$75,000.

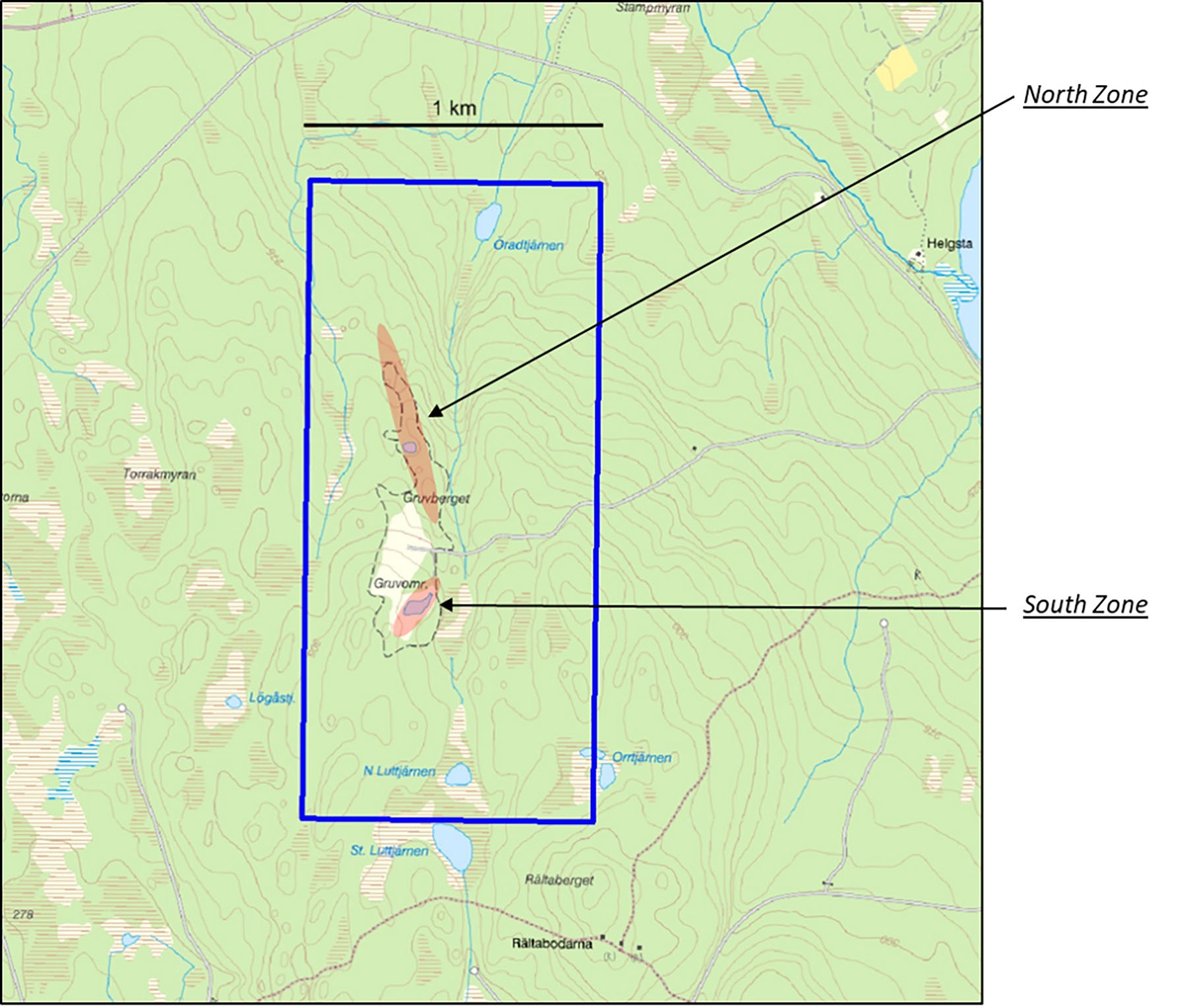

Gruvberget

District Metals entered into an agreement with Explora Mineral AB, a local vendor, to acquire Gruvberget a systematically underexplored polymetallic project. The asset is pretty close to Tomtebo (35 kilometers) so there are plenty of potential synergies as geologists can just drive around from one project to another. Mineralization was first discovered in the 1900s but it took about 80 years before mining activities actually took place on the property. In 1987, a company extracted about 40,000 tonnes of rock and shipped it to the Falun mine for processing. The average grade of the produced ore was approximately 90 g/t silver, 5.1% zinc, 1.9% lead and 0.3% copper. While we can hardly speak of a ‘mining’ operation per se, having access to the data of what we should consider a big bulk sample is very valuable to District Metals. Not only will this help to direct future drill programs, but it also provides the company with a rough idea about what it can expect.

The South zone on the Gruvberget contains a very shallow unmined historical resource (13,500 tons at 4.65% Zn, 1.55% Pb, 60 g/t Ag and 0.3% Cu) and District has access to all the historical drill data on the South zone. Some of those historical holes contained very high-grade mineralization with for instance 6.4 meters containing more than 4 ounces of silver per tonne as well as almost 12% ZnPb and 0.48% copper, and 4.6 metes containing 4.5 ounces of silver per tonne in combination with almost 15% ZnPb and 0.42% copper.

When there’s a South zone, there usually is a North zone too and according to the data available to District Metals, the North zone has a strike length of 550 metes and a vertical extent of about 160 meters (and remains open at depth). The grades of the historical drill programs are perhaps a bit lower (8.9 meters of 1.3 oz/t silver, 5% ZnPb and 0.16% copper), but just like the South Zone, the North Zone for sure remains interesting.

But the main reason for District Metals to pick up the property is the potential to find more mineralization all over the project. The South and North zone at Gruvberget are on a known strike length of approximately one kilometer but the project hosts numerous historical polymetallic mines and mineral occurrences along a 14 kilometer long trend so there’s plenty of rocks to kick at Gruvberget.

The acquisition terms are surprisingly reasonable. At the closing of the transaction, District Metals will issue one million shares and make a C$20,000 cash payment to the vendor while committing to spend at least C$0.5M on exploration in the first two years of the agreement. And finally, the vendor will obtain a 2.5% NSR which could be entirely repurchased for C$8M in cash.

When we were in Sweden, some field geologists walked portions of the Svardsjo and Gruvberget properties the day before and brought some rock samples to the core shack. While the rocks will be sent for analysis, the initial XRF results were very encouraging. Of course, we shouldn’t read too much into grab samples (only the really interesting rocks will be taken home for analysis), but it does show how prolific the projects are and although the initial focus will remain on Tomtebo, District Metals is likely keen on getting active on the properties as soon as practically possible.

Conclusion

Site visits are always interesting to get a first-hand impression of the projects and seeing Tomtebo didn’t disappoint. The initial drill results from the Phase I drill program were very encouraging and its understandable District wanted to kick off a Phase II drill program right away. The drill rig was testing the northeast gravity anomaly and an anomaly like that is usually caused by one of three things: polymetallic sulfides, a mafic intrusion and/or iron sulfide. Unfortunately the anomaly was likely caused by a magnetic dyke swarm so you never really know what Mother Nature has in store!

The proof of the pudding will be in the eating but it will likely take a while before seeing detailed assay results from the current drill program. Fortunately, the company’s treasury is in a good shape and District won’t have to go back to the markets before the drill results are out unless of course a financing window opens up.

The Bergslagen district in Sweden hosts numerous past-producing and currently producing mines so District is definitely exploring for base metals in the right jurisdiction and we are eagerly awaiting the assay results from the Tomtebo drill program.

Disclosure: The author has a long position in District Metals. District Metals is a sponsor of the website. Please read our disclaimer.