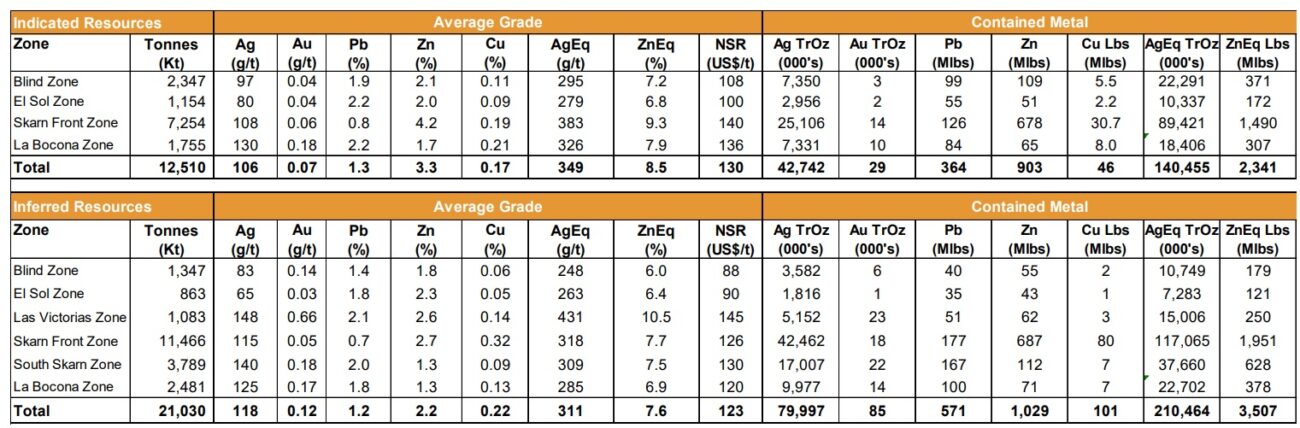

Southern Silver Exploration (SSV.V) has released the results of an updated resource calculation on its flagship Cerro Las Minitas polymetallic project in Mexico’s Durango state. The updated resource now contains 12.5 million tonnes of rock in the indicated resource with an additional 21 million tonnes in the inferred resource category. The average silver-equivalent grade is 349 g/t in the indicated resource category and 311 g/t in the inferred resource category, resulting in a total silver-equivalent resource of just over 140 million ounces and 210 million ounces respectively.

Of course not every silver-equivalent ounce was created equal and any economic scenario will have to take recovery rates, concentrate qualities and payability percentages into account. That’s why it is very commendable to see Southern Silver also publishes the Net Smelter Return. And although the indicated resources contain in excess of $220/t in gross rock value (based on a silver price of $20/oz), the net recoverable and payable rock value is ‘just’ $130/t. That’s pretty standard for these types of deposits but most companies don’t bother publishing the NET recoverable value per tonne in an attempt to make the project look better than it is.

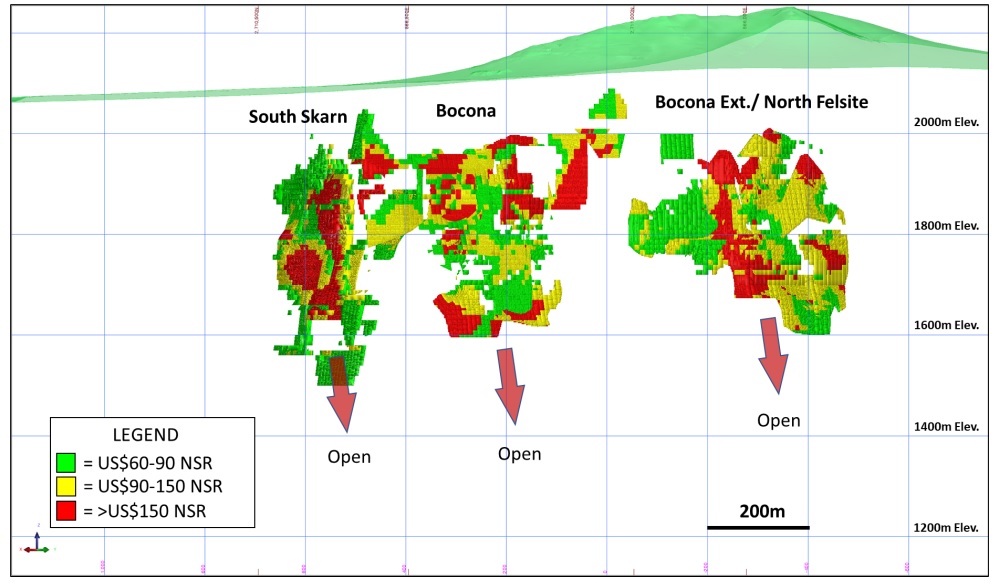

There still is plenty of exploration upside on the project (mainly at depth as all three main zones remain open at depth) but with 350 million ounces silver-equivalent across all resource categories it looks like the ‘critical mass’ required for the project has been reached.

We will provide a more in-depth review soon.

Disclosure: The author has a long position in Southern Silver Exploration. Southern Silver is a sponsor of the website. Please read our disclaimer.