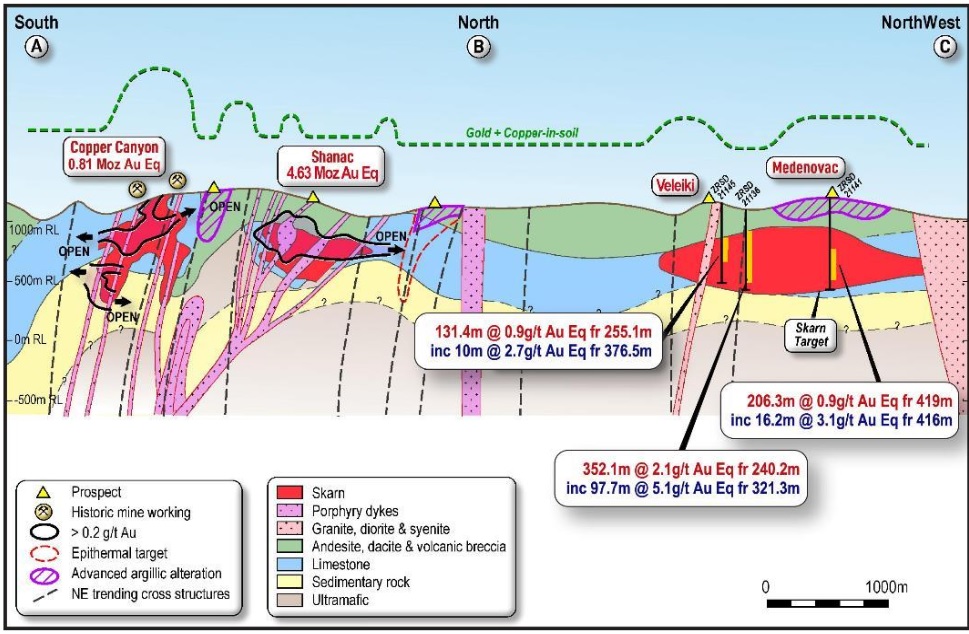

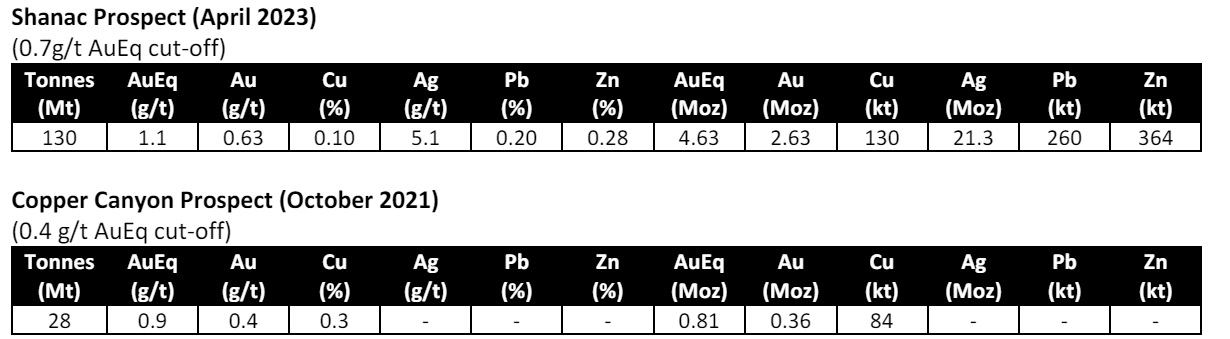

Strickland Metals (STK.AX) has confirmed the acquisition of the Rogozna project in Serbia which contains 2.96 million ounces of gold, about half a billion pounds of copper and approximately 800 million pounds of zinc as well as 600 million pounds of lead and 21 million ounces of silver, for a total of 5.44 million gold-equivalent ounces. The resource contains of two major parts, as shown below. While the average gold grade is low, the gold-equivalent grade could work for an open pit mining operation and economies of scale.

Additionally, there are several targets that have been drilled before and encountered some pretty interesting grades. Shown below are some highlights of the Veleiki zone and the Medenevac zone where for instance the almost 98 meters of 5.1 g/t gold-equivalent and 16.2 meters of 3.1 g/t gold-equivalent could have a positive impact on the average grade (although those zones will likely have to be mined using underground mining methods).

The company is acquiring the project by paying A$750,000 in cash and issue almost 380 million shares for a total consideration of A$34.2M. An additional 50 million options with an exercise price of A$0.135 have been issued to the vendor as well. Subsequent to completing the transaction, Strickland plans to complete 60,000 meters of diamond drilling with three rigs to further increase the total resources at Rogozna as some of the exploration target may be seen as some low-hanging fruit. At the end of March, Strickland Metals had A$50M in cash and marketable securities (shares in Northern Star Resources) on its balance sheet, so the company is well-funded.

Disclosure: The author has no position in Strickland Metals. Please read the disclaimer.