StrikePoint Gold (SKG.V) recently hired Michael Allen (Eclipse Mining, Northern Empire) as its new CEO and although StrikePoint has assets in British Columbia, CEO Allen is heading back to Nevada where he has plenty of experience. Northern Empire was successfully sold to Coeur Mining (CDE) but the sale of Eclipse Mining to Northern Vertex (now Elevation Gold Mining (ELVT.V)) was a disappointment. And since closing the acquisition of Hercules, Elevation’s share price has lost about 90% of its value.

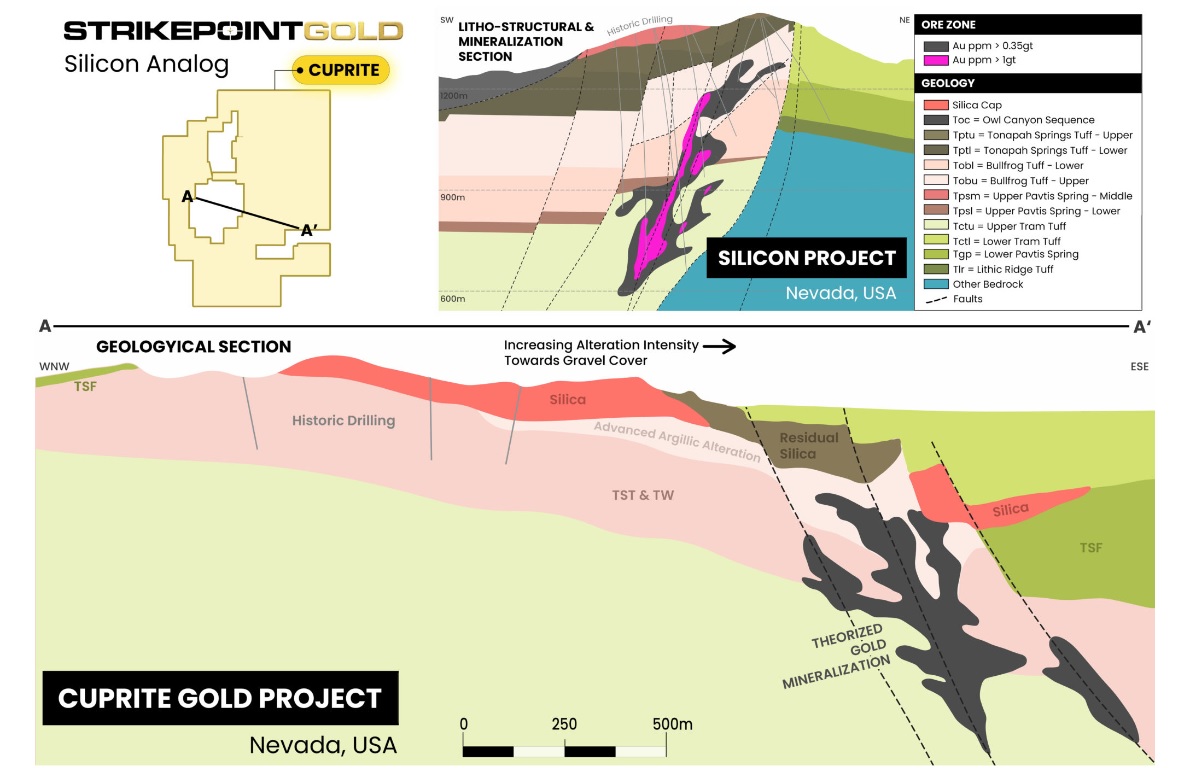

Now Allen has taken the reigns at StrikePoint Gold, Nevada is becoming a focus point for the company as SKP entered into an agreement with Orogen Royalties (OGN.V) to acquire the Cuprite Gold Project in Nevada’s Walker Lane gold trend. There appear to be some similarities to the Silicon discovery announced by AngloGold Ashanti (AU) and which triggered a consolidation in the Beatty district in Nevada as AngloGold continued to acquire Coeur’s neighbouring project while it also acquired Corvus Gold (KOR.TO). And just 15 kilometers northeast of Cuprite, Centerra Gold (CG.TO, CGAU) acquired the Gemfield oxide project in 2022.

To secure full ownership of the project, StrikePoint will have to issue just over 6.4 million shares (with a deemed value of C$450,000) reimburse the seller for just over US$35,000 in expenses and issue a 3% NSR to Orogen. 1/6th of that royalty can be repurchased for US$2.5M. An although that NSR is pretty high, it effectively is a low-cost acquisition with almost no cash to be paid to the optionor.

Disclosure: The author has no position in StrikePoint Gold. Please read our disclaimer.