Taiga Gold (TGC.C) has closed a non-brokered placement in April which consisted of just under 12.5M flow-through units priced at C$0.20 per unit. Each FT unit consisted of one share as well as a full warrant allowing the warrant holder to acquire an additional share of Taiga Gold at C$0.30 for a period of 2.5 years (ending mid-October 2023). Should those warrants end up being ‘in the money’, Taiga would be able to raise an additional C$3.75M.

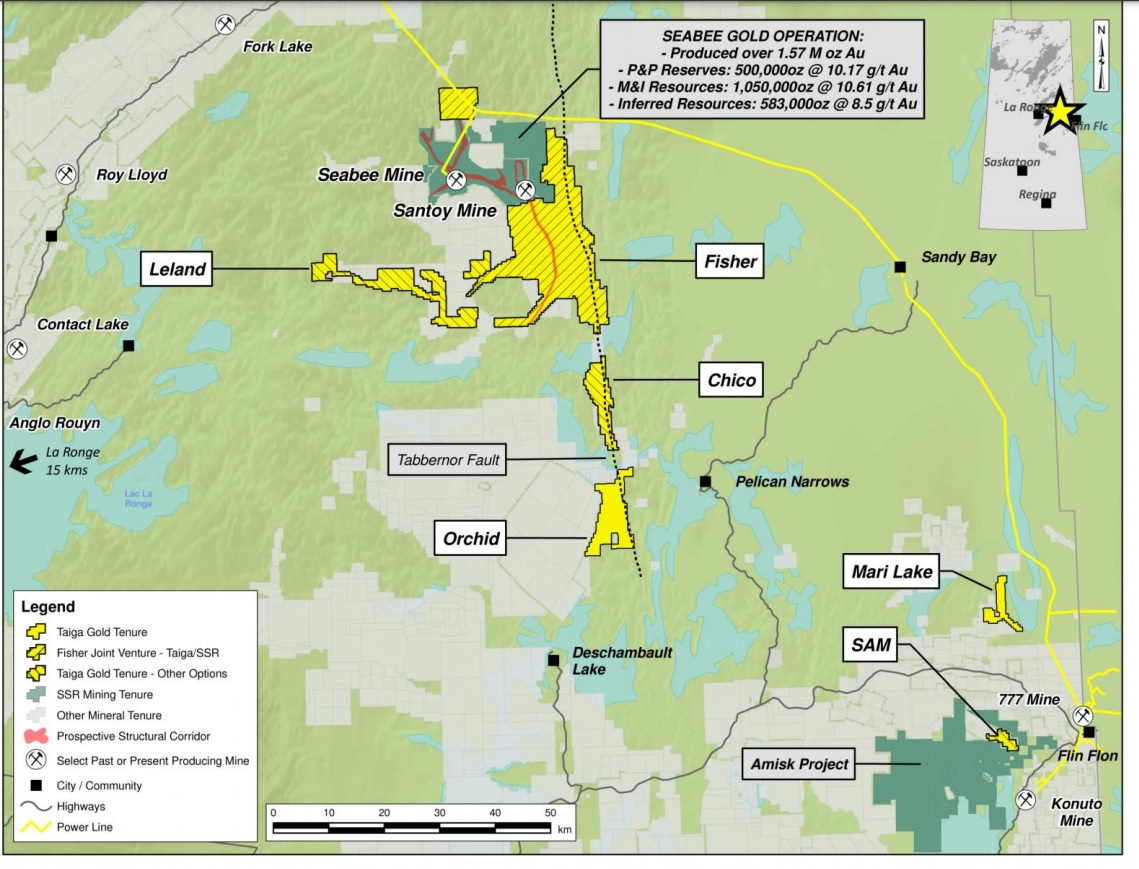

This raise puts Taiga Gold in an excellent position as it will have about C$5M in cash after receiving the C$3M option payment from SSR Mining (SSRM, SSRM.TO) and this puts the company in an excellent position to continue to contribute its 20% share whenever there’s a cash call for exploration activities on the Fisher project rather than being pushed into a corner. Additionally, the recently raised cash will also be used to fund the exploration activities on the Orchid and Mari Lake exploration projects.

With over C$5M in cash, Taiga Gold is in an excellent position as it will be able to contribute to the Fisher exploration programme while advancing the other projects in its portfolio. A solid move by the Taiga Gold management team.

Disclosure: The author has a long position in Taiga Gold and participated in the recent financing. Taiga Gold is a sponsor of the website. Please read our disclaimer.