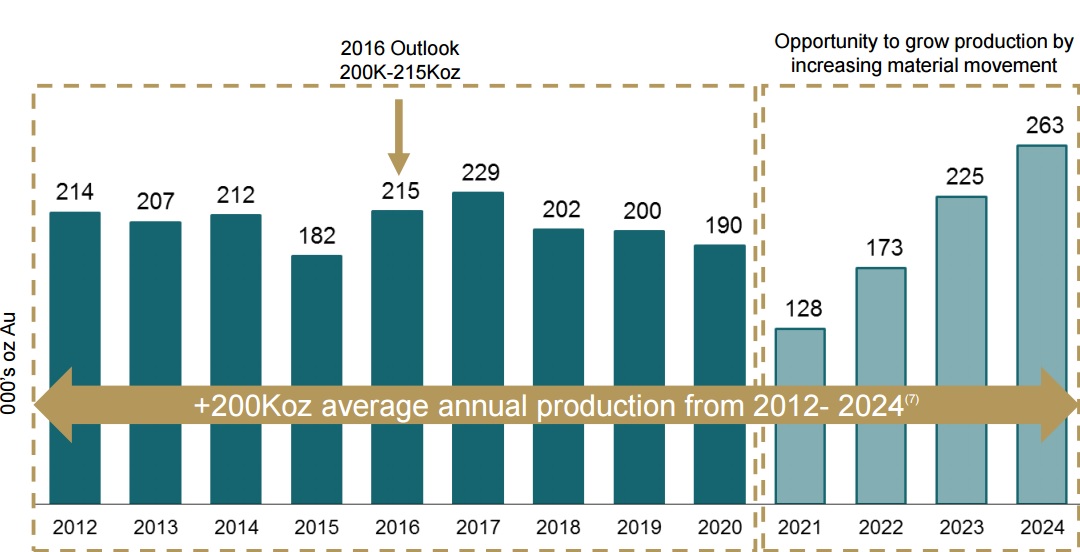

Teranga Gold (TGZ.TO) has updated the market after an excellent first quarter of the year. During the first three months of the year, its mine in Senegal produced in excess of 70,000 ounces of gold due to a high mill throughput and the higher grade nature of the ore. Keep in mind this production rate will most definitely not be sustainable, and you should expect an average quarterly production rate of 50,000 ounces of gold which would result in a full-year production of 200,000-215,000 ounces of gold (although we wouldn’t be surprised to see Teranga beating its guidance).

The company’s free cash flow per ounce came in at $144 in the first quarter, and even though this might sound disappointing considering the AISC was less than $825/oz, keep in mind the company has to deliver gold to Franco Nevada (FNV) as part of the streaming agreement. As Teranga’s working capital position is still positive and as the company generated a positive free cash flow of approximately $10M in the first quarter of the year, Teranga is in a pretty good shape but we’re keen to see the impact of the lower production rates in the next few quarters on the production cost and operating margins.

Go to Teranga’s website

The author has no position in Teranga Gold right now. Please read the disclaimer