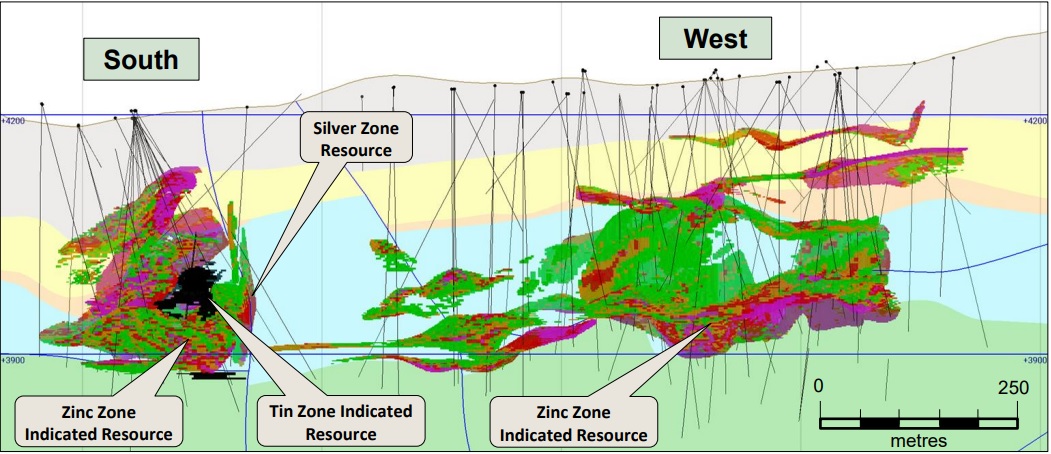

Tinka Resources (TK.V) has released the outcome of an updated Preliminary Economic Assessment on its flagship Ayawilca zinc project in Peru. The mine plan envisages a 2 million tonnes per year silver-zinc-lead operation over 21 years with a tin kicker based on a 15 year mine life at 0.3 million tonnes per year. This should result in an annual metal production (the press release doesn’t mention if this is the payable output but we would like to assume so given the provided details on which concentrate the silver ends up in) of 200M pounds of zinc, 1,500 tonnes of tin and just over half a million ounces of silver.

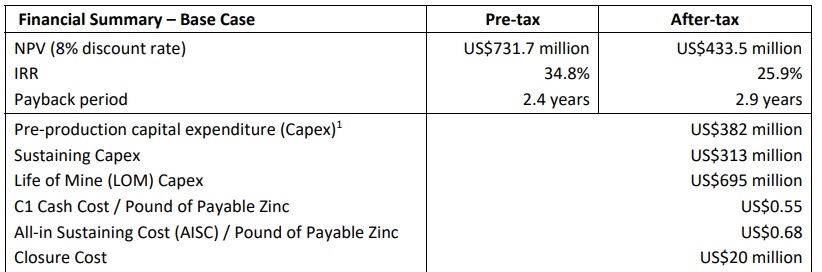

The initial capex has been estimated at US$382M and this results in an after-tax NPV8% of US$434M using a zinc price of $1.30 per pound. Applying a 10% lower zinc price would reduce the after-tax NPV8% to US$300M base on the sensitivity table below. Thanks to the abundance of by-product credits, the C1 cash cost per pound of payable (!) zinc is estimated at $0.55 while the all-in sustaining cost per pound of payable zinc is estimated at $0.68 per pound.

Tinka currently has 391 million shares outstanding, for a market capitalization of C$43M. At the end of December, the company had a net working capital position of just over C$5M.

Disclosure: The author has a long position in Tinka Resources. Please read the disclaimer.