Titan Minerals (TTM.AX), which acquired Core Gold (CGLD.V) a little while ago, has announced it closed the sale of the Zaruma mine concession and the Portovelo processing plant to Pelorus Minerals for a total of US$15M in cash and a 2% Net Smelter Royalty on the copper production at Zaruma. Of the US$15M cash consideration, US$5.5M should have been received by now while an additional US$2M is due before the end of this month.

The remaining US$7.5M will follow shortly as Pelorus plans to make US$2.5M payments by December 1st, March 1st and June 1st and if Pelorus doesn’t make these payments before or on the agreed upon date, they will start to accrue interest at a rate of 20% per year. The interest will also start to accrue if Pelorus is unable to complete its IPO before the end of October, so it looks like Titan Minerals secured an ironclad deal with Pelorus.

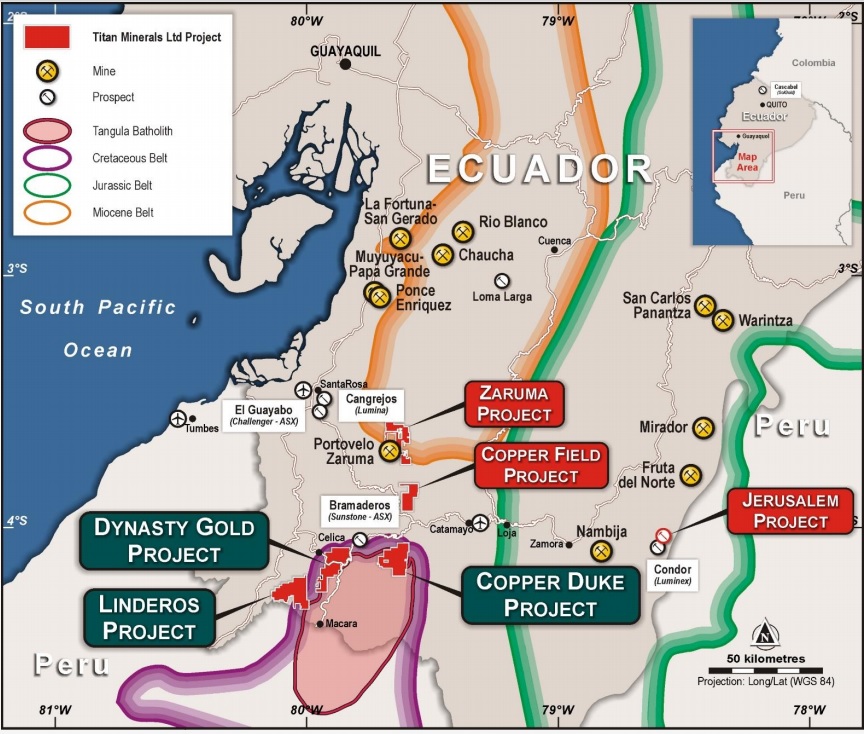

The Zaruma project was deemed non-core by Titan Minerals as it will focus on the existing gold projects in and around the Dynasty and Linderos projects. As a reminder, Dynasty currently contains 2.1 million ounces of gold at an average grade of 4.5 g/t gold, but Titan plans to update the resource before the end of this year and the cash proceeds from the Zaruma sale will put the company in a strong position to continue drilling. Two additional drill rigs have been directed to Dynasty, so we should see more high-grade assay results soon, and then it will be up to Titan’s consultants to put all the data together in a hopefully coherent resource update.

Disclosure: The author has no position in Titan Minerals. Please read our disclaimer.