Although most attention was going to Tocvan Ventures (TOC.C) El Picacho project where the company recently disclosed the assay results from 10 holes, its flagship project still is the more advanced Pilar gold-silver project, which is also located in Mexico’s Sonora state.

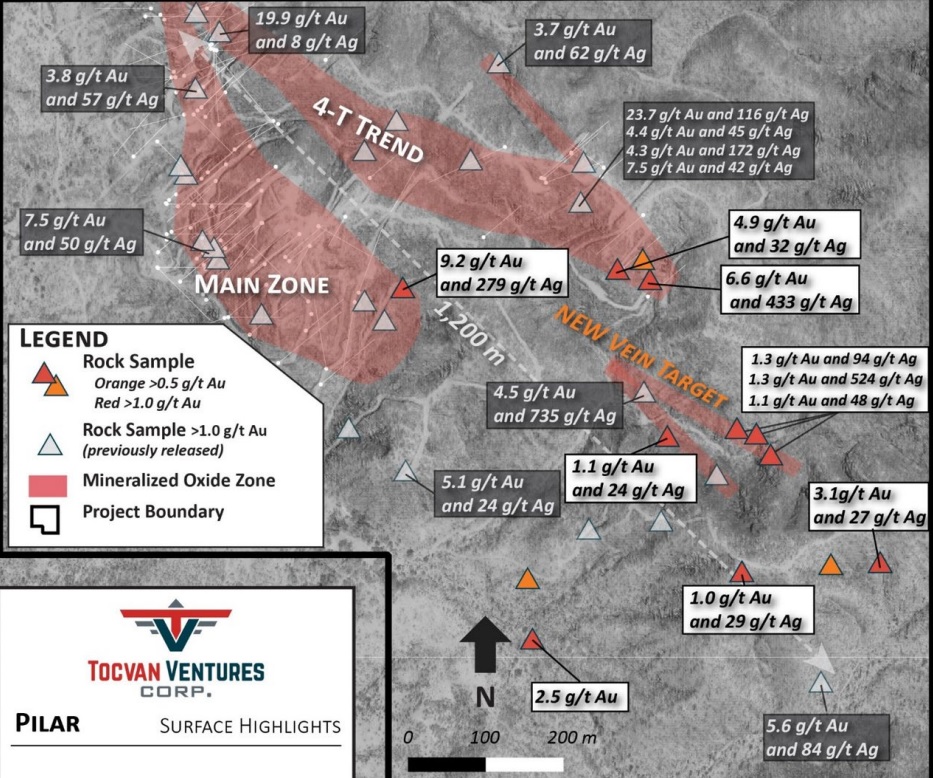

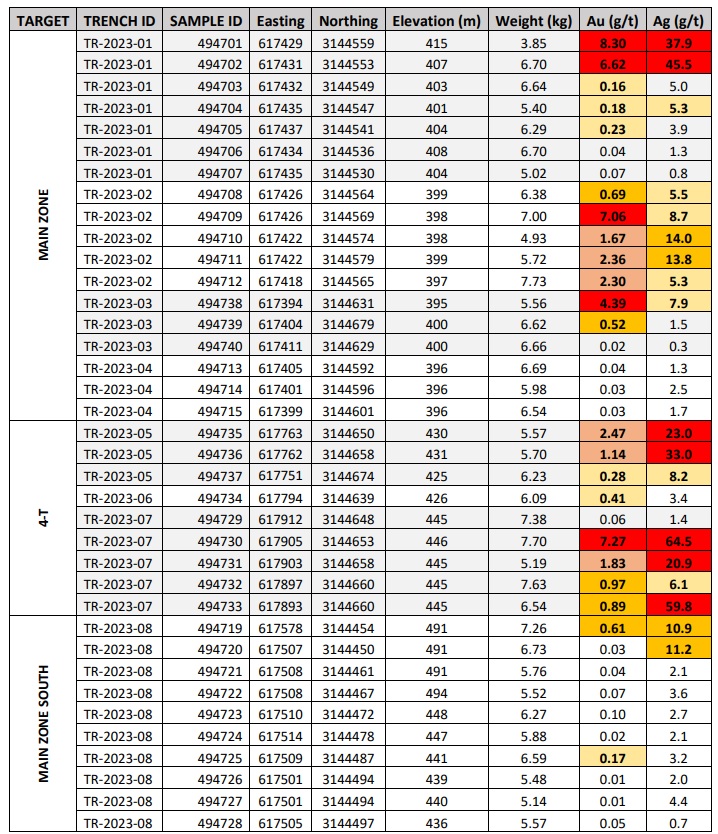

Tocvan recently completed a surface channel sampling program on the areas that are currently being prepared for a bulk sampling program. Channel samples were taken every five meters perpendicular to the mineralization and alteration that was exposed at surface along the 4-T and Main trends. The company tested eight locations and all eight returned anomalous gold and silver values.

While ‘anomalous’ doesn’t mean ‘economical’ and while some companies would argue anything above 3 ppb (the average gold grade in the earth crust) is anomalous, Tocvan’s assay results do indicate very anomalous gold and silver values. The detailed breakdown can be found below as the company was nice enough to highlight the high-grade results.

Again, anomalous values in a trenching program are encouraging (and they exceeded our and the Tocvan management’s expectations) but the upcoming bulk sample will provide more and better information of the main zones. Tocvan is gearing up for a 1,000 tonne bulk sampling program which will be taken from different spots on the Main Trend and 4-T Trend. The material will subsequently be transported to a private mining operating approximately 25 kilometers away where it will be processed using the heap leach method as this will provide a more detailed and more reliable recovery rate. Metallurgy is a key component of any (potential) mining operation so a successful outcome of the bulk sampling and leaching test would be an important box to tick.

Additionally, Tocvan successfully renewed the exploration permit for Pilar. That’s good news as it allows the company to dig trenches in nine distinct areas and construct 83 drill pads during a two year period. These additional drill pads will allow the company to complete an infill and step-out drill program along the currently known 1,200 meter long trend (which remains largely untested).

The company recently also raised just over C$630,000 by completing a private placement priced at C$0.52 per unit with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to purchase an additional share at C$0.62 for an 18 month period. As Tocvan also had to make a share payment to a service provider, there are now approximately 38.8M shares outstanding (excluding the impact from shares that may have been issued to Sorbie Bornholm in the past two weeks).

Disclosure: The author has a long position in Tocvan Ventures. Tocvan is a sponsor of the website. Please read our disclaimer.