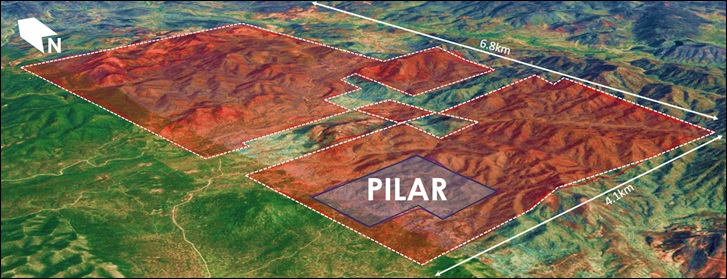

Tocvan Ventures (TOC.C) has announced it has signed an agreement with a private title owner for the acquisition of in excess of 2,000 hectares of land directly adjoining the Pilar project where Tocvan is earning in full ownership from Colibri Resources (CBI.V). This appears to be a strong vote of confidence from Tocvan for the project.

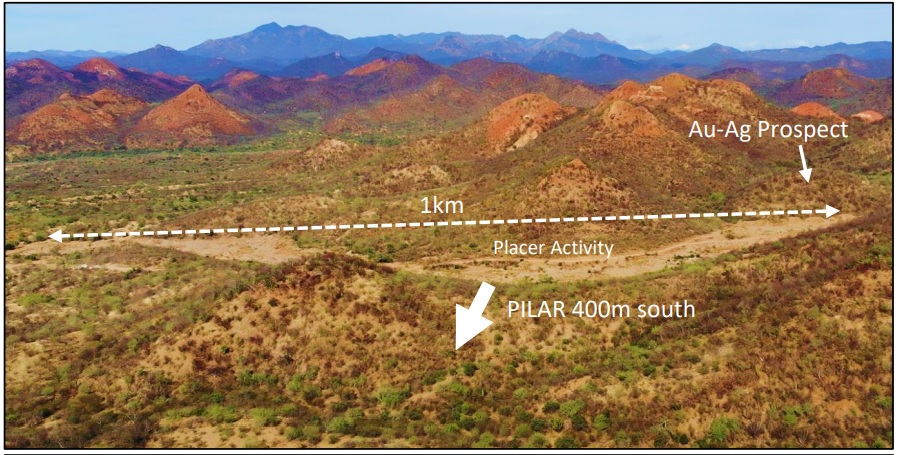

According to Tocvan, the 2,123 additional hectares have only seen very limited exploration activities but the existing and recent placer mining site suggest there may be untested gold and silver potential. CEO Brodie Sutherland commented:

Applying the knowledge we have gained from evaluating Pilar over the last few years gives us a huge advantage in quickly defining new areas of mineralization […]

We feel this acquisition will make Pilar standout as an emerging exploration district and recent placer mining in the area suggests there is much more to be discovered

The acquisition isn’t cheap for a small company like Tocvan, but fortunately the earn-in requirements are spread over a 5 year period. According to the press release, the company needs to complete US$4M in cash payments and issue 2.5M shares (with a current pro forma value of just under C$1.25M based on the current share price) on top of a US$1M work commitment. The title owner will retain a 2% NSR on the property while an additional US$0.5M cash payment subsequent to completing the 5 year earn-in agreement will be required to purchase full title ownership.

Disclosure: The author has a long position in Tocvan Ventures. Tocvan is a sponsor of the website. Please read our disclaimer.