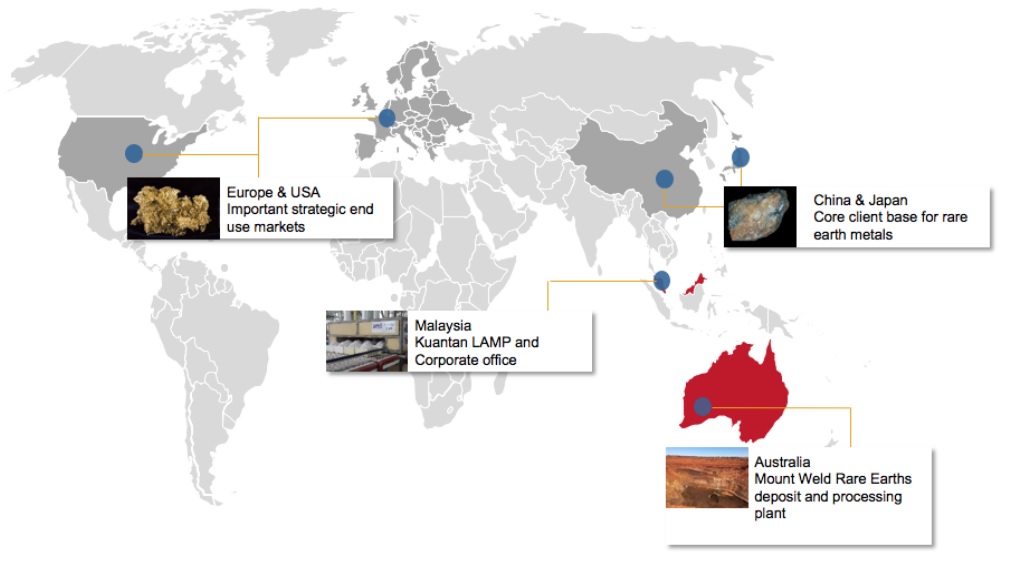

An interesting update from the Rare Earth Elements front this week as the Australian conglomerate Wesfarmers (ASX:WES), known for its ownership of the Coles supermarket chain, decided to put the incoming cash from the sale of its Australian coal mines to work. Apparently the most attractive sector Wesfarmers found is the REE space as the conglomerate made an all-cash offer to acquire Lynas Corporation (ASX:LYC), the REE producer with activities in Australia (the mine) and Malaysia (the processing plant).

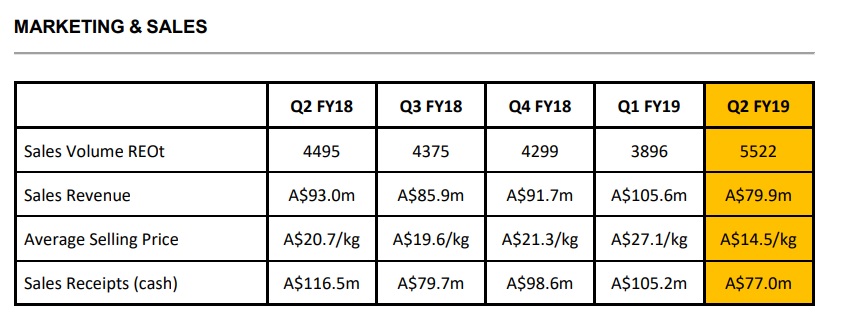

And that’s interesting as it does show the smart money is paying attention to the REE space, and Wesfarmers didn’t want to waste too much time to secure a position in the race. The offer values Lynas at A$1.7B (including A$200M in net debt), which is approximately 17 times its annualized EBITDA (using the A$50.8M EBITDA in the first semester as starting point). Although this appears to be a fair offer based on the current circumstances, we also do understand the reluctancy of Lynas’ board of directors to accept the offer as the EBITDA result in the first semester was skewed due to the relative overweight of low-priced REE’s cerium and lanthanum in the production mix in the second quarter of the financial year, which effectively cut the average received price for the REE basket by almost 50% as Lynas also made the strategic decision to stockpile some of the higher value REE’s rather than selling into a weak market.

For comparison purposes; the EBITDA result in FY 2018 was A$122M, indicating Wesfarmers’ opening offer values Lynas at 14 times its EBITDA. And while the multiple of 14 could be seen as fair, Lynas’ board obviously realizes it’s sitting on a Tier-1 asset that could be the key to securing non-Chinese NdPr product. NdPr is the key input material to powerful rare-earth magnets needed to power EVs.

And this basically paves the way for Medallion Resources (MDL.V) to capture the attention it deserves. Medallion is finalizing its flow sheet to process monazite (a waste product from mineral sands production) to recover the REE’s into a saleable concentrate. Turning another company’s waste into revenue and profits usually is a good business plan as purchasing and processing the monazite will be relatively cheap.

Medallion has just closed a first tranche of its financing, raising almost C$600,000 by issuing units at C$0.09 with each unit consisting of 1 common share and ½ warrant with a strike price of C$0.15. The proceeds will be used to further fine-tune the flow sheet, and it’s important to note this relatively small capital raise should allow Medallion to make considerable progress as the Canadian federal government recently granted almost C$85,000 in subsidies to complete the test work.

We are working on an update report on Medallion to highlight the updated expectations based on the current REE price deck. But before publishing that report, we wanted to draw your attention to this report from Alquimista Assets which provides an excellent overview of the REE space – highlighting the magnet metals. If anything, it’s an excellent read to refresh your memory about the REE space, as it isn’t the easiest sector to master.

Open the Alquimista report on Magnet Metals and Medallion Resources (PDF)

The author has a long position in Medallion Resources, and did participate in the most recent financing. No position in either Lynas or Wesfarmers for now. Medallion Resources is a sponsor of the website. Please read the disclaimer