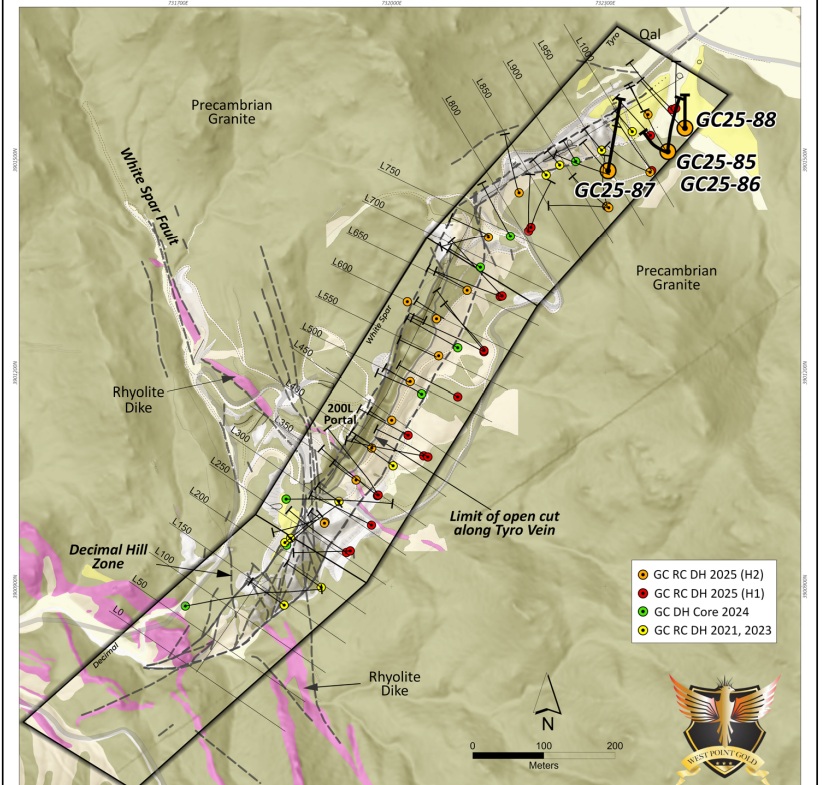

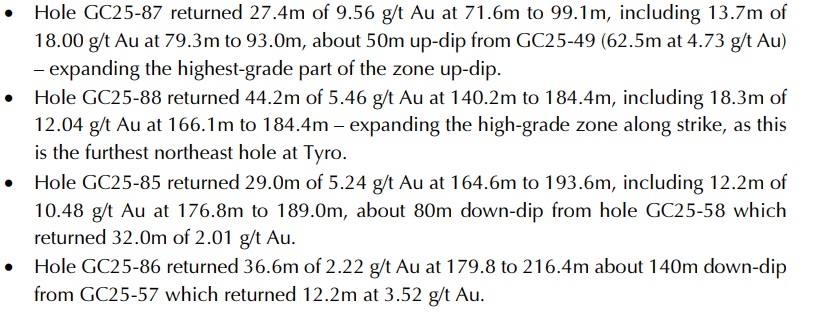

West Point Gold (WPG.V) has released the assay results from an additional four holes that were drilled on the Tyro zone. All four holes encountered high-grade mineralization (we even count the 2.22 g/t in hole GC25-86 as high-grade as that will likely be more than 10 times higher than the cutoff grade in an oxide-hosted gold project). The bullet points below show the highlights of the four holes, and it’s quite clear the 27.4 meters of 9.56 g/t in hole GC25-87, starting at just under 72 meters down hole, is excellent. But all holes are exceeding our expectation as it looks like the company continues to intersect underground grades in a potential open pit configuration (to be confirmed when the maiden resource calculation will be published). In any case, CEO Derek Macpherson’s comment highlights the continuity of the mineralization, as the high-grade zone at NE Tyro appears to continue at depth and towards the northeast.

Two additional drill holes have been completed, and the company still has to work on over 70% of its 15,000 meter drill program. This means we should expect a pretty steady news flow going forward. The ongoing drill program continues to focus on the deeper portions of the high-grade zone between the Main Zone and Tyro NE.

The company still is well-funded with in excess of C$7M in cash on the bank, and the continuous exercise of warrants (we also exercised our warrants) will likely ensure a healthy cash balance to support the current drill program.

We expect to see an update on the company’s plans for 2026 in the near future, and we are specifically interested in seeing the timing for the maiden resource estimate. As the company continues to hit good gold grades, it is perhaps becoming increasingly difficult to decide on the cutoff moment for the maiden resource.

The results from the drill program at Tyro and NE Tyro are exceeding our expectations, and it’s good to see the market is rewarding the company for its exploration success, as the share price has more than quadrupled in the past six months.

Disclosure: The author has a long position in West Point Gold but recently sold shares to exercise warrants. No additional share sales are expected at this time. West Point Gold is a sponsor of this website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.