Good news from Contact Gold (C.V) as the company has reached an agreement with Waterton whereby the latter has agreed to be flexible on the preferred shares Contact had issued in consideration for the acquisition of Pony Creek (and other projects) from Waterton when the company came out of the gate. The preferred shares never seemed to be bothering North American investors, but the issue was raised several times during European investor meetings.

In a first step, Contact Gold will be raising at least C$10M in a prospectus offering (no hold period in either Canada or the USA), of which C$5M will be used to repay the preferred securities. In a second step, Waterton will subscribe to as many shares at the same terms as it takes for Contact Gold to get enough cash in to repay Waterton’s remaining preferred shares, without Waterton exceeding 47% ownership of Contact Gold.

Perhaps a theoretical example will make things clear. Let’s say Contact Gold raises C$10M at C$0.20 per unit (the price hasn’t been determined yet as this will be set by the lead orders), issuing 50M shares to end up with a share count of approximately 147M shares. C$5M will be paid to Waterton to settle a portion of the C$14.65M preferred shares (the C$14.65M is the value of the liability on the balance sheet as of the end of March). This means an additional C$9.65M remains payable, and that Waterton will have to subscribe for C$9.65M / C$0.20 = 48.25M shares. The C$9.65M paid by Waterton for the shares will immediately be repaid to Waterton to extinguish the preferred shares.

In this scenario, Contact Gold would end the current quarter with a total share count of 147M +48M = 195M shares. At C$0.20 this would give the company a market capitalization less than C$40M which appears to be relatively low for a company with two irons in the fire in a booming gold market. Of the 195M shares, Waterton would own 48.25 + 31.2M current shares = just below 80M shares and below 40% of the expanded share count, and that makes everyone happy.

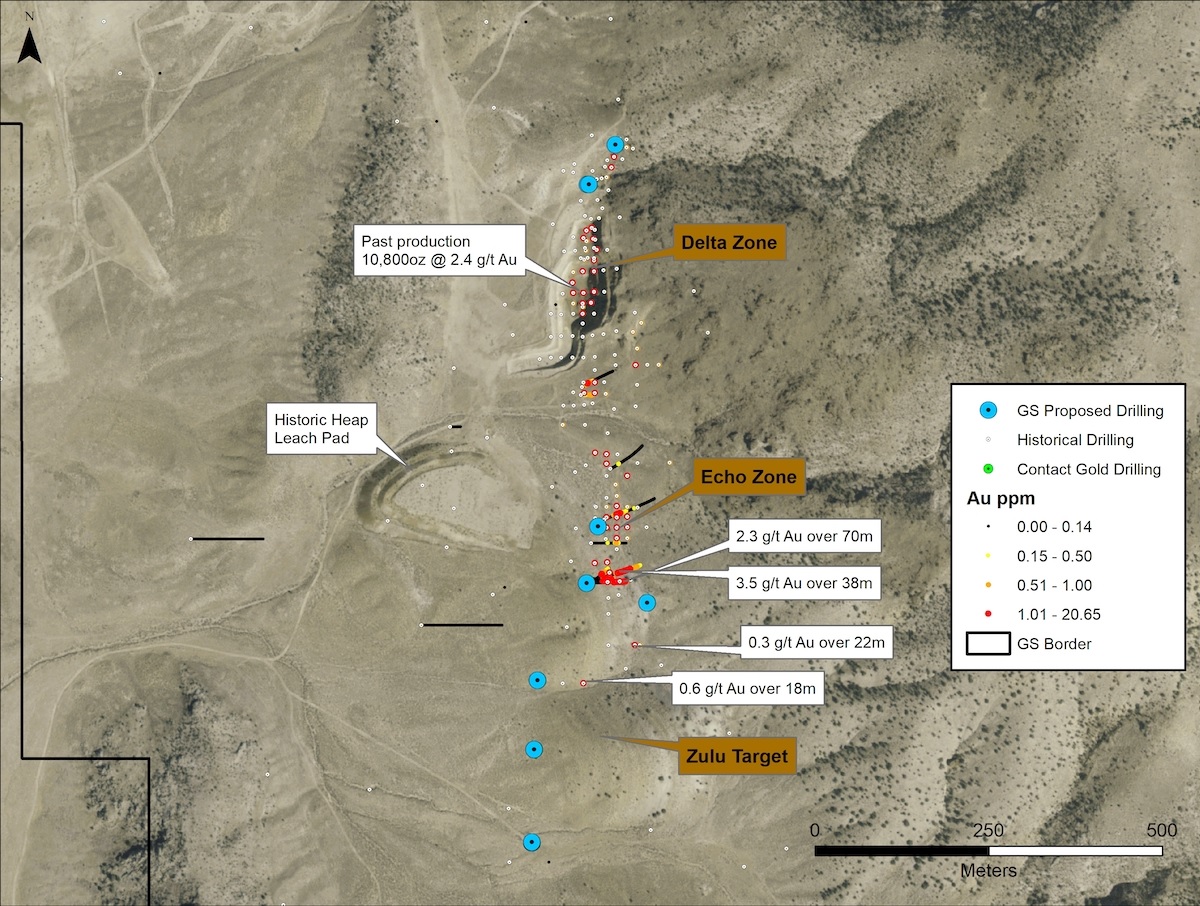

Of course, our example above is currently purely for educational purposes as long as the effective issue price hasn’t been determined. The higher the price, the better, but it looks like this could be a well-orchestrated deal to get rid of the preferred shares, thus reducing the balance sheet risk. Contact Gold’s only focus should now be on completing the C$10M raise and getting the deal done as that will allow the team to fully focus on a two-pronged exploration approach at both Pony Creek and Green Springs. Once the initial C$10M raise will be completed, Contact Gold will retain C$5M in cash which will be used to immediately start drilling Green Springs where it encountered high-grade gold in oxide mineralization in the previous drill programs.

Disclosure: The author has a long position in Contact Gold. Contact is a sponsor of the website.