We already reported on Columbus Gold’s (CGT.TO) press release from earlier today, wherein it proposed to nominate five new directors for Eastmain Resources’ (ER.TO) board of directors. Eastmain has already reacted, calling Columbus’ proposal ‘cynical’ and ‘self-serving’, but that’s not necessarily true.

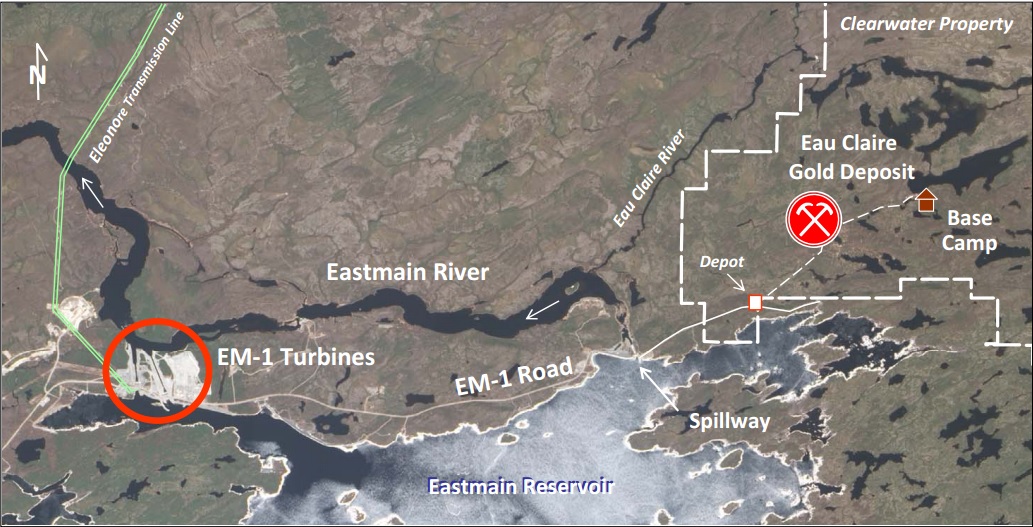

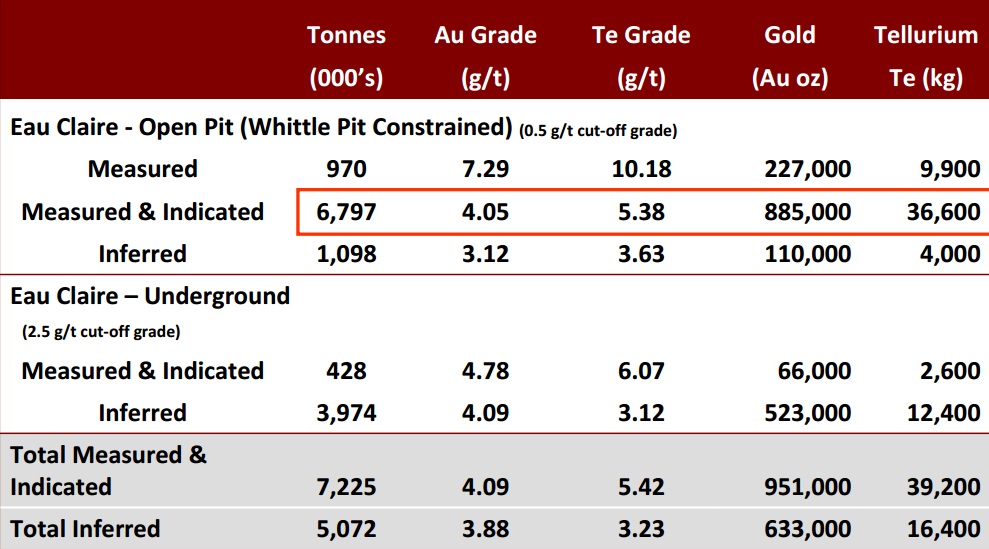

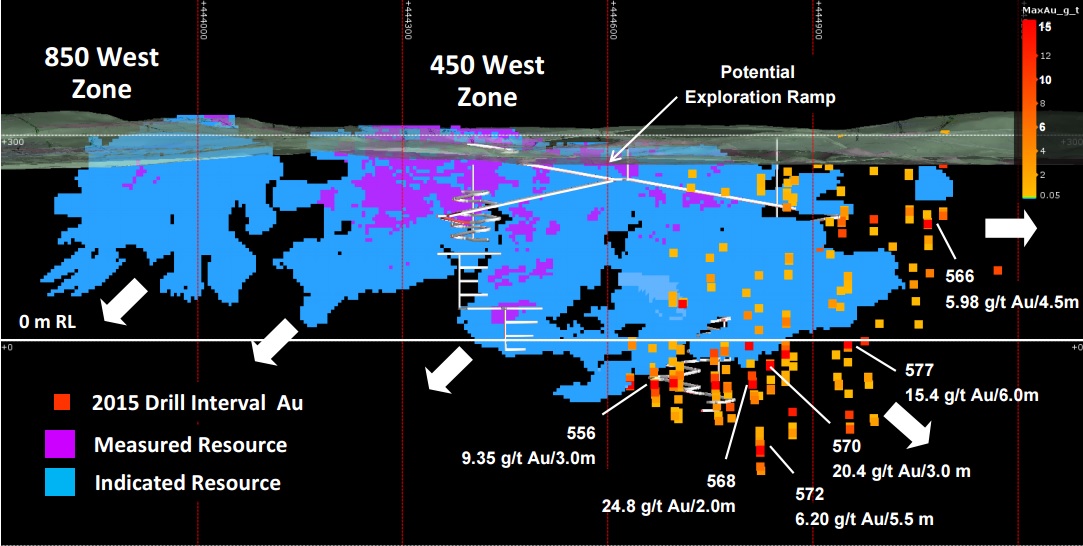

The Clearwater project has been around for a long time (we have discussed some of the company’s drill results in February 2014) and even though Eastmain’s management team made the right decisions by drilling approximately 200,000 meters on the property, it’s really sad to see not a single economic study has been prepared in the past decade. Eastmain’s website only archives press releases back to 2003, but even back then the company was already drilling at Clearwater and we can’t think of any other gold project where a company has been drilling for in excess of 13 years without doing as much as completing a PEA. Granted, this PEA should now be completed in the next quarter, but if you look at the time Eastmain Resources needed to get to this stage, you really can’t dismiss Columbus Gold’s claim there is a ‘lack of progress’ because at the current pace we shouldn’t be expecting a feasibility study before the end of this decade. And that would be disappointing, as we do think the Clearwater project is a very interesting one.

It’s also very interesting to see Eastmain’s press release accusing Columbus Gold of being self-serving. After all, Donald Robertson has been CEO of Eastmain for more than 20 years whilst his own wife has been appointed as exploration manager for the company (according to THIS ARTICLE published on metalsnews.com).

‘Robinson runs Eastmain with his wife and partner, Catherine I. Butella, B.Sc. (Geology-Biology), who has been Exploration Manager of Eastmain since 1996. ‘

That seems to be pretty self-serving to us and it’s not really credible to say another company is ‘self-serving’ when you’re making C$226,800/year as CEO (source: management information circular FY 2014, the MIC for 2015 hasn’t been filed yet) and also have your wife on the payroll in a senior capacity. Of course, if Catherine Butella is doing a good job, it’s perfectly normal to keep her on but in all fairness, it does derail the claim of Columbus being ‘self-serving’.

Columbus Gold (which, by the way, has not read this article before it was published) said in its press release its first priority would be to appoint a new board of directors which would then initiate a process to unlock more value.

Don’t get us wrong, the Clearwater project is a very interesting project but it might be a good idea to stop wasting time and try to unlock the real value of the asset, be it by inviting third parties to propose a strategic transaction or by fast-tracking the property towards a construction decision.

Does Columbus Gold have what it takes to advance an asset at a faster pace? Considering Columbus Gold has acquired full ownership of its flagship project, Paul Isnard in French Guiana just 52 months ago, the progress has been remarkable. The total resource has grown from 1.9 million ounces to almost 5 million ounces with a definitive feasibility due by the end of this year (so within 5 years after acquiring the property) whilst attracting a joint venture partner with deep pockets in the process.

Columbus Gold has engaged Laurel Hill as its proxy solicitation firm so it looks like Columbus is pretty serious about overthrowing Eastmain’s board. This isn’t the first proxy fight on the Canadian mining scene as for instance Taseko Mines (TKO.TO, TGB) is fighting a war against Raging River Capital and Red Eagle Mining (RD.V) was involved in a battle against Batero Gold (BAT.V) to gain control over CB Gold (CBJ.V) which owns the Vetas gold project in Colombia. The current activism of Columbus Gold might be a wake-up call for the Eastmain management to accelerate the development of the Clearwater project, as we at Caesars are convinced this will be a mine one day and we’re really looking forward to see the outcome of the upcoming PEA!

As a reminder, we have a long position in Columbus Gold but no position in Eastmain Resources (and no intention to initiate a long position).

The author holds a long position in Columbus Gold. As of right now, Columbus Gold no longer is a sponsor of the website. Please read the disclaimer