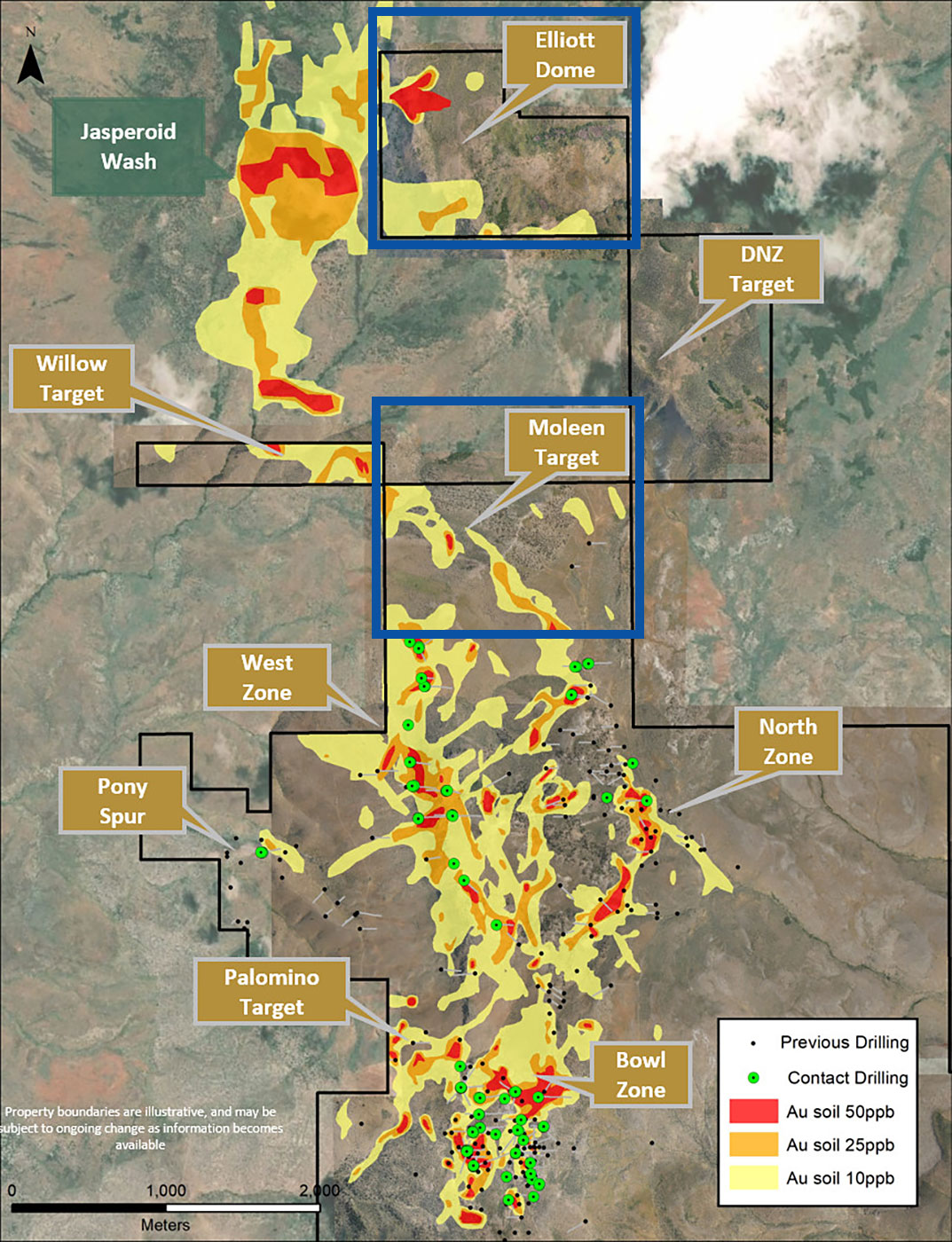

Contact Gold’s (C.V) continuous exploration efforts at its Pony Creek project continue to pay off as the company has now identified an additional three high-priority large gold anomalies. The new systematic approach that’s being deployed by the company has resulted in the discovery of three new strong gold-in-soil anomalies called Palomino, Willow and DNZ. The combination of the gold in soil anomalies, mapped structures and CSAMT anomalies are exactly what Contact Gold is looking for and considering these new anomalies appear to be located in the same structural corridor as the Bowl Zone, the Emigrant mine and Gold Standard Ventures’ (GSV.TO, GSV) deposits, there’s a good reason for Contact Gold wanting to follow up on these targets as soon as possible.

The three new targets

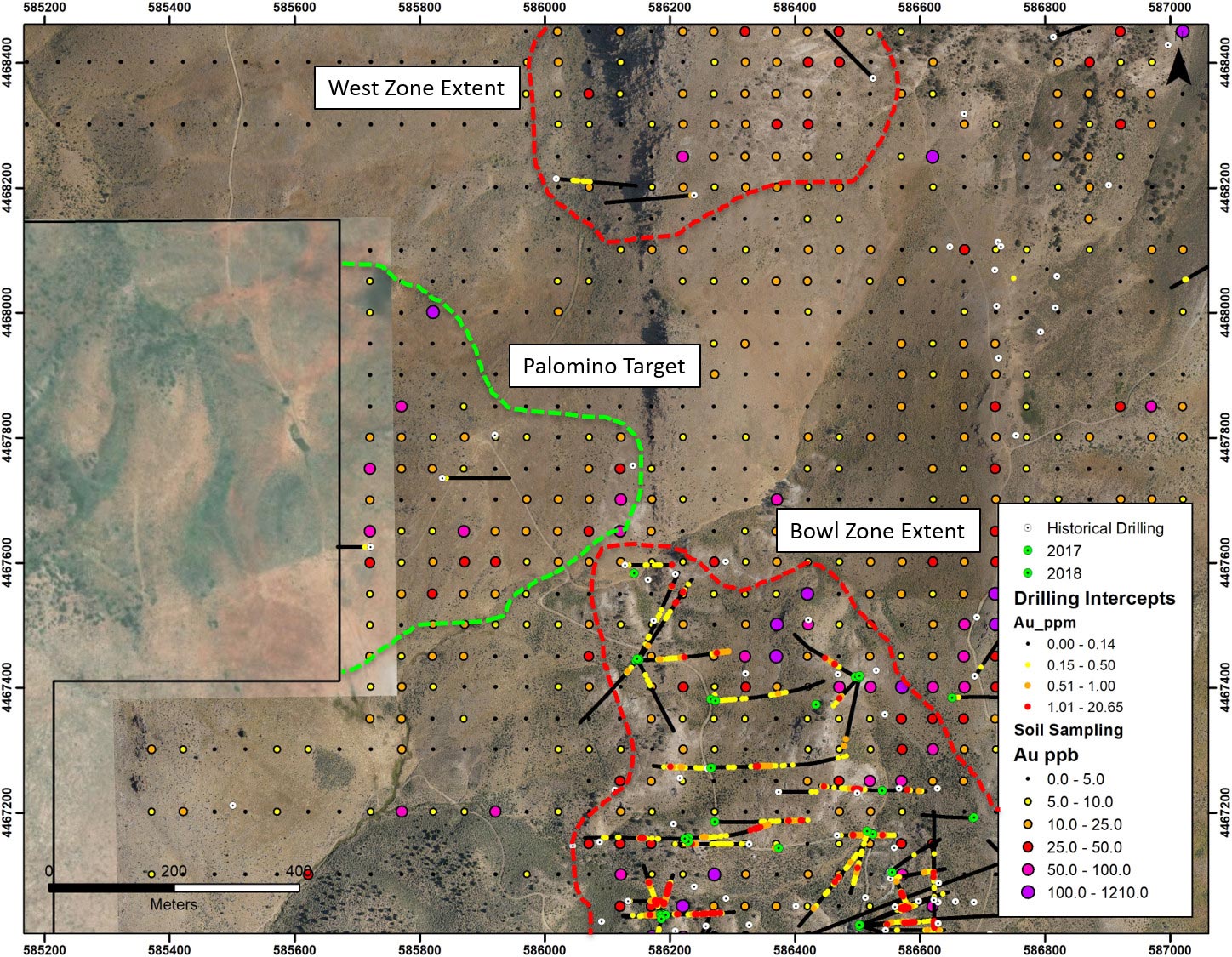

The Palomino Target has a total surface area of 200,000 square meters with gold values of up to 552 ppb (0.55 g/t), which actually is the third highest grade soil sample ever taken at Pony Creek and several samples in the 50 ppb range, which is considered to be highly anomalous. This zone is located northwest of the Bowl Zone, and remains open in all directions as only three historical drill holes have been completed in this zone.

The DNZ zone was discovered through Contact’s CSAMT exploration program. According to the company’s explanation, there were structural breaks in 4 east-west oriented CSAMT lines which identified a new fault. This fault appears to be running from the north to the south, and seems to be lying directly on strike with the North Zone of Pony Creek as well as the Dixie target on Gold Standard’s ground.

The Willow Target appears to be very intriguing as well, as it’s located directly south of and pretty much adjacent to Gold Standard Ventures’ Jasperoid Wash discovery. On top of that, it appears to be the continuation of the Moleen target (with a strike length of 1,500 meters) which still has to be drilled. With gold values of up to 79 ppb and a surface area of 187,500 square meters (18.75 hectares), the existence of two targets (Willow and Moleen) next to a proven discovery (Jasperoid Wash) clearly indicates the potential size. Of the entire district.

Gold Standard Ventures actually had an interesting update on its Jasperoid Wash zone yesterday, as the company now calls it a new ‘large, shallow oxide gold deposit’ after releasing the assay results from an additional 19 Reverse Circulation holes and 2 core holes.

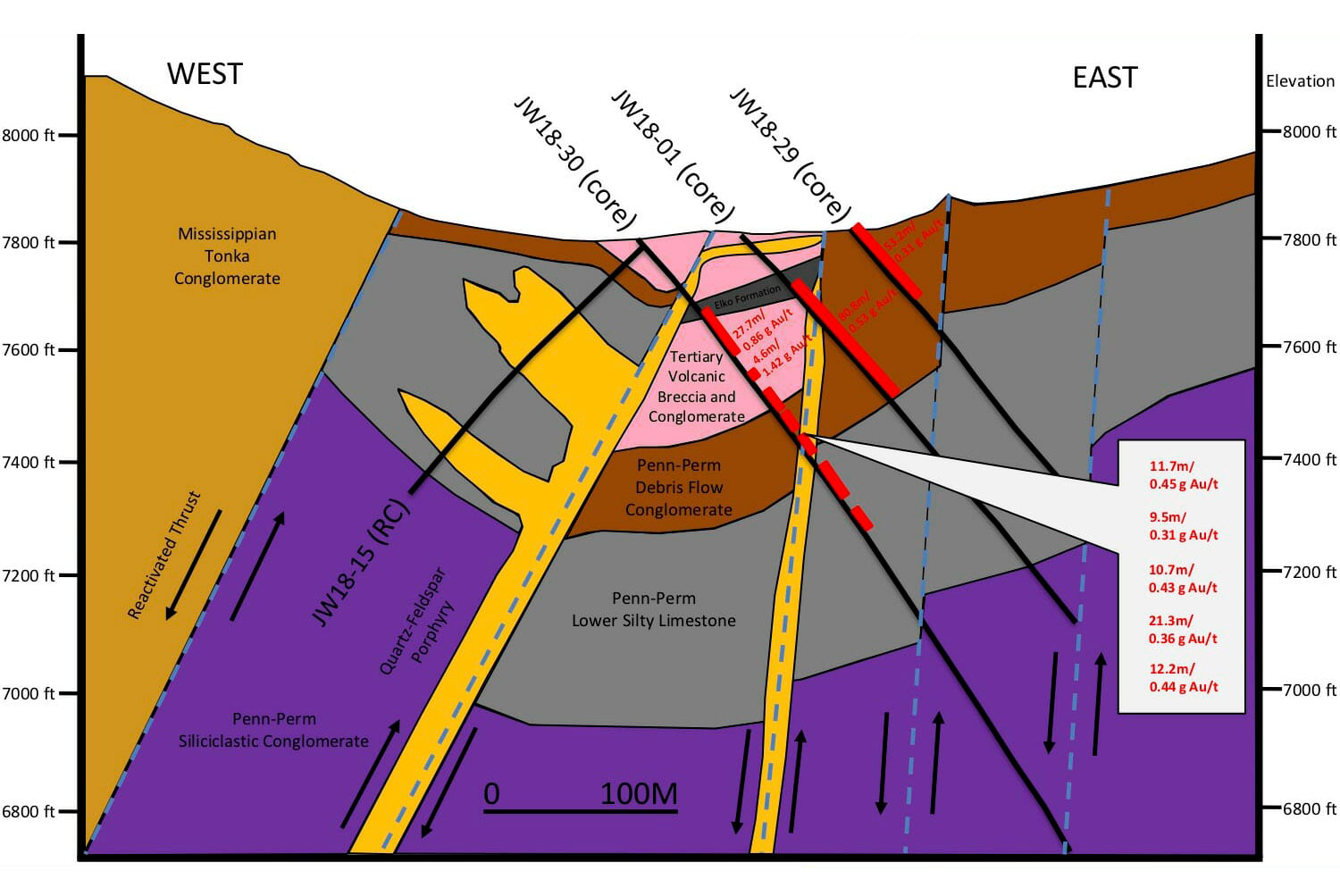

Two of the holes drilled by Gold Standard intersected gold mineralization in the Pennsylvanian-Permian debris flow conglomerate (the brown zone on the next image) with 53.2 meters of 0.31 g/t gold in (core) hole 29, as well as 9.5 meters of 0.31 g/t gold, 10.7 meters at 0.43 g/t gold and 21.3 meters of 0.36 g/t gold in hole 30 (this also was a core hole). Hole 30 also encountered almost 27.7 meters at 0.86 g/t in the Tertiary Volcanic Breccia (the pink zone higher up in the system).

This confirms the Jasperoid Wash zone as an important mineralized zone for Gold Standard Ventures, as it has now expanded the surface area to approximately 1,575 meters by 650 meters (which is approximately one square kilometer).

So what do these drill results mean, and why are they important for Contact Gold?

First of all, the assay results from the additional holes confirm the existence of a widespread gold mineralization at Jasperoid Wash. Not only does this confirm Contact Gold’s findings (as its 2018 drill program also encountered gold in almost all holes), it also ‘upgrades’ Contact’s own drill targets in close proximity to the Jasperoid Wash zone.

Indeed, the larger the mineralized zone at the Jasperoid wash gets, the more important it will be for Contact Gold to drill-test the Elliott Dome and Moleen targets as these could (and perhaps should) be seen as the extensions to the Jasperoid Wash zones.

Secondly, the intercepts from Gold Standard Ventures at Jasperoid Wash are very similar to what Contact Gold has been pulling out of the ground at the West Target and from the GSV cross section it also appears Contact’s Elliott Dome and Willow target areas.

And that’s why Contact Gold wants to drill all five high-priority targets (Palomino, DNZ, Willow, Moleen and Elliott Dome) in the upcoming spring drill program.

The capital raise

Contact Gold has already announced its intention to raise C$2M in a financing that could best be described as ‘creative’.

Rather than attaching a warrant which could create an overhang, Contact Gold ‘rewards’ participants with an additional ‘Convertible Right’ to receive additional shares providing a discount based on the share price the next, larger, capital raise will be executed at. Contact is planning to complete the current private placement to raise enough money to avoid any delays in its Spring exploration programs. Those five high-priority discoveries will have to be drilled, and Contact doesn’t want to postpone the start of the drill program due to the delayed paperwork.

The current placement has been priced at C$0.29, and provides a very interesting ‘discount clause’ based on the price of an anticipated prospectus offering through the use of ‘Convertible Rights’. In the event the prospectus offering happens at a lower price than the current C$0.29 placement, the current participants will be awarded ‘bonus’ shares equal to the equivalent of applying a discount of 10% to the prospectus price, but without breaking the rules of the TSX Venture regarding the maximum 25% discount for a private placement.

Confusing? Sure. But a few examples will help.

The current placement is conducted at a price of C$0.29. Assuming someone participates for 100,000 shares, that person will pay C$29,000 and will receive 100,000 shares and a bunch of rights that could be converted into ‘bonus’ stock.

A first example

If the prospectus offering would be priced at C$0.28, the additional 10% discount would result in an effective discount of C$0.028 and an effective participation price of C$0.28 – C$0.028 = C$0.252.

So for the C$29,000 paid in the current offering, the investor will receive C$29,000 divided by C$0.252 = 115,079 shares, of which 100,000 will have been issued in the current round, while the additional 15,079 shares will be issued as a ‘bonus’ upon the conversion of the rights.

A second example

In the unlikely event the market collapses and Contact Gold would need to price its prospectus offering at C$0.22, the 10% discount would indicate an effective conversion price for the current PP participants of C$0.198. However, as this is lower than the maximum 25% price discount on the C$0.29 (the TSX V rules), the bonus shares will be calculated based on this maximum 25% discount, which would be C$0.2175.

Using the same calculation by dividing C$29,000 by C$0.2175, a total of 133,333 shares will have to be issued, of which 100,000 will be issued at the current placement and the remaining 33,333 shares will be issued upon the conversion of the rights.

A third example

What if the gold market gains momentum and the prospectus offering will be priced at C$0.35? Great news for Contact Gold as it will reduce the dilution, but it’s also good news for the placement participants as they will receive an amount of bonus shares equal to the amount they would have received based on a 5% discount to the current offering price of C$0.29.

A 5% discount would result in an effective price of 0.95 * C$0.29 = C$0.2755. The same C$29,000 divided by this price would be 105,263 shares, so on top of the 100,000 shares to be received upon closing this round, Contact Gold will issue an additional 5,263 bonus shares when the rights will be converted into bonus shares.

It does look like the structure of this deal mainly provides the current participants with ‘downside protection’ due to the additional discount rather than providing a warrant which could subsequently be exercised at a higher share price. We think Contact Gold preferred this structure for two reasons. First of all, it does provide a favor to the current participants and shareholders as pretty much every shareholder has confirmed its pro-rata participation and should the next, larger raise happen at a lower price, they are being compensated for stepping up the plate now and having a 12 month lock-up on the stock (the placement shares will have the mandatory hold of 12 months – typical for US-domiciled companies, which could subsequently be reduced to 6 months upon the filing of a prospectus. So the longer lock-up period is another reason why the current placement needs to be sufficiently attractive to find enough participants).

Just attaching a warrant to the financing would have been more conventional, and perhaps wouldn’t have made a big difference considering the units would have ended up in the same strong hands, but Contact Gold wanted to keep its share structure as clean as possible and as it hasn’t ever attached warrants to a financing (nor at C$0.50 during the last private round, nor at C$1.00 in the RTO), it didn’t want to start doing it now either. We also have the impression Contact would like to complete the prospectus offering without attaching a warrant to the units, but that will obviously be decided by the market circumstances.

Conclusion

Contact Gold definitely isn’t (and wasn’t) running out of exploration targets, as the company now has five new undrilled high-priority targets it will deal with in the Spring, on top of further delineation drilling at the Bowl Zone. As we noted in a previous report, there’s gold all over the place at Pony Creek, but Contact will need to zero in on the viable gold mineralization with a grade that’s high enough for it to be leached profitably at $1300 gold.

Contact is currently raising C$2M in a creative financing deal to make sure it can get the drill rigs out to the targeted areas as soon as feasible, but this raise will very likely be followed up by a larger prospectus offering later this semester.

Disclosure: Contact Gold is a sponsor of the website. The author has a long position in Contact Gold.