In an extensive review on the Caesars website earlier this year, we discussed Duran Ventures (DRV.V), which was in the final stages of constructing a flotation plant in Northern Peru. As the construction phase has now been completed and the commissioning of the plant has started, we discussed Duran’s business plan with CEO Jeffrey Reeder. As Duran will process poly-metallic rock, the current zinc, lead and copper prices are tremendously working in the company’s favor and Duran might very well exceed its own EBITDA guidance of US$1.5M per quarter!

General

Let’s start with probably the most important question. We have seen numerous companies focused on milling operations in Peru in the past few years, but only a few have been relatively successful. What sets you apart from the crowd? Why is Duran Ventures different from the other milling ventures?

There are several factors. What makes us different is our superior in-country knowledge and our geological knowledge of the country. I have been working continuously in Peru since 1994, so I do know my way around.

But besides this, it’s important to note that we are located in Northern Peru where there are very few toll milling plants. We originally wanted to establish a Carbon in Pulp (‘CIP’) plant to treat oxide gold but after intensive review of this business in Peru, we decided the best route for shareholder value was to build a flotation plant to treat polymetallic mineral.

In fact, in our area, Duran owns the majority of the only processing plant that can produce 3 concentrates from the same mineral. Furthermore we have numerous properties in Northern Peru that we will want to supply our mill in the future.

We met before in Toronto, earlier this summer, and you expressed your wish to eventually pay a dividend once everything is up and running. How easy is it to ‘repatriate’ cash from Peru to Canada?

Peru and Canada have a tax treaty and repatriating cash is quite straight forward. I would like to pay a dividend as I am the second largest shareholder of the company and would certainly enjoy to pay myself and our other shareholders a bonus. Of course, we will only do this once our operation is running smoothly.

You own small stakes in Quikflo Health (formerly Viper Gold) and in semi-sister company Rio Silver. What do you intend to do with these positions? Once the cash flow starts rolling in, would you consider increasing your stake in Rio Silver to gain exposure to its exploration properties?

We will have to sell those shares. I don’t believe that junior companies should own shares in other companies, so these positions will be divested in the near future

Earlier this year, you optioned the Panteria project to First Quantum Minerals (FM.TO). We all know First Quantum is only interested in elephant-sized deposits, so they must have identified some really exciting prospects there. Could you shed some light on this project, and what First Quantum expects to find?

First Quantum expects to drill shortly. They have identified several targets and hope to complete the permitting process for drilling soon.

First Quantum is targeting a Cu-Au porphyry system, which are always big targets. They purchased Antares Minerals in late 2010 for their Peruvian project called Haquira. They paid $460M for this project and have not been able to develop this project because of social issues.

What Duran did was that we de-risked our Panteria project before First Quantum got involved. They wanted our social team to be involved as they felt this was a real plus. Note they have to spend monies to complete a feasibility study, as we are carried.

These are large projects that require tens of millions of dollars to explore. At the end, we could own 20% of a very large project. That would be a big win for our shareholders with no risk.

Financial

You recently raised C$965,000 in a private placement at 9 cents. What will the cash be used for?

We needed more upgrades to plant. We also started on the development of the Chucara property we acquired through mineral assignment and another portion of the funds we raised was used as general working capital.

Your balance sheet is showing an equity deficit of C$47.9M as of at the end of June. That’s actually a positive feature for investors that want to get in now, as it will act as a tax shield. How is the C$47.9M sub-divided in Peruvian and Canadian equity losses, and what will the impact be on the taxable income for the next few years?

We have about $6 million in tax losses carried forward. Plus we have over $1 million value added tax which will become recoverable on concentrate sales.

It always takes some time before VAT expenses are being reimbursed by the Peruvian Government. How do you plan to mitigate the impact on your working capital?

This is the difference between the other toll millers. Since we will produce Zn concentrates, Ag-Pb concentrates and Au-Ag-Cu concentrates, we plan on selling them to traders inside Peru and charging a VAT tax of 18% on the concentrate sales. The first $1 million of these VAT taxes collected do not have to be remitted to the Peruvian Government. This will be added to cash flow.

By selling our concentrates to a domestic purchaser, we don’t have to go through the lengthy process of waiting to reclaim the VAT we would have to pay to our own ore suppliers.

Operational

You have an 80% interest in the Aguila Norte processing plant, which has a capacity of 100 tonnes per day. Why did you think it’s more advantageous to own 80% of a plant, instead of obtaining full ownership?

We negotiated with our partner a straight investment for our 80%. NO payments were made. Our partner has lived in Trujillo (30 km’s from the plant) all his life and knows the miners well. I did not want to create competition so we partnered together. Furthermore, he had the best site for a plant, so an 80/20 ratio was a perfect solution to align our interests.

Why is the location of the Aguila Norte plant so important?

Again, we are at the junction of three main access routes in Peru. We located just 11 kilometers from the highway, and are close to second largest city in Peru called Trujillo allows us to recruit the best people.

On top of that, there’s an existing powerline just nine kilometers away, and we will connect the processing plant with this power grid in the near future which will allow us to reduce our operating expenses.

Also very important, there are no communities and we have just received the surface rights to the area from the government.

Let’s talk a minute about a potential expansion. Of course, by increasing the throughput of the mill, you would indeed unlock economies of scale and synergy benefits as the processing cost intensity would decrease. What are your expansion plans? How easy would it be to permit an expansion, and would expanding the tailings facility be simple as well?

The difference in a Carbon in Pulp plant like Dynacor/Inca One and others is that a flotation plant is much cheaper to operate. By expanding, the cost per tonne will be reduced and I expect to expand to 500 tons per day in the future.

On top of the 100 tpd processing plant, you were planning a small CIP circuit to be able to treat oxide ore to recover gold. Why was there a need for a separate circuit?

We are getting great interest from small miners in the area to build a CIP circuit. Many of these miners drive right pass the plant and drive another +1100 kilometers to deliver their mineral to processing plants located in the south. Furthermore, we plan on producing high grade Au concentrates which can be later be processed using our CIP circuit to produce Gold dore.

You will start to commission the plant using third party ore you purchased, but it’s our understanding you’d like to move towards a 100% self-sufficient model whereby you will source all of your ore from projects you own the mineral rights on. A first step in this direction is the acquisition of the mineral rights of the Chucara project which is currently mined by some artisanal miners which are mining ultra high-grade ore. Could you elaborate a bit more on this strategy and the 50/50 profit split with the property owner?

Securing feed for the mill is everything. We are continuously reviewing new opportunities and have acquired new concessions by application.

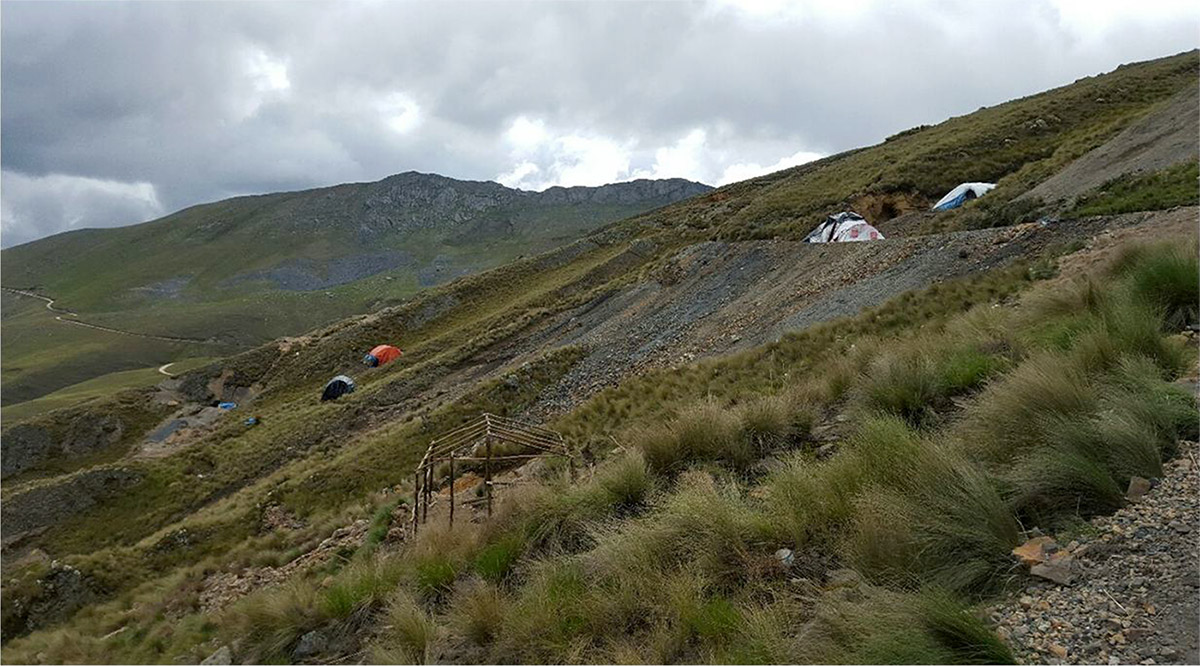

The Chucara Property has polymetallic mineralization with small miners currently mining the property. We acquired this project by assignment which basically means we are renting the property. Profits will be split 50/50 but after we charge a processing fee and expenses. (so we’ll earn 50% of the net revenue after taking our operating expenses into account).

You can easily understand why we like this type of arrangement. We don’t have to purchase the mineral upfront and this minimizes the risk in case of poor recoveries or lesser grades. After will sell the concentrates, we get paid first and then split the profits.

Competitors having only the CIP circuit must pay upfront for the mineral purchases. They need several millions of dollars in working capital to keep the mineral purchases ongoing as a lot of it is tied up in inventory.

You also own some concessions in the Huachocolpa mining district which is widely known for its very high-grade polymetallic deposits. Can you elaborate on this pillar of your business plan and how you plan to mine and process the ore?

We own over 2,900 hectares there. This district is a historical mining area. Duran owns the properties 100% and mapping and sampling programs have identified several high grade precious metal showings with significant base metals. We want to start the permitting process to extract mineral from our properties early 2017. We first can treat the ore in Nasca and eventually build a flotation plant in Southern Peru like Aguila Norte in the north.

Conclusion

Duran Ventures is now commissioning its Aguila Norte plant, which will be the only plant in Northern Peru capable of producing three different concentrates, offering a competitive advantage to process polymetallic mineral. The operating margins could be substantially, as Duran will secure its own ore which would make it fully independent from any third party suppliers.

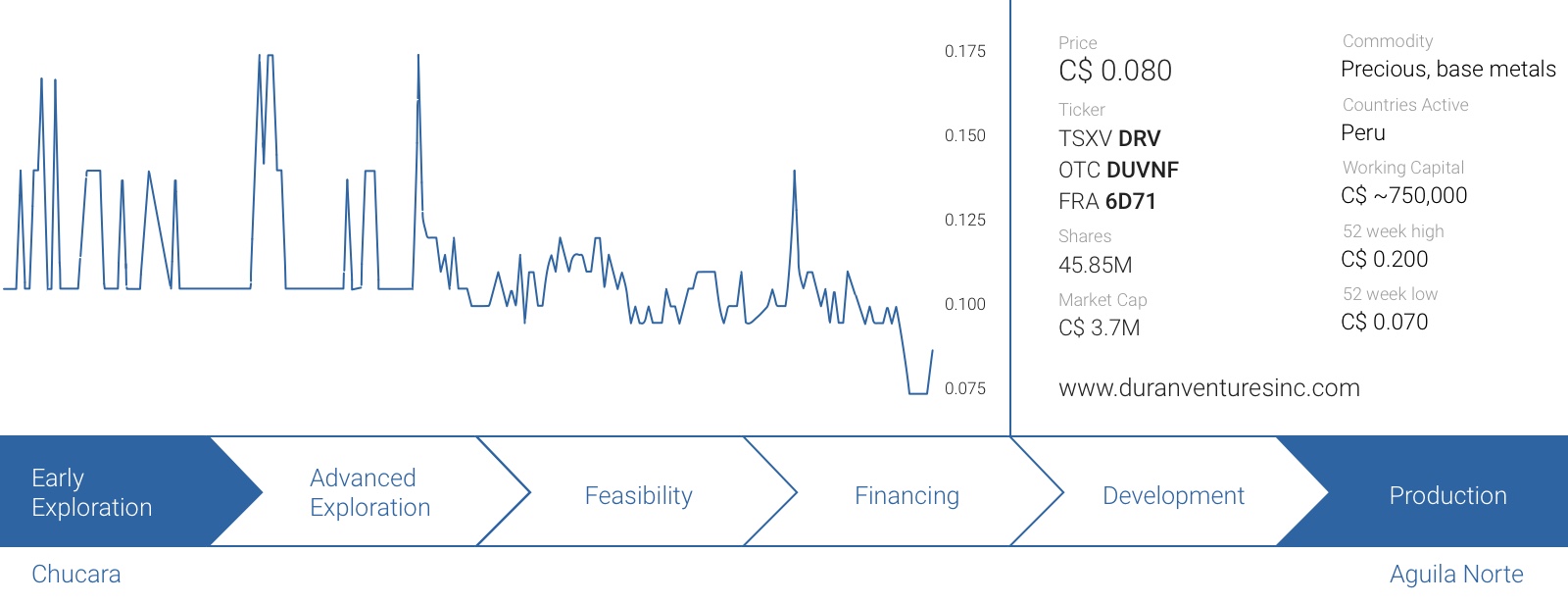

Duran Ventures is debt-free and appears to be fully funded to generate a positive EBITDA in 2017 (the compay is estimating to generate an EBITDA of almost US$6M on an annualized basis), which could put the company on a lot of radar screens. Once everything is up and running, Duran might very well become a dividend-paying company which could attract income-oriented investors. At a current value of C$3.7M, Duran is providing a lot of value for money if it can execute on its plans!

Disclosure: Duran Ventures Inc. is a sponsoring company, we have a long position.