Every once in a while we come across companies where the risk/reward ratio is incredibly appealing, and we feel 88 Energy (88E) is one of those stories. The company is exploring for commercial oil resources on Alaska’s North Slope and the appraisal well (with a production test to determine the flow rate) which will be drilled in the second quarter will be extremely important for the company’s future.

And the potential is huge. The company estimates Icewine contains 5.1 billion recoverable barrels of oil equivalent (4.1 billion barrels are oil – in this report we will leave the unconventional gas resources out of the equation) – and this (internal) mean estimate was completed BEFORE an additional hundreds of thousands of acres were added to the land position. Needless to say the world’s eyes will be on 88 Energy’s appraisal well. We travelled to London and sat down with CEO David Wall and Paul Basinski, the CEO of 88E’s joint venture partner.

88 Energy is an Australian company but as the majority of the company’s shares are in British hands, the company has a dual listing on both the ASX and the AIM-segment of the London Stock Exchange. The London listing is actually more liquid with an average daily volume of in excess of 30 million shares, compared to ‘just’ 4 million share changing hands on a daily basis in Australia.

Introducing you to Project Icewine

The Icewine project was brought to 88 Energy by Paul Basinski’s Burgundy Xploration. Basinski is a very well-respected geoscientist with an absolutely amazing track record in unconventional oil plays and one of the masterminds of the early days at the Eagle Ford oil district. He was instrumental in helping ConocoPhillips (COP) to the Eagle Ford shale, where it picked up more than 300,000 acres of prime real estate.

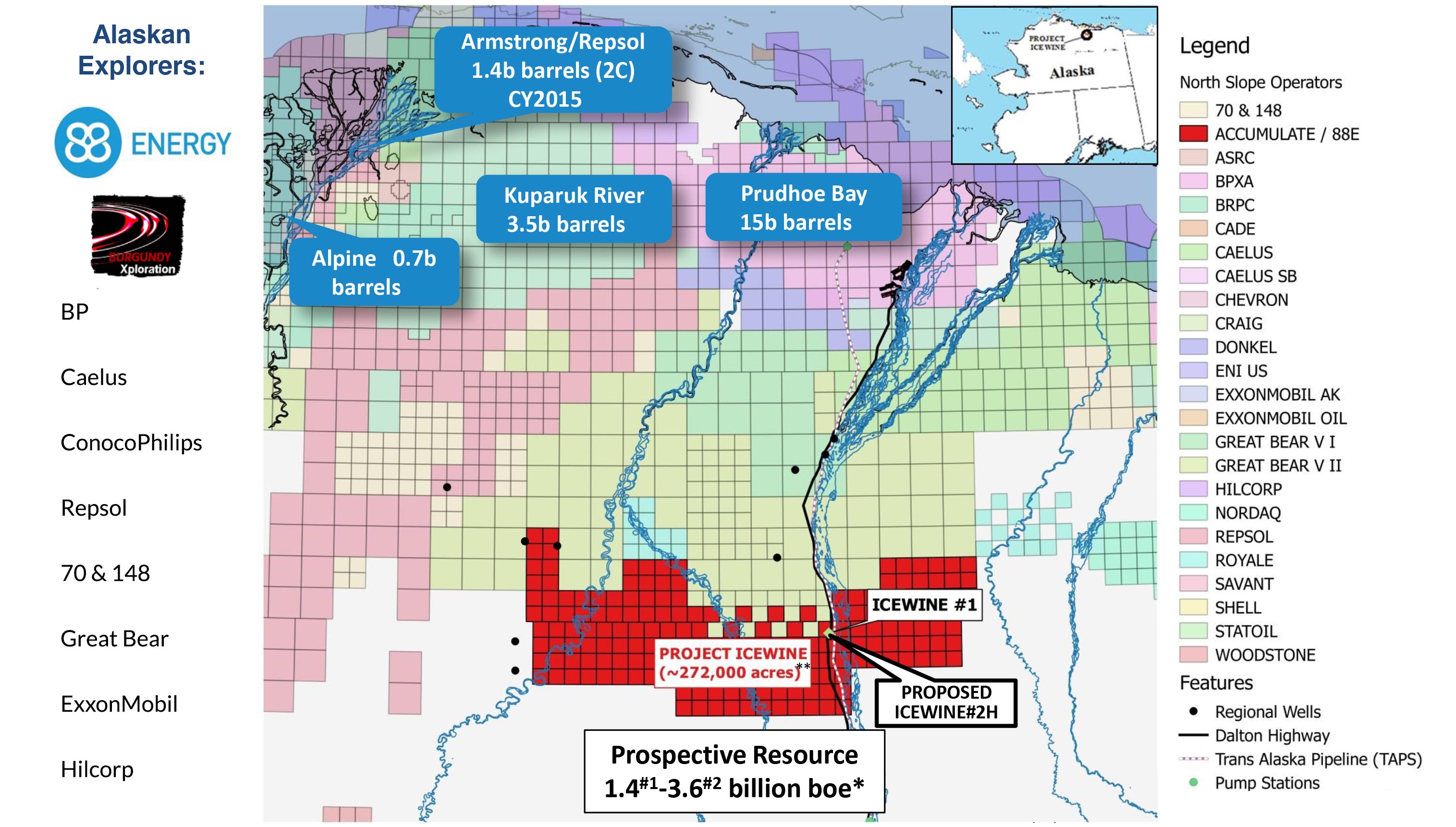

After his huge success in the Eagle Ford district, Basinski’s Burgundy Exploration started to stake ground on Alaska’s North Slope as Basinski’s newest theory was focusing on what seem to be quite unique geological circumstances close to the giant Prudhoe Bay oil field. The above-average porosity and resource concentration are what made the Eagle Ford and Bakken districts work, and Basinski has now applied the same theory to the Alaskan north slope (the HRZ shale) – and this could actually mean the current recoverable resource estimates might actually be too conservative (see later).

This has been confirmed with the test results of Icewine #1, which confirmed the target reservoir had exceptionally high permeability, as well as other favourable characteristics. That’s really important as the permeability (which basically just means how easy the host rock lets liquids like oil pass through the system) is a significant indicator for both the existence of oil reservoirs as well as the expected initial flow rate.

The location of the project probably is as good as it gets. Icewine is located next to the huge land packages owned by major oil producers whilst the Trans-Alaska Pipeline System and the Dalton Highway is running straight through the Icewine property.

The unconventional resource will be the real company maker

“Astounding”.

That’s the word CEO David Wall used last year when 88 Energy announced the exploration results at Icewine #1. Astounded, because the actual exploration results confirmed the originally exploration theory and the expectations based on that model. The Icewine #1 well which was drilled in 2015 confirmed the world class potential of the entire project.

Whilst shale plays usually have a porosity of 4 to 7%, the Icewine 1 well confirmed a porosity of ~13% which is twice as good as one would have expected from a shale play. The well was logged whilst the core from within the HRZ objective was cut for lab analysis, which subsequently confirmed the so-called ‘thermal maturity sweet spot’ at HRZ.

Originally, Icewine was described as an ‘untested, unconventional liquids-rich shale play in the HRZ shale, a prolific source rock’, but now, 2.5 years later after entering into the binding agreement with Burgundy Xploration, Icewine has matured to a full-blown unconventional oil play with a multi-billion barrel potential. That by itself already is a massive achievement, but if 88 Energy would indeed be sitting on one of the most important oil discoveries of the past few years, it would make sense to consolidate the entire land package around Icewine and to lock up the prospective land.

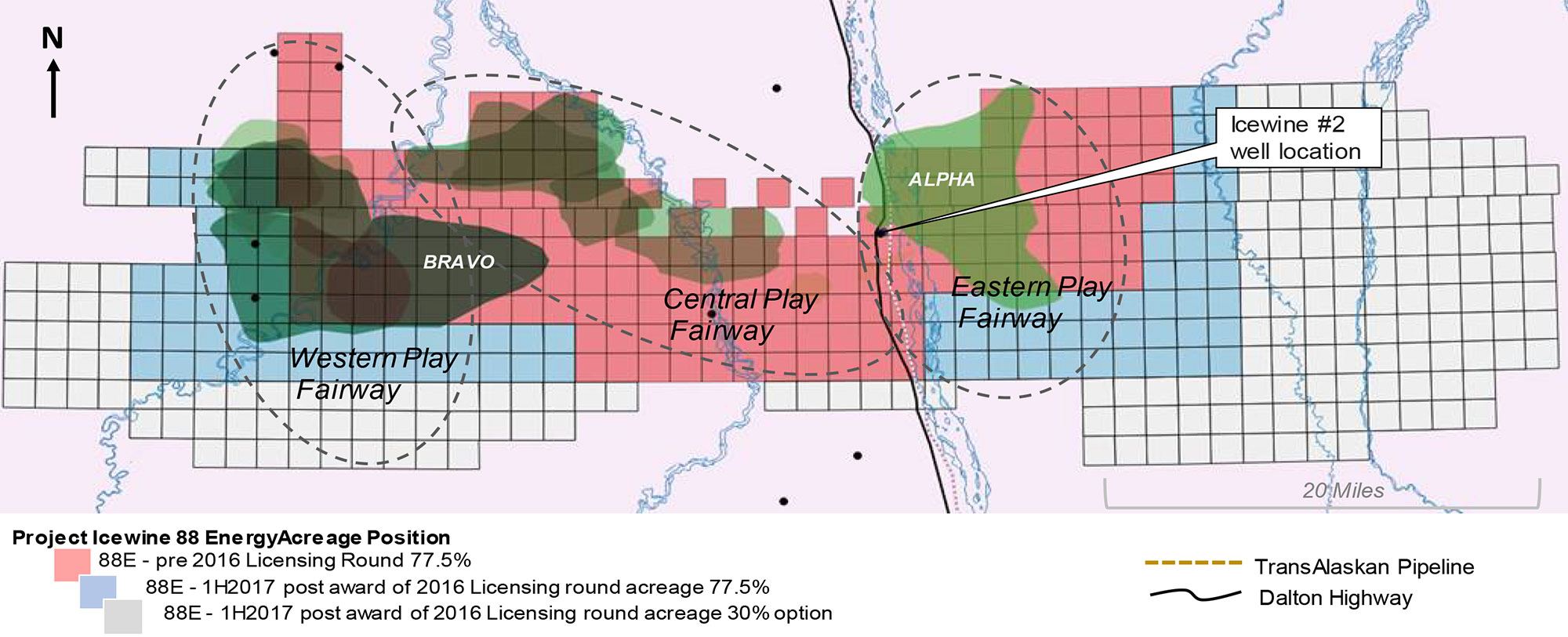

At the end of 2016, and anticipating the Icewine #2 well, 88 Energy and its partner have picked up an additional 410,000 acres. Accumulate Energy, 88 Energy’s 77.5% owned subsidiary was the highest bidder for 143,000 acres, whilst Burgundy Xploration, 88E’s joint venture partner in Alaska was declared the highest bidder on an additional 280,000 acres. Accumulate retains a back in right for 30% of these 280,000 acres at cost.

Originally, the external consultants were counting on a recovery of just 13% of the oil in place and only 42% of the acreage being prospective, but the results from Icewine#1 were almost exactly as predicted meaning that the mapping of the sweetspot is likely to be accurate. That’s the main reason why 88 Energy’s internal recoverable oil resource of 2.6 billion barrels (3.6 billion barrels oil-equivalent, which contain 2.6 barrels oil) is much higher than the 1.4 billion barrels estimated by its consultants whilst a second reason is using a higher recovery factor of ~17%, which is more in line with what we see from recent results from the better shale plays in Texas. Also keep in mind the 2.6 billion barrel scenario was based on the land position BEFORE adding the additional acreage in 2016, so we wouldn’t be surprised to see further increases, if the Icewine#2 well is successful

Let’s not forget about the conventional resources

Yes, all eyes will be on Icewine #2 which will test the flow potential of the unconventional part of 88 Energy’s resource base. But the company isn’t a one-trick pony as the Icewine land package also contains a substantial conventional resource.

According to the most recent estimate, the total conventional resources contain a recoverable resource of 1.47 billion barrels of oil (of which 1.14 billion barrels are attributable to 88 Energy).

Even though all eyes will be on the unconventional play, 88 Energy has another ace up its sleeve with this conventional resource. The recently acquired 2D Seismic data have confirmed the potential of the conventional oil, and the recoverable resource of 1.47 billion barrels is based on the gross mean resource.

However, if we would just look at the low estimate (which is obviously more conservative), you’d still end up with almost 700 million barrels of recoverable oil (540M barrels net to 88 Energy). So even though the conventional play has been put on the back burner as the company is fully focusing on the unconventional resource, rest assured there’s more value at Icewine. The Bravo and Alpha zones are very intriguing, and as CEO Wall previously indicated, the conventional play is the icing on the Alaskan cake.

Not far to the north of 88E, other companies have been successfully exploring the same conventional play and have discovered a stunning 4 billion barrels of oil in only the last three years. The source rock and reservoir of these discoveries is the same as on 88E’s acreage and the trend continues southwards…

The company is cashed up for Icewine #2 – and this well will determine the company’s future

During the second half of 2016, 88 Energy fine-tuned the well design for Icewine #2 which will now be a vertical well with a multi perf cluster stimulation, rather than a lateral well. This new design is aimed to get a better impression of the results of the primary objective of the well – determining the viability and production potential of the HRZ shale.

As of at the end of December, 88 Energy had approximately A$27.3M in cash which is definitely sufficient to cover the company’s contribution of A$20M for the Icewine #2 well. However, 88 Energy also raised an additional A$17M by issuing 460M new shares at A$0.037 per share, pushing the pro-forma cash position to approximately A$40M right now. This means that the Company is covered for worst case scenarios and, if all goes to plan, will have enough money to test a conventional objective possibly early next year.

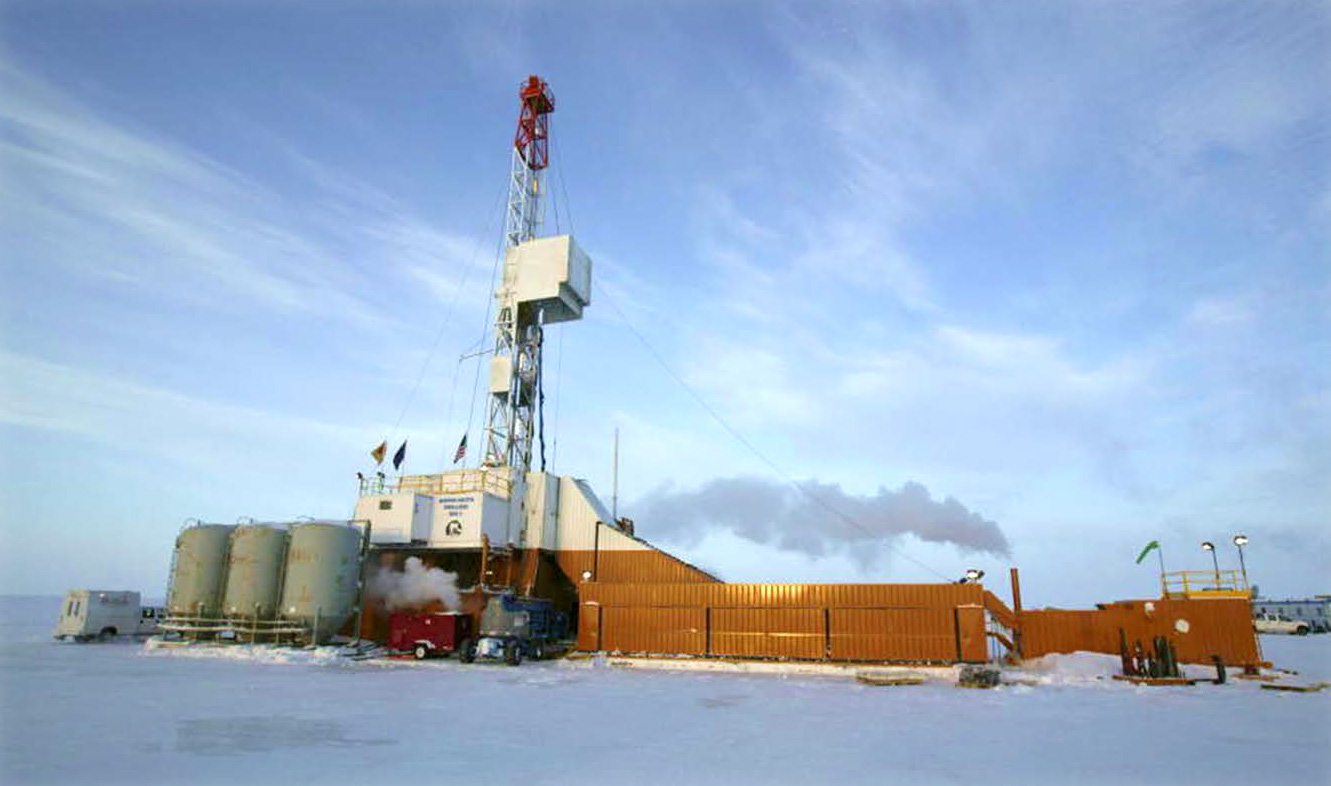

88 Energy has contracted the Arctic Fox drill rig which will immediately start drilling the Icewine #2 well when it finishes its current job in Alaska. The company anticipates to spud the well in April, and CEO Wall has emphasized the importance to use a ‘hot’ drill rig several times during an investor presentation in London. It’s usually a better idea to use a ‘hot’ drill rig rather than re-commission a rig which has been cold-stacked. The crew working the rig will be coming right off another job and this usually increases the efficiency and reduces the risk of the drill rig encountering mechanical and technical issues.

The well will be spud in April, and we would expect to see the results in June/July. A flow rate of 100-150 barrels per day would be a major success and confirm the economic potential at Icewine.

Management

Michael Evans – Non-Executive Chairman

Mr Evans was the founding Executive Chairman of ASX oil and gas explorer FAR Limited, a position he held from 1995 until his resignation in April 2012. Under Mr Evans’ stewardship, FAR established and built up an extensive international oil and gas portfolio spanning Africa, North America, China and Australia with industry partners including Amoco, Shell, BHP, BP, Exxon, CNOOC, Woodside and Santos, amongst others. He has in excess of 30 years experience in the natural resource sector.

David Wall – Managing Director

As a leading oil and gas equity analyst for the past six and a half years, Mr Wall brings extensive experience with junior oil and gas exploration companies. His skillset spans asset evaluation across many fiscal regimes / play types as well as corporate advisory / M&A and equity capital markets, having led >$300m in capital raisings.

Brent Villemarette – Non-Executive Director

Mr Brent Villemarette is a petroleum engineer with more than 30 years experience in the oil and gas industry, both domestic and international.

Dr. Stephen Staley – Non-Executive Director

Dr. Stephen Staley ( Non-Executive Director, appointed 9 April 2014). Dr Staley has 30 years’ of management and technical experience in the European, African and Asian oil, gas and power sectors, including with Conoco and BP.

Conclusion

88 Energy’s first well at Icewine confirmed exactly what the theoretical model of joint venture partner Burgundy Exploration had predicted. We had the chance to meet with Paul Basinski, Burgundy’s CEO, and we were impressed with his approach to prove up the discovery of a commercial oil deposit on Alaska’s north slope. Should the Icewine #2 well confirm a flow rate of in excess of 100-150 barrels of oil per day, there’s absolutely no reason why the share price couldn’t double or triple overnight, as suddenly 88 Energy might very well be sitting on in excess of 5 billion barrels of oil. And this would undoubtedly attract the attention from other major oil companies, which are already present on Alaska’s North Slope.

We wouldn’t call it an ‘everything or nothing’ exploration program because even if 88 Energy’s vertical well would miss the expectations, it wouldn’t mean the project is ‘dead’. First of all, if 88E would know what went wrong and how the flow rates could be improved, the unconventional play could still be improved – although the company might be required to drill a third well to show a final proof of concept. But even if the unconventional route wouldn’t pay off, 88 Energy still has access to in excess of a billion barrels of recoverable oil in the conventional play to fall back on.

88 Energy could be seen as a ‘binary option (either the unconventional play works or doesn’t work) with a plan B (the conventional oil resources)’. But should the Icewine #2 well meet the expectations, all bets are off, and we would expect major oil producers to come knock at 88 Energy’s door to have a look at the data.

Disclosure: the author has a long position in 88 Energy. 88 Energy is not a sponsor of the website, but we expect to be compensated by a third party for this report.

Dave Wall’s background would be helpful

88e was never ever @ 76c!

Thank you! We made the necessary corrections.