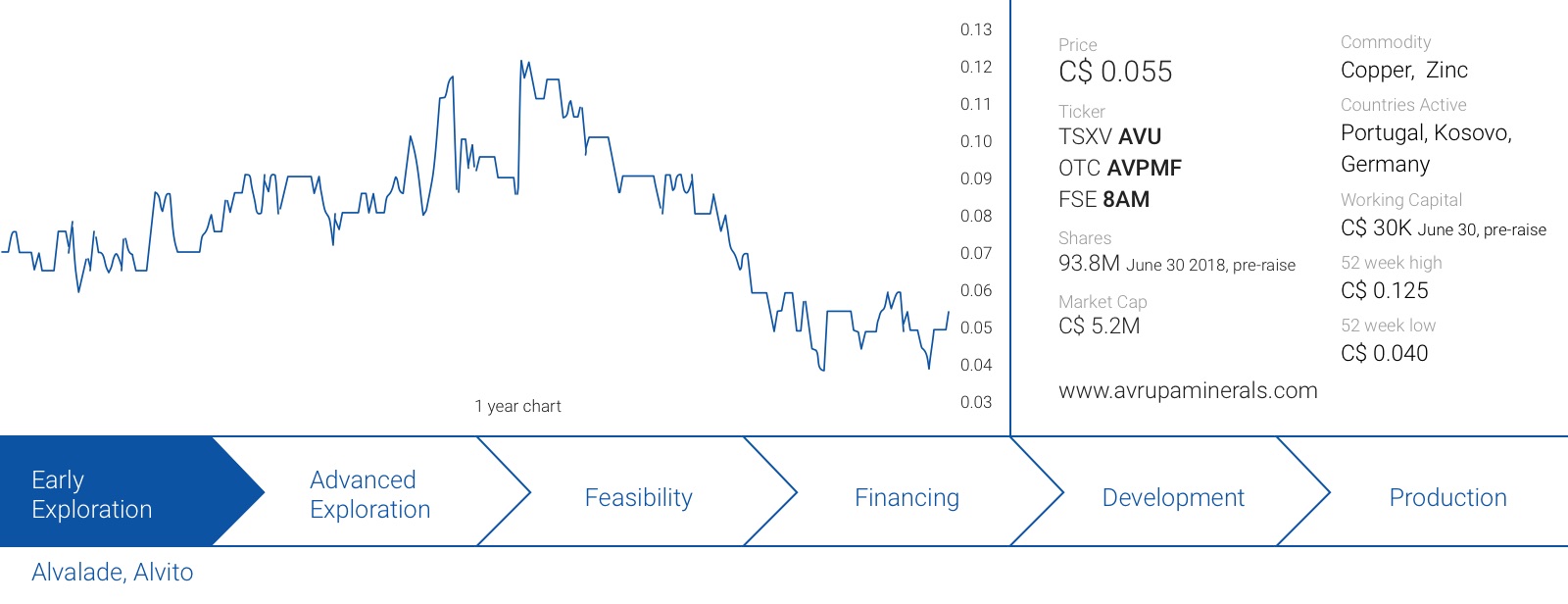

We do like European stories and whilst it’s not always easy to find good companies with good European projects, the project generator model does make sense. We first met the CEO of Avrupa Minerals (AVU.V) Paul Kuhn on a site visit in Portugal years ago, when we were keeping an eye on the developments of Blackheath Resources (BHR.V) which was trying to advance its tungsten assets in the country.

We recently had a chance to catch up with Paul Kuhn on the phone, and met with Mark Brown during our most recent trip to Vancouver. Both seem to be very excited about the potential of the Alvalade project and as the new joint venture partner still needs to execute the joint venture agreement, Avrupa decided to just drill the project themselves. Positive drill results could help to attract a new partner, while the company keeps the project in good standing by doing some more work.

Avrupa has now slightly tweaked its operating model by having one flagship project – Alvalade – that it will drill itself, while working to find partners to fund exploration at other projects. They did this to get more work on the main project going faster and after several delays caused by third parties.

The prospect generator model in Europe

For those unfamiliar with the prospect/project generator model: Avrupa’s business model is to add projects to the portfolio and to generate exploration and drill targets on them, while looking for a joint venture partner to do the heavy lifting.

This makes it a very cost-effective way of exploring multiple projects without incurring the associated expenses as the partners usually cover the exploration expenses in return for a majority stake in the properties they are working on. The relatively low requirement to spend its own funds on exploration is clearly visible in Avrupa’s financial statements as the vast majority of the expenses are being reimbursed by the optionees.

In the first six months of the year, the total amount of expenses incurred on Avrupa’s properties was approximately C$1.08M, and C$873,000 was reimbursed by the joint venture partners. This is approximately 81%, which means Avrupa has been funding just 19% of all the property-related expenses. We are still waiting for the Q3 financial results, but we would expect to see a similar ratio of partner-funded and optionee-funded work. Keep in mind the majority of these expenses were very likely incurred on Alvito, and this ratio might change change next year depending on Avrupa’s ability to bring on a new joint venture partner on its Portuguese projects.

The joint venture deal on the Slivovo gold project in Kosovo provides an interesting case study of the modus operandi of Avrupa as a prospect generator. Avrupa detected a promising gold target in the country and allowed an Australian company, Byrnecut, to earn an initial stake of 75% after spending a few million dollars on advancing the project. Byrnecut then increased its stake to 85% after delivering an economic study on the project, and as soon as it reaches a 90% stake, Avrupa’s position will be reduced to a 2% Net Smelter Royalty. Considering the current (non-NI43 compliant) resource estimate contains approximately 130,000 ounces of gold and 350,000 ounces of silver, the theoretical gross value of a 2% NSR could be significant for Avrupa. Assuming a production rate of 20,000 ounces of gold per year, the 400 ounces (representing the 2% NSR) would allow Avrupa to add in excess of C$600,000 per year in cash to its bank account.

A deeper dive into Avrupa’s two main projects: Alvalade and Alvito

Avrupa’s portfolio obviously consists of several projects as it essentially generates exploration targets that are subsequently available for a joint venture deal, but in this initial report we will focus on the company’s two main projects in Portugal: Alvalade and Alvito. While Alvalade is interpreted as a very large copper exploration target, Alvito appears to be a typical IOCG (Iron Oxide-Copper-Gold target). Although both properties are very close to each other, they should be seen as two different projects as the mineralized systems of both zones are completely different.

Alvalade

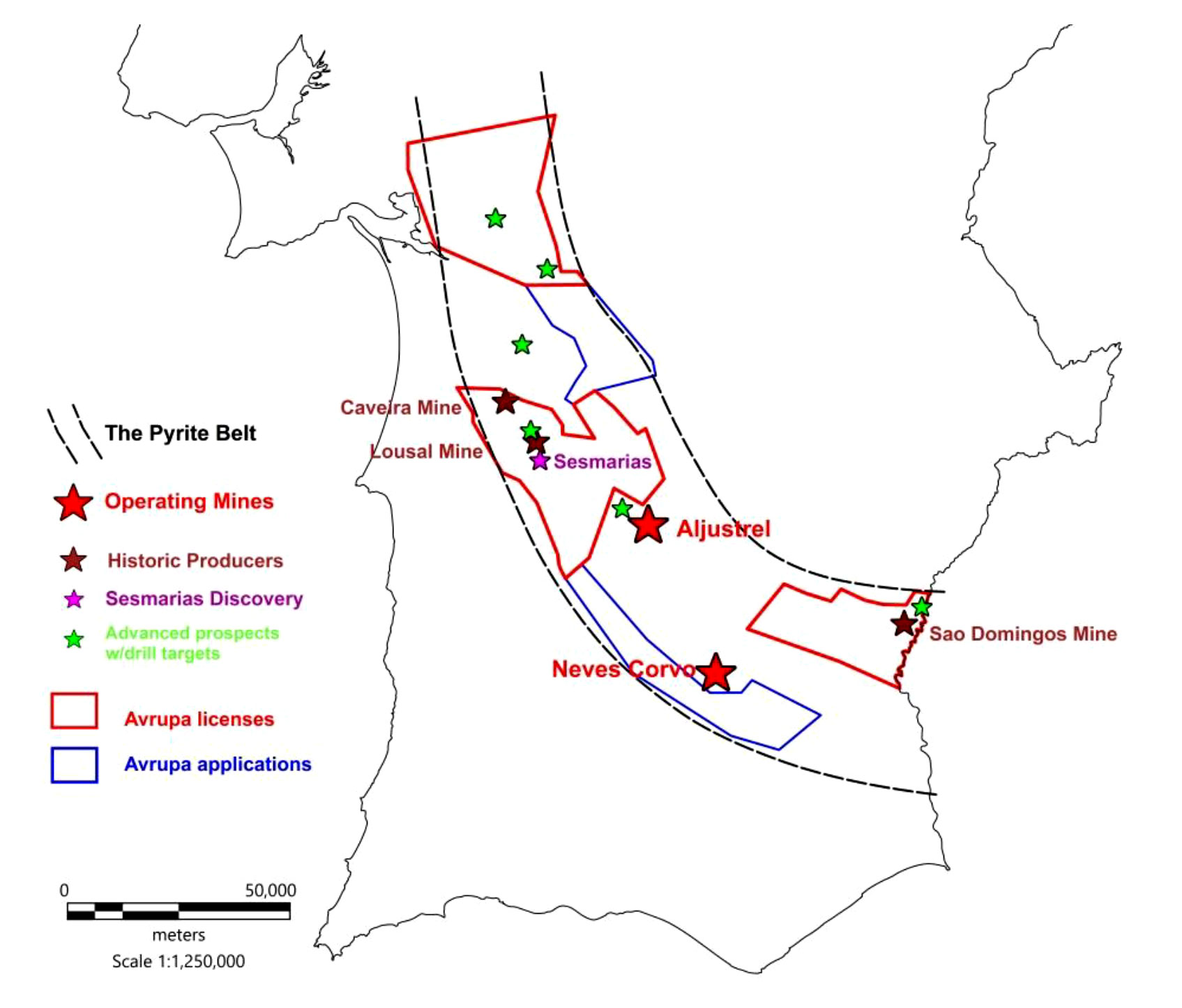

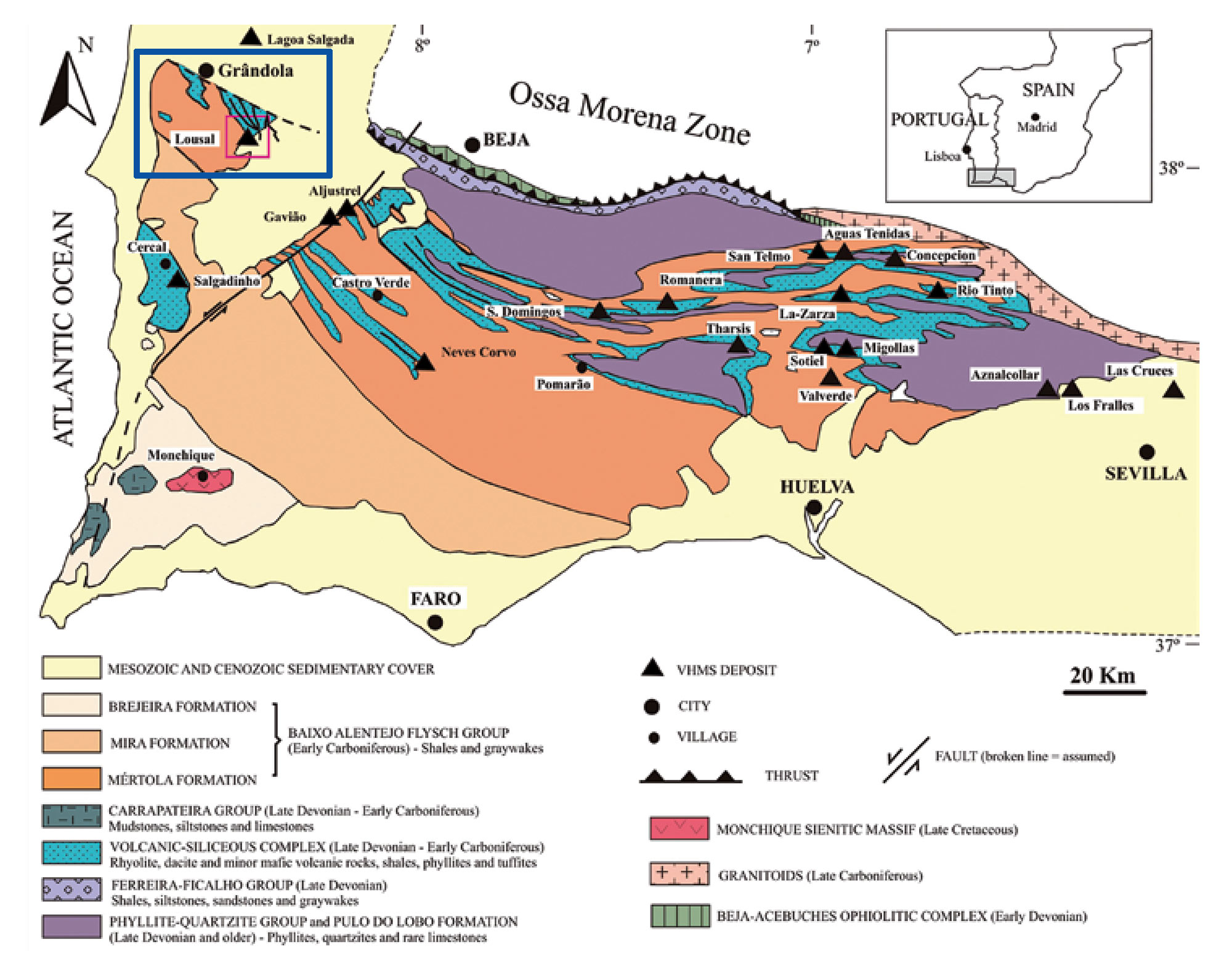

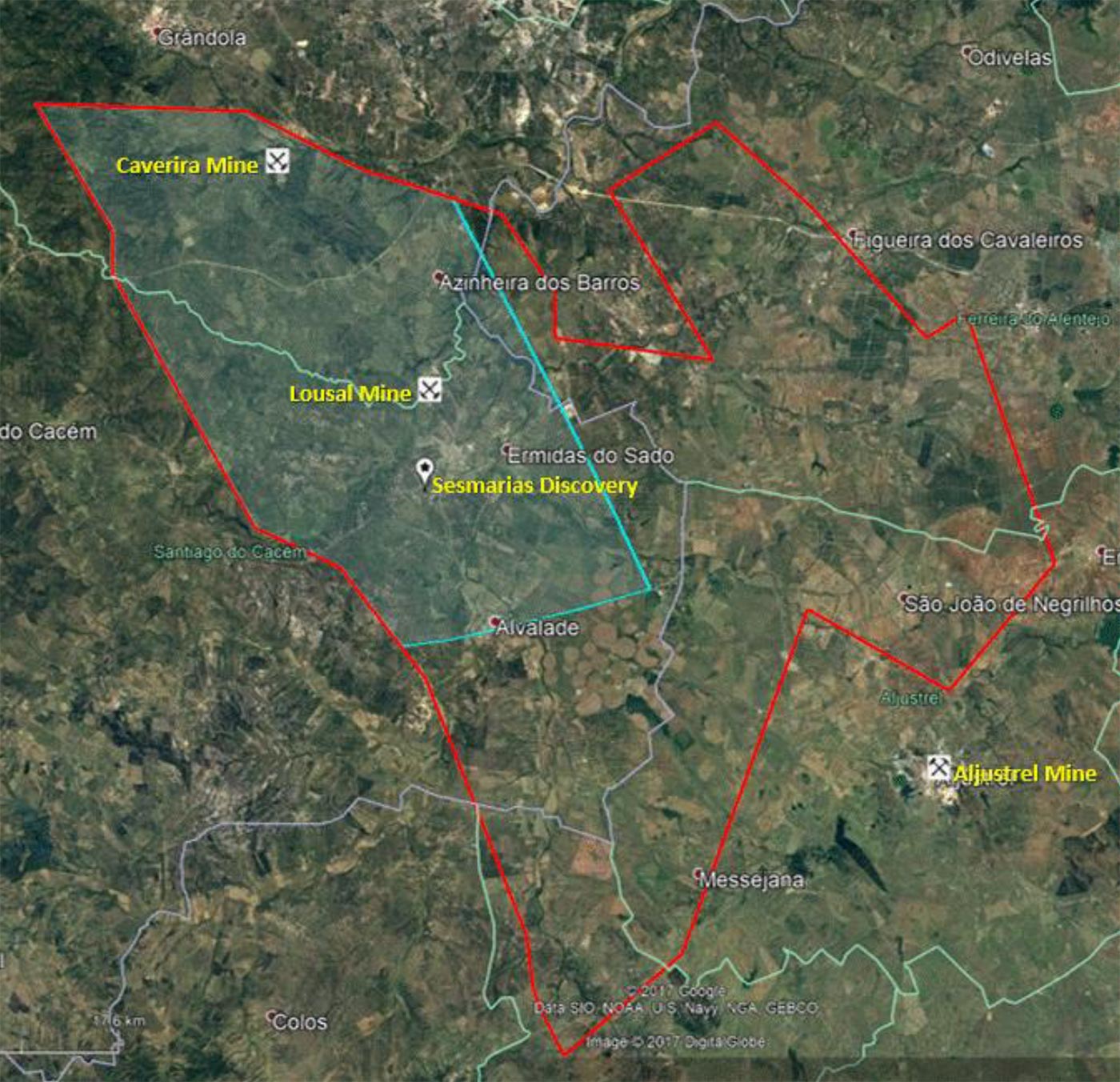

The Alvalade project could easily be seen as Avrupa’s flagship project, and is located on the western side of the Iberian Pyrite belt (which has been explored and mined 3,000 years before the Romans occupied the Iberian Peninsula). Alvalade has been the subject of two previous joint venture agreements, and the previous partners have spent approximately C$10M on exploring the tenements (of which the bulk, US$6.5M was spent by Antofagasta (ANTO.L). The two previous partners successfully identified several ‘pods’ of massive sulphide mineralization over a strike length of almost 2 kilometers at Sesmarias. Some of the assay results showed high-grade polymetallic mineralization with 10.85 meters of 1.81% copper, 6.95% ZnPb as well as 75 g/t silver.

Sesmarias is located just seven kilometers from the Lousal mine also on the Alvalade claims. Lousal was owned and operated for about 90 years by SAPEC, a Belgian family-owned company which delisted last year after a family-led buyout, and the mine has now been converted into a tourist attraction. The Lousal mine contained approximately 50 million tonnes of rock (and just 20 million tonnes have been mined) with an average grade of 1.4% zinc, 0.8% lead and 0.7% copper for a total of 1.5 billion pounds of zinc, 860 million pounds of lead and approximately 750 million pounds of copper. It’s also interesting to note the pyrite of the mine was used as a source for the sulfur for the production of fertilizer (which was SAPEC’s main business), and perhaps this could provide Avrupa with an attractive revenue stream in the future as well.

But, let’s focus on the base commodities. The Sesmarias target on the Avrupa land package shows similarities to the Lousal mine as the latter also consisted of several mineralized pods. We aren’t saying the Alvalade project mirrors the Lousal mine, but the basic signatures of a multiple-lens/pod mineralized system have already been established.

And although two previous joint venture partners dropped the project, a third large conglomerate stepped up the plate and signed a non-binding LOI with Avrupa Minerals to spend a total of 13 million Euro (C$19.5M at the current exchange rate) on the Alvalade, Marateca and Mertola zones. The bulk of the money (10M EUR) would be spent on the Alvalade zone where the North American group was planning to drill up to 30,000 meters as part of the initial plan to earn a 51% stake in Alvalade. An additional 24% could be earned upon the completion of a feasibility study.

This joint venture agreement was announced in March but still hasn’t been executed yet. Although the exclusivity period has now expired, our recent conversations with Avrupa indicate it is still actively pursuing the final execution of this joint venture deal.

But the clock is ticking, and Avrupa will spend a few hundred thousand euros on drilling the projects themselves (see later).

The downside at Alvalade appears to be limited. As only 40% of the 50 million tonne Lousal mine has effectively been extracted, Avrupa estimates there’s approximately 30 million tonnes still in the ground. While mining 2.2% ZnPb and 0.7% copper wouldn’t have been very profitable in the ‘80s and ‘90s, the current gross rock value (before applying a recovery rate and smelter payability percentage) would be approximately $100/t (using $1.20 zinc, $1.00 lead and $2.75 copper). Note that the tonnage nor the grades have been estimated according to NI43-101 standards, so the numbers we quoted should just be seen as ‘potential’ and not as a ‘hard fact’.

In a worst-case scenario, Avrupa Minerals could always fall back on the existing 30 million tonnes at Lousal, perhaps complemented by the mineralized pods at Sesmarias.

Alvito

Avrupa recently took full control and ownership of the Alvito IOCG project again, after joint venture partner OZ Minerals (OZL.AX) decided to drop the option to earn a majority stake in the property. That’s interesting, as OZ spent approximately 1.5 million (Canadian) dollars on exploration programs and a drill program.

Granted, the drill program didn’t encounter high-grade copper results but with 86.3 meters of 0.16% copper, almost 45 meters grading 0.21% copper and 2.55 meters containing 0.91% copper, there was no good reason to be very disappointed with the maiden drill program. It’s our understanding OZ Minerals decided to not further pursue the option agreement because the mineralized system lacks the size it had been looking for.

Apart from the size, Avrupa’s exploration update from the Entre Matinhas zone confirms the mineralization and alteration patterns “fit into the general characteristics and parameters for IOCG deposits”. As the first drill program consisted of just over 2,400 meters on a limited area of the 300 square kilometer project, Avrupa remains optimistic about the potential of the property. Future exploration activities will focus on a 20 square kilometer high-priority target.

So after completing roughly C$1.5M on exploration expenditures, OZ returned the project to Avrupa Minerals for no additional consideration (although it technically satisfied the requirements to earn a 51% stake in the property, it just returned it to Avrupa). The information from the drill program will now help Avrupa to re-market the property while it doesn’t need to incur any exploration expenses to keep it in good standing until the end of 2019.

This means there are no immediate plans to drill Alvito, and Avrupa’s main focus will be the Alvalade project where the potential appears to be much larger, while there also is some ‘urgency’ to spend a few hundred thousand dollars on exploration to satisfy the requirements of the Portuguese government.

Drilling at Alvito IOCG Project. Completed 18 holes, totalling 2,437 meters at 8 separate targets.

The current financing

As Avrupa didn’t want to waste any time on the Alvalade project, the company is currently raising C$1.5M to cash up in anticipation of a drill program (which will start any day, so even before the financing closes).

Unfortunately Avrupa’s share price is quite low, and financing at these levels comes at a high cost. To raise the C$1.5M, Avrupa will be issuing 30 million units at C$0.05 with each unit consisting of one common share of Avrupa as well as a full warrant. Each warrant will allow the warrant holder to acquire an additional share at C$0.10 for a period of three years after closing, but there’s an acceleration provision whereby Avrupa is allowed to ‘trigger’ the warrant should the share price close above C$0.20 during 20 consecutive days. A first tranche of the financing has already closed, and we expect the next tranche to close soon.

Drilling Alvalade

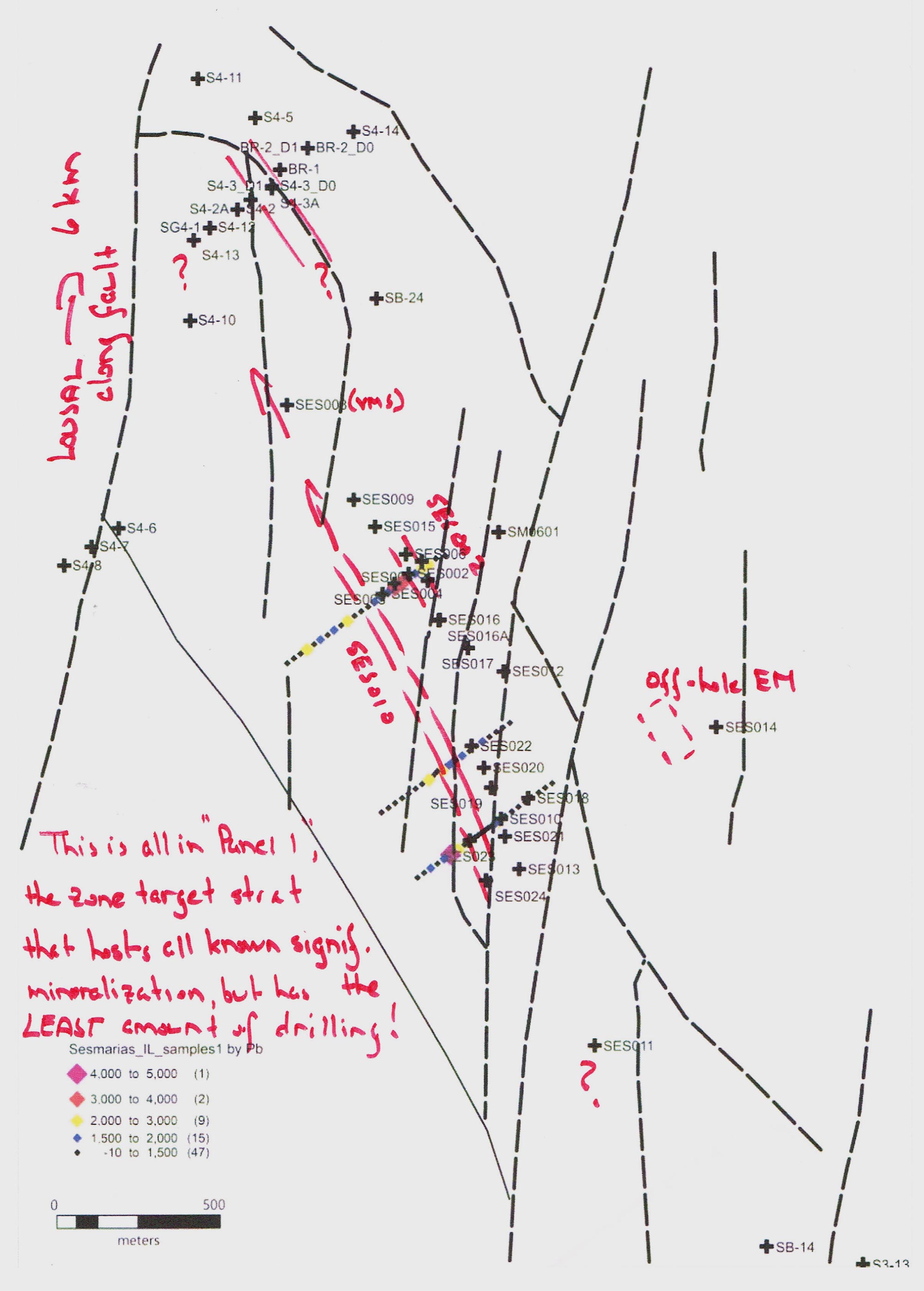

Avrupa is already mobilizing a drill crew to get the drill program at Alvalade started as soon as possible. The focus will be on the Sesmarias zone, where Avrupa will start drilling at the SES010 lens where it’s targeting a 375 meter long ‘pod’ that works out to be approximately 7.5 million tonnes with an average grade that’s quite typical for the Pyrite Belt (0.3-0.6% copper and 1.5-2.5% ZnPb). The grades aren’t extraordinary high, but it’s definitely doable.

After double-checking on the SES010 lens, Avrupa will move the drill rig to a position approximately 150 meters towards the northwest of SES022, where it will be following up on an anomaly. Should Avrupa indeed hit massive sulphide zones (preferably mineralized), an additional 2.5 million tonnes would be added to the overall size of the project. Should this first hole indeed hit the VMS, Avrupa will just ‘follow the trend’ in a northwestern direction (see the map) in an attempt to continue to define a viable resource.

A second drill rig will be directed towards the SES008 area where a previous drill program identified a massive sulphide zone and another mis a la masse anomaly. This will be a deep hole as CEO Kuhn thinks the previous holes just didn’t go deep enough.

Avrupa will be drilling approximately 3,000 meters at a total cost of just over half a million Euro (C$800,000-850,000) with three targets in mind. The first priority is to satisfy the spending requirements from the Portuguese government, whilst the second (and third) priorities would be to either speed up the final execution of the joint venture deal announced in March, or to attract a new joint venture partner. Now the exclusivity period on the Alvalade license has expired, the hunting season is open.

Doing business in Portugal

In the past, we have discussed Blackheath Resources (BHR.V) which was trying to advance a portfolio of tungsten assets in Portugal, so we are quite familiar with Portugal as a mining destination. And so is Avrupa. In fact, one of the assets Blackheath Resources was working on (the Covas tungsten project in Northern Portugal) was optioned from Avrupa Minerals, which has assembled a diversified portfolio of assets in the country over the past few years.

Perhaps one of the most neutral ways to look at Portugal as a mining destination is the annual report of the Fraser Institute which does a good job in compiling a ranking of how appealing certain jurisdictions are for mining companies. The Fraser Institute looks at countries based on how prospective they are to discover mineralization, but also how good the legal framework is (in some countries you own a mine, and the next day the president’s cousin is the new owner).

According to the annual survey of the Fraser Institute in 2017, Portugal isn’t scoring great on the ‘Investment Attractiveness Index’, but it remains ahead of other jurisdictions like Montana, Mexico and South Africa. However, the Investment Attractiveness Index judges countries based on a combination of the policy perception index (the legal framework) and the mineral potential index (how much is there to be found).

Whereas Portugal is performing pretty poor on the mineral potential index due to the relatively high percentage of the answer ‘not a deterrent to investment’ which only counts for half the value of a vote for ‘encourages investment’. But Portugal’s really strong point is the ‘Policy Perception Index’, where the country scores a stunning 87%, ranking it the 11th best nation to explore in the world, based on the perceived legal framework to conduct exploration and development activities.

And that’s what ultimately matters. Avrupa believes it owns some key pieces of land in Portugal that are very prospective (which takes care of the mineral potential side of the index), and knowing the government policy is to be supportive of exploration and mining activities only strengthens Avrupa’s case.

A look at Lundin Mining’s Neves Corvo operations

The existing mining activities that perhaps resemble most what Avrupa Minerals is chasing is the Neves Corvo mine in Southern Portugal, owned and operated by Lundin Mining (LUN.TO). Lundin is currently producing copper and zinc from two differently mineralized lenses of the geological system, and is currently spending in excess of 300 million dollar to upgrade the zinc circuit at Neves Corvo to improve the efficiency of the operations.

Neves Corvo is currently producing copper and zinc concentrate from the two separate lenses, and the operations consist of a 2.5 million tpa copper plant and a 1.2 million tpa zinc plant (which is currently being expanded to accommodate a throughput of 2.5 million tonnes per year as well). In the first nine months of the current financial year, Lundin Mining has processed almost 2 million tonnes of copper ore (at 2.3%) as well as almost 840,000 tonnes of zinc ore (at an average grade of 7.9%). The recovery rates are respectively 75% and 81% for the copper and zinc, and this means Lundin has produced 77 million pounds of copper as well as approximately 125 million pounds of zinc, 11 million pounds of lead and 1.3 million ounces of silver.

Lundin considers Neves Corvo to be a copper mine (although the copper/zinc ratio will approach 50/50 upon completion of the expansion of the zinc plant), and after deducting the by-product credit revenue, the AISC per produced pound of copper was approximately US$1.73 in the first nine months of this year. The ‘pure’ C1 cash cost was $1.22/lb.

Alvalade’s status as early stage exploration project obviously isn’t anywhere close to where Neves Corvo currently is, but it does give you a good indication of the type and size of mineralization Avrupa will be targeting at Alvalade.

Conclusion

It’s not always easy to put a value on prospect and project generators, as the very essence of the business model is to generate targets that are per definition conceptual. And while all theoretical concepts appear to be very intriguing, the proof will be in the pudding, and a lot more work will be required to upgrade the prospects to ‘real’ projects.

That’s why it’s always useful to find partners with deep pockets, partners who don’t care about spending an additional million dollars if that’s what it takes to push a project forward. We sincerely hope the joint venture agreement with the senior mining company that was announced in March of this year will be successfully executed, as the 13M EUR would provide a major contribution to prove up what’s in the ground. And just to provide a perspective of how important that joint venture deal would be: the partner would be spending up to three times (!) Avrupa’s market capitalization on the projects just in the first stage of the earn-in which then increases.

Disclosure: Avrupa Minerals is a sponsor of this website. The author has a long position in Avrupa Minerals. Please read the disclaimer