Over the past few years, we noticed one common thing in the mining sector: most companies prefer to fall back on the so-called Tier-1 destinations in safe mining jurisdictions like North America and Australia. Mining companies that are operating in tougher jurisdictions like Africa and South America have been avoided a bit, purely because of the more negative perception of those countries and not so much because the mines or projects ‘don’t work’.

One of those companies that has been pulling the ‘safe jurisdictions card’ is OceanaGold (OGC.TO) as it wanted to reduce the importance of the Didipio copper-gold mine in the Philippines in its asset portfolio. The company made a first strong move into North America with the acquisition of Romarco Minerals, but has stepped up its pace by entering into several joint exploration agreements with junior exploration companies.

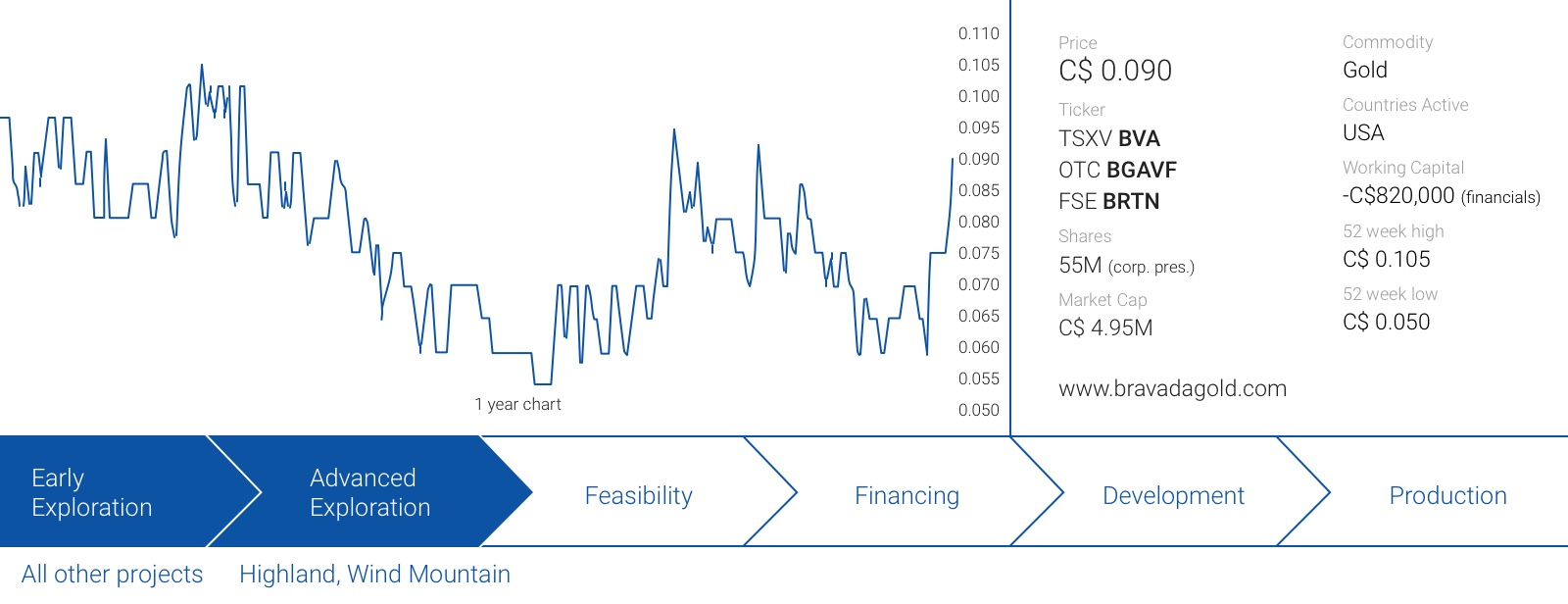

One of those companies is Bravada Gold (BVA.V) that owns numerous prospects and projects in Nevada, a jurisdiction that’s probably as safe as it gets. Bravada was a bit ‘dormant’ in the past few years as this small company was waiting for better times in the gold sector, but we feel the recently announced deal with OceanaGold is a good move for the company. Oceana will need to spend C$13M on exploration to earn a 75% stake in the project, and that minimum spending requirement on this single project is a multiple of Bravada Gold’s current market capitalization.

There’s another reason why we are giving Bravada Gold another good look. CEO Joe Kizis and then-consultant Max Baker were the people who brought the DeLamar project to Integra Resources (ITR.V). Unlike the upper management of Kinross Gold (KGC, K.TO) that failed to properly identify the exploration potential at the Idaho-based property, Kizis does seem to have a good nose for potentially valuable projects and this nose, in combination with his field experience on Nevada properties and his extensive in-state network were important considerations for us as well.

Zooming in on the main projects

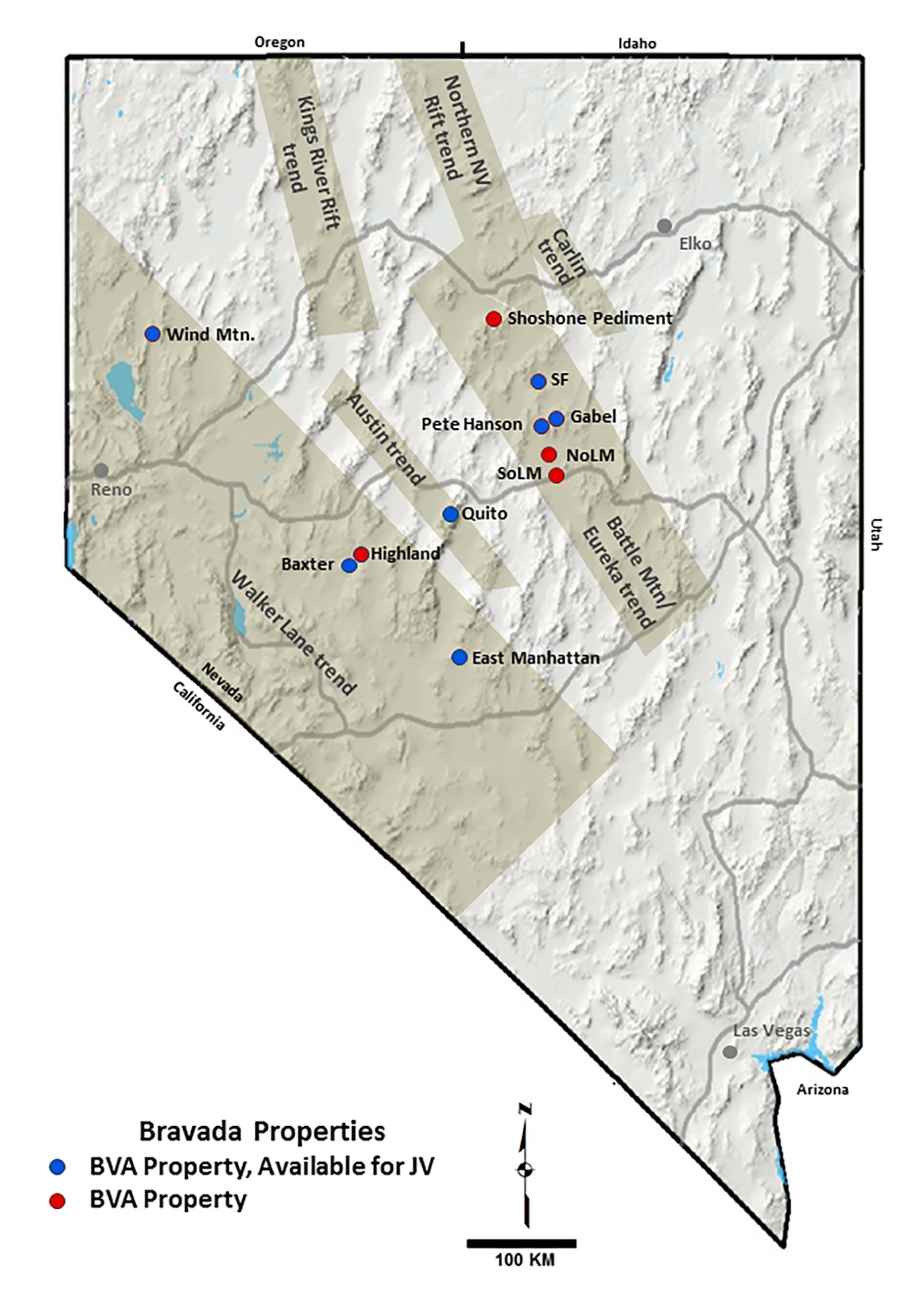

Bravada has approximately a dozen projects in its asset portfolio and while all those projects seem to have their own merit for being part of the portfolio, we will just highlight a few of them. The Highland and Wind Mountain projects are most definitely the two flagship projects, and we will also briefly provide the background stories of the SF and Shoshone Pediment properties.

Highland

We will discuss the joint venture terms with OceanaGold later in this report, but there are some very good reasons why OceanaGold was so keen on securing a right to earn into the Highland property in Nevada. The project does have a rich history as the first gold occurrences were discovered in the early 1900’s. This was followed by a short period of gold production where just a handful of ounces were produced right before the second world war started.

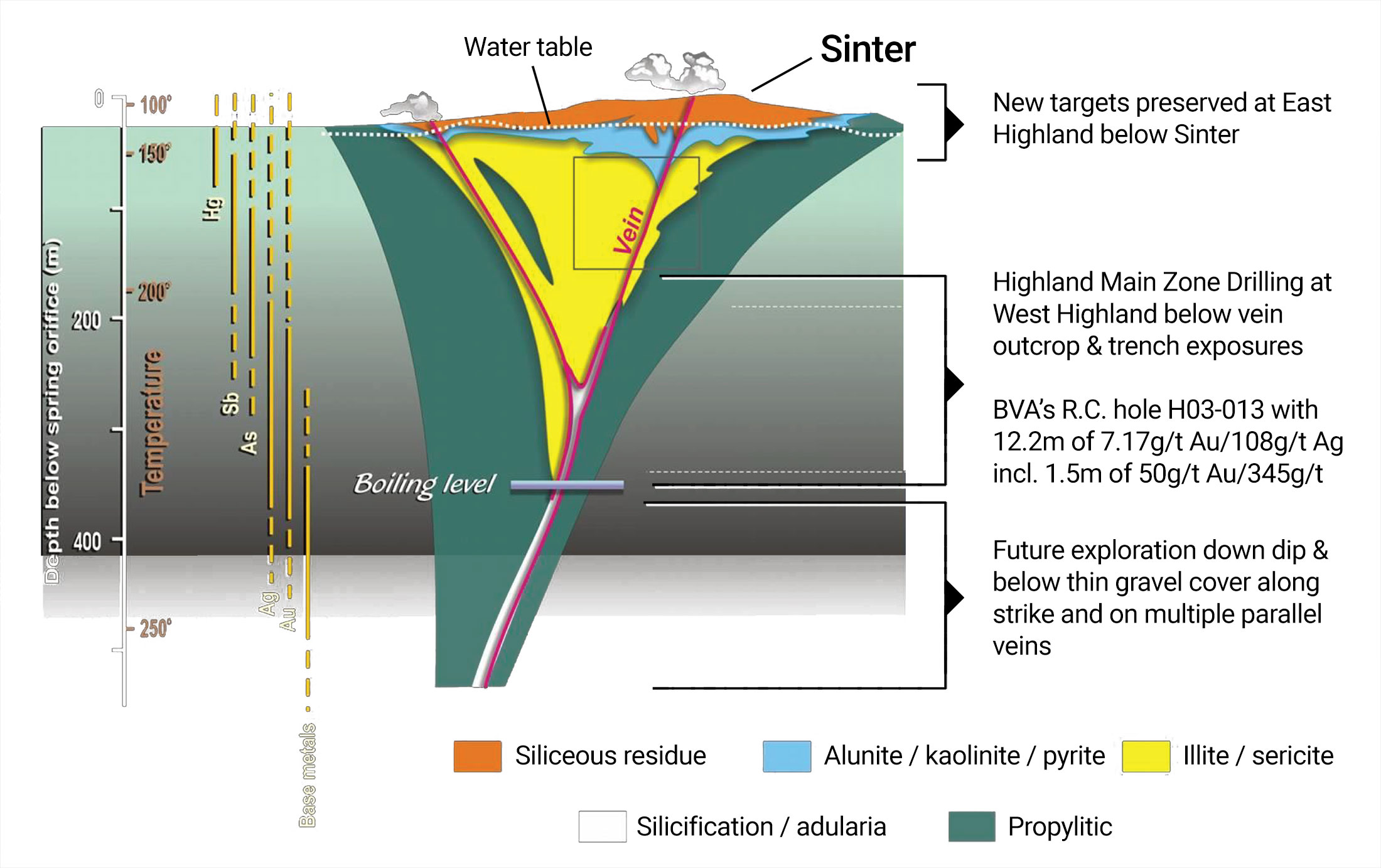

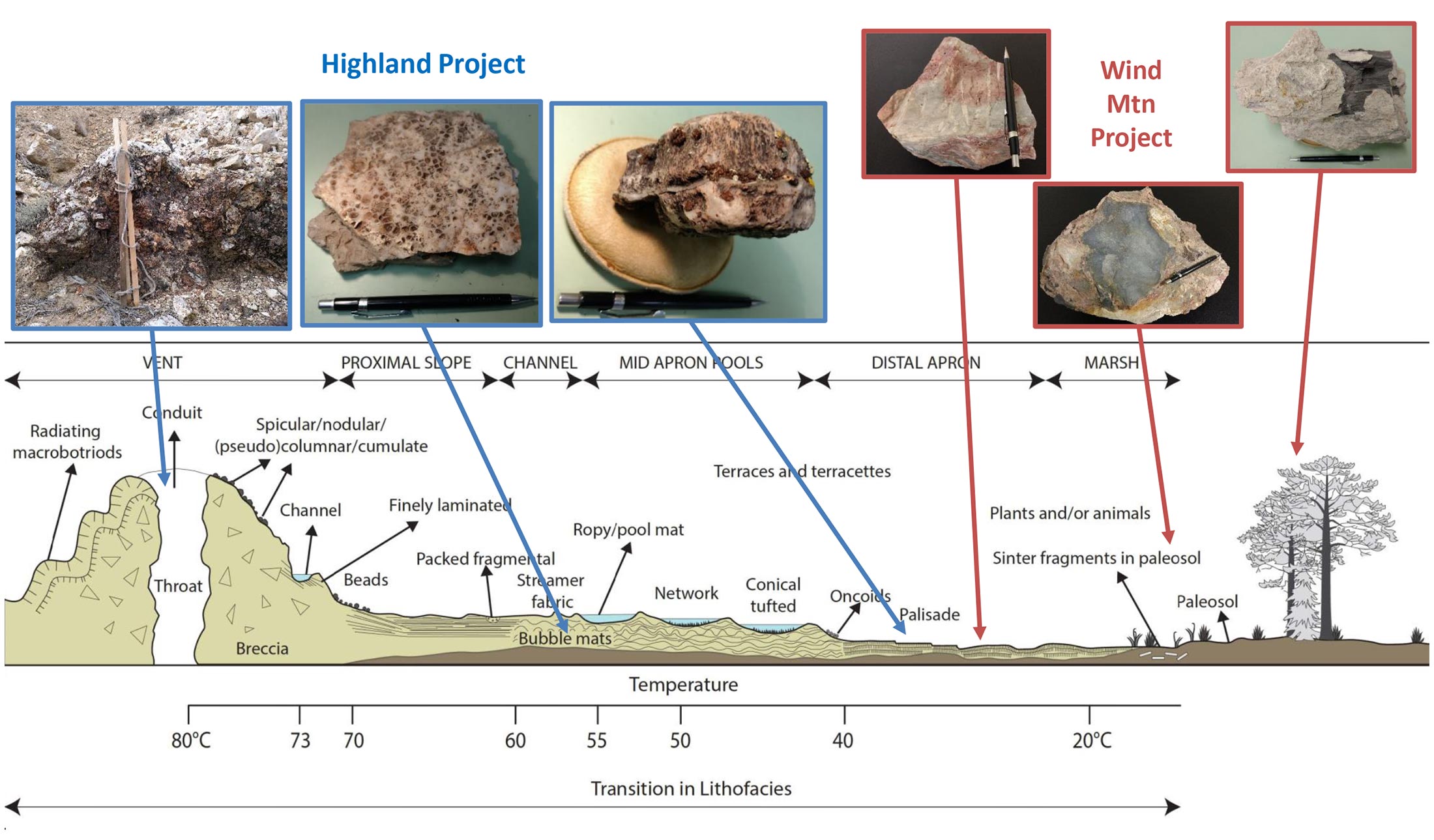

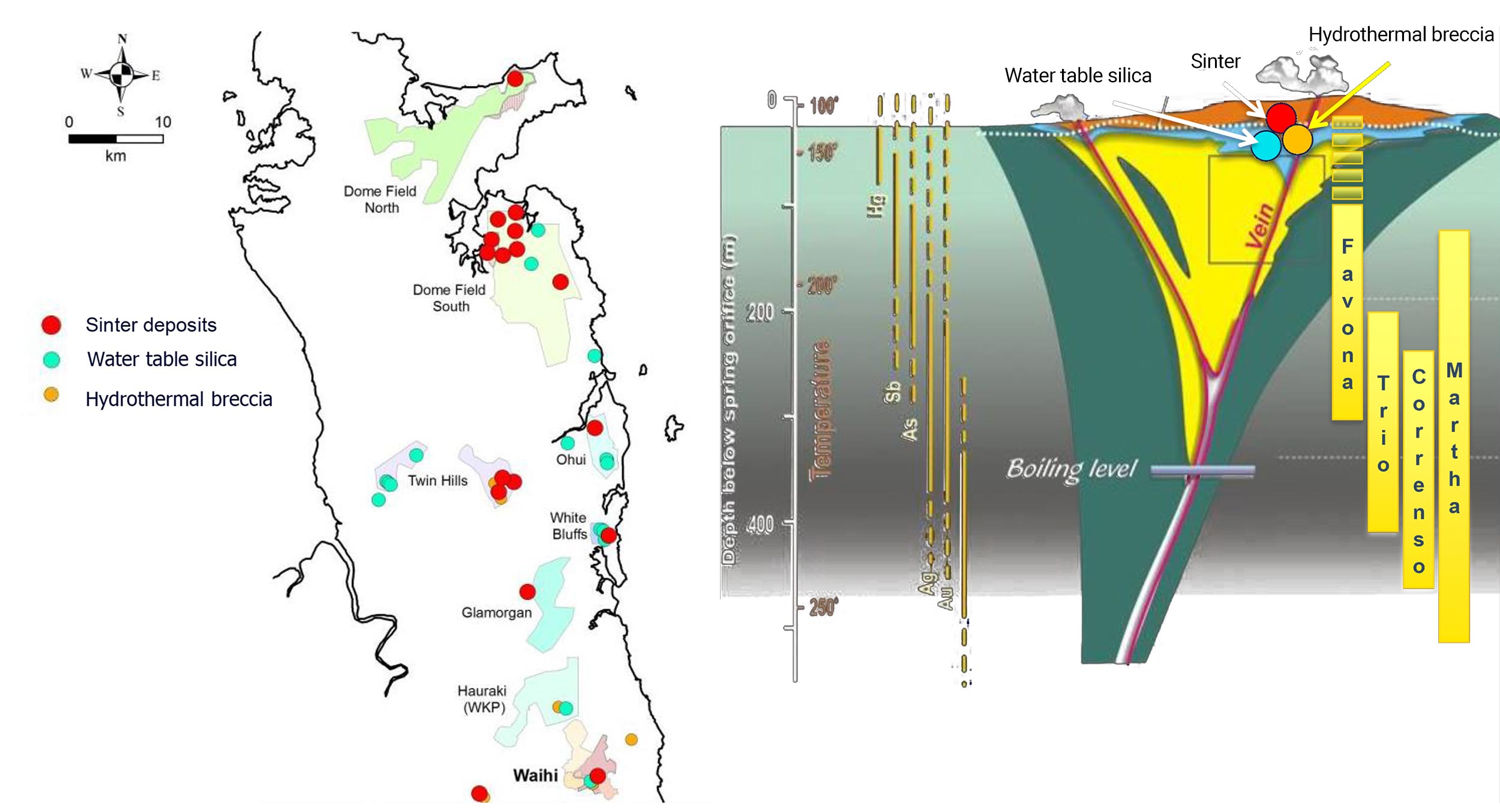

What originally attracted Bravada to Highland were the numerous exposures of high-grade gold veins in trenches through shallow gravel cover. But what has excited them recently (and its joint venture partner OceanaGold) is the sinter-based exploration theory.

Sinter zones (high-silica rock) are formed by hot springs, and have been demonstrated to occur along ancient surfaces on top of known gold deposits (which are ‘hidden’ underground and sometimes remain completely undetected). They usually do not ‘contain’ gold as some gold was only ‘left behind’ as the fluids made their way to the surface. So if you’d complete a sampling program of the sinter zones, the assay values usually wouldn’t be too exciting.

What matters is that these sinter zones that appear on the surface could very well point towards the existence of one of those ‘hidden’ gold deposits, usually 200-400 meters deeper as the gold ‘deposited’ at the ‘right’ chemical environment along the way to the surface hot spring and ‘developed’ high-grade gold-bearing veins. So detecting and understanding these sinter zones could help a company to zoom in on high-priority drill targets to find the gold zones.

Just an elusive theory? Not really. In fact, the theory is based on microbes identified in modern hot springs within active geothermal fields, where the microbes match fossils in sinters that are tens of millions of years old. The variety of microbes are very sensitive to temperature, so knowing which microbes (or fossils of the microbes) are present, and where, can lead geologists to the key faults where the gold-bearing fluids traveled.

Because little gold or other geochemistry exists in the sinter to guide exploration, mapping these fossils can be a powerful tool to identify blind ore-bearing structures.

There’s a very good reason why specifically OceanaGold has shown a lot of interest in Highland’s sinter model. Oceana’s Waihi mine in New Zealand has been mined and explored for several decades and in the past few years OceanaGold has been very successful in deploying its sinter-focused exploration theory. As we highlighted just a few weeks ago in a brief update on OceanaGold, the mid-tier producer was able to extend the mine life of Waihi once again as its updated resource estimate on the Martha zone now contains around 1 million ounces of gold.

In fact, OceanaGold has been deploying the sinter-based exploration theory all over New Zealand’s northern island in an attempt to increase its project and resource base in the country. As you can see on the next image, courtesy of OceanaGold again, you can clearly see how the company’s exploration theory completely zooms in on the sinter deposits to define the potential of discovering an epithermal system underneath.

Wind Mountain

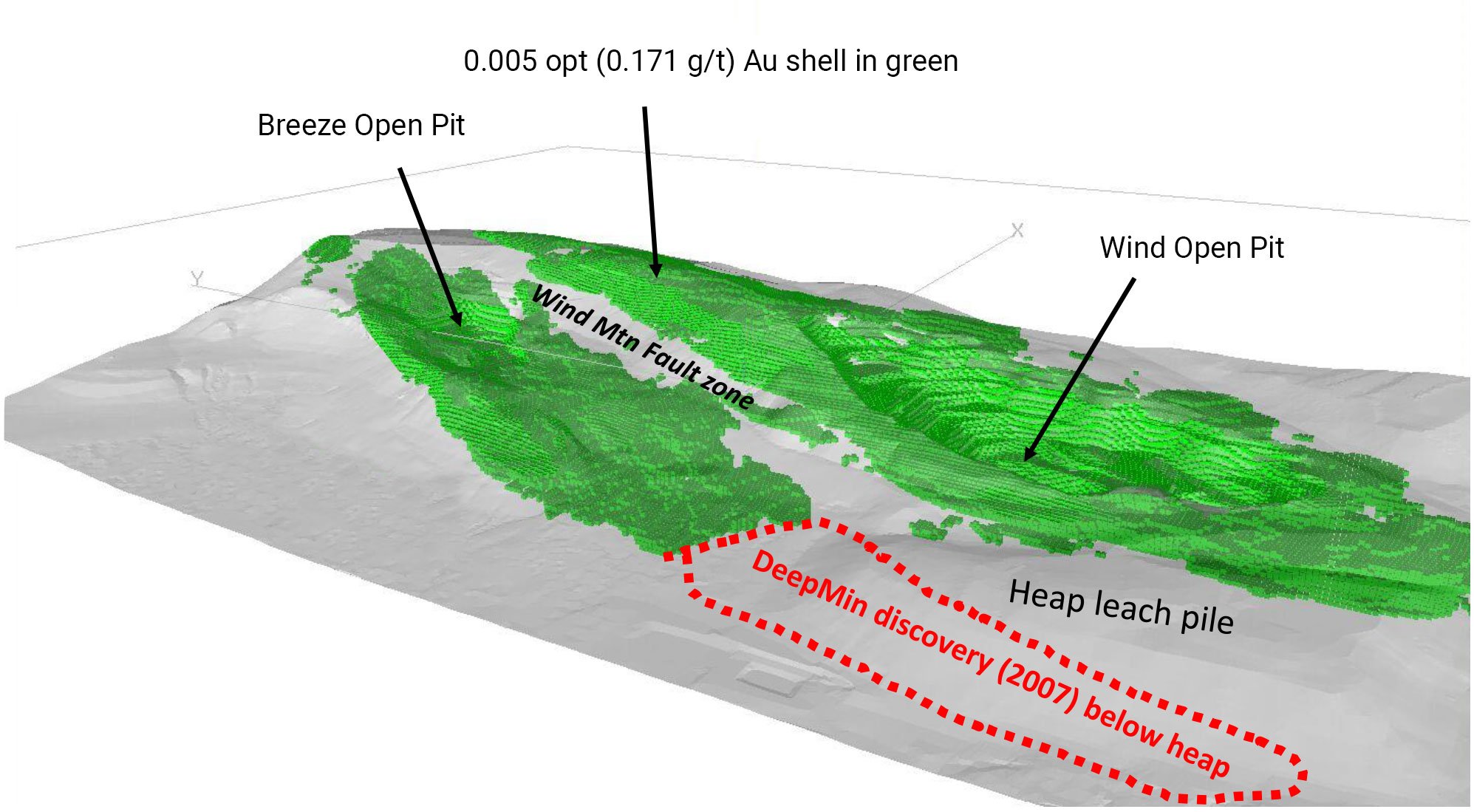

While the Highland property recently got all the attention, we shouldn’t forget about Wind Mountain which is by any standard Bravada’s most advanced property. The first serious exploration efforts were initiated in the late-70’s and between 1989 and 1999 Amax had recovered just over 430,000 ounces of gold by mining and heap-leaching rock initially with an average grade of just over 0.5 g/t, where-after the average grade dropped. Despite the lower average grade, the operation remained profitable and, according to the Wind Mountain NI43-101 technical report, this was mainly due to the low strip ratio, the low process costs (as the majority of the rock placed on the leach pad was run-of-mine) and good recovery rates.

The current resource estimate contains 59 million tonnes of rock in the indicated resource category (containing approximately 570,000 ounces of gold at an average grade of just over 0.3 g/t gold), but what’s perhaps equally interesting is the average silver grade of just over a quarter of an ounce per tonne. The inferred resource category contains roughly 35 million tonnes at a similar gold grade but a slightly higher silver grade. Across all resource categories, Wind Mountain contains roughly 925,000 ounces of gold and 26 million ounces of silver. That being said, only 690,000 ounces of gold (and 18 million ounces of silver) are hosted in oxidized rock which would be amenable for a heap leaching process. It’s interesting to note that previous operators were also able to recover the silver, as the historic operations recovered almost 6 ounces of silver per ounce of gold, indicating the silver could be a valuable by-product; either to reduce the net cost per produced ounce of gold, or to be used as the subject of a streaming deal to help fund a part of the capex funding package.

The resource was used by Bravada’s independent consultants to put a Preliminary Economic Assessment together. As this PEA is more than 5 years old we wouldn’t focus too hard on the study, but at least it does provide the confirmation that the Wind Mountain project could be a viable mining operation at today’s prices. A total of 288,000 ounces was expected to be recovered which would result in an after-tax NPV5% of US$26.5M (around C$35M) using a gold price of $1300/oz. Again, we would recommend to interpret the PEA results as a ‘fait divers’, and the economics are actually pretty irrelevant as to why this project could be interesting.

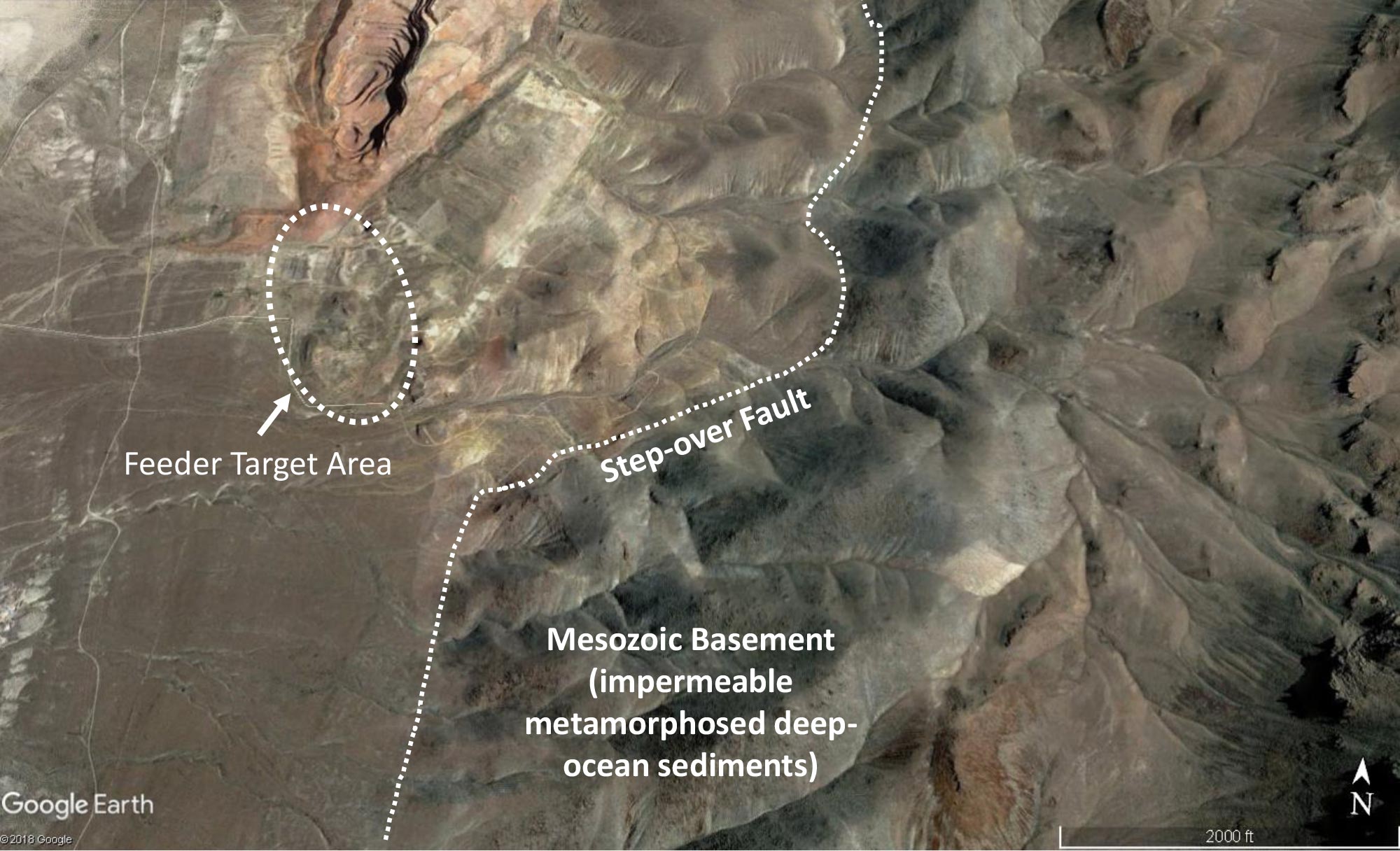

As Bravada Gold has been exploring the Wind Mountain tenements for about a decade, it has been able to gain a much better understanding of the geology. Yes, there’s almost 1 million ounces of gold in the current resource estimate, but CEO Kizis is chasing something much larger. He reckons there’s a feeder zone to be found south of the currently known resource and the historic open pit.

A valid assumption, as there are plenty of indicators pointing in the direction of the existence of a ‘hidden’ feeder zone. A key finding of the 2017 drilling is that the gold-bearing fluids moved laterally though permeable sediments from the south. Kizis notes that lateral flow is a common feature in modern geothermal fields, so we should expect similar features in ancient systems. Another important finding was the unexpected thick package of permeable sediments under volcanic rocks in the feeder target area, which could result in a large, funnel-shaped deposit with much higher gold grades.

It does look like the hole drilled in 2017 was too far out, but that hole also provided sufficient geological data to further fine-tune the expected position of the feeder zone which would be approximately half a kilometer northwest of the previous drill hole. We expect Bravada Gold to drill-test this high-priority drill target soon, and just a few holes could be enough to find out if there indeed is a higher grade feeder zone underneath.

SF

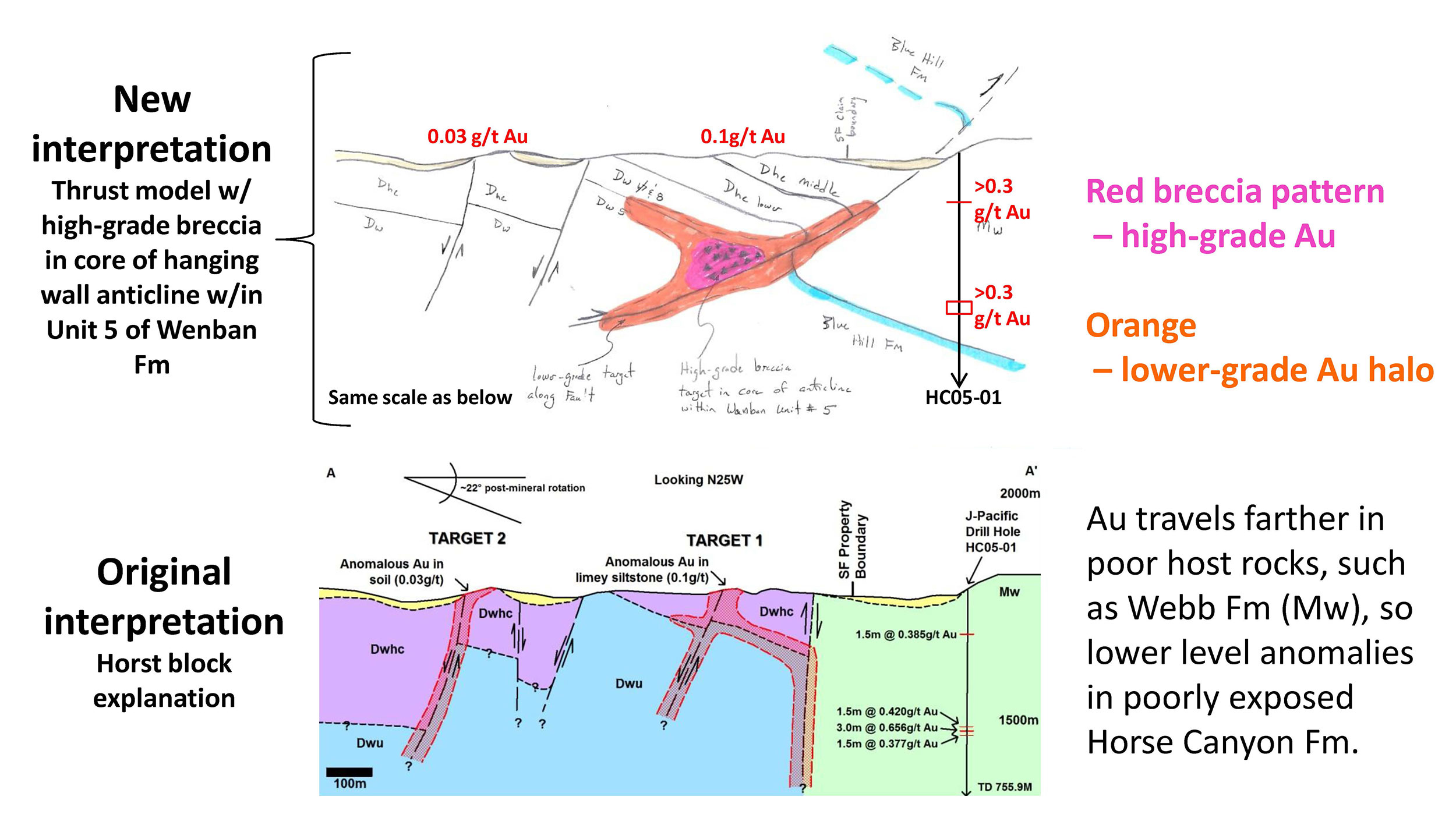

The SF project is a Carlin-type target, the type for which Nevada is famous, located directly east of the Cortez mining district on the Battle Mountain Gold Trend. The geological structures of the property weren’t well understood in the past, when a neighbor encountered short zones of gold mineralization with grades of in excess of 0.3 g/t gold but Bravada Gold was finally able to put a few additional pieces of the puzzle together and overhauled its exploration theory.

The discovery of low-grade oxidized gold zones by its neighbors has now been interpreted as being part of a northwest trending fault that’s covered by gravel.

According to Bravada Gold, 2015 published data on Nevada stratigraphy and structure at Barrick’s giant Goldrush deposit led to a reinterpretation of stratigraphy and structure at SF, greatly upgrading an untested target.

Comparisons to Goldrush include the same host rocks (the Horse Canyon and Wenban formations) and structure (major thrust faults). It should be noted that two other giant Carlin-type deposits, Cortez Hills and Pipeline, occur in the same geologic setting. With three of the best deposits discovered in Nevada during the past three decade in such a setting, Bravada feels a relatively cheap proof-of-concept drilling program creates an excellent risk/reward opportunity for its exploration dollars.

Shoshone Pediment

The odd duck in the asset portfolio is without any doubt the Shoshone Pediment project. Most of the projects are focusing on precious metals, but Shoshone should currently get your attention for a whole different reason.

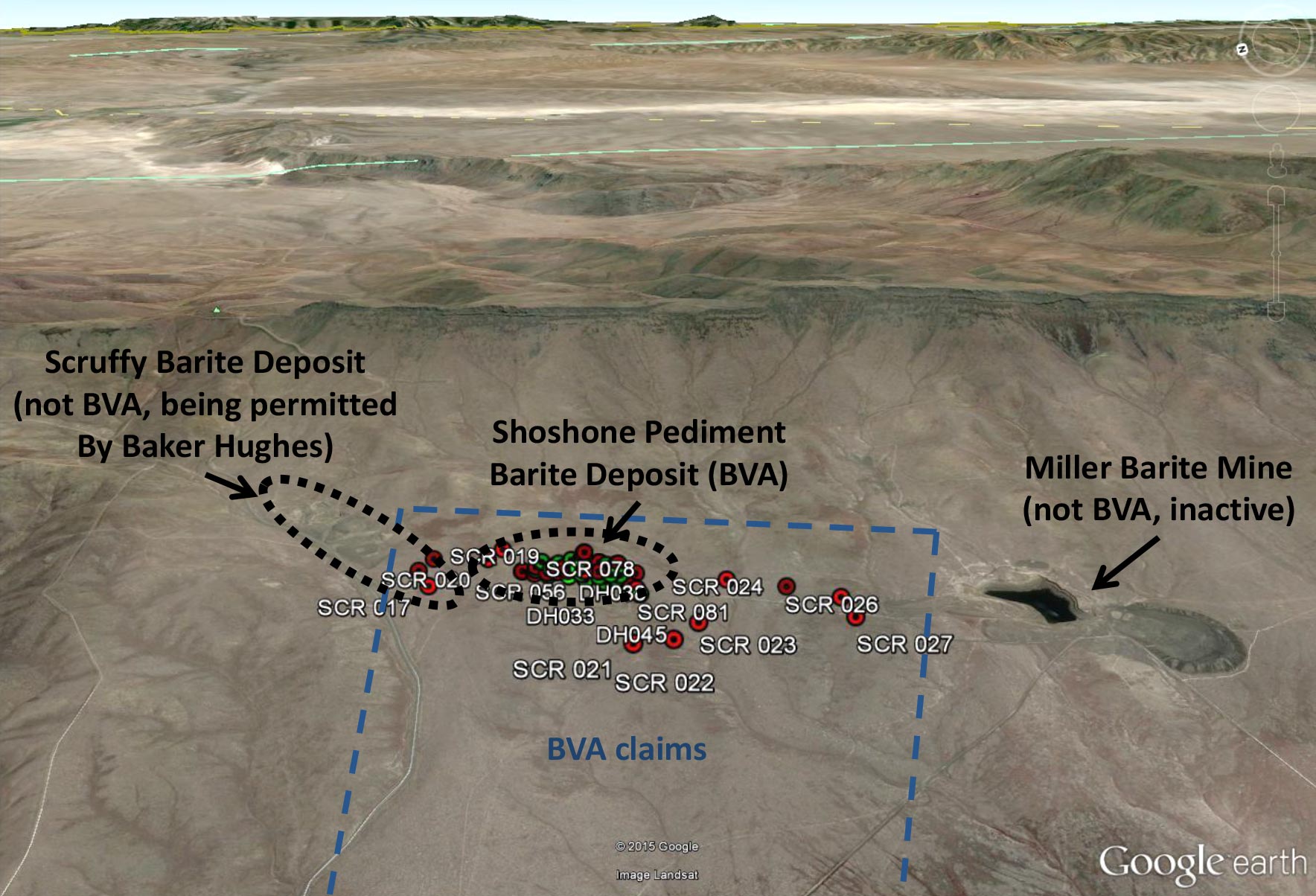

Although Bravada originally picked up the property to explore for precious metals (not a surprise), it did assign the barite rights to Baker Hughes (BHGE), which is already producing barite nearby and is permitting its own project along with Bravada’s part of the same deposit as you can see on the next image. Baker Hughes has their processing facility about 6km to the north. Barite is primarily used in oil and gas drilling, and recent price increases and depleting reserves at their mines has lit a fire under Baker Hughes to develop this property.

Baker Hughes doesn’t provide Bravada with a lot of details, but CEO Kizis has been told that BHI expects to initiate barite production later this year, in which case a (small) royalty would become payable to Bravada Gold. We aren’t expecting too much of this royalty, but if we would use the company’s ballpark number of C$0.5-1M per year for about 2-3 years, the incoming cash could be incredibly important for Bravada Gold to continue its gold and silver focused exploration activities in Nevada without blowing up the share count.

We hope to see more clarity from Baker Hughes (and Bravada Gold) about the expected incoming cash flows from Shoshone in 2020 and beyond.

Please note the four projects we highlighted are just a fraction of Bravada Gold’s asset portfolio which contains 11 projects. Discussing every single project would be overkill, but we will very likely touch on the subjects in a future Q&A report with CEO Joe Kizis and/or should Bravada Gold get some work done on these tenements.

What attracted OceanaGold to the Highland project?

Just one month after signing a Letter of Intent with OceanaGold, Bravada Gold was able to convert the LOI into a binding agreement which allows OceanaGold to acquire a 75% stake in the Highland Gold-Silver project located about 6 kilometers north of the Bruner gold deposit in Nevada’s Walker Lane gold trend.

OceanaGold can earn an initial 51% stake in the property by completing some initial cash payments to Bravada Gold that will subsequently be used to make the Advanced Minimum Royalty payments to the vendors of the property while a final US$200,000 payment from OceanaGold can be made in cash or shares. On top of that, Oceana will be required to spend at least US$4M on exploration before establishing the 51% stake. And this means OceanaGold will be spending 170% of Bravada Gold’s entire market cap, just to acquire a little over half of one project (indicating the perceived value of the remaining 49% of the project already exceeds Bravada’s current market capitalization).

Should OceanaGold like what it sees, it will be able to acquire an additional 24% stake in the property for US$6M in exploration expenditures, where after a 75/25 joint venture will be established.

Some people don’t appreciate the fact Bravada Gold is giving up a majority stake in one of its most important properties but let’s just leave emotions out of this decision and look at the numbers. OceanaGold needs to spend US$10M, or approximately C$13M on the ground to establish a 75% stake. This basically means Oceana needs to spend roughly 4 times Bravada’s current market capitalization on exploration. And the choice between this and seeing Bravada dilute its share count by several hundreds of percent is an easy one. In some cases it really is better to own 25% of a project that effectively is being advanced by a smart partner than retaining 100% of something that’s just gathering dust on the proverbial shelf.

For OceanaGold, the Highland project just is a good match. It meets the requirement of a project being located in a Tier-1 country and as Oceana has proven it knows its way around sinter zones and connecting those zones to epithermal systems. This almost looks like a match made in heaven as OceanaGold will also be able to further define and refine its exploration approach based on Bravada’s previous drill results of, for instance, 12.2 meters (true thickness: 8 meters) containing 9.5 g/t gold and 109 g/t silver.

Drilling at Highland

The recently announced placement shouldn’t have come as a surprise

As of the end of January, which is when Bravada’s first semester ended, the balance sheet looked pretty dramatic. BVA had just C$22,300 in current assets and almost C$850,000 in current liabilities for a working capital deficit of in excess of C$800,000. That’s a very unhealthy situation and even if you’d consider the ‘liabilities due to related parties’ to be a ‘benign’ liability (as far as that’s possible), there still was almost C$400,000 owed to unrelated parties.

There currently are some warrants that are ‘in the money’ but given the warrants with a strike price of C$0.05 (the only ones in the money) are only expiring in September (4.5M) and October (2.25M) 2020, Bravada can’t really count on the proceeds (almost C$340,000) from these warrants to further boost its cash and working capital position. The other warrants either have a higher exercise price (between C$0.10 and C$0.30) or have expiration dates that are even further out. Of course, it’s always possible the C$0.15 and C$0.30 warrants come in the money before they expire in 2020, but let’s not assume that as our base case scenario here.

Looking at that balance sheet, it wasn’t a huge surprise to see Bravada effectively announcing a private placement. The company will issue 10 million units that are priced at C$0.07 per unit, and each unit consists of one common share as well as a full warrant which will only expire 4 years after the issue date. The exercise price of the warrants is C$0.12, so should Bravada be successful in issuing this 10M unit deal, it could expect an additional C$1.2M to come in if those C$0.12 warrants will be ‘in the money’.

Despite the weak balance sheet (which will now be repaired with the completion of the private placement), it would be unfair to point fingers at the way the company has been run. Joe Kizis and his team have been able to run a tight ship and the burn rate in the first half of the financial year was just C$215,000 (excluding exploration and property expenses) while an additional C$60,000 was attributed to exploration expenses and C$192,000 was a capitalized ‘property acquisition cost’. So of the total net expenses of approximately C$470,000 in the first semester, roughly C$250,000 was directly spent on the project and that’s probably as good as it gets when the treasury is running on fumes.

Drilling at Baxter Sinter Target

Where to go from here?

Bravada Gold has just announced the initial exploration program for the Highland project, and it looks like OceanaGold is planning to spend in excess of US$400,000 (C$0.5M) on exploration this year which will include additional mapping and sampling programs, with a 35 line-kilometer geophysics and soil sampling program as main elements.

It’s also interesting to see that OceanaGold and Bravada have increased the size of the project by in excess of 55% to 1,300 hectares.

It looks like OceanaGold doesn’t want to waste any time and immediately get to work on the Highland property. For illustration purposes, should Bravada have had to embark on a similar C$0.5M exploration program by itself, it would very likely have had to issue 10 million shares at the current share price to fund the program. Another reason why we do support the joint venture agreement with OceanaGold.

We also expect to see an exploration update from Bravada Gold on its other properties, but that will obviously be subject to the financial situation.

Quito Historic Open Pit (left) – Pete Hanson Property (right)

Bravada Gold’s management team

Bravada Gold is part of the Manex Resource Group, which is the umbrella group Southern Silver Exploration Corp. (SSV.V) also belongs to. The Manex group is lead by Larry Page and has a few resource companies under its wings. Not all companies have been a huge success, but we refer back to the intrinsic qualities of CEO Kizis who does have a good name in the sector and built even more credibility after being instrumental – together with Max Baker, Integra Resources’ current VP Exploration – bringing the DeLamar project to Integra Resources.

Joe Kizis – Director & President

Mr. Kizis is a Registered Geologist with a B.S. in Geology from Kent State University and an M.S. in Geology from the University of Colorado. He has 35 years of experience in exploration for gold, silver, copper, molybdenum, lead, zinc, and uranium in the U.S., Canada and abroad. He is the President and a director of Homestake Resource Corp., Bravada Gold Corporation and previously of Fortune River Resource Corp. (which amalgamated with Bravada Gold Corporation in 2011). Mr. Kizis has held previous executive positions with Fairmile GoldTech, Sierra Geothermal, the Geological Society of Nevada, and the GSN Foundation.

Larry Page Q.C. – Director & Chairman

Lawrence Page obtained his law degree from the University of British Columbia in 1964 and was called to the Bar of British Columbia in 1965 where he has practiced in the areas of natural resource law and corporate and securities law to the present date. Through his experience with natural resource companies and, in particular, precious metals development, Mr. Page has established a unique relationship with financiers, geologists and consultants and has been counsel for public Companies which have discovered and developed producing mines in North America. Specifically, he has been a Director and Officer of Companies which have discovered and brought into production the David Bell and Page Williams mines in Ontario, the Snip, Calpine/Eskay Creek and Mascot Gold Mines in British Columbia, as well as the discovery of the Penasquito Mine in Mexico.

Mr. Page is the principal of the Manex Resource Group of Vancouver which provides administrative, financial, corporate, corporate finance and geological services to a number of public companies in the mineral resource sector. He currently serves as a director of three public companies, including Bravada Gold Corporation, Southern Silver Exploration Corp. and Valterra Resource Corporation.

Conclusion

The least you can say about Bravada Gold is that the company has a lot of irons in the fire. We are particularly charmed by OceanaGold spending a multiple of Bravada’s current market capitalization to acquire a 75% stake in the Highland property. There obviously is no guarantee whatsoever OceanaGold will effectively complete the earn-in deal, but even if OceanaGold walks away further down the line, the millions of dollars it will spend on exploration will remain very valuable to Bravada Gold.

Now the balance sheet will be repaired with the recently announced C$700,000 offering, we are looking forward to see what Bravada Gold wants to do on its wholly-owned projects this year.

Stay in touch with our weekly newsletter and when we publish a report. Unsubscribe at any time.

The author has no position in Bravada Gold but will participate in the current financing. Bravada Gold isn’t a sponsor of the website, but could become one in the near future. Please read the disclaimer